How to boost your pension pot as 35% of UK over 50s face huge retirement savings gap

Over 50s are facing a later life with little to no funds - but there are steps you can take now to boost your pot.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A warning has been issued to over 50s facing a retirement income shortfall. We reveal ways to boost your pension pot.

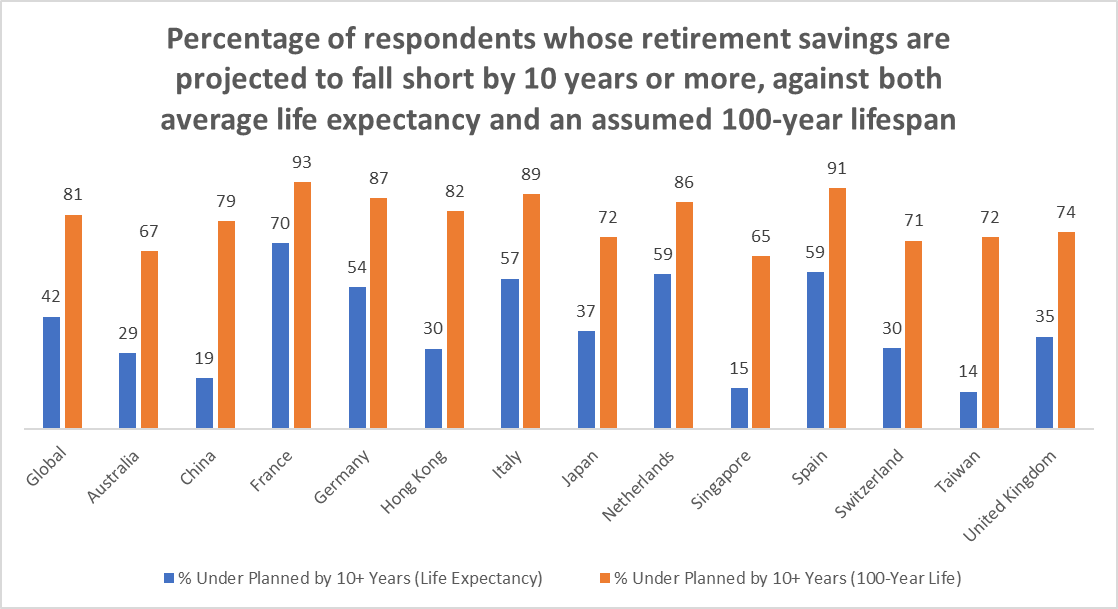

More than one in three (35%) Brits aged 50+ face a retirement income shortfall of 10 or more years, based on the average life expectancy, new research shows.

Meanwhile, more than seven in 10 (74%) are projected to come up short, measured against a potential 100-year lifespan.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Fidelity International surveyed more than 11,800 people globally, living in 13 countries, to find out how set they are for later life, including 1,000 UK-based retirees and pre-retirees.

Across the 13 countries, 42% are facing an income shortfall of 10 or more years while 81% would hit the bottom of the barrel if they were to reach 100.

The 10-year savings gap was calculated by comparing how long people expected their retirement savings to last against the average UK life expectancy for men and women.

According to the Office for National Statistics (ONS), men aged 65 in 2023 can expect to live until 85 on average while women can expect to live to 88.

Those surveyed in the UK said they expected to live another 19 years at 66 and for their savings to last until they die.

However, based on the average life expectancy, they would run out of savings during their retirement, the calculations show.

Others who live longer face a greater period without enough money to cover day-to-day living.

Stuart Warner, global head of platform solutions at Fidelity International, said: “People are living longer than ever, but too many are preparing for retirements experienced by their parents and grandparents.

“This mismatch between life expectancy and savings horizons risks leaving many underprepared.

“With the right planning, longer lives can be a positive reality, but it requires a new mindset and earlier action.”

Fidelity International also asked the UK-based over 50s how positive they felt about how their life will be in retirement.

Surprisingly, 56% of pre-retirees and 74% of retirees said they felt positive.

Meanwhile, just 24% said they had a budget prepared for retirement and only 18% had sought financial advice to help plan for later life.

Tips to boost your retirement pot

If you’re facing an income shortfall in later life, there are steps you can take now to boost your pension pot.

Maximise your workplace pension

Kate Smith, head of pensions at Aegon, said it’s worth maximising your workplace pension contributions.

Most people are automatically enrolled into a workplace pension, with an employer having to put 3% minimum in while you contribute 5%. However, some businesses will match your contributions.

Kate said: “If you are 50 plus this is a low-effort way to boost your pot while you’re still earning.

“It’s especially useful if you’re planning a phased retirement or staying in work for longer.”

Track down old pensions

Track down old and lost pensions from previous jobs. You might want to see if it’s beneficial to combine them so you’ve got less administration on your hands and can save money on fees, Smith said.

“Many pension providers now offer a free tracing service, along with the Government's tracing service.”

Top up your state pension

The state pension might not be enough on its own to offer you a comfortable post-retirement life, but you should still boost it where possible.

You can get a forecast of what your state pension will be via the government’s check your state pension tool.

If you’re not on course for a full new state pension, currently worth £11,973 a year, you can top up any missing National Insurance (NI) years.

Deferring taking out your state pension increases what you eventually do get when you come to claim it too.

The new state pension increases by the equivalent of 1% for every nine weeks you defer, working out at just under 5.8% for every 52 weeks.

We look at how deferring the state pension works and the pros and cons in a separate piece.

Maximise pension contributions

Try to make the most of your pension allowances, said Marianna Hunt, personal financial specialist at Fidelity International.

You can add up to £60,000 into your pension each year and still receive tax relief.

Marianna added: “Remember, you can use unused annual allowances from the previous three tax years, potentially allowing contributions of more than £60,000 in a single year.”

Use salary sacrifice

Use some of the money from your salary and put it towards your pension instead via salary sacrifice.

It means you pay less income tax and National Insurance on your salary and will give your pension a top up.

Your employer also pays less NI and some will put this saved amount into your pension leading to a double top-up.

Review investment choices

Many default pension funds will reduce the risk of your portfolio as you get closer to retirement age.

However, you might want to take more of a risk and increase the chances of bigger returns over the long term.

Hunt said: “You may prefer to take more risk by allocating more to stocks and shares as opposed to bonds in the hope of better returns.

“If you do this, it’s important to have a strong cash buffer to avoid having to sell investments at a loss if markets dip and you need to withdraw from your pension.”

Think carefully before taking your 25% tax-free lump sum

Taking out your 25% lump sum tax-free might be tempting, but delaying the decision could be better for your finances in the long run, said Sarah Pennells, consumer finance specialist at Royal London.

“Taking the cash is tempting, but it reduces what’s left invested to grow.

“If you do take a lump sum, have a clear plan for it and be mindful of tax on further withdrawals.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sam has a background in personal finance writing, having spent more than three years working on the money desk at The Sun.

He has a particular interest and experience covering the housing market, savings and policy.

Sam believes in making personal finance subjects accessible to all, so people can make better decisions with their money.

He studied Hispanic Studies at the University of Nottingham, graduating in 2015.

Outside of work, Sam enjoys reading, cooking, travelling and taking part in the occasional park run!

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how