What is Rishi Sunak’s net worth?

We look at former prime minister Rishi Sunak’s net worth, and his new role after losing the 2024 general election to Keir Starmer

Vaishali Varu

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Rishi Sunak’s net worth makes him the richest-ever prime minister to have occupied 10 Downing Street.

The former Conservative Party leader and his wife, Akshata Murty, have a personal fortune of £640 million, according to The Sunday Times Rich List 2025.

Their combined wealth puts them within touching distance of some of the richest people in the world, and matches King Charles' net worth, which rose significantly this year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What is Rishi Sunak’s net worth?

Rishi Sunak and Akshata Murty’s combined worth is £640 million, according to The Sunday Times.

Most of it comes from Murty’s shareholdings in Infosys, an Indian IT company founded by her father, N. R. Narayana Murthy (known as the Steve Jobs of India) in 1981. The company’s market capitalisation as of May 2025 is roughly £57 billion.

Murty has a 0.93% stake in the company. In April, Mint reported that Infosys’ share price had fallen over 26% on a year-to-date basis, and shares have declined 30% over the past six months.

The latest annual report suggests that Murty received about £7.5 million in dividends — adding to the £73+ million she has already been paid over the years.

While Murty’s vast fortunes are well-known, her tax affairs have not been quite as transparent. At one point, this “threatened to end Sunak’s chance to lead the country”, according to The Sunday Times. Murty held a non-dom status that meant she could avoid paying UK tax on her Infosys dividends, possibly as much as £20.6 million.

However, she announced she would stop using the special status soon after the fact made headlines during Sunak’s premiership.

Murty’s earnings far exceed those of the former prime minister. In February 2024, Sunak released his financial statements, which showed that he made £2.2 million in 2022-23, of which only 6.5% was his MP and prime ministerial wages.

Other earnings include roughly £1.8 million through capital gains and around £300,000 from interest and dividends, and he paid £508,308 in tax.

The Sunaks have an extensive property portfolio. According to The Sunday Times, their main Kensington mews house is worth £7 million. They also own a flat on Old Brompton Road in Kensington, a £1.5 million Georgian manor house in North Yorkshire, and a £5.5 million penthouse in Santa Monica, California.

Sunak can also take advantage of the Public Duty Costs Allowance, which will allow him to claim financial support of up to £115,000 a year for any administration costs as a result of his position as a former UK prime minister.

What did Rishi Sunak do before he entered politics?

Before entering politics, Sunak worked as an analyst for Goldman Sachs from 2001 to 2004. He then studied for an MBA at Stanford University in California, where he met his now-wife.

Soon after, he moved back to the UK and joined The Children’s Investment Fund Management (TCI), founded by hedge fund billionaire Chris Hohn. In 2006, the year Sunak became a partner, the firm reported profits of £321 million, according to Companies House documents. In the two years leading up to the financial crisis, TCI saw profits nearing £900 million.

After leaving TCI in 2009, Sunak returned to California to work with former colleagues at the new hedge fund firm Theleme Partners. He served as a director at Catamaran Ventures from 2013 to 2015, before becoming an MP for Richmond and Northallerton – a seat he has held since.

What is Rishi Sunak doing now?

Despite losing out to Starmer in the 2024 general election, Rishi Sunak has hung on to his seat as an MP in his constituency of Richmond and Northallerton.

Many speculated that Sunak would return to California after leaving Downing Street. However, he was quick to debunk this claim at the G20 summit, insisting that he aims to remain an MP for the next few years.

Sunak has now taken up two new jobs at his former universities — an unpaid role at the University of Oxford’s Blavatnik School of Government, and a visiting fellowship at the Hoover Institution, a think tank based at Stanford University.

Meanwhile, Akshata Murty was made a trustee at the Victoria and Albert Museum in London.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Oojal has a background in consumer journalism and is interested in helping people make the most of their money.

Oojal has an MA in international journalism from Cardiff University, and before joining MoneyWeek, she worked for Look After My Bills, a personal finance website, where she covered guides on household bills and money-saving deals.

Her bylines can be found on Newsquest, Voice.Cymru, DIVA and Sony Music, and she has explored subjects ranging from politics and LGBTQIA+ issues to food and entertainment.

Outside of work, Oojal enjoys travelling, going to the movies and learning Spanish with a little green owl.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

General election 2024: who’s in the Labour cabinet?

General election 2024: who’s in the Labour cabinet?A new Labour cabinet has been appointed by Keir Starmer after his party won the general election. Here’s the latest on who’s in it

-

What does the Labour election win mean for your money? Key manifesto points after landslide

What does the Labour election win mean for your money? Key manifesto points after landslideNews The Labour election win was not as large as some polls had predicted. But the new government’s majority will mean it can enact significant changes.

-

What would a Labour supermajority mean for capital markets?

What would a Labour supermajority mean for capital markets?The Conservative Party has warned that a Labour supermajority would be bad for democracy. But what impact could a big win for Keir Starmer have on the markets?

-

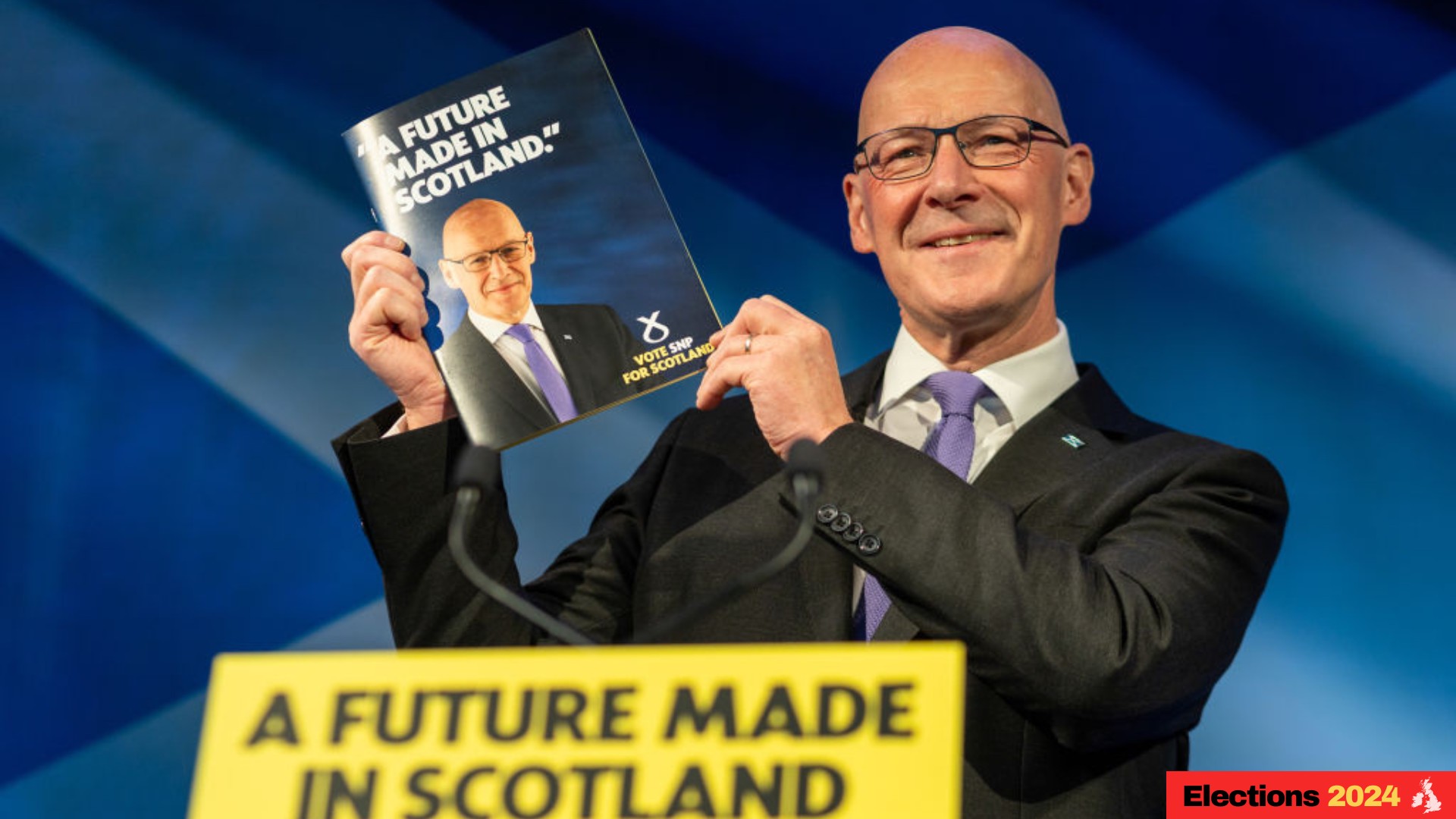

SNP manifesto 2024: what money policies did John Swinney announce?

SNP manifesto 2024: what money policies did John Swinney announce?The SNP manifesto has been launched in Scotland, and makes several key commitments, including a pledge to end austerity and a commitment to rejoin the EU.

-

Labour pledges to open 'at least' 350 banking hubs over next Parliament

Labour pledges to open 'at least' 350 banking hubs over next ParliamentNews The Labour Party claims it will ‘bring banking back to the high street’ if it forms the next government after the 2024 general election.

-

What does the Labour manifesto say about property? Key 2024 general election pledges

What does the Labour manifesto say about property? Key 2024 general election pledgesNews The Labour manifesto has made several promises around rental reforms, the leasehold system and housing market support. Here’s what a Keir Starmer government means for property.

-

Green Party manifesto 2024: key personal finance general election policies

Green Party manifesto 2024: key personal finance general election policiesA Green Party government would introduce a wealth tax, increase National Insurance Contributions for high earners, and move towards a universal basic income.

-

Conservatives pledge to raise high income child benefit threshold – how much could you save?

Conservatives pledge to raise high income child benefit threshold – how much could you save?News The high income child benefit charge threshold could be doubled to £120,000 if the Conservative Party wins the general election, Chancellor Jeremy Hunt has pledged.