House price rise slows – but not by much

The rate of increase in UK house prices slowed in the year to January. But nothing seems able to halt their determined march higher, says Nicole Garcia Merida.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

House prices in the UK saw a 7.5% increase over the year to January 2021, the Office for National Statistics’ latest house price index revealed. That’s down from the 8.0% increase the market saw in December, but it confirms what we have been saying for some time now: houses are getting more expensive.

An average house in England would set you back £267,000 in January 2021 compared to £247,355 a year before. The northwest of England saw the highest annual growth in average house prices with a 12% surge, while the West Midlands saw the lowest at 4.7%.

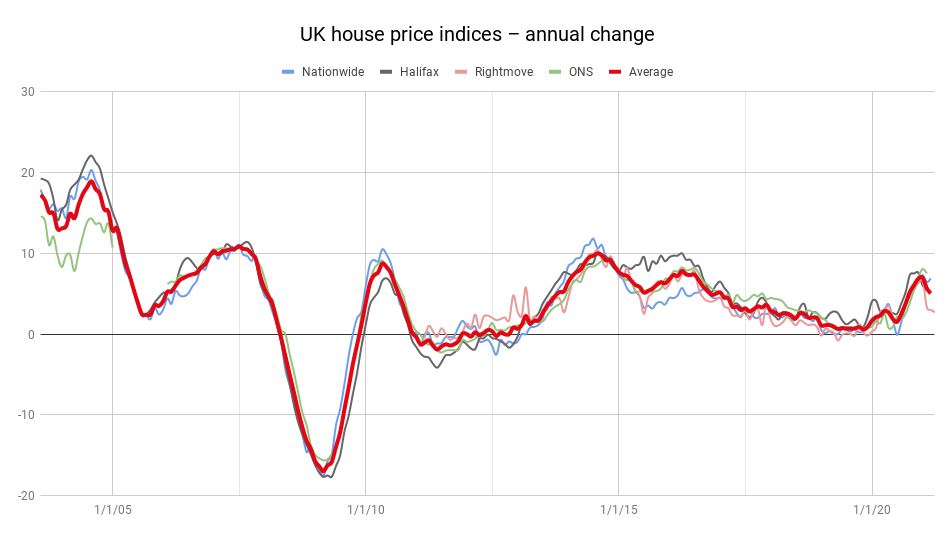

The past four years saw a “general slowdown” in UK house price growth. Things seemed to be heating up at the beginning of 2020, which saw a pick-up in annual growth in the market. But that was short-lived, as lockdown restrictions were put in place at the end of March.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Lockdown changed buyers' priorities

However, prices have been growing steadily since lockdown measures were first eased, exacerbated by the stamp duty holiday announced by the chancellor in early July. Not having to pay as much tax on properties valued at up to £500,000 freed up some extra spending money, which enabled sellers to ask for higher prices, and gave buyers the ability to meet them.

Data by property portal Zoopla showed the latest Budget, in which Rishi Sunak announced an extension of the stamp duty tax holiday until June, stimulated an 80% spike in buyer demand for property compared to the four year average. But there simply aren’t enough homes, according to Zoopla, and the imbalance between supply and demand is exerting further pressure on house prices, sending them up. This is predicted to continue throughout the second quarter of 2021.

In a sign of how the pandemic has changed priorities for buyers, houses are now selling three weeks faster than flats. Once buyers found themselves permanently at home due to lockdown many reevaluated their needs and prioritised space over being close to city centres. Demand for three-bed homes was up 30% in the week after the Budget was announced, and they continue to be the most coveted type of property across the UK.

London could be regaining its attraction

The twin effects of the 95% mortgage guarantee and the stamp duty tax holiday also saw an increase in demand for one- and two-bed flats in London and the southeast, which indicates “increased buying intent” among those buying for the first time.

It’s not just buyers who are considering returning to the capital. The promise of an end to lockdown also saw rental searches surge in London zones one and two. Many renters left London last year as part of a mass exodus that saw office workers trade the city for more space and cheaper rents. According to Rightmove, data from last summer reflected people wanting to move to quieter areas further away from London as home working became the norm. But the tide appears to be turning; annual growth of rental searches in inner London is outperforming last summer’s search activity. So essentially, all the people who left the city because they no longer needed to commute might be looking to come back as both work and leisure venues promise to open back up again.

It’s not a stretch to say that the pandemic has forever changed buyers’ priorities. The shift towards home working seems to be here to stay, at least in a hybrid form. The “race for space” could very easily turn from a sprint into a marathon, and a very costly one at that.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Nic studied for a BA in journalism at Cardiff University, and has an MA in magazine journalism from City University. She has previously worked for MoneyWeek.

-

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impact

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impactFrozen tax thresholds and pensions falling within the scope of inheritance tax will drag thousands more estates into losing their residence nil-rate band, analysis suggests

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

Rishi Sunak: MoneyWeek Talks

Rishi Sunak: MoneyWeek TalksPodcast On the MoneyWeek Talks podcast, Rishi Sunak tells Kalpana Fitzpatrick that we need better numeracy skills to improve financial literacy and boost the economy.

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

We need a coherent and affordable plan for the transition to Net Zero

We need a coherent and affordable plan for the transition to Net ZeroEnergy analyst Clive Moffatt gives his views on the energy market and how to transition to Net Zero

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.