Nationwide: House price growth slows but market remained resilient despite Budget worries

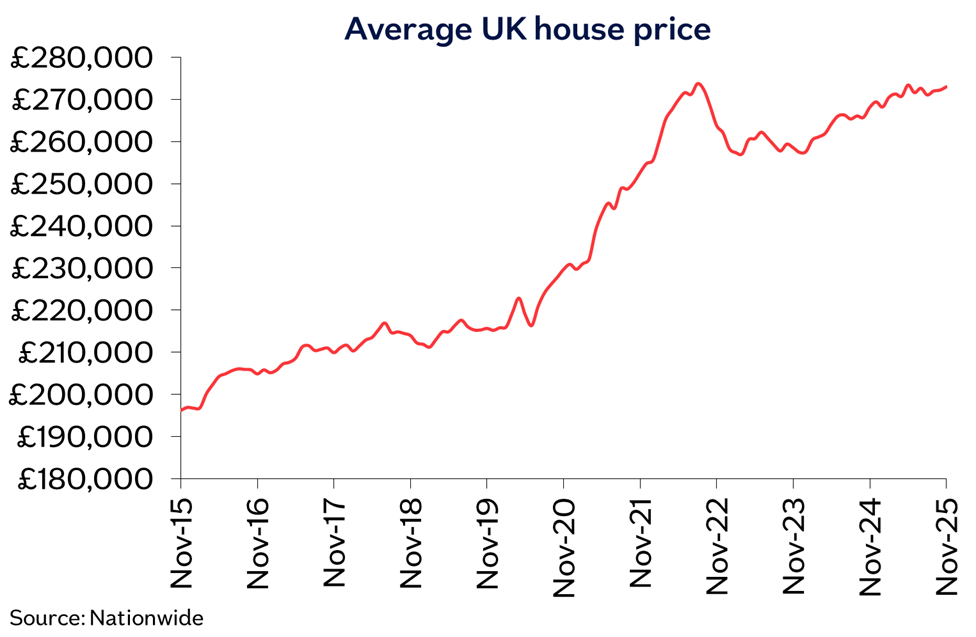

The average price of a house in the UK was £272,998 in November, as annual house price growth slowed to just 1.8%, Nationwide said.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Annual house price growth dipped in November but the market remained resilient despite threats of increased taxation in the Autumn Budget, new figures show.

House prices are up 1.8% in the year to November, according to Nationwide’s House Price Index, down 0.6 percentage points from October’s annual price growth figure of 2.4%.

The slower rate of annual growth meant the price of a typical house increased by 0.3% between October and November, bringing the average price of a UK house to £272,998 – a month on month rise of £772.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Robert Gardner, chief economist at Nationwide, said: “The housing market has remained fairly stable in recent months, with house prices rising at a modest pace and the number of mortgages approved for house purchase maintained at similar levels to those prevailing before the pandemic.

“Against a backdrop of subdued consumer confidence and signs of weakening in the labour market, this performance indicates resilience, especially since mortgage rates are more than double the level they were before Covid struck and house prices are close to all-time highs.”

Did the Budget affect house prices?

In November, many homeowners and prospective buyers will have been anticipating a shake-up to how property is taxed in the Autumn Budget, which was delivered on 26 November.

In the weeks leading up to it, reports suggested the chancellor was going to hike property taxes, but most owners were spared. Just those with a home valued at £2 million or more face a new ‘mansion tax’.

These rumours had a strong effect on consumer sentiment, which took a hit before the Budget, but this does not seem to have translated into a palpable dip in the market.

Gardner at Nationwide believes the new ‘mansion tax’ is “unlikely to have a significant impact on the housing market” in the long term as the new levy will apply to less than 1% of properties in England and around 3% in London.

Gardner expects the increase to the rate of income tax on property income to have a more profound impact, as it may dampen the supply of new rental properties.

Alice Haine, personal finance analyst at Bestinvest, supports this view, calling the two percentage point tax hike a “sting in the tail” for landlords.

She added: “This could be the tipping point for some landlords, prompting sales after years of rising taxes and tighter regulation, while others may resort to passing increased costs on to tenants – pushing rents even higher.”

Where will house prices go next?

Following a Budget where the worst-case scenarios were avoided, Gardner at Nationwide believes the outlook for some buyers is set to improve.

He said: “Looking forward, housing affordability is likely to improve modestly if income growth continues to outpace house price growth as we expect. Borrowing costs are also likely to moderate a little further if Bank Rate is lowered again in the coming quarters.

“This should support buyer demand, especially since household balance sheets are strong. Indeed, in aggregate, the ratio of household debt to disposable income is at its lowest for two decades.”

Increased affordability in the market is also expected by Haine at Bestinvest, who said market confidence could return after this Autumn’s pre-Budget dip, as buyer demand and the number of listings could increase.

She said: “While property tax changes may dampen demand at the upper end of the market, and higher taxation could accelerate buy-to-let exits, there could be a resurgence in wider market activity. Buyers who paused moving plans in the run-up to the Budget, in a bid to assess the impact of any new measures, may now make a return.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Daniel is a financial journalist at MoneyWeek, writing about personal finance, economics, property, politics, and investing.

He covers savings, political news and enjoys translating economic data into simple English, and explaining what it means for your wallet.

Daniel joined MoneyWeek in January 2025. He previously worked at The Economist in their Audience team and read history at Emmanuel College, Cambridge, specialising in the history of political thought.

In his free time, he likes reading, walking around Hampstead Heath, and cooking overambitious meals.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Nationwide: UK house price growth bounced back in January

Nationwide: UK house price growth bounced back in JanuaryHouse price growth slowed in 2025 but the new year is showing more positive signs for the property market

-

London house prices to outperform rest of UK, says economist

London house prices to outperform rest of UK, says economistAfter years of underperformance, London house prices are set to grow faster than the rest of the country, according to Capital Economics. We look at the reasons behind this forecast – and whether other experts agree

-

Nationwide: Average house prices rose in January – will property values recover in 2024?

Nationwide: Average house prices rose in January – will property values recover in 2024?News The latest Nationwide house price index shows lower mortgage rates are boosting house prices. What does this mean for the property market?

-

Nationwide: House prices fell by 1.8% in 2023 – will they drop further this year?

Nationwide: House prices fell by 1.8% in 2023 – will they drop further this year?News Nationwide’s latest house price index reveals how the property market performed in 2023

-

Nationwide: House prices fall at fastest rate since July 2009

Nationwide: House prices fall at fastest rate since July 2009High borrowing costs continue to undermine the housing market, but some buyers are making their move before rates rise further.

-

Will mortgage rates fall this year?

Will mortgage rates fall this year?The mortgage price war may be over in a blow for borrowers. Whether you're buying a home, remortgaging or you’re a buy-to-let landlord, we look at the outlook for mortgage rates this year and into 2026

-

Halifax: House prices bounce in February, but market remains subdued

Halifax: House prices bounce in February, but market remains subduedNews Latest house prices show a rise in February - has the potential house price crash stalled?

-

Halifax: UK house prices tread water as mortgage costs rise

Halifax: UK house prices tread water as mortgage costs riseNews Halifax’s latest house price index shows the average house price has remained largely unchanged from December.