New ways to profit from a love of whisky

Chris Carter looks at the latest online developments for whisky lovers.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

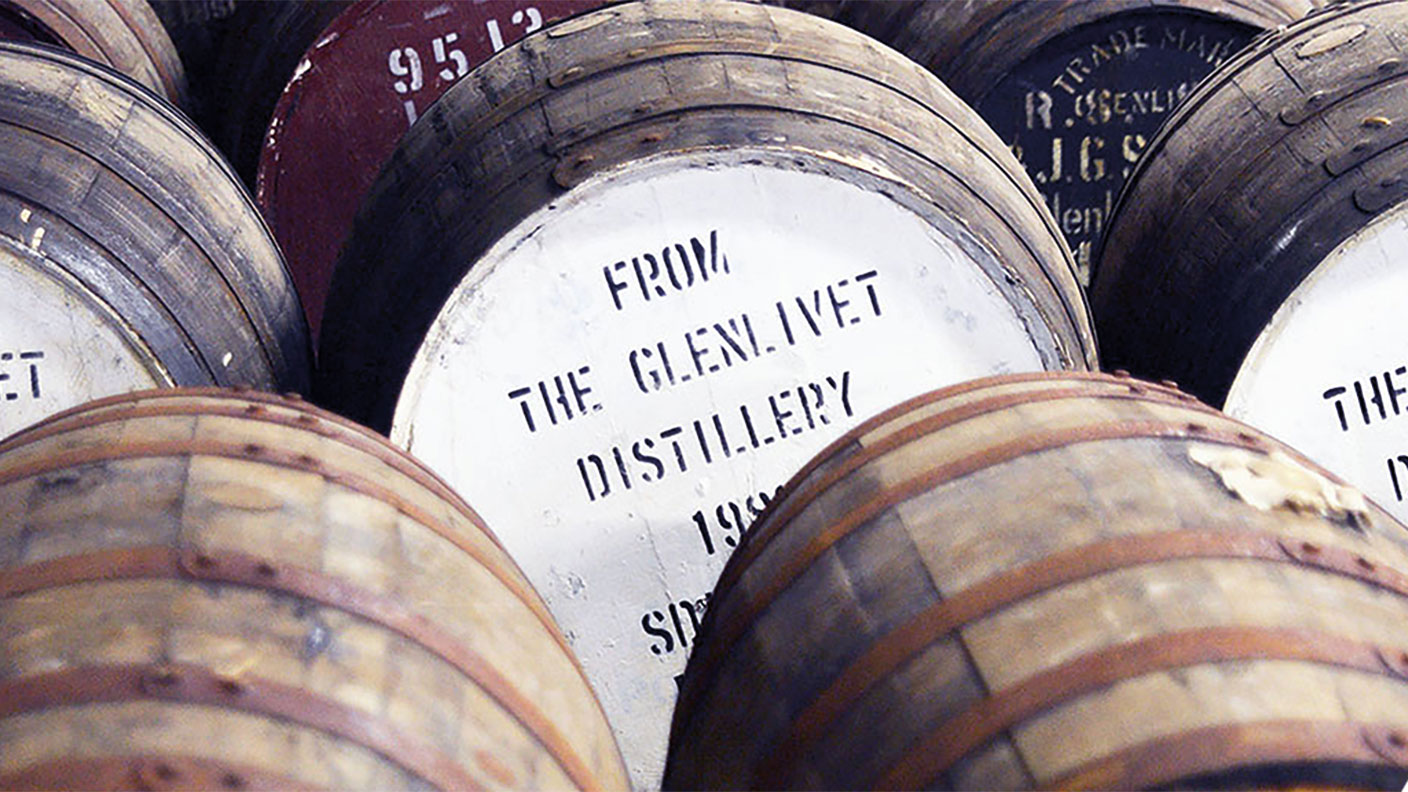

Investing in whisky has never been easier from the comfort of your home, even when it’s still in the cask. Whisky Invest Direct (whiskyinvestdirect.com) is a platform that was launched five years ago by the people behind popular gold and precious-metals dealing service BullionVault. Users simply log on and buy whisky that is still in the barrel and kept in the original distiller’s bonded warehouse. The idea is that, as it slowly ages, and other whiskies get consumed, your whisky appreciates in value. Then, you sell it via the platform. Just like on BullionVault, there is a live order board that allows you to set your own asking price.

Another option is to buy and sell whisky by the cask via an online auction. In February, Cask Trade’s (casktrade.com) newly launched auction service, called auctionyourcask.com, held the world’s first live, online whisky auction dedicated to casks. Around 300 whisky lovers registered to take part, withroughly 100 samples sent out to prospective buyers in North America, Asia, Europe and Australia.

“People loved the option of receiving samples,” founder Simon Aron said. “Try before you buy is incredibly powerful.” A 1995 Springbank sherry hogshead was among the casks sold, going for £45,000. Rather than you buying from the distiller, London-based Cask Trade owns the casks outright in bonded warehouses, and it only sells whole casks. The next auction is scheduled for 14 August.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Against the backdrop of the worsening crisis, Cask Trade has seen a steep rise in demand for its services, particularly in Asia. “Our new Asian customers are very enterprising”, says Aron. “They have a love of whisky, so they keep some, bottle some of the casks they are buying and trade others on as they are buying from us at a better price than some of their local competitors.” It’s perhaps a little too soon to say how the crisis has affected whisky prices, but it bodes well that demand has held up. It is also yet another reminder that alternative investments, such as whisky, wine and art, can form part of a properly diversified portfolio.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

Where to look for Christmas gifts for collectors

Where to look for Christmas gifts for collectors“Buy now” marketplaces are rich hunting grounds when it comes to buying Christmas gifts for collectors, says Chris Carter

-

How dinosaur fossils became collectables for the mega-rich

How dinosaur fossils became collectables for the mega-richDinosaur fossils are prized like blue-chip artworks and are even accelerating past the prices of many Old Masters paintings, says Chris Carter

-

Sotheby’s fishes for art collectors – will it succeed?

Sotheby’s fishes for art collectors – will it succeed?Sotheby’s is seeking to restore confidence in the market after landing Leonard Lauder's art collection, including Gustav Klimt's Portrait of Elisabeth Lederer

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.