Gold has been so bad that it’s now starting to look good

Gold has had a terrible year. But the price is now so low that it could be worth a punt. Here, Dominic Frisby outlines eight reasons to buy gold now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Back in mid-July we discussed the summer gold trade.

Should you take the plunge, attempt to catch the golden knife that was falling, and buy gold with a view to off-loading with a 10%-20% sometime in the autumn on winter?

The overall message was one of ambivalence. It didn't quite feel right. The timing was off. It looked as though gold had further to fall.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Such sentiment was well placed. At the time, gold was $1,227. This week we hit $1,204.

But this week, however, may be the time to risk the summer trade in gold.

Eight reasons to buy gold now

Just for clarity's sake: I'm not calling the start of a great new bull market in gold, much though I would like that to happen. Rather, we are looking at a flip trade between now and sometime in the autumn or winter.

Moreover, none of these reasons US dollar aside are enough on their own. It is the coincidence of all of them their aggregate that makes the trade so tempting.

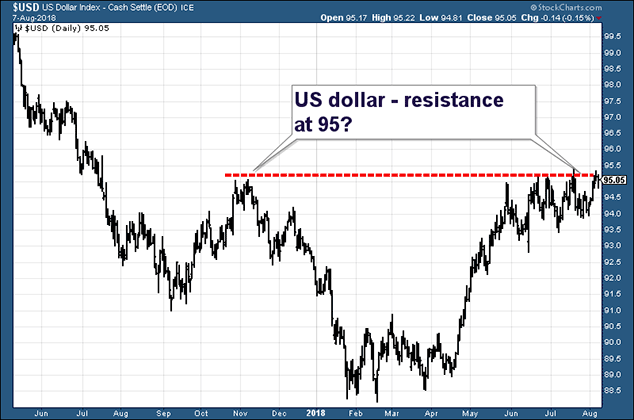

Exhibit A: the US dollar

Gold is usually, though not always, the opposite of the US dollar. If the dollar is strong, gold is weak; if the dollar is weak, gold is strong. That has been the case these last few months with the extraordinary rally we have seen in the dollar, which has put the heebie jeebies up just about everyone. But the dollar rally may have run out of steam.

Here is the US dollar index, which measures the dollar against the currencies of the US's major trading partners the euro, the yen, the pound, and so on. You can see it has met some resistance in the 95 area.

Not conclusive, I know, but 95 has been a barrier for over two months now. The dollar could be due a retreat, which would mean gold is due a rally.

The direction of the dollar is the single biggest determinant of where gold goes next more important than anything else I mention below. If it rallies through 95, bets are almost certainly off. The dollar is the biggest risk to gold.

That said, consider my other seven reasons to buy gold.

Exhibit B: the CoT Report

The Commitments of Traders report on the futures exchanges has proved to be an extremely useful indicator over the years. The more open positions there are, the more bearish it is for gold. There are various categories of traders on the exchange. Generally speaking, the "commercials" are considered the wiser heads. The shorter they are ie the more they are betting that the market will fall the more concerned you want to be. The large speculators (hedge funds, basically) are the "not so wise".

Currently the traders' commitments are at depressed levels not seen since July last year, when gold rallied from around $1,200 to $1,360.

The last time they were this low was winter 2015-2016, after which gold went on a monster run from $1,050 to $1,380.

Meanwhile, the positions of the large speculators specifically in gold futures are at or near capitulation levels. The last time they were lower was January 2016.

Exhibit C: Positive seasonality

The seasonal gold trade is a hard trade to time, but there is almost always a clear low sometime between June and August. This was particularly apparent during the bull market years, but, as often as not, it has also applied now the world has lost interest in precious metals.

This week the gold price hit new lows for the summer. We have no way of knowing, of course, whether it is the low, but August only has about three weeks left. The low can't be that far off.

Then we head into September, which usually sees large volumes of buying in India, as the wedding season comes into play.

Exhibit D: GLD inventory levels

The world's largest gold exchange-traded fund, GLD, is how many institutions buy gold, especially in the US, so it pays to monitor inventory levels. Currently, there are 787 tonnes under storage.

The last time inventory levels were this low was summer 2017 after which that rally from $1,200 to $1,360 followed and the time before that was early 2016 when inventory levels were much lower (and the ensuing rally was much greater).

Low inventory levels mean low ownership. Low ownership means a lot of potential buyers.

Exhibit E: the ratio between the miners and the metals

Typically, the ratio between the gold miners' share prices and the price of gold falls during bear markets and rises during the bull markets. People tend to trade miners and hoard bullion.

If the ratio is rising in other words the relative performance of miners is better than gold that is a bullish sign. It means the market suspects lower metal prices are a temporary aberration that will not unduly affect the profitability of miners over a longer term

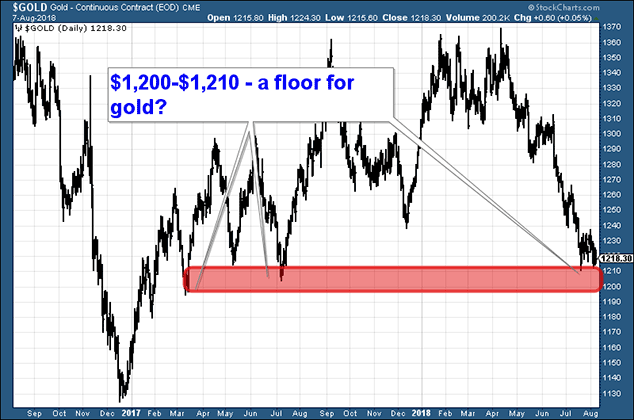

Exhibit F: There is a lot of support at $1,200

The $1,200 to $1,210 area has marked the low for gold for almost two years, as demonstrated in the chart below. There is support here.

Exhibit G: inflation expectations

Gold is an inflation trade. Inflation expectations have been gently, but steadily rising for two years now. The ProShares inflation ETF (NYSE: RINF) has been creeping up even over this last month, as gold has been falling.

For inflation expectations to be rising as gold is falling is abnormal. One resolution of this is for inflation expectations to come down. The other more likely resolution is for gold to rally and catch back up.

Exhibit H: bargain hunters are coming into the market.

Ross Norman at bullion dealer Sharps Pixley tells me that the physical market this year has been "dire". Many dealers report that trade is down around 40% year on year. "But the market has a very effective correcting mechanism", he says. "It's called the price. At these levels, gold is starting to look compelling. And bargain hunters are now coming into the market."

Ross adds that "there has been a speculative overhang of some 700 tonnes which which has been holding the market back. That has now been removed."

I'm going to leave you with Ross's final comment to me, which just about sums it all up: "Gold has been looking so bad it's starting to look good."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.