The gold bulls are back – so let’s just be careful out there

The world has fallen back in love with gold again and the price is on the rise. It could have further to go yet, says Dominic Frisby – but it could be another false dawn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The world has fallen back in love with gold again. The price is rising. No surprise it's the only investment solution to today's turbulent world. The dollar, the pound, the euro they're all falling apart at the seams.

Quick buy gold and scoff at the minions as the world unravels.

Or... is some caution required?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Our gold trade has performed well

Back in the summer, with gold around $1,200 an ounce and muchly unloved, we were recommending a trade on these pages. Look for a summer low and buy, with the aim of off-loading in the winter for a 10%-20% gain, was the general idea.

The seasonal factors (gold usually makes a low in the summer) were onside. Gold was oversold. It was cheap. The US dollar was stalling. Sentiment was awful. The positions traders had taken on the futures exchanges were unusually negative (which in itself was bullish). In short, gold was "so bad it was starting to look good".

Here we are in the deep midwinter, and things are looking rather better. It's been a rocky ride to get here, but get here we have with gold at $1,320 we have reached our 10% target. Bullish sentiment is now rather more pronounced. Even Goldman Sachs is talking it up. Its head of commodities research, Jeff Currie, said yesterday that gold will hit six-year highs this year. $1,450 is the target some 10% higher than where we are today.

There might still be a little gas left in the tank. But, if you made that trade, now might be time to think about lightening up, taking some money off the table, moving up stops and such like.

I stress: now might be a time to be thinking about those things, not necessarily acting on them.

The winter months tend to be good for gold, especially November, January and February, while things start to get a bit more dicey in March. This year, however, December was a very strong month, and the suspicion is that the portfolio allocation usually made by institutional investors in January might have been brought forward to December as in an attempt to beat the rush.

If that theory is true, the typical March drop could come a little early too.

The gold bulls are emerging once again but it could still have further to go

Gold is, as we know, an emotional metal, and sentiment can be a major driver of price. (Price is also a driver of sentiment.) The gold bulls are out of the closet again, which is another warning sign.

On the other hand, there are other factors which make me think gold could go higher. Inventories of SPDR Gold Shares (NYSE: GLD) the exchange-traded fund which is the most favoured means for investors to buy gold are starting to rise as well, but they are not yet at levels concomitant with major highs.

The same goes for the COT (Commitment of Traders) report, which details the positions taken by futures traders in Chicago. Interest is rising, but it is not yet at major highs.

According to research by bullion dealer Ross Norman, retail investors have not yet come back into the gold market in a big way, which also leaves room for more buying. That said, according to World Gold Council (WGC) research, retail investment in bars and coins rose by 4% last year. Coin demand surged to reach a five-year high of 236.4 tonnes (the second highest on record), while demand for bars remained constant in its five-year range between 780-800 tonnes.

I can also see the narrative that gold, not the US dollar, is the international reserve currency starting to emerge again. As the WGC notes, central banks bought added 651.5 tonnes to official gold reserves. This is an extremely significant statistic. It is the second-highest yearly total of central bank purchases on record, the highest since 1971, the year the dollar came off the gold standard. Should central banks exceed that 1971 figure, alarm bells for the dollar will ring very loudly.

So what should you watch out for now?

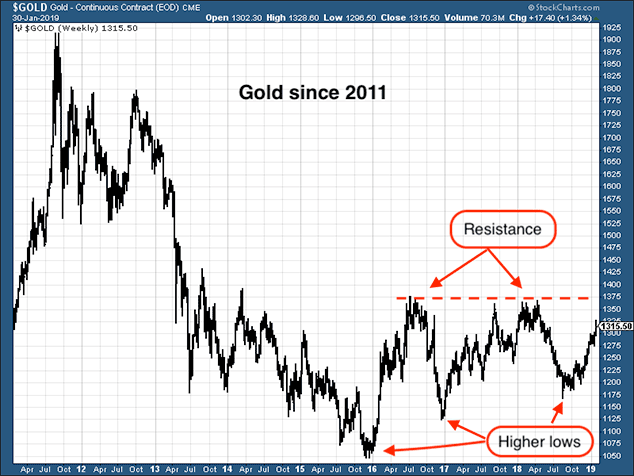

In the chart below we see the gold price since 2011, when it made its historic high at $1,920 an ounce.

I want to draw your attention to two things, which I have flagged up in red. First, is that since gold's bear market low at $1,050 an ounce in late 2015/early 2016, each subsequent major low has been higher than the last. The 2018 low was higher than the 2017 low, which was higher than the 2016 low. That is good.

On the other hand, the $1,360-$1,380 level has been barrier through which gold has not been able to pass for coming up to five years now since early 2014. I rather think that level will decide for me whether we are in a a major new, multi-year bull market for gold, or whether the move we are enjoying is just typical annual fluctuations.

If we can get above it, then I'm happy to say "bull market". While there is subsequent resistance at around $1,420 and $1,450, if we can get through the red barrier, I think gold is on its way to $1,520.

It might sound jaded, but it could also be deemed wise: I'm all too aware of false dawns in gold and excessive promise. For now, though, my target for 2019 is that red barrier at $1,360-$1,380. If we get there, I will, of course, reassess.

But I'll also be taking some money off the table.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how