We need a coherent and affordable plan for the transition to Net Zero

Energy analyst Clive Moffatt gives his views on the energy market and how to transition to Net Zero

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Rishi Sunak has tried to make a name for himself by rolling back some of the UK’s climate policies over the past few months, but his tinkering has done little to bring about what the UK really needs, a coherent, realistic plan for the country to hit its climate goals.

That’s the view of Clive Moffatt, energy analyst and founder and chairman of the UK Energy Security Group.

Renewable energy drive is costing the UK

Moffatt has over three decades of experience in the energy sector, both in the UK and EU markets. He led a consortium of energy market participants and investors during consultations with the government on the content and subsequent implementation of the 2013 Electricity Act and founded the cross-industry UK Energy Security Group (UKESG). He was formally worked as a Treasury economist and business journalist at the FT and BBC.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

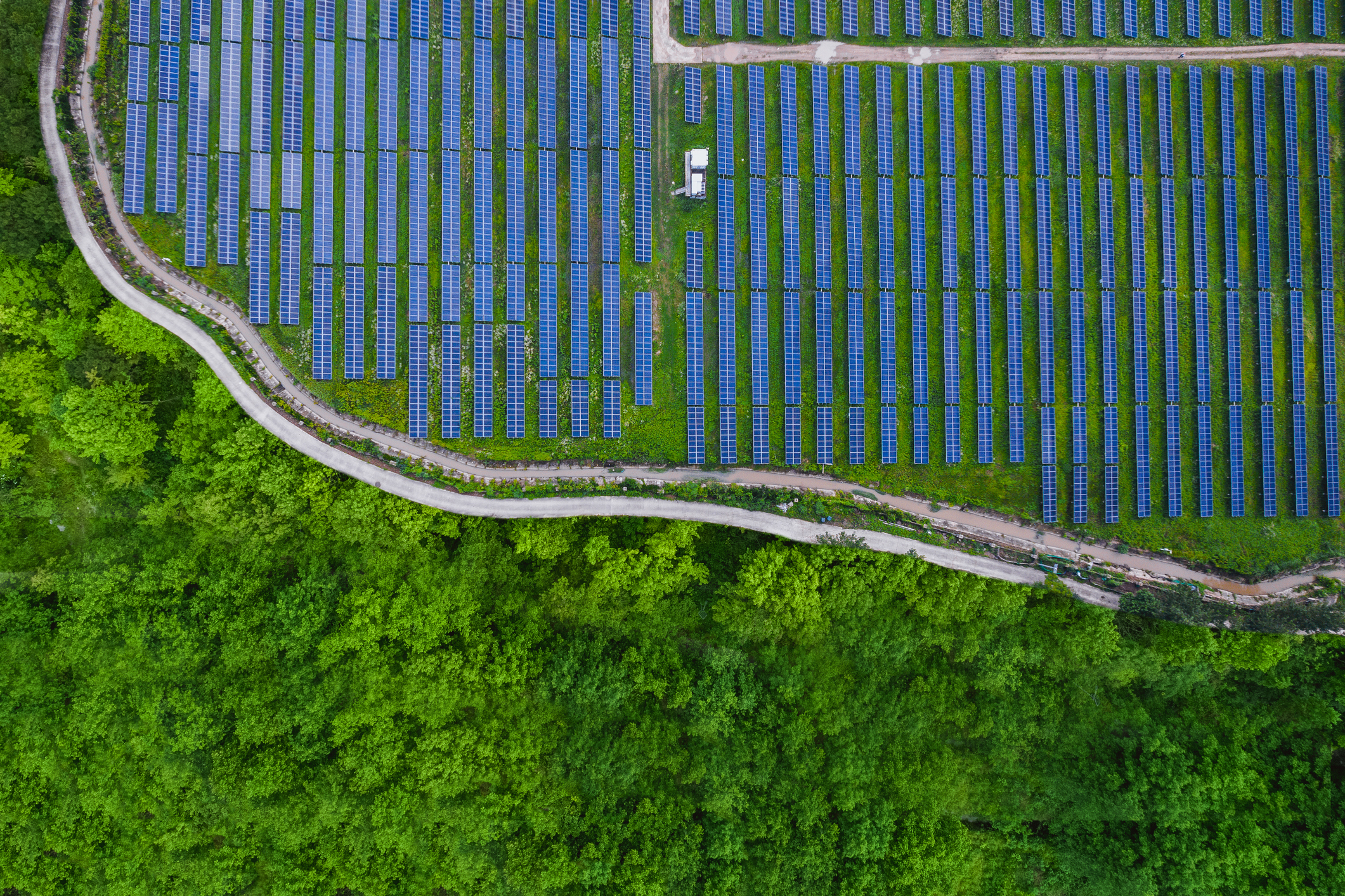

Moffatt notes the UK’s decision to charge headlong into wind and solar energy, without a long-term plan for the role of other energy sources as a source of heat and power has only increased the costs for the country. By not investing in other energy sources, the country is forced to compete in the global energy market for supplies.

Much was made about the government’s energy security “understanding” with the USA, which was signed last year, to help underpin UK gas security of supply at times of system stress.

However, it’s “market participants and not governments trade gas and there is no evidence that the UK Government has agreed to facilitate directly long- term gas supplies from USA or Qatar or Australia,” notes Moffatt.

With the UK Government keen to avoid the “embarrassment of a gas and power shortfall” it could be the case that energy suppliers are effectively forced to strike up deals which could either “ lock in consumers to paying a significant premium above the market rate to guarantee supply” or the government “subsidising energy suppliers here for the difference between what they have agreed to pay US importers for “guaranteed” supplies and what any retail energy cap allows for them to pass on in higher prices to UK consumers.”

Whatever the outcome, these short-term fixes are “no effective substitute” for “taking action now to promote new investment in more UK gas storage and peaking gas power.”

How to transition to Net Zero

That’s not to say the government should give up on Net Zero and the transition away from fossil fuels. “We need a coherent and affordable plan for the transition to Net Zero,” which balances cost with long-term growth says Moffatt.

As part of this transition, he believes the government should impose a Public Service Obligation (PSO) on gas suppliers and shippers in the UK “to store a greater proportion of their estimated demand for gas.”

This combined with some form of storage capacity-based subsidy auction would underpin new investment in gas storage (currently less than 2% of total demand compared with an average of 25% in the EU) thereby reducing price volatility”.

The gas market

Given the inextricable link between the gas and power market Moffatt is also advocating a formal system of Demand Side Reduction (DSR) in the gas market. Similar to the one already in existence for electricity, this system would “reward a significant number of industrial users for voluntarily curtailing (if required) their gas demand at times of system stress.”

The UK says Moffatt is “‘desperately short of reliable and flexible power generation to provide support at times of system stress especially with the expansion of intermittent renewable energy”.

Therefore, he believes the government should impose an obligation on the System Operator to ensure that the “power reliability margin is not allowed to fall below 10% of projected demand.” This would “prompt a a separate capacity auction to secure more flexible unabated gas capacity and eliminate the need for expensive, short-term market balancing measures.”

Taking politics out of energy

His last, and perhaps most far-reaching proposal is to “take the politics out of energy.”

An independent Strategic Energy Authority (SEA), with an independent chair and expert management board, should be set up to remove all conflicts of interest at the regulatory, political and corporate levels.

This would eliminate the need for the Climate Change Committee, Ofgem and the National Grid’s current role as System Operator. The SEA would be charged with delivering a workable and affordable and balance between security and sustainability over the long term.

Such a body could set “longer-term investment targets up to 2050 and beyond for generation transmission and distribution,” as well as create a “consistent and cost-effective policy framework,” that’s not influenced by the political cycle. It would also “oversee the real time system operation of both the electricity and gas market and facilitate greater liquidity in the short-term balancing market” while working directly with the Treasury to “define and publish long-term budgets for taxes and levies impacting consumers and industry.”

A “rational and national debate on energy security” is “long overdue” argues Moffatt, and consumers are paying the price. The country will continue to pay the price as well, as high energy costs weigh on economic activity and hold back living standards. Moving away from a politically driven market, towards one that’s based around rational long-term thinking will be a major step forward for the UK.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Rishi Sunak: MoneyWeek Talks

Rishi Sunak: MoneyWeek TalksPodcast On the MoneyWeek Talks podcast, Rishi Sunak tells Kalpana Fitzpatrick that we need better numeracy skills to improve financial literacy and boost the economy.

-

Why the UK's investment prospects are improving

Why the UK's investment prospects are improvingCover Story The outlook for the UK has darkened since last year, but the chancellor’s £15bn energy relief package should mean recession is avoided, says John Stepek.

-

Should you be worried about energy windfall tax proposals?

Should you be worried about energy windfall tax proposals?Analysis Calls have been growing for a windfall tax on UK oil and gas producers. It's a popular idea, but is it a good one? And what does it mean for investors in the UK's energy companies? Rupert Hargreaves explains.

-

Should we levy a windfall tax on Big Oil's big profits?

Should we levy a windfall tax on Big Oil's big profits?Briefings Soaring oil prices mean huge profits for energy firms. Politicians are keen to impose windfall taxes, but that could discourage vital investment in new production.

-

House price rise slows – but not by much

House price rise slows – but not by muchNews The rate of increase in UK house prices slowed in the year to January. But nothing seems able to halt their determined march higher, says Nicole Garcia Merida.

-

UK house prices hit a new record high – can it last?

UK house prices hit a new record high – can it last?News Despite the pandemic, UK house prices have hit a new high. John Stepek looks at what’s driving the surge in prices, and what it means for house prices in the longer run.