The charts that matter: The US dollar falls and Tesla hits the $1trn milestone

Tesla hits a market cap of $1trn and the US dollar weakens. Here’s how that has affected the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

This week, we’re looking at investment trusts. A discount to net asset value should never be the primary reason for buying this type of fund. But there are seven, however, that look too cheap and boast encouraging records, says Max King.

Elsewhere, Cris Sholto Heaton explores how the investment strategy of holding too many small positions can often result in more stress and higher costs without improving returns.

If you’re not already a subscriber, sign up here and get your first six issues free.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We don’t have a new podcast for you this week, but don’t forget to listen to last week’s one with where Merryn speaks to Andrew Hunt. You may have seen his recent feature on fossil fuels. Andrew’s a “deep value” investor, finding companies in the unfashionable corners of the market where many institutional investors fear to tread. He’s got lots of ideas on what to buy – listen to the what he has to say here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: What does Rishi Sunak have in store for investors this Wednesday?

- Tuesday Money Morning: When investors get over-excited, it’s time to worry- but we’re not there yet

- Wednesday Money Morning: How to invest as oil prices keep heading higher

- Thursday Money Morning: Budget 2021: the chickens come home to roost

- Friday Money Morning: What's in store for sterling?

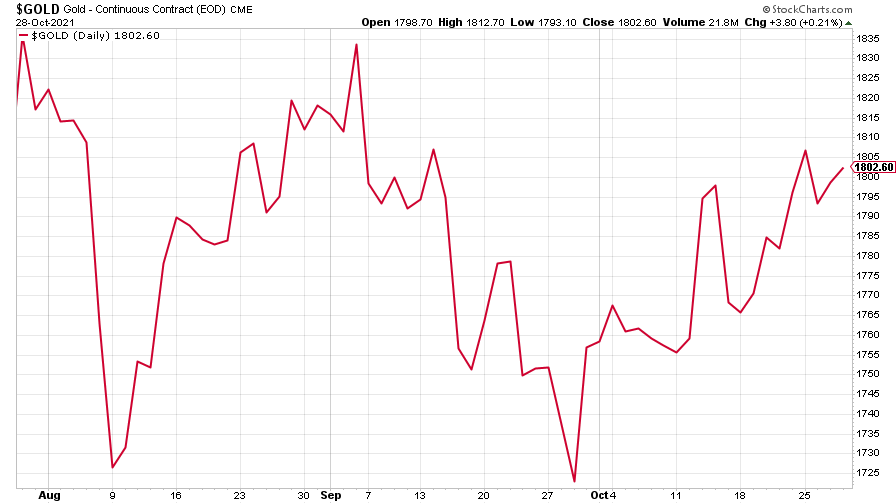

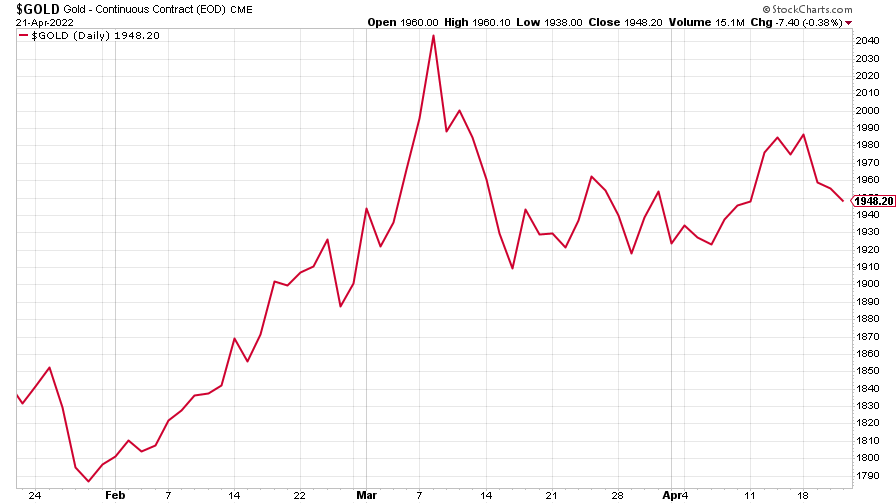

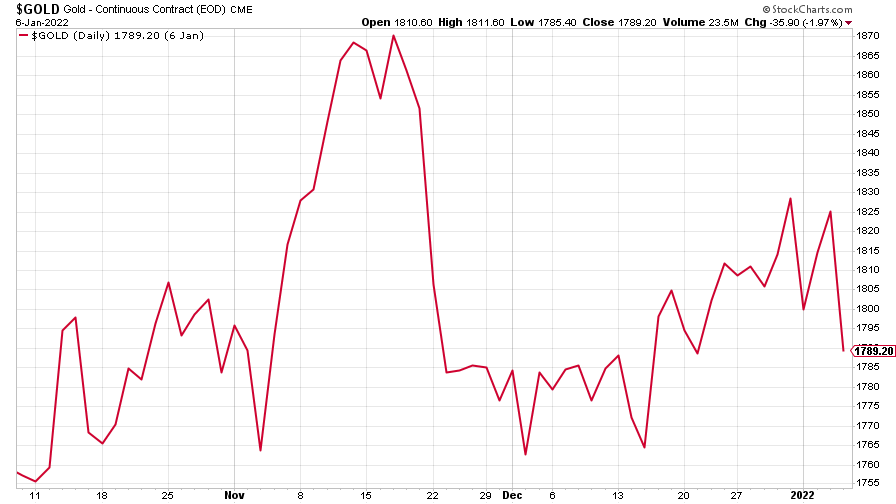

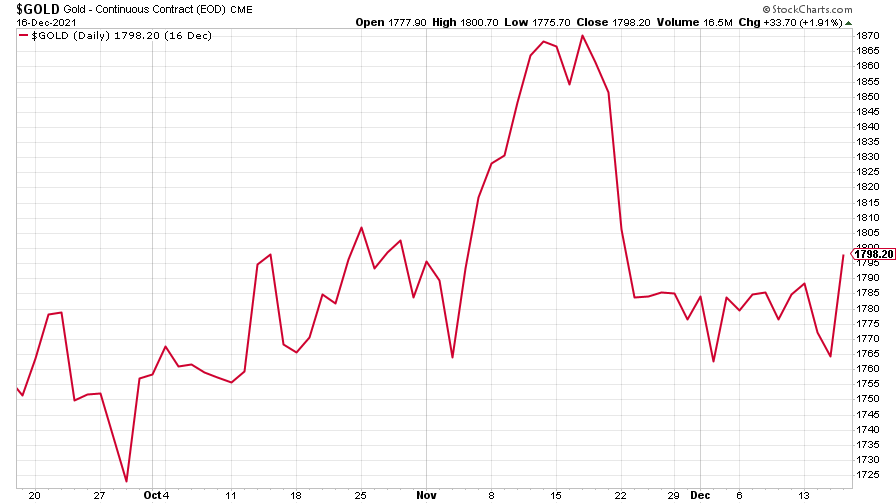

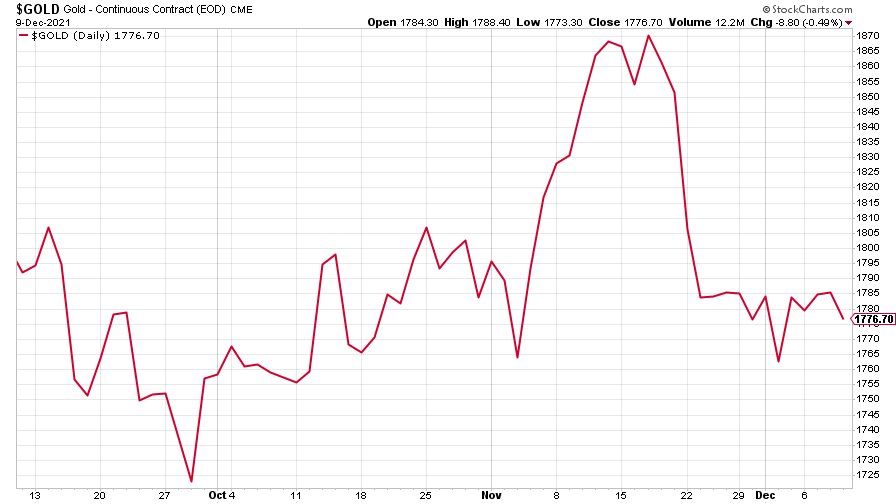

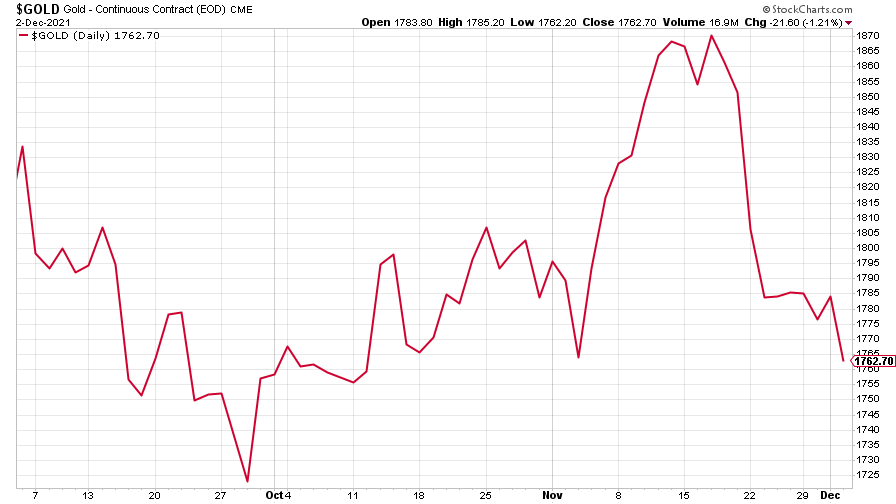

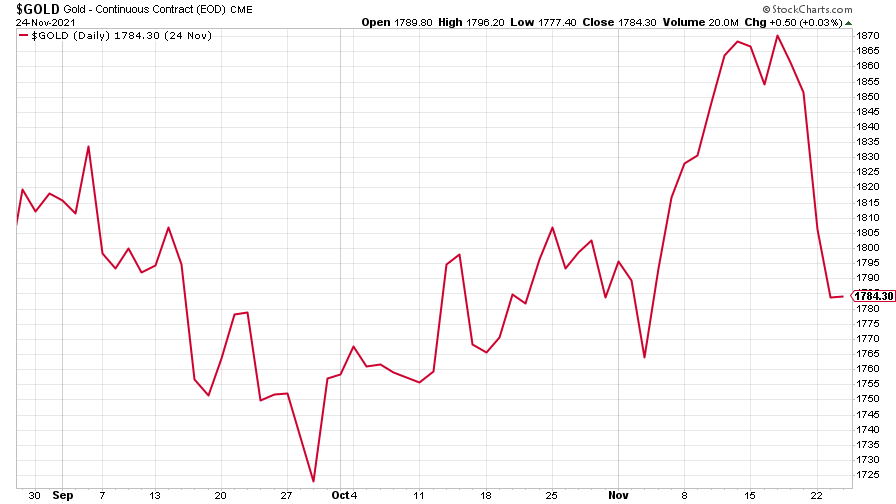

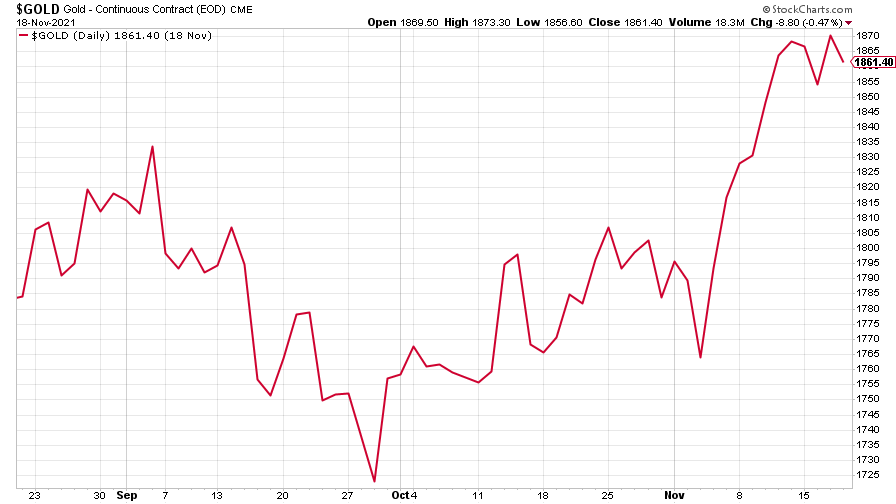

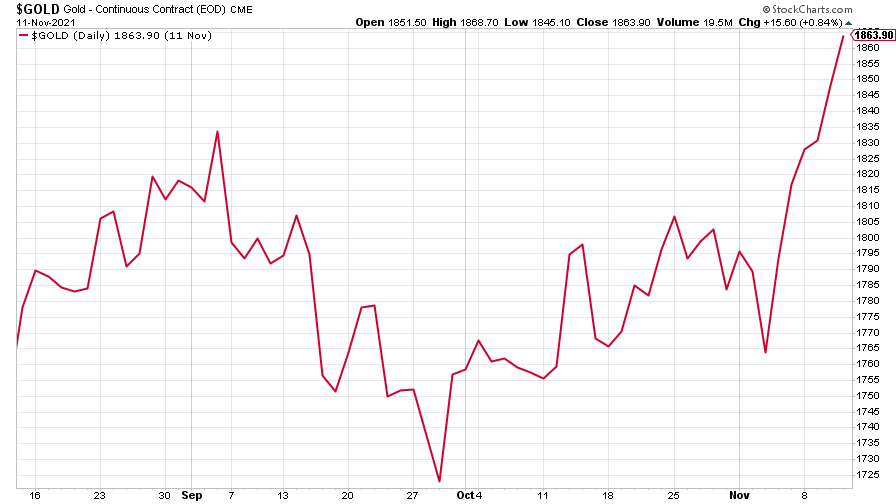

Gold prices rose amid a weaker dollar.

(Gold: three months)

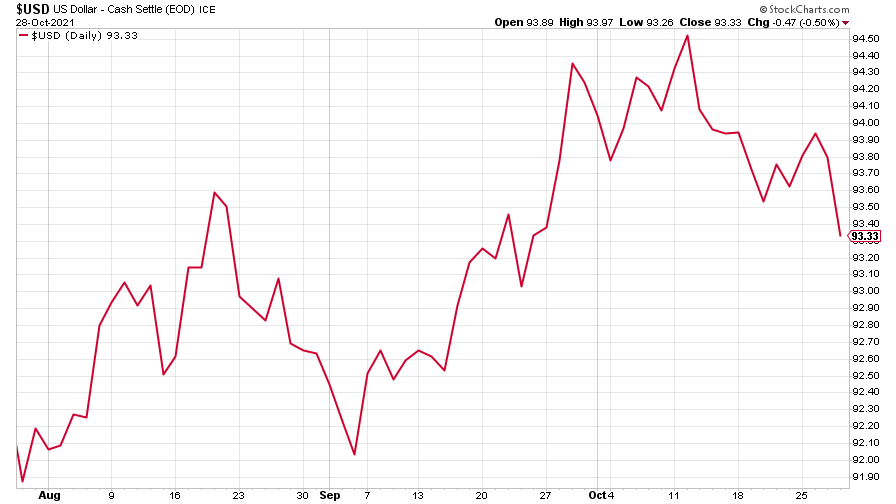

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) fell this week as other currencies shot and after the Bank of Canada signalled it may raise interest rates sooner than expected.

(DXY: three months)

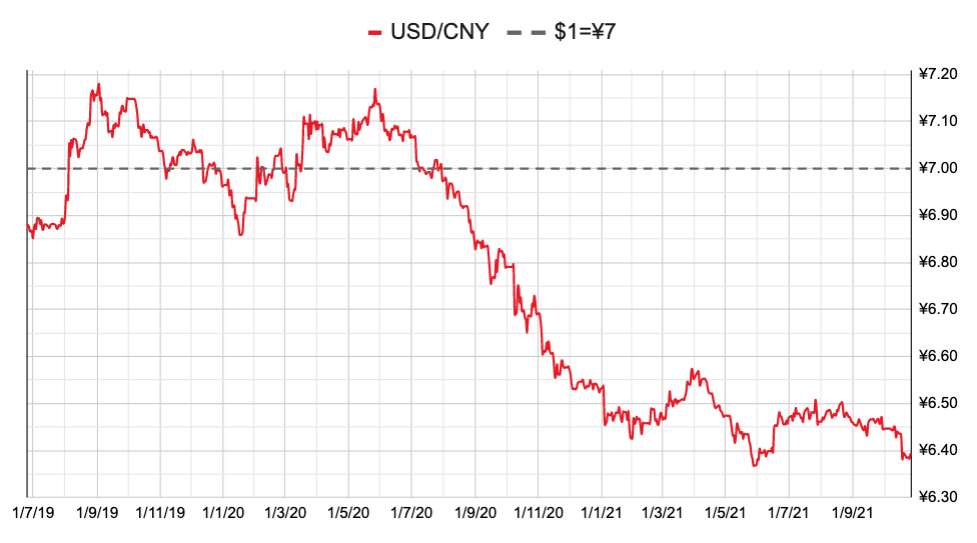

The Chinese yuan (or renminbi) strengthened a little against the US dollar (when the red line is rising, the dollar is strengthening while the yuan is weakening).

(Chinese yuan to the US dollar: since 25 Jun 2019)

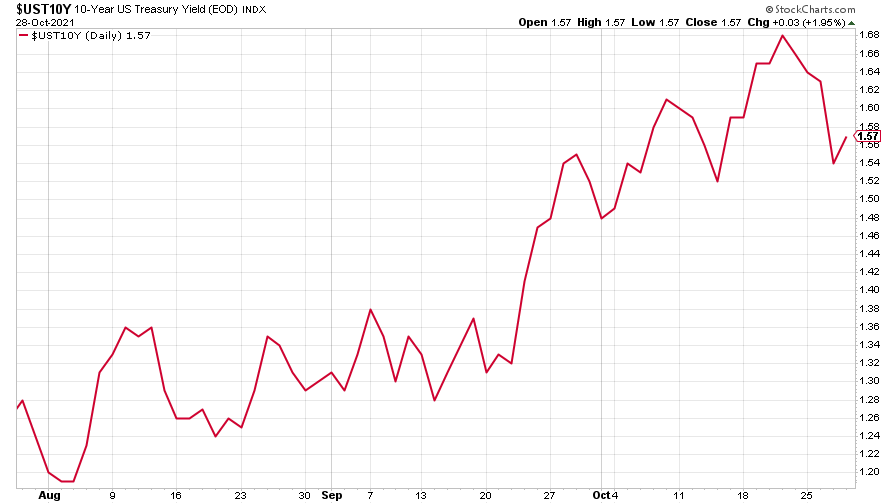

The yield on the ten-year US government bond rose as investors ignored weaker than expected US economic growth.

(Ten-year US Treasury yield: three months)

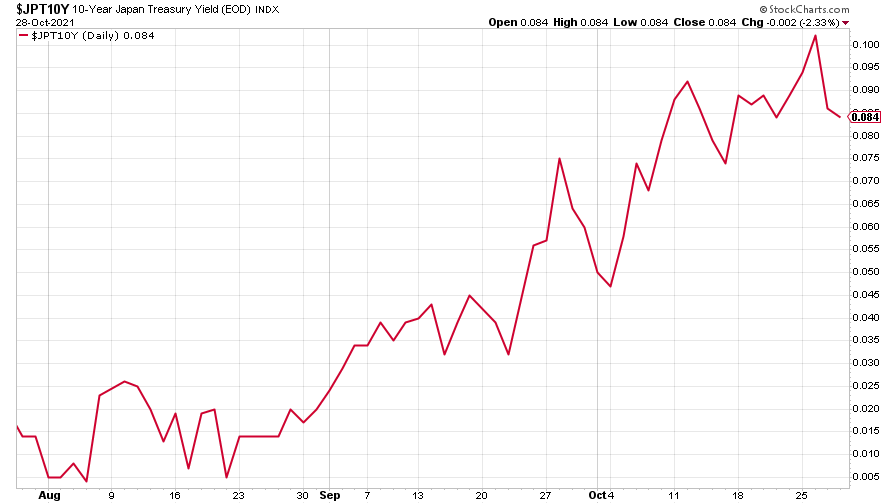

The yield on the Japanese ten-year bond fell a little ahead of central banks' policy reviews.

(Ten-year Japanese government bond yield: three months)

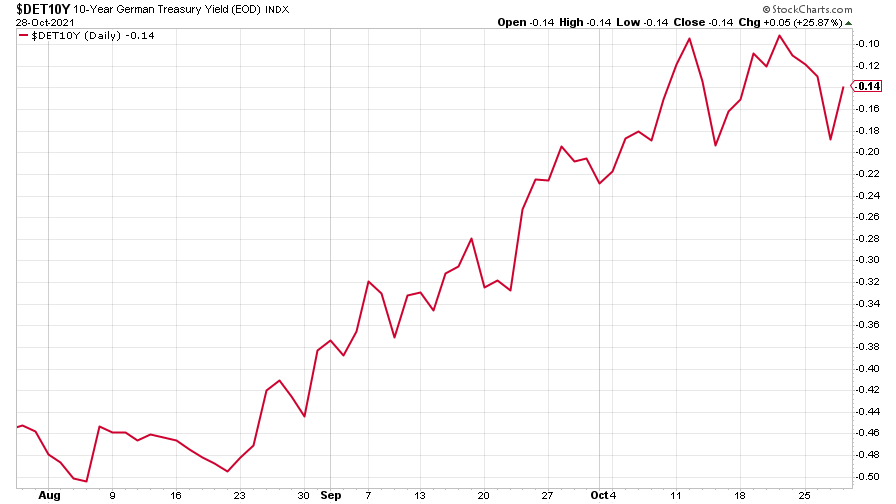

And the yield on the ten-year German Bund rose.

(Ten-year Bund yield: three months)

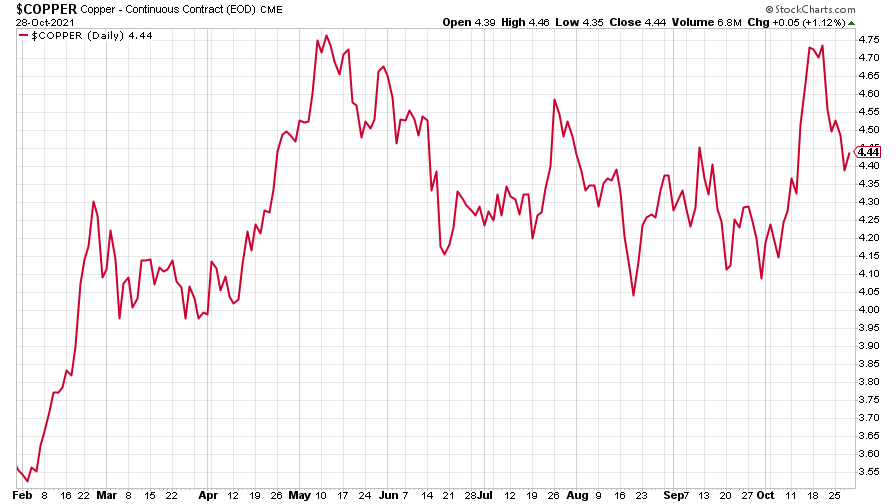

Copper prices rose in line with the global energy supply crunch.

(Copper: nine months)

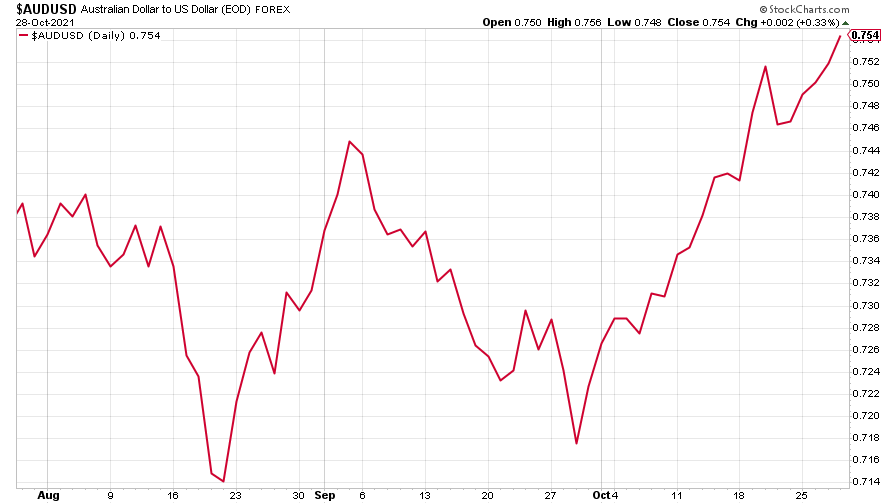

The Aussie dollar rose as the US dollar index fell.

(Aussie dollar vs US dollar exchange rate: three months)

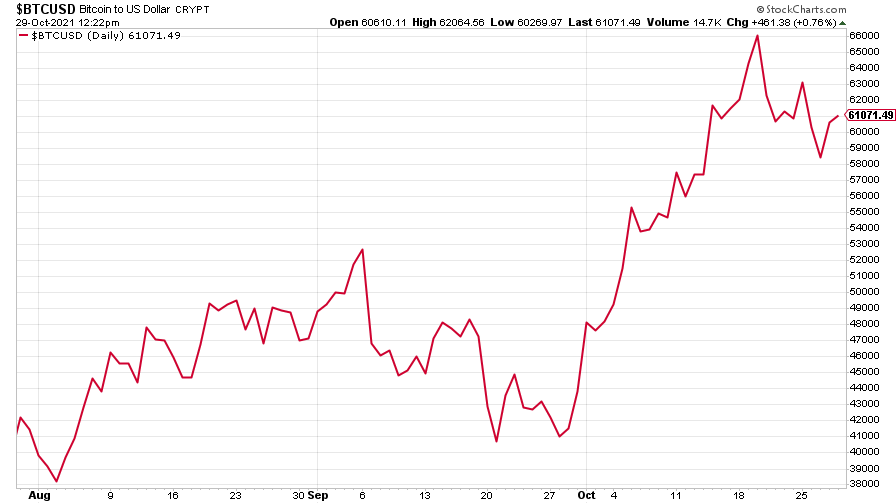

Bitcoin recovered and rose above $60,000 following a volatile week.

(Bitcoin: three months)

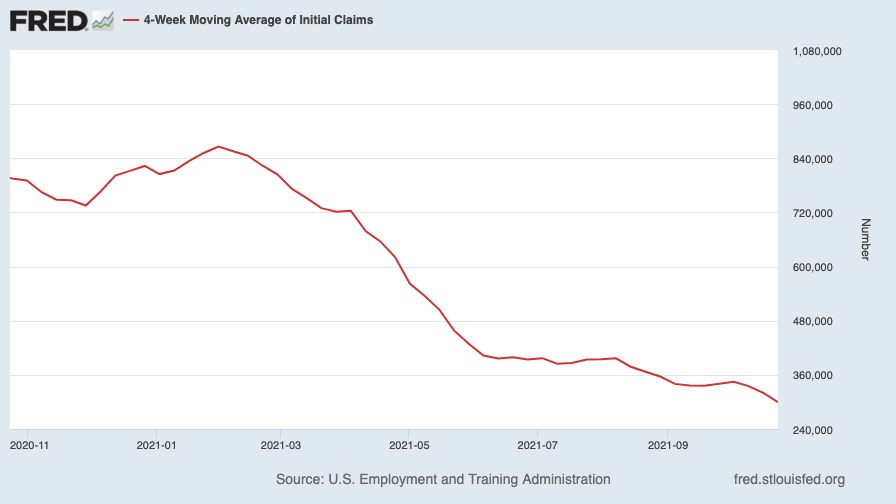

US weekly initial jobless claims fell 10,000 to 281,0000.

(US initial jobless claims, four-week moving average: since Jan 2020)

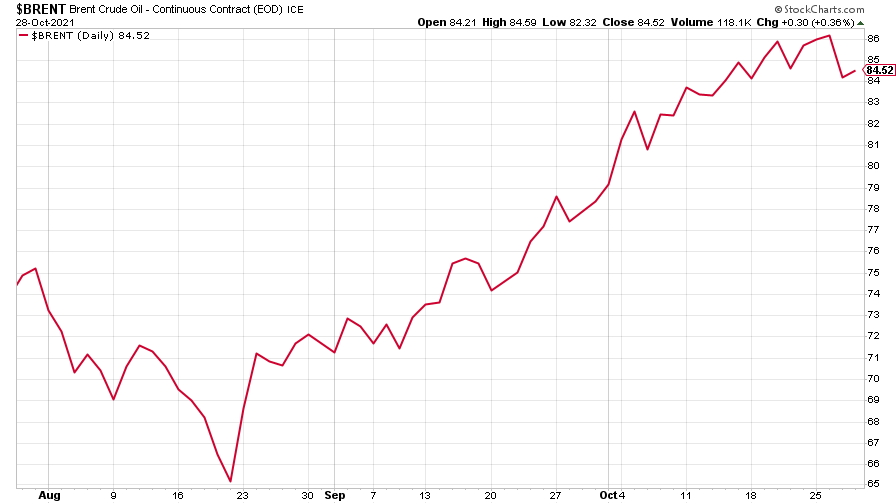

The oil price rose a little as U.S crude stockpiles unexpectedly fell.

(Brent crude oil: three months)

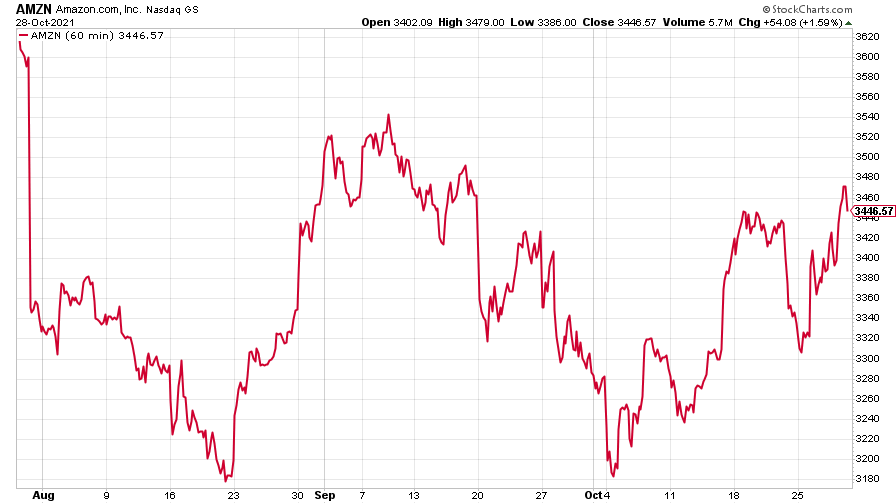

Amazon's stock faced a volatile week amid disappointing earnings.

(Amazon: three months)

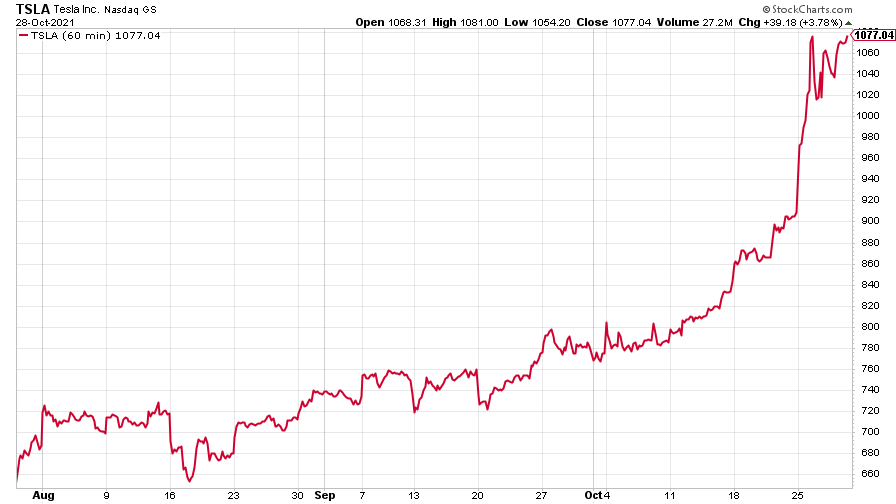

Tesla shot up in value this week after the electric car producer hit the $1trn valuation mark this week.

(Tesla: three months)

Have a great weekend.

Saloni

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Saloni is a web writer for MoneyWeek focusing on personal finance and global financial markets. Her work has appeared in FTAdviser (part of the Financial Times), Business Insider and City A.M, among other publications. She holds a masters in international journalism from City, University of London.

Follow her on Twitter at @sardana_saloni

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

The charts that matter: bond yields and US dollar continue to climb

The charts that matter: bond yields and US dollar continue to climbCharts The US dollar and government bond yields around the world continued to climb. Here’s what happened to the charts that matter most to the global economy.

-

The charts that matter: markets start the year with a crash

The charts that matter: markets start the year with a crashCharts As markets start 2022 with a big selloff, here’s what happened to the charts that matter most to the global economy.

-

The charts that matter: Fed becomes more hawkish

The charts that matter: Fed becomes more hawkishCharts Gold rose meanwhile the US dollar fell after a key Fed meeting. Here’s what else happened to the charts that matter most to the global economy.

-

The charts that matter: a tough week for bitcoin

The charts that matter: a tough week for bitcoinCharts Cryptocurrency bitcoin slid by some 20% this week. Here’s what else happened to the charts that matter most to the global economy.

-

The charts that matter: omicron rattles markets

The charts that matter: omicron rattles marketsCharts Markets were rattled by the emergence of a new strain of Covid-19. Here’s how it has affected the charts that matter most to the global economy.

-

The charts that matter: the US dollar keeps on strengthening

The charts that matter: the US dollar keeps on strengtheningCharts The US dollar saw further rises this week as gold and cryptocurrencies sold off. Here’s how that has affected the charts that matter most to the global economy.

-

The charts that matter: gold hangs on to gains while the dollar continues higher

The charts that matter: gold hangs on to gains while the dollar continues higherCharts The gold price continued to hang on to last week’s gains, even as the US dollar powered higher this week. Here’s how that has affected the charts that matter most to the global economy.

-

The charts that matter: inflation fears give gold a much needed boost

The charts that matter: inflation fears give gold a much needed boostCharts US inflation hit its highest in 30 years this week, driving gold and bitcoin to new highs. Here’s how that has affected the charts that matter most to the global economy.