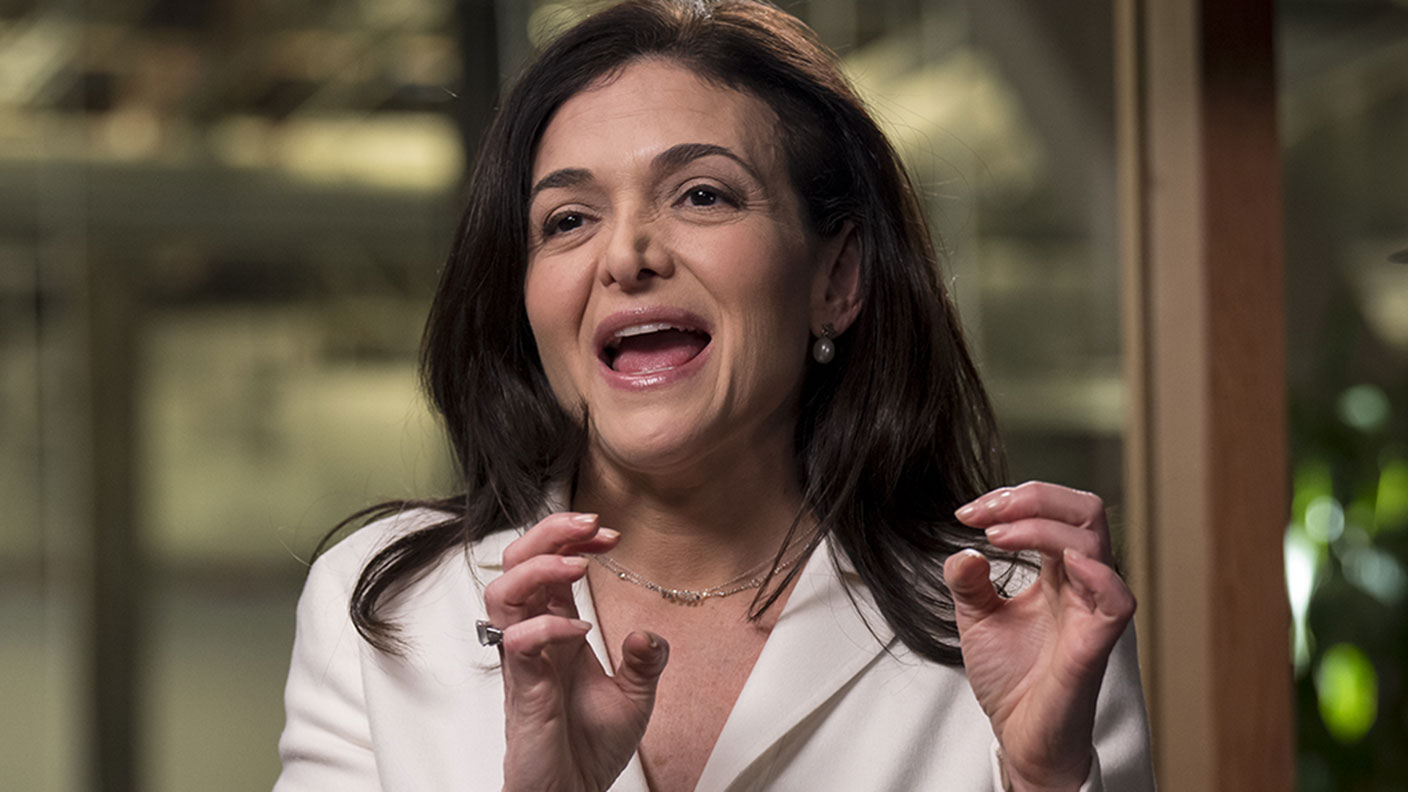

Why UK companies should lean in and poach Sheryl Sandberg

Sheryl Sandberg has quit Facebook. Now’s the time for corporate Britain to move in and poach her says Matthew Lynn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

We may not ever know exactly why Sheryl Sandberg quit Facebook, now Meta. But there’s no question that Sandberg is one of the most talented corporate executives of her generation.

When she joined Facebook from Google in 2008, hired by the site’s founder Mark Zuckerberg, the business had revenues of just $272m and was making losses of $56m. It had no real business model, nor much idea how to create one.

After taking over as COO, Sandberg turned it into a brutally effective advertising machine, monetising all those hundreds of millions of eyeballs to brilliant effect.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

By last year, Meta had revenues of $118bn and profits of $39bn. At its peak, it had a market value of more than $1trn, one of only a tiny handful of companies to break through that barrier. Sandberg’s brand of right-on, corporate feminism – especially as championed in her best-selling book Lean In – may have become a little grating over the years, but she is a class act. Without her, Facebook might have struggled to find a business model that actually worked.

What will happen to Meta without her remains to be seen. It faces a stiff set of challenges. But the more interesting question is what Sandberg will do next. After all, at 52 she is still relatively young. Every company in the world should be trying to snap her up. And some of the giants of the FTSE should be trying to tempt her across the Atlantic. Here are three that could definitely use someone of her ability.

Three UK companies that could use Sandberg's talents

First, Unilever. Alan Jope is completely out of his depth at the consumer-goods giant. It has trailed behind rivals such as Nestlé and Procter & Gamble while focusing on wishy-washy virtue signalling far more than delivering returns for shareholders. He launched the most hopeless takeover bid of recent times with a failed attempt to buy GlaxoSmithKline’s consumer goods unit ahead of its demerger, and his only plan for the conglomerate seems to be the kind of “reorganisation” that consultants come up with when they can’t think of anything better to suggest. US corporate raider Nelson Peltz has already taken a stake and a seat on the board. Sandberg would be the blast of butt-kicking corporate fresh air the company so badly needs, while also maintaining its impeccably liberal credentials.

Next, the company Jope tried to buy half of – GSK. The hapless Emma Walmsley may finally complete her long-planned demerger into its pharmaceuticals and consumer goods unit this year. But she will remain in charge of the more important drugs business even after years of failing to deliver the major new medicines the company needs to start growing again. There is no reason to imagine she will be any better at the job now she doesn’t have to worry about toothpaste sales any more. Sandberg knows how to run a tech-based business, and one that depends on cutting-edge science, and swapping genes and molecules for codes and algorithms shouldn’t be much of a problem.

Finally, HSBC. The world’s only real global bank needs a leader with political skills and vision to navigate the tense relationship between its Chinese and European interests. Perhaps it needs to demerge? Create two self-managing companies? Or find a way of keeping both sides happy at the same time? These are hard questions and it will take a lot of tact and diplomacy, and a firm idea of where its future lies, to provide the answers. Sandberg is more likely to be able to manage that than another grey, faceless career banker.

Snap her up before the Americans do

Of course, a US company would be a more natural home. Regardless of whether Elon Musk buys it or not, she may well be the one person who could sort out the mess that is Twitter. Jeff Bezos must be wondering if she wouldn’t make a better successor as CEO at Amazon than the man he chose, Andy Jassy. Or Ford could use her talent as it transforms into a manufacturer of electric vehicles. There are not many executives as talented as Sandberg out there – if any British company could hire her it would be a huge coup.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.