Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

On the cover of this week’s magazine, we’ve got the “metaverse”. Discerning readers will recognise the term from Neal Stephenson’s 1992 dystopian sci-fi novel Snow Crash. Reality and virtual reality come together in an online universe controlled by mega-corporations, in which our heroic protagonist, called, er, Hiro Protagonist, grapples with a mystery computer virus that’s proving deadly in both the virtual world and the real world.

Anyway, Facebook’s Mark Zuckerberg has decided he’s going to build the metaverse, and has rebranded his company as “Meta Platforms”.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So, what does it all mean? Is it just marketing flannel to sell more Oculus VR headsets, or will it prove to be the beginning of a whole new way of living? Nobody really knows. But what’s certain is that it will open up some new opportunities for investors.

Elsewhere, Dr Mike Tubbs picks nine of his favourite stocks that he reckons you should buy and hold forever; David Stevenson looks at four of the best new investment trusts coming to market; and we ask – is it worth taking out private health insurance?

If you’re not already a subscriber, sign up here and get your first six issues free.

In this week’s podcast Merryn – fresh from her appearance at the COP26 Fringe – is joined by John. They discuss the climate conference and talk about nuclear power (it’s a lot safer than pretty much everybody thinks), the world’s ageing population and, of course, inflation. Listen to what they have to say here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: Central banks are still sticking to the plan on inflation

- Tuesday Money Morning: Is investors’ enthusiasm for renewable energy justified?

- Merryn’s blog: Inflation forecasts mean interest rates should be on the rise – so why aren’t they?

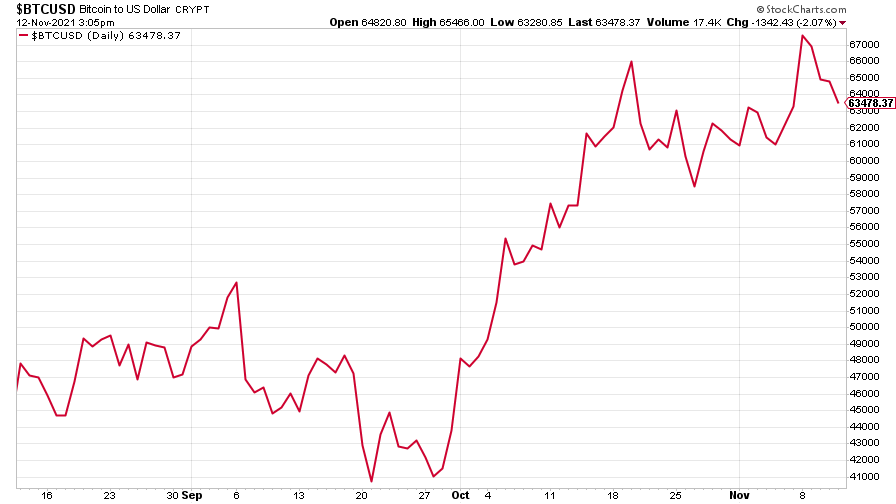

- Wednesday Money Morning: Bitcoin hits a new record – and we all know what usually comes after fresh highs

- Thursday Money Morning: Inflation might surprise us again in the short-term – but it’s here to stay

- Friday Money Morning: All you need to know about investing for the year ahead in one handy package

- Cryptocurrency roundup: New highs for bitcoin and ether as Twitter jumps on the crypto-wagon

Now for the charts of the week.

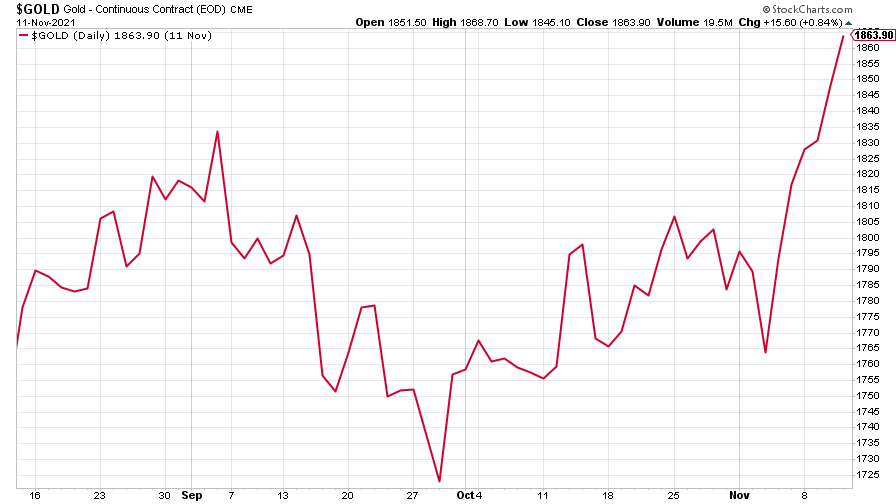

Gold really took off this week after a long time going nowhere. US inflation surpassing expectations to hit a 30-year high has driven investors into the arms of the yellow metal, who hope it will provide some protection.

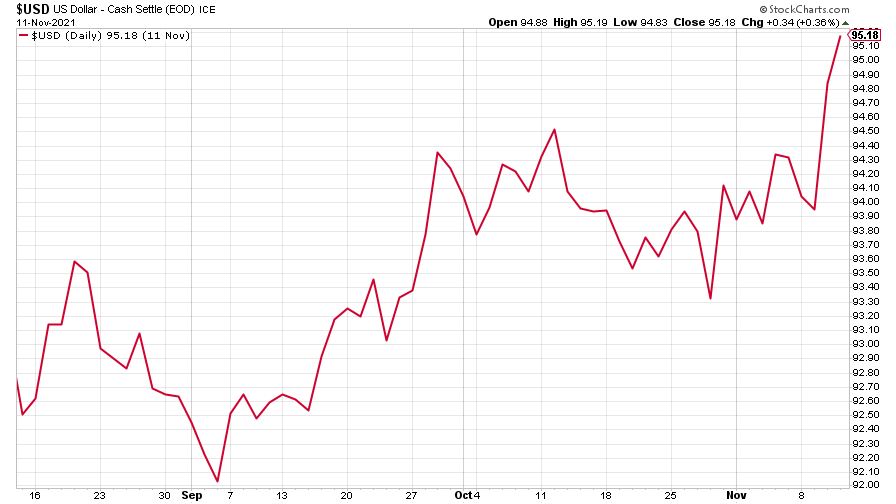

Interestingly (given that it traditionally goes in the opposite direction to gold), the US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) also put on a show of strength.

While the Chinese yuan (or renminbi) weakened against the US dollar (when the red line is rising, the dollar is strengthening while the yuan is weakening).

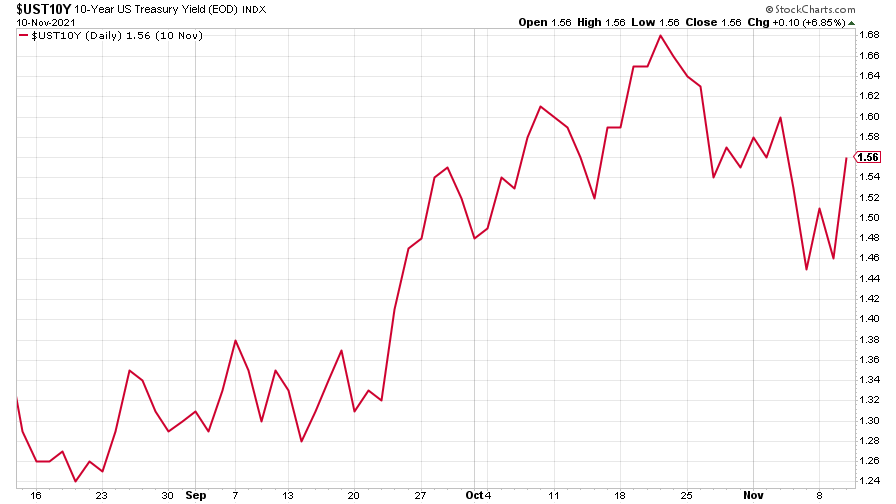

The yield on the ten-year US government bond turned back up after earlier falls, as investors bet on rates rising faster (in line with inflation).

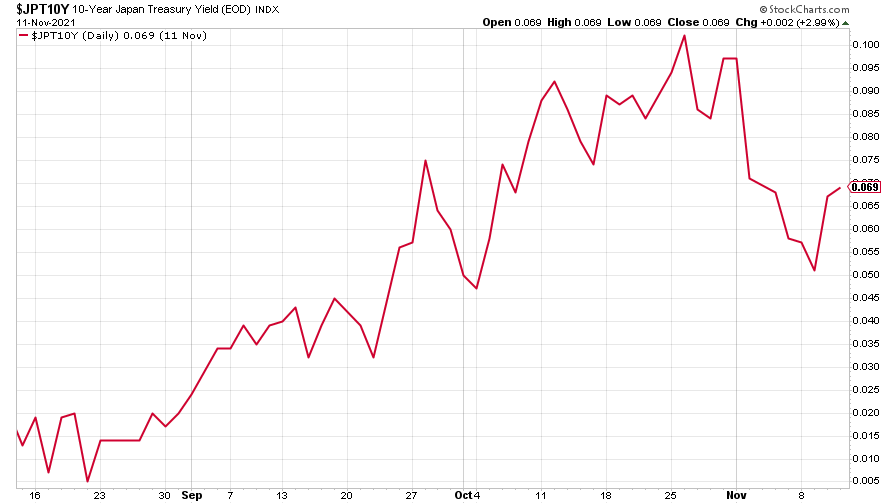

The yield on the Japanese ten-year bond halted its recent slide and also turned back up.

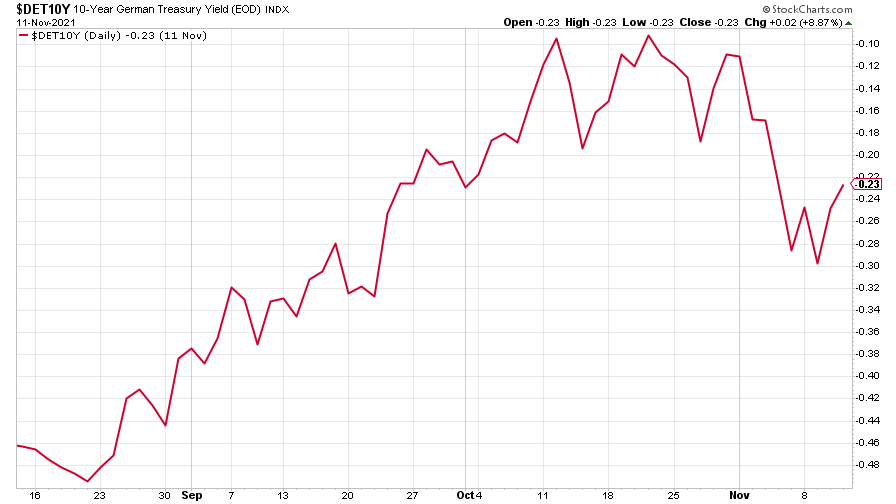

A move which was mirrored in the yield on the ten-year German Bund.

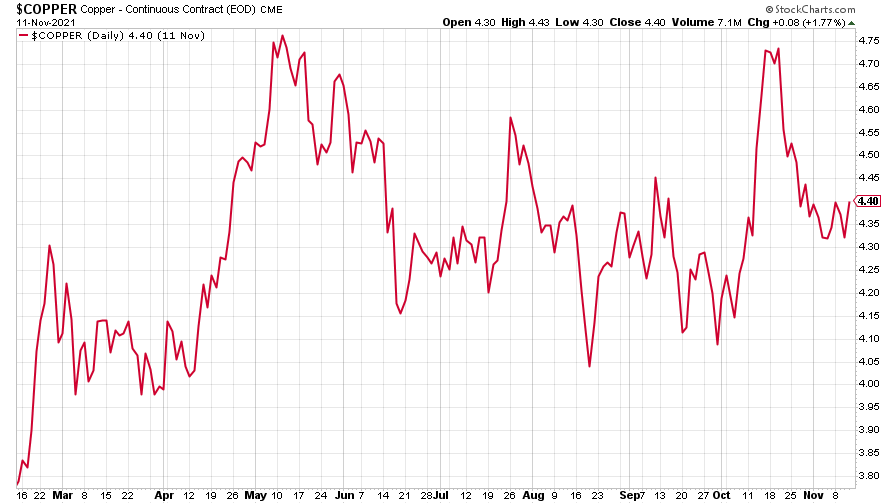

Copper traded sideways.

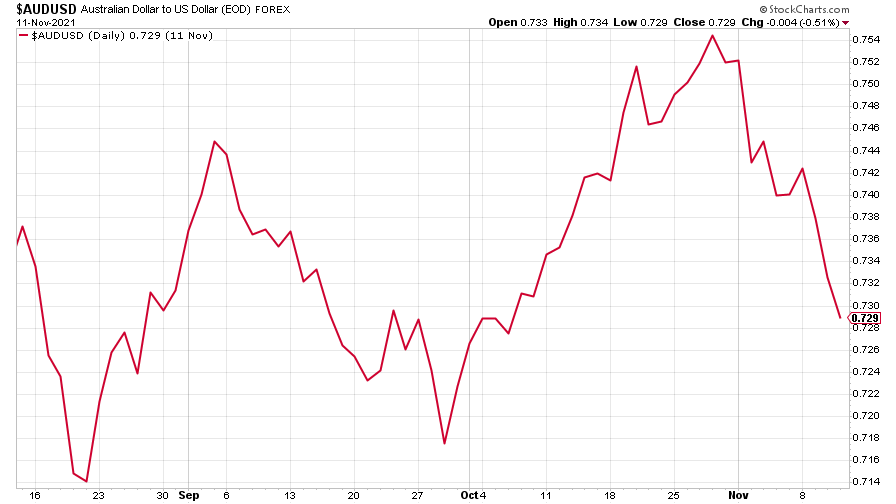

The closely related Aussie dollar fell against the strengthening dollar.

Bitcoin hit a new all-time high of around $68,500, then retreated a little. But, as Dominic said this week, the thing about new highs is that they tend to lead to more new highs.

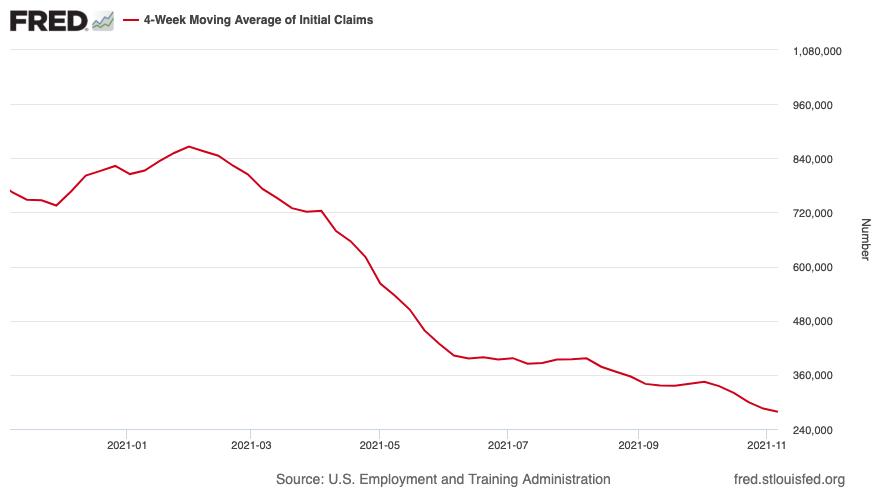

US weekly initial jobless claims fell by 4,000 to 267,000. The four-week moving average rose by 2,000 to 271,000.

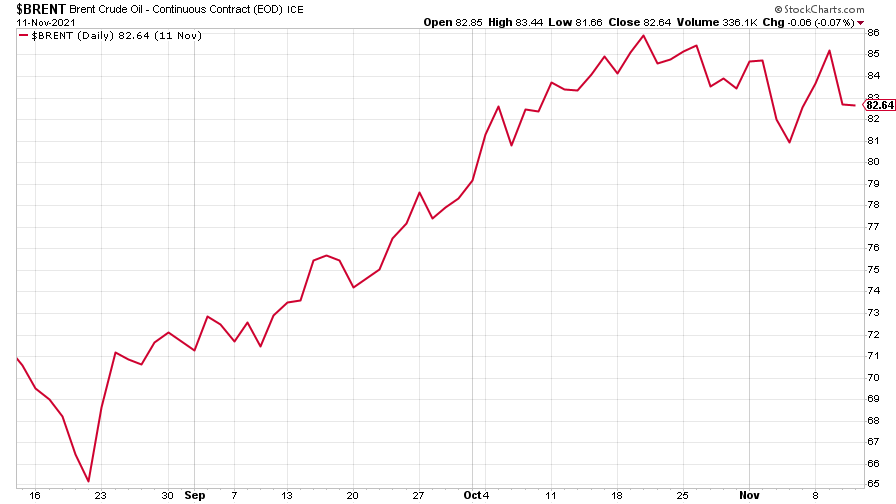

The oil price recovered somewhat.

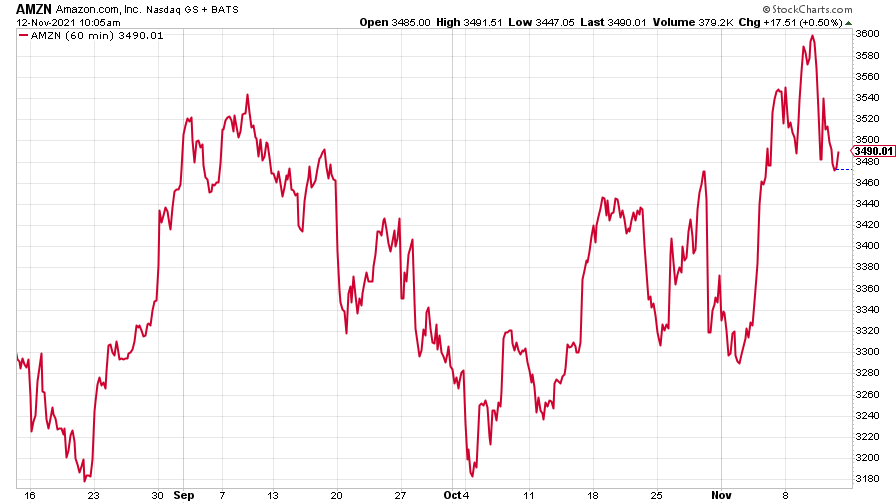

Amazon's share price turned down as growth stocks in general suffered an inflation-driven selloff (they don’t like the risk that interest rates will go up).

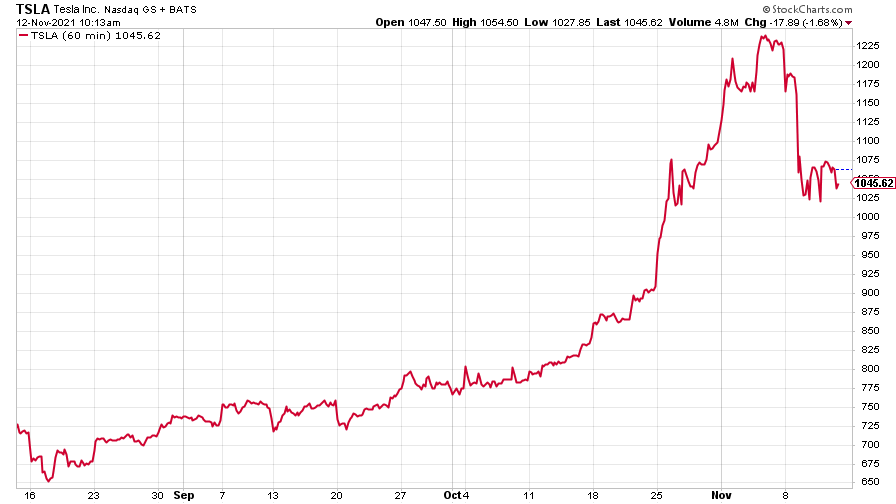

And Tesla’s share price took a battering from its own CEO, Elon Musk, who asked the Twitter hive mind if he should sell 10% of his holdings. Twitter said “yes”. So that’s what he did.

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.