ONS: House prices up 10.3% in November

Official data shows house prices went up in November 2022, but a slowdown is still on thee cards

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

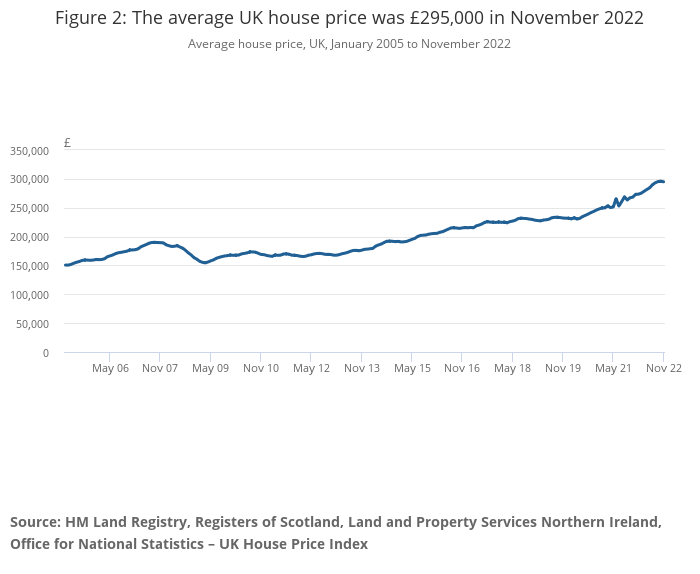

Average UK house prices were up 10.3% in the year to November, according to the Office for National Statistics’ latest house price index.

Even though that represents a year-on-year increase, house price growth fell from 12.6% in October, reflecting a slowdown in the housing market.

The average UK house price was £295,000 in November - £28,000 higher than the same time last year, but slightly lower than October’s peak of £296,000.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The data shows house prices remained high despite the market panic caused by the mini-budget, which sent mortgage rates up to 14-year highs as the cost of borrowing increased.

Recent data from Rightmove also showed house prices increased in January, with asking prices up by 0.9% from the month before.

“November’s positive 0.1% GDP growth and the rallying of the FTSE to record highs will certainly help to improve confidence among buyers and sellers, and we expect this will be reflected in transaction activity in coming months,” says Emma Cox, managing director at Shawbrook.

“Nevertheless, there are still many first-time buyers feeling the effect of inflation and rising energy costs, which are hampering their ability to get onto the property ladder.” Figures from the ONS showed that inflation slowed to 10.5% in November, but the cost of living crisis still rages on as it remains close to historic highs.

What happened to house prices per region?

House prices in England increased 10.9% year-on-year, down from 13% the month before, bringing the average house price to £315,000.

House prices rose the most in the North West, increasing by 13.5% year-on-year. Meanwhile London was the English region with the lowest annual house price inflation; average prices increased 6.3% year-on-year, down from 6.7% in October.

But London house prices remain the most expensive in the UK, with an average price of £542,000.

In Scotland the average house price increased 5.5% over the year to November 2022, down from 7.9% in October.

In Wales house prices were up 10.7% year-on-year, down from 11.9% the month before. The increase was the same in Northern Ireland, falling from 13% the month before.

Where will house prices go next?

Rightmove and the Office for National Statistics have posted positive results, but more widely house prices are predicted to fall in 2023 as the property market cools down.

Earlier in January Halifax reported house prices’ fourth consecutive monthly fall. The lender reported prices fell 1.5% in December from the month before, with the average property costing £281,272. The decrease was largely driven due to the rising cost of living and rising interest rates, the lender said.

Halifax expects house prices to fall by around 8% this year as wider economic headwinds weigh on supply and demand. Nationwide expects house prices to fall 5% in 2023, and the Office for Budget Responsibility expects prices to fall 9% over the next two years.

The property market boomed from 2020 to 2022, boosted by stamp duty cuts and cheap borrowing costs.

But mortgage rates have risen over the last few months. Though they have climbed down from their 6.65% peak in October, they remain significantly higher than they were this time last year and many will face significantly higher repayments as their fixed deals come to an end.

“As we head into 2023, the UK must brace for further house price drops as increased energy bills will still cause financial strain for millions in the upcoming months,” says Charlotte Nixon, mortgage expert at Quilter.

“As a result, many might be more hesitant to move and incur all the expense that comes with it. The Financial Conduct Authority (FCA) estimates that 750,000 people are at risk of defaulting on their mortgage and these people may be looking to sell up to release equity in their home and avoid getting into financial difficulty. This could lead to an increase in housing stock when demand is depressed, causing house prices to drop lower.”

The cost of borrowing will likely remain high as interest rates are predicted to continue climbing as the Bank of England fights to get inflation under control.

But Bank of England governor Andrew Bailey believes the market volatility that followed the mini-budget in September has normalised. “Coupled with Prime Minister Rishi Sunak's recent statement that inflation is expected to halve in the next year, and today's slightly lower inflation figure, hopefully indicates a permanent change in direction for the mortgage market,” says Nixon.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Nic studied for a BA in journalism at Cardiff University, and has an MA in magazine journalism from City University. She has previously worked for MoneyWeek.

-

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impact

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impactFrozen tax thresholds and pensions falling within the scope of inheritance tax will drag thousands more estates into losing their residence nil-rate band, analysis suggests

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.