Summary

- Inflation held steady at 3.8% in August, marking no change compared to July's report.

- It is likely to be a brief hiatus, with price rises forecast to hit 4% when September's report is published next month.

- The latest reading of 3.8% is in line with what the Bank of England had forecast. Some economists had predicted a slight increase to 3.9%.

- Easing pressure from airfares helped, with prices rising by less than a year ago. This was offset by upward contributions from restaurants & hotels and motor fuels.

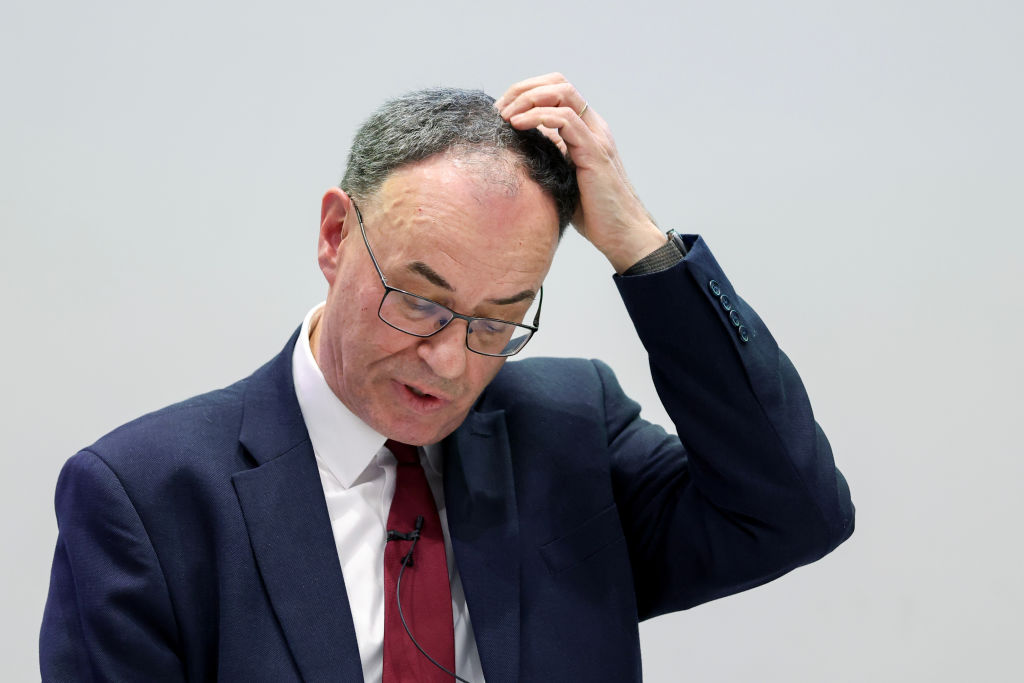

- The Bank of England’s next interest rate decision will be announced tomorrow. Policymakers are expected to keep rates on hold at 4%.

- The Bank’s governor Andrew Bailey recently said that inflation risks had “gone up”, casting “considerably more doubt” on the timing of future rate cuts.

- After peaking in September, inflation is expected to gradually cool, before finally returning to the 2% target in the second quarter of 2027, according to the Bank of England’s forecasts.

| What is inflation? | CPI vs RPI inflation | When will interest rates fall further? | CPI release dates | MPC meeting dates |

What to expect from tomorrow’s inflation report

Good afternoon and welcome to our inflation live coverage.

The Office for National Statistics will publish August’s inflation report tomorrow morning at 7am, and it is unlikely to make pretty reading. Forecasters think inflation will either hold steady at 3.8% or creep up slightly to 3.9%, before peaking at 4% next month when September’s figures are released.

July’s reading of 3.8%, published last month, was the highest in 18 months. Higher food prices have been a big driver of increases in recent months.

Oxford Economics: Food and petrol could push inflation higher

Advisory firm Oxford Economics is one of the forecasters that thinks inflation will inch up to 3.9% tomorrow. By comparison, the Bank of England’s forecasts point to a 3.8% reading, which is also what Deutsche Bank, the investment bank, is expecting.

A 3.9% forecast “reflects our view that further upward pressure from food prices and a smaller drag from the petrol category should more than offset the impact of a modest fall in services inflation due to July's temporary spike in air fares unwinding,” said Edward Allenby, economist at Oxford Economics.

Experts say September rate cut unlikely

The next Monetary Policy Committee (MPC) meeting will take place on 18 September, just one day after August’s inflation report is published. The Bank of England is expected to hold rates at 4%. Economists polled by Bloomberg and Reuters were unanimous in ruling out a September rate cut.

Speaking to MPs earlier this month, the Bank of England’s governor Andrew Bailey said inflation risks had “gone up”. While rates are still on a downward path, he added that there is now “considerably more doubt about exactly when and how quickly we can take those further steps”.

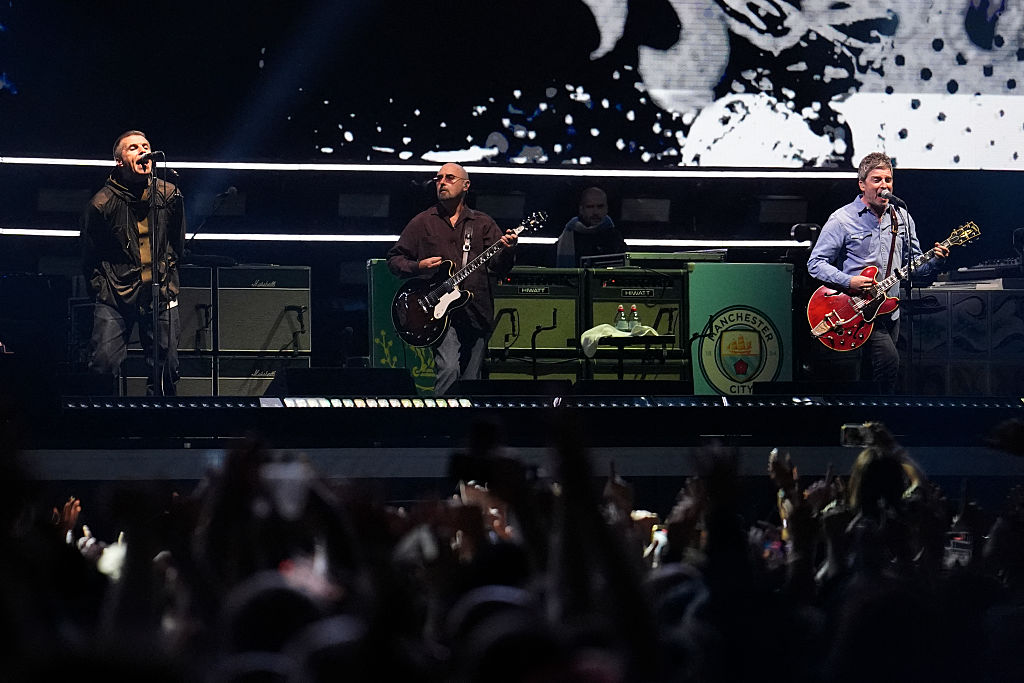

Oasis reunion tour could push hotel prices up

Hotel prices jumped in July, partly off the back of the Oasis reunion tour. This could add pressure in August too, with the concerts continuing into the month. Pantheon Macroeconomics thinks this, combined with other factors like higher food price inflation, will push the headline figure up to 3.9%.

“A jump in food price inflation, a fall in motor fuels last August dropping out of the annual inflation comparison, and hotel prices inflated by an Oasis concert on CPI collection day should more than offset slowing airfare inflation,” said Pantheon’s chief UK economist Robert Wood.

State pensioners more interested in September CPI report

It is August’s inflation figures that we will get tomorrow. Pensioners will have to wait another month for September’s figures (due on 22 October), which will play a role in setting how much state pension they receive in 2026/27.

Under the triple lock policy, state pension payments are uprated annually in line with inflation, earnings growth, or by 2.5% – whichever measure is highest.

September’s CPI report is the one that is used in the calculation. The wage growth figures used cover the period between May and July. These were published in today’s labour market report.

This year’s triple lock calculation will almost certainly be based on earnings growth, as this came in at 4.7% between May and July (including bonuses), whereas September’s inflation reading is expected to come in at 4%.

A 4.7% increase “would see a full new state pension rise from its current level of £230.25 per week to £241.05 per week from April,” said Helen Morrissey, head of retirement analysis at investment platform Hargreaves Lansdown.

“Those retiring on the basic state pension would see their weekly income increase from £176.45 per week to £184.75.”

See also: When will I pay tax on my state pension?

Households brace for impact of inflation

More than four in five people (83%) expect inflation to hit their personal finances in the next five years, according to research from Yorkshire Building Society. One of the most damaging effects of inflation is the way it can erode your savings.

Even if inflation were to sit at around 2% (the Bank of England’s target), it would only take 36 years for the value of your savings to halve.

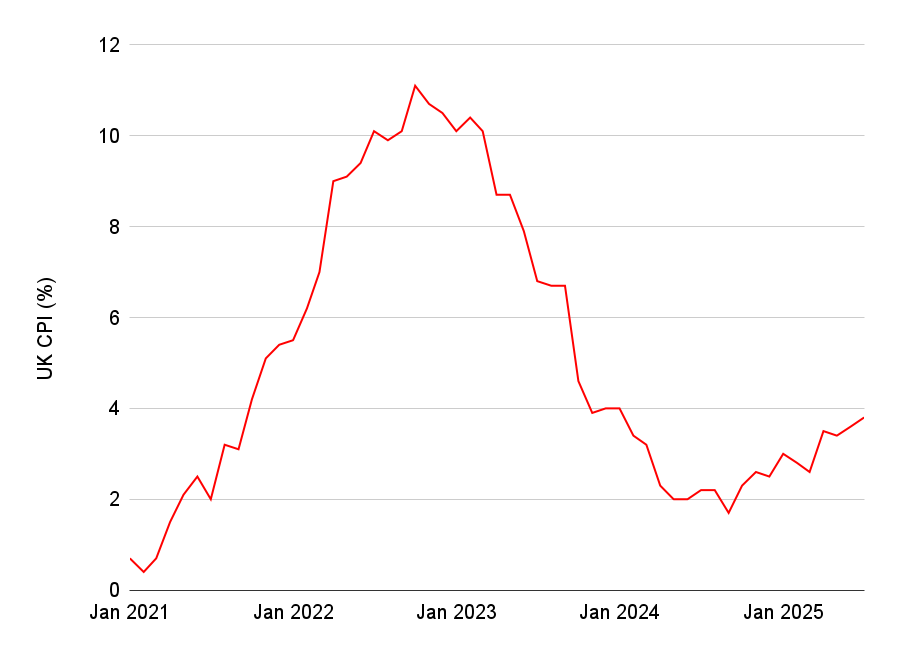

Over the past few years, the rate of inflation has been far higher than this; UK inflation peaked at 11.1% in October 2022. At this elevated level, it would only take around six and a half years for the value of your money to halve.

While investing can be a good way to beat inflation over the long run, we all need to hold a decent amount of cash for day-to-day spending, short-term savings goals and emergencies.

One of the best ways to protect the value of your cash is to find a savings account that offers real returns. Although this is becoming more difficult (as interest rates have come down while inflation has gone up), there are still inflation-busting rates on the market.

Analysis from Moneyfacts, conducted last month, showed 956 accounts were still offering inflation-beating rates in August.

See our round-up of the best easy-access rates, one-year savings accounts, regular saver accounts and cash ISAs for the latest deals on cash savings.

When will inflation return to the 2% target?

As we have introduced in our previous posts, inflation is expected to peak at 4% in September’s report (published in October) before gradually falling back after that. It could be some time before it returns to the 2% target, though.

Bank of England policymakers believe inflation will average 3.1% in the first quarter of 2026, 3% in the second, 2.7% in the third and 2.5% in the fourth.

They expect it to return to the 2% target in the second quarter of 2027.

What’s happening with food inflation?

Food has been one of the categories driving inflation higher, and it is an area the Bank of England seems to be concerned about. Food prices are very visible to consumers – it is easy to see when your weekly or monthly supermarket bill is going up.

One thing the Bank is worried about is that this will translate into higher household inflation expectations, which could prompt people to bargain for bigger wage increases. It is a vicious circle, because pay rises themselves are a big driver of future inflation. The Bank needs wage growth to come down before it can cut interest rates much further.

In July’s report, the cost of food and non-alcoholic beverages rose by 4.9% – the fourth consecutive increase in the annual rate and the highest recorded since February 2024.

“The Food and Drink Federation is forecasting food inflation could reach 5.7% by the end of December and still be running at 3.1% by the end of 2026,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

“Higher employer and packaging taxes are being blamed for increasing costs for companies, which they can no longer absorb.”

Thank you for following our preview analysis this evening. We will be back tomorrow morning when August's inflation figures are published at 7am. Join us for live reporting and analysis then.

Good morning – what to expect from August’s inflation report

Good morning and welcome back to our live inflation coverage. August’s CPI report will be published in less than half an hour. To recap: forecasters are expecting inflation to either hold steady at 3.8%, or creep up slightly to 3.9%. Stick with us as we bring you the latest news and analysis.

Explainer: What is inflation and how does it affect you?

You will have heard a lot about inflation over the past four years. It refers to how much the cost of goods and services is going up. Put simply, if you spent £1 on a product this time last year and annual inflation now stood at 10%, that same product would be likely to cost £1.10.

Economists believe having some inflation – a target level of 2% – is a sign of a healthy economy because it encourages spending and means GDP can grow. However, too much inflation can be harmful to living standards, as we have seen through the cost-of-living crisis.

At 3.8% (July's inflation reading), prices are currently rising at almost double the Bank of England’s target rate, which is why interest rates are very unlikely to be cut tomorrow.

Interested in learning more? See our full inflation explainer.

The path of inflation

After slowing considerably from its peak of 11.1% in 2022, inflation has been heating up again in recent months.

BREAKING: Inflation holds steady at 3.8%

Inflation held steady at 3.8% in August, marking no change compared to July. This is in line with what the Bank of England had forecast.

Easing pressure from airfares

Airfares made the largest downward contribution to the monthly change in CPI, according to the Office for National Statistics (ONS), while restaurants & hotels and motor fuels added upward pressure.

Airfares rose by 2.1% between July and August 2025, compared with a rise of 22.2% between the same months in 2024.

The smaller monthly change this year can be explained by July's high index level. There was a large spike in airfares in last month's report, partly explained by the timing of school holidays in 2025 versus 2024.

Fuel prices rose this August after falling a year ago

Fuel prices added upward pressure to August's inflation reading, rising on a monthly basis this year after having fallen a year ago.

The average price of petrol rose by 0.3 pence per litre between July and August 2025, compared with a fall of 2.1 pence a year ago.

Similarly, the price of diesel rose by 0.8 pence per litre in August 2025, compared with a fall of 2.6 pence a year ago.

Supersonic hotel demand from Oasis concert?

Hotel and restaurant costs rose by 3.8% on an annual basis in August, up from 3.4% in July. The Oasis reunion tour may have been partly to blame, with index collection day falling on 12 August this month. One of the Edinburgh gigs took place that day, suggesting fans may have been looking for places to stay overnight.

Food inflation rises for fifth consecutive month

Food inflation has been coming in hot in recent months, and August's report showed a fifth consecutive increase in this category.

The cost of food and non-alcoholic beverages rose by 5.1% on an annual basis in August, up from 4.9% in July.

Vegetables, milk, cheese, eggs and fish all added upward pressure. This was partially offset by small downward effects from bread, cereals, oils and fats.

Cheese was one of the items driving higher food inflation in August

Rachel Reeves: "I know families are finding it tough"

Chancellor Rachel Reeves responded to this month's inflation report by acknowledging the challenges faced by many households as cost pressures pick up again.

She said: "I know families are finding it tough and that for many the economy feels stuck. That's why I’m determined to bring costs down and support people who are facing higher bills.

"Through our Plan for Change we are taking action – raising the National Living Wage, extending the £3 bus fare cap, and expanding free school meals, to put more money in people's pockets while we work to build a stronger, more stable economy that rewards hard work."

Little relief for struggling households

Although a pause in the ascent of the inflation rate is better news than an acceleration, many will be bracing themselves for next month. September’s report (due on 22 October) is expected to show a reading of 4%.

This month’s report will offer “little relief for cash-strapped households still grappling with overstretched budgets,” said Alice Haine, personal finance analyst at investment platform Bestinvest.

She added: “Stubborn inflation is worrying for consumers as it means prices are still very much on the rise – they are just increasing at the same pace as the previous month.

“Add to that the extended freeze on income tax thresholds, where more people find themselves dragged into higher tax brackets as their wages rise, and household budgets will continue to feel stretched.”

Haine explains that building a strong financial foundation is key to navigating economic uncertainty. Tips she shares include:

- Living within your means

- Delaying big-ticket purchases

- Cancelling unused subscriptions

- Cutting non-essential spending

- Shifting expensive debts to a 0% balance transfer credit card

- Building up emergency savings to cover three to six months of essential expenses

Slowdown in core and services inflation

One positive development within August’s report is that both core and services inflation slowed compared to July. Core CPI came in at 3.6%, down from 3.8% previously. Services CPI came in at 4.7%, down from 5%.

Core inflation strips out categories that tend to see short, sharp fluctuations in prices, like food and energy, making it a good indicator of how embedded price pressures have become.

Services inflation covers things like hotel stays, airfares, educational costs and more. Services make up around 80% of the UK economy, so this is an important measure.

“Slowing services and core inflation offers a rare silver lining as it suggests that underlying price pressures are becoming less sticky,” said Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales.

“The squeeze from a cooling jobs market should help keep it on a downward path.”

Encouraging report today – but BoE will want to see more of the same

Deutsche Bank, the investment bank, said today’s inflation data would be seen as “a positive for markets – even, perhaps, encouraging”. However, the Bank of England will want to see more evidence that inflation is coming under control before cutting interest rates again. Remember that policymakers think inflation will peak at 4% in the next report.

“This is why we continue to see a slightly longer pause when it comes to the Bank’s next rate move,” said Sanjay Raja, Deutsche Bank’s chief UK economist. He doesn’t think the Monetary Policy Committee (MPC) will trim rates again until December.

“For us, the MPC may want to wait for a larger accumulation of evidence before dialling down restrictive policy again,” he added. “Seeing the downtrend in CPI begin could assuage fears on the committee that the hump in inflation is not turning into a plateau.”

Governor of the Bank of England, Andrew Bailey

“Tug of war within Threadneedle Street”

Tomorrow’s meeting at the Bank of England looks close to a foregone conclusion. Economists polled by Reuters and Bloomberg unanimously said they expect rates to be kept on hold at 4%. We could see a 7-2 voting split, with only MPC doves Swati Dhingra and Alan Taylor voting for a cut.

If this forecast materialises, it would be a decisive outcome but, longer term, the votes may become more scattered. We have seen some division among committee members in recent meetings, including in August, where two votes were required before a 5-4 split was achieved.

Looking beyond September’s meeting, “the inflation outlook has triggered a tug of war within Threadneedle Street,” said Rob Morgan, chief investment analyst at wealth management firm Charles Stanley.

“Some MPC members argue that signs of weakening demand and softening price pressures justify another rate cut before year-end, continuing the Bank’s ‘gradual and careful’ easing cycle,” he added. “However, the persistence of elevated inflation complicates that narrative.”

With CPI expected to come in at 4% in September, Morgan thinks the MPC could opt to hold rates steady at November’s meeting too. While GDP growth is “tepid”, it hasn’t slowed enough to confirm a decisive disinflationary trend, in his view.

“Little to cheer for mortgage borrowers”

Although expected, an inflation reading of 3.8% will still come as bad news to some mortgage borrowers. It will do little to dissuade the Monetary Policy Committee (MPC) from sounding a cautious note in its statement tomorrow.

A ‘hold’ decision is already priced in, but hawkish rhetoric could cause markets to become more cautious on the longer-term outlook for rate cuts, impacting mortgage pricing.

“Mortgage rates have edged up in recent weeks, as the rate outlook of ‘higher for longer’ has taken its toll on lenders’ funding,” said David Hollingworth, associate director at broker L&C Mortgages.

“Although that hasn’t sent rates sky high, it’s certainly forcing borrowers to make quicker decisions and act quickly to secure a deal.”

How to beat inflation

One of the best ways to protect your cash savings is to find an account offering real returns – i.e. paying inflation-beating interest rates. But even then, most people shouldn’t hold excessive amounts of cash.

Once you have built up enough savings to cover day-to-day spending, emergencies and near-term savings goals (which could range from a house deposit to a wedding), consider investing. A diversified portfolio of investments can be a good guard against inflation, and is one of the best ways of building long-term wealth.

Before investing, you should be willing to lock your money up for five years or more, as this can help you ride out any short-term market volatility.

Although equity markets can be volatile, data from Barclays looking back over the past 120 years shows that equities have outperformed cash 70% of the time, based on a two-year holding period. If you extend the holding period to 10 years, it rises to 91% of the time.

Also see: Beginner's guide to investing

House price inflation slows to 2.8%

Each month on inflation day, HM Land Registry also publishes its latest house price report, showing how much property prices have gone up or down over the past year.

Land Registry data is published with a two-month time lag, so this month’s report covers July (rather than August, which is what the CPI report covers).

Annual house price growth slowed to 2.8% in July, down from a revised estimate of 3.6% in June. On a monthly basis, prices grew by 0.3%. It takes the typical UK property to £270,000, which is around £8,000 higher than a year ago.

Food inflation could reflect tax changes in last year’s Budget

Weak growth and high borrowing costs have created a challenging fiscal backdrop for the government, particularly given its promise not to raise the three main working taxes.

In an attempt to raise money in last year’s Budget, the government increased employers’ National Insurance contributions, but it was far from a silver bullet. The effects are now being seen in the economic data.

Economists and company bosses say rising food prices are a consequence of higher labour costs. The National Insurance hike has made it more expensive for companies to hire people, and they are offsetting some of the impact by putting prices up. An increase to the minimum wage has had a similar effect.

“Retailers are doing everything they can to deliver great value for their customers, but are unable to absorb the £7 billion in costs they have been landed with this year thanks to the rising cost of National Insurance, a higher National Living Wage, and a new packaging tax,” said Kris Hamer, director of insight at the British Retail Consortium.

He warns that imposing more costs on businesses in this year’s Budget could push inflation even higher.

Traders pricing in just one more rate cut

According to investment platform Hargreaves Lansdown, traders are pricing in just one more rate cut between now and the end of 2026. Markets have become more cautious in recent weeks after the Bank of England expressed concern about inflation pressures.

Some economists are slightly more optimistic. Financial institution ING still thinks we could see a cut in November this year, with more to follow in 2026. Deutsche Bank broadly agrees, but thinks this year’s remaining cut will come in December.

ING’s UK economist James Smith said: “Certainly, we aren’t in the camp that thinks rate cuts are over. Services inflation should show more visible progress next spring, while wage growth should ease below 4% by year-end.

“Add in the fact that the late-November Autumn Budget is likely to be dominated by tax rises, and we think there’s still a decent case for UK interest rates to fall two or three more times by next summer.”

Thank you for following our inflation live coverage today. The next report (covering September) will be published on 22 October. For the remaining dates in 2025, see our CPI release calendar.

The week's busy news agenda will continue tomorrow with the Bank of England's interest rate decision, due at midday. Our preview analysis has already started over on our interest rates live report. Join us there.