Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

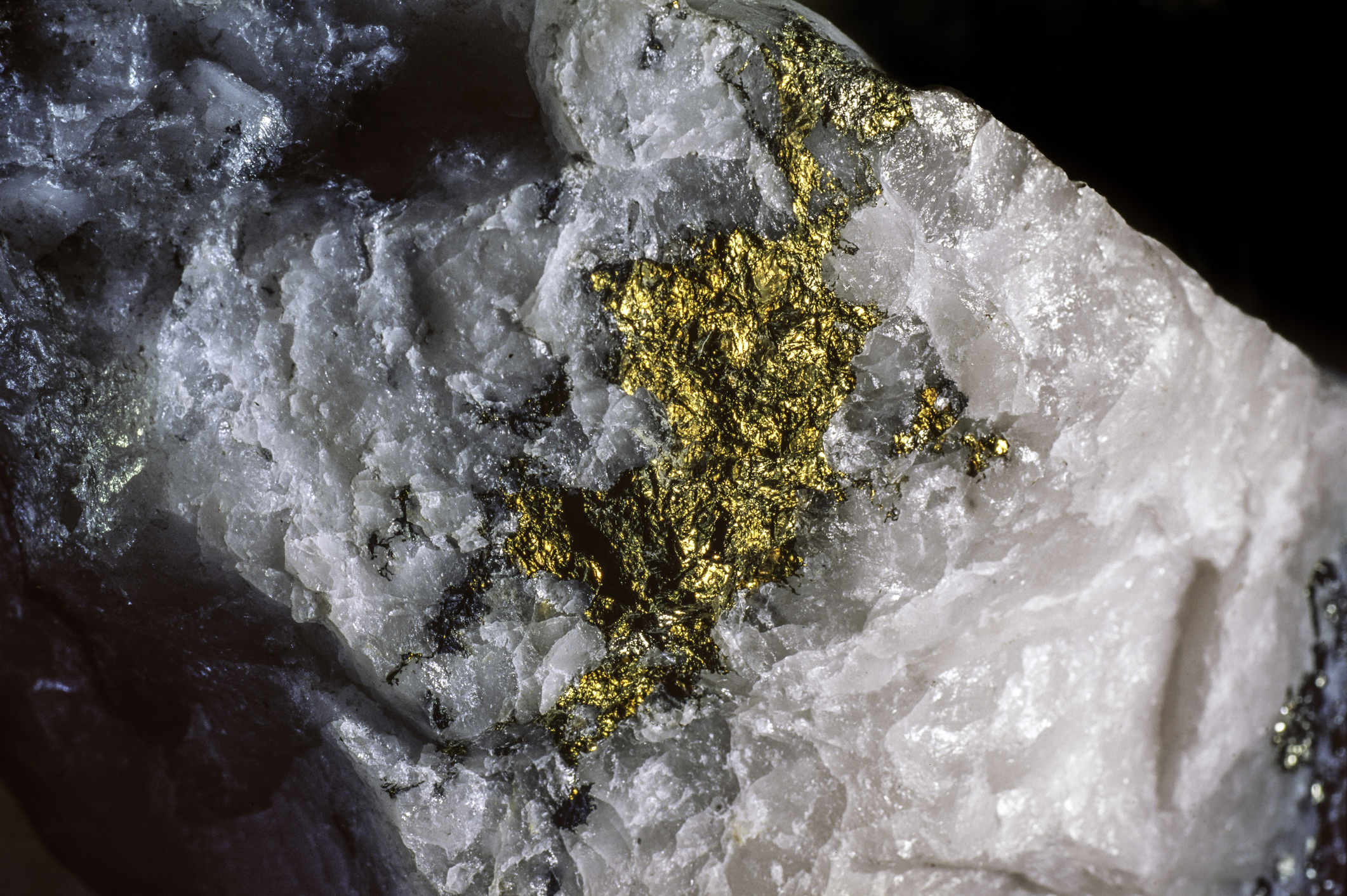

The rise in the gold price ought to be very good news for gold miners. In theory, every dollar on the gold price goes straight to profits as mining costs are fixed. Gold-mining shares used to be regarded as a leveraged play on the gold price, amplifying the rise in the metal. In practice, it hasn’t worked out like that. The gold price has risen over 20% this year and 32% over one year to around $2,500 an ounce. The price is 40% higher than the peak reached 12 years ago. Yet the FTSE Gold Mining index stands nearly 30% below the level reached in late 2011.

Is the BlackRock World Mining Trust a good buy?

This doesn’t necessarily mean that gold-mining shares are a bargain. Miners are beset by rising costs, falling ore grades and government taxation and regulation, which means that their break-even gold prices rise steadily. For example, in the early 1990s South Africa was the world’s leading gold producer, accounting for 30% of global output. But today it is not even in the top ten. Output increased 12% in 2023, but that was 40% below the volume in 2010 and 90% below the level seen in 1970.

Still, investors in global mining are at last making money. The £1bn BlackRock Gold and General Fund, managed by Evy Hambro and Tom Holl, has made investors no money since it launched in 2011, but it is up 17.5% in 2024. About 55% of the fund is invested in Canada, 31% in the US and 10% in Australia, showing a strong preference for safe and stable countries. Half of the fund is invested in large-caps with a market value above $10bn and 43% in mid-caps with values of $1bn-$10bn. Almost 90% is invested in gold miners and 10% in silver. The top ten holdings account for 59% of the portfolio and the top three, Newmont, Agnico Eagle Mines and Barrick Gold Corp, for almost a quarter.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The fund is almost a mirror image of the $4bn BlackRock World Gold Fund, launched in 1994, but has considerably lower costs – 1.15% per annum versus 2.06%. That the World Gold Fund has returned an annualised 7.7% since its inception shows how abruptly the fortunes of gold miners changed in 2011; until then, the fund had multiplied sevenfold on a quadrupling of the gold price. If the gold price keeps climbing and the upward trajectory is deemed sustainable rather than the prelude to a nasty bear market, gold-mining shares should continue to perform, and even outperform the gold price.

A safer option might be the £1.2bn BlackRock World Mining Trust (LSE: BRWM), also managed by Evy Hambro, but with Olivia Markham as co-manager. Almost 25% of its assets are invested in gold miners although there will also be gold production in the 35% invested in “diversified” miners. The proportion invested in gold varies depending on the managers’ view of the outlook, so the trust, which trades at around net asset value (NAV), should provide a smoother ride than a pure gold fund. At present, 24% of the fund is invested in copper, whose price rose strongly earlier this year, but has since fallen back. The trust is down 8% over one year and has returned just 4% over three, but 68% over five. So it is hardly riding the crest of a wave. The shares yield 6% to pay for the wait until the next boom.

Hambro says that “constrained mined commodity supply, an evolving demand picture, strong balance sheets and valuations below historic averages make us optimistic about the outlook for the sector on a long-term view”. Cynics would point out that he is always optimistic. But his observation that “mining companies have focused on capital discipline in recent years, meaning they have opted to pay down debt, reduce costs and return capital to shareholders, rather than investing in production growth” is inarguable. The massive boom in demand driven by China between 2002 and 2011 is over, but other drivers of demand, such as infrastructure spending and renewable energy, are replacing it. Gold bulls will prefer BlackRock’s Gold & General fund, but World Mining is a compelling alternative.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Max has an Economics degree from the University of Cambridge and is a chartered accountant. He worked at Investec Asset Management for 12 years, managing multi-asset funds investing in internally and externally managed funds, including investment trusts. This included a fund of investment trusts which grew to £120m+. Max has managed ten investment trusts (winning many awards) and sat on the boards of three trusts – two directorships are still active.

After 39 years in financial services, including 30 as a professional fund manager, Max took semi-retirement in 2017. Max has been a MoneyWeek columnist since 2016 writing about investment funds and more generally on markets online, plus occasional opinion pieces. He also writes for the Investment Trust Handbook each year and has contributed to The Daily Telegraph and other publications. See here for details of current investments held by Max.

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

Could you get cheaper loans under ‘significant’ FCA credit proposals?

Could you get cheaper loans under ‘significant’ FCA credit proposals?The Financial Conduct Authority has launched a consultation which could lead to better access to credit for consumers and increase competition across the market, according to experts.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom