How a dovish Federal Reserve could affect you

Trump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

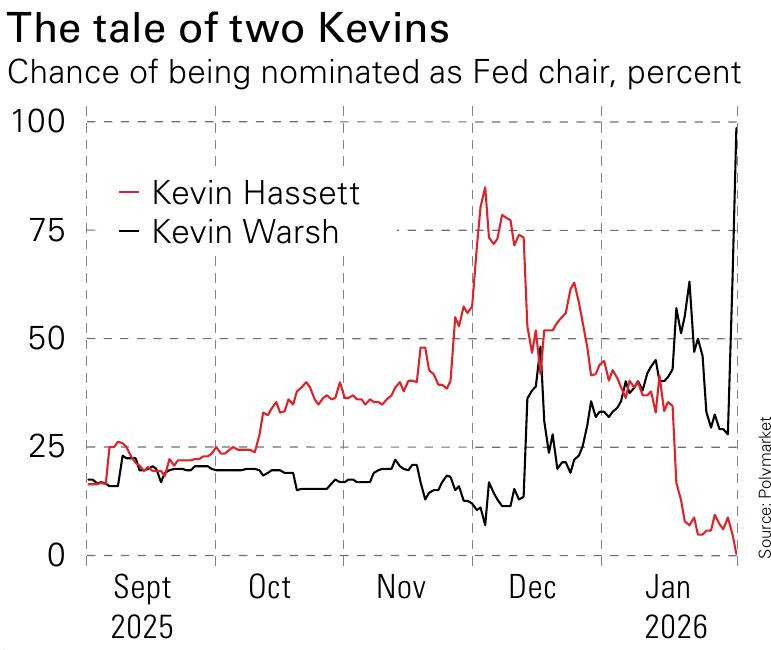

I must admit to being rather disappointed that Donald Trump has chosen the wrong Kevin to be the next chair of the Federal Reserve. For many months, Kevin Hassett – who investors with long memories may know as the author of the laughable Dow 36,000 – sat in pole position. Appointing him would not have been good for the Federal Reserve’s credibility, but his obsequious enthusiasm for cutting interest rates promised to be very entertaining. Sadly, Trump changed his mind, and we have been robbed of the central bank boss that our peculiar times deserve.

Still, any idea that Kevin Warsh will be some kind of interest-rate hawk does not sound plausible, regardless of his position when he was last at the Federal Reserve 15 years ago. He appears to be in favour of cutting short-term rates aggressively, if not quite as aggressively as Hassett. At the same time, he also wants to shrink the Fed’s bond holdings. The latter course of action should, in theory, mean higher long-term yields, since the Fed will no longer be mopping up so many longer-dated bonds, and a steeper yield curve. How that squares with treasury secretary Scott Bessent’s desire to cap longer-term yields is unclear, to say the least. All told, the outlook could get quite confusing.

The Federal Reserve is an institution that Republicans still seem to care about

Of course, this assumes Warsh is confirmed as chair and manages to get enough of the Fed governors on his side, which is by no means certain. One of the few US institutions the Supreme Court and Republican senators still seem to care about shielding from presidential whim is the cargo cult of modern central banking. Trump has been able to get away with extreme levels of overreach in practically every sphere, but giving him free rein over the panel of technocrats who can supposedly guide the direction of a $30trillion economy by tinkering with interest rates is apparently a step too far. Nonetheless, past experience suggests he will more or less get his way. If so, Warsh’s statements seem consistent with how our asset-allocation portfolio is positioned. We remain concerned that longer-term bonds offer too little compensation for the risk of higher yields and higher inflation (not just in the US but in the UK and elsewhere) and so we are sticking to short-term bonds.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Part of our protection against central banks getting it badly wrong is our 10% allocation to gold. I am doubtful that the rapid sell-off in gold at the end of last week had much to do with Warsh’s appointment, even though that explanation has been widely quoted. Metals had rocketed the previous week with clear signs of speculative excess; a pull-back was overdue. Huge moves in data and digital companies that might – or might not – be affected by AI point to a twitchy and volatile market in any case.

We are not making any changes to our holdings, but investors who have held gold for a while may find that it now accounts for a much larger share of their portfolio than originally intended. If you find that you are now heavily overweight, you may want to trim a bit back to target. We will do this in our regular rebalance at the end of the tax year.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Can US small caps survive the software selloff?

Can US small caps survive the software selloff?US stocks have made their worst start to a year since 1995 relative to a global benchmark. But experts think some sectors of the market are still worth buying.

-

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of Kefalonia

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of KefaloniaTravel Eliamos Villas Hotel & Spa on the Greek island of Kefalonia is a restful sanctuary for the mind, body and soul

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems