A long bull market beckons for copper

Ignore short-term volatility: a worsening supply squeeze implies far higher prices in future, says Albert Mackenzie, copper analyst and market reporter at Benchmark Mineral Intelligence

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

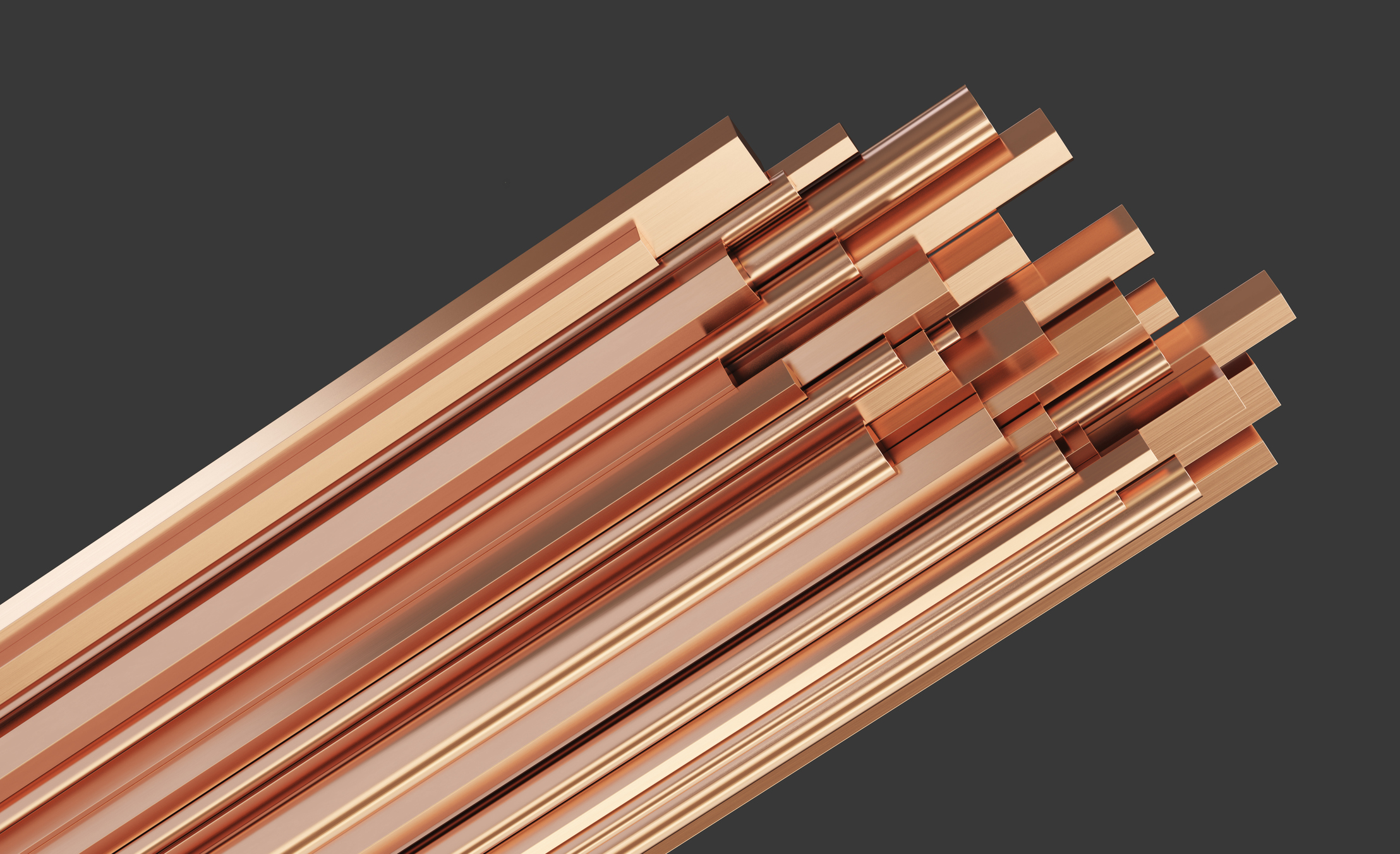

Copper is used in virtually every area of industry and modern life. The red metal is the third most-used metal globally, behind only steel and aluminium. It is even nicknamed Dr. Copper because demand is tied to the health of the broader economy. The idea is that if demand for copper is robust, the broader economy is healthy.

Since China’s rapid industrialisation in the last few decades, copper’s price has been closely tied to the Chinese economy, with 58% of total global refined copper consumed in China alone last year. The Trump administration’s policies have unsettled the market; 2025 has hitherto seen unprecedented volatility. But the long-term picture is clearer: most analysts expect a broad supply deficit.

The Donald Trump effect

Donald Trump’s return to the White House has unsettled the copper market. On 7 April, just after “Liberation Day”, copper traded in a range of $8,105 - $9,096.50 per tonne, an unprecedented one-day range. Recent US policy has not just suppressed global risk appetite, but also dented expectations about demand for copper over the next few years. Many goods shipped from China to the US are copper-intensive, such as washing machines, fridges and televisions.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Huge tariffs on these goods are likely to reduce these flows. Some market participants estimate that as much as 5% of Chinese demand for copper ends up in the US in products such as those mentioned above. Recent copper consumption, however, has not declined: the fear of tariffs has led to the “front-loading”, or expedited shipments, of goods. The front-loading of exports has actually increased apparent demand for copper over recent months, but this is unlikely to last.

Beyond the surprising immediate effects on the copper market, tariffs in general are considered bad for the global economy and, by extension, household spending and government investment in copper-intensive areas such as grid infrastructure. Copper declined sharply after Liberation Day owing to fears that the tariffs could affect demand. The London Metal Exchange’s (LME) cash copper price fell 11% in the week after the announcement.

The copper price is also closely related to the value of the US dollar. LME copper prices are priced in US dollars. If the US dollar strengthens, copper becomes relatively more expensive for participants operating in other currencies, so dollar strength tends to pull the LME copper price down.

Trump’s economic policy is having a significant impact on the US dollar. So far in 2025, the US dollar index has already traded in a range 44% wider than in 2024 – adding to the volatility of the copper price.

Recent US government policy has also threatened to affect copper directly. The US government has announced an investigation into the national security implications of the US’s reliance on copper imports. This has led to speculation that the US will implement a tariff on the red metal.

Most American market participants use copper prices from the Chicago Mercantile Exchange (CME), whereas most international traders and producers use the LME price. The LME price is a duty-free copper price, and the CME is a duty-paid price. The CME copper price would therefore be likely to rise to reflect any import duty. A historically broad arbitrage has opened between the two markets, with participants using the spread as a play on the expectations of tariffs. For example, it recently widened sharply after Trump threatened the EU with a 50% tariff.

The fear of tariffs and the broad spread between US and world copper prices has seen the US flooded with copper. The rest of the world, on the other hand, has seen markets virtually drained, pressing premiums for copper being delivered in Europe to record highs, and creating a shortage of material.

Premiums for copper being imported into China also hit multi-year highs in May, with those premiums as much as 85% higher when compared with the levels seen before Trump’s inauguration.

US participants want to ensure a good stockpile of material in case tariffs do come in, so they are rushing to secure extra material promptly. Participants, predominantly metal traders, are also moving copper from across the globe, including South America and Europe, into the US to take advantage of the arbitrage.

The upshot? Since January, the copper market has seen record-breaking price movements, spread movements, and arbitrage. Copper miners’ share prices have swung wildly too. One analyst told me recently that forecasting price movements is now so challenging, he wished he could forgo forecasting the price at all in 2025. Still, copper prices are up 10% this year, outperforming UK and US stocks.

Look far beyond this year

The long-term picture for copper is much clearer than the tariff-driven short-term. In the long run, most analysts and participants agree that the copper market will slide into a substantial deficit by the end of the decade.

This fear of a supply deficit and the expectation of higher prices has been highlighted by the significant number of mergers and acquisitions in the copper market in recent years. Miners are rushing to acquire assets to bolster their own supply. The most prominent examples are BHP’s and Glencore’s attempts to acquire Anglo American and Teck Resources, respectively, in multibillion-dollar deals.

New technologies such as electric vehicles (EVs) and increased investment in grid infrastructure are expected to massively increase demand for copper. Copper is an excellent conductor of electricity, which makes the metal critical as the world rushes to electrify. Renewable energy generation, such as wind power, along with the related grid infrastructure, is significantly more copper-intensive than traditional energy generation.

Electric cars drive demand

The increased use of EVs also looks likely to power the requirement for copper. EVs are more copper-intensive than traditional cars, and the same is true of the related energy needs and infrastructure. EVs and plug-in hybrids respectively use 250% and 144% more copper than traditional cars do.

There is also an expectation that the world will need more electricity in the coming years, with AI and the internet generally relying on energy-hungry data centres. Trafigura, a major copper trader, predicted last year that AI alone could generate demand for an extra one million tonnes of copper by 2030 (currently, there is an annual demand for around 28 million tonnes of copper). All these factors mean electrical infrastructure and transport will increase copper usage by 26% and 29% respectively between now and 2030, according to Benchmark Mineral Intelligence’s Copper Service.

Meanwhile, as nations develop, industrialise and bolster infrastructure, their demand for copper rises greatly. Indian copper usage is forecast to grow 76% between 2024 and 2030. In total, copper usage globally is forecast to increase by 16% overall by 2030. Yet supply is only set to grow by 11% over the same period, so that a significant deficit will open by the end of the decade. The International Energy Agency is predicting a 30% shortfall of supply by 2035, as mines have been affected by “declining ore grades, rising capital costs, limited resource discoveries and long lead times”. Problems range from deep, low-ore grade mines in South America and logistical challenges in Africa to delays securing permits in the US.

Nations in South America, such as Chile, the world’s largest copper producer, have been exploiting some of their best resources for some time now, with some of Chile’s largest mines many decades old. Major copper miner BHP estimates that global copper-ore grades have declined by 40% since 1991.

As ore grades decline, mining becomes less efficient and more expensive. “Declining grades… means that more ore needs to be mined, processed and transported to produce the same amount of copper. Without technological advancements, grade decline is likely further to increase production costs on a unit of output basis,” BHP said last year.

In several countries, obstacles to acquiring permits and local resistance to projects have caused supply problems: witness First Quantum’s Cobre Panama mine, which was closed in late 2023 after nationwide protests. Cobre Panama had only opened in 2019 following a $10 billion investment from First Quantum and its predecessors. The risks in investing in opening new mines are high, which militates against new production.

“Return on investment is long in the mining industry. From finding a resource to actually mining it can take 15-20 years,” a source at a large copper miner told me. With all this in mind, there is an expectation that copper prices will move up significantly in the coming years. Benchmark is forecasting a 32% increase in copper prices by 2030, while some traders believe that the upswing could prove even more dramatic.

Where to look now

Small and medium-sized individual mining companies offer a leveraged bet on a metal’s price, writes Andrew Van Sickle, but the 33% decline in First Quantum’s stock when the Cobre Panama mine closed is a stark reminder of the downside of this approach: if key projects go wrong, you could lose a great deal of money.

Temper risk by considering the big names in copper extraction, such as Anglo American (LSE: AAL) and Antofagasta (LSE: ANTO), both of which are listed on the blue-chip FTSE 100 index.

Alternatively, diversify further by opting for a group of miners through exchange-traded funds such as the Global X Copper Miners UCITS ETF (LSE: COPG), which holds shares in an array of miners, including Antofagasta and Freeport-McMoRan. A second option is the Sprott Copper Miners ESG-Screened UCITS ETF (LSE: CPPR), which holds shares in BHP and Anglo American, among others.

A way to invest in copper without the risk inherent in particular mines or companies is through an exchange-traded commodity (ETC), which tracks the price of a raw material. One popular one to consider is the WisdomTree Copper ETF (LSE: COPA).

This ETC has gained 15% so far this year, but it is worth noting that due to copper’s recent volatility, it slumped by 16.8% following Donald Trump’s announcements on tariffs on his “Liberation Day” in early April – although it bounced back rapidly too.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Copper analyst and market reporter at Benchmark Mineral Intelligence

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

The graphene revolution is progressing slowly but surely – how to invest

The graphene revolution is progressing slowly but surely – how to investEnthusiasts thought the discovery that graphene, a form of carbon, could be extracted from graphite would change the world. They might've been early, not wrong.

-

Stock markets have a mountain to climb: opt for resilience, growth and value

Stock markets have a mountain to climb: opt for resilience, growth and valueOpinion Julian Wheeler, partner and US equity specialist, Shard Capital, highlights three US stocks where he would put his money

-

Metals and AI power emerging markets

Metals and AI power emerging marketsThis year’s big emerging market winners have tended to offer exposure to one of 2025’s two winning trends – AI-focused tech and the global metals rally

-

King Copper’s reign will continue – here's why

King Copper’s reign will continue – here's whyFor all the talk of copper shortage, the metal is actually in surplus globally this year and should be next year, too

-

Why a copper crunch is looming

Why a copper crunch is loomingMiners are not investing in new copper supply despite rising demand from electrification of the economy, says Cris Sholto Heaton

-

'It’s time to close the British steel industry'

'It’s time to close the British steel industry'Opinion The price tag on British steel is just too high. It's time for Labour to make a grown-up decision and close down the industry, says Matthew Lynn

-

How to profit from the scramble for metals and minerals

How to profit from the scramble for metals and mineralsCopper and other metals will be vital in the transition to cleaner technologies and artificial intelligence. Soaring demand is pushing prices up

-

Alchemy: gold for the gullible

Alchemy: gold for the gulliblePeople have fallen for alchemy for centuries, including Isaac Newton and Johannes Kepler. They should have known better