Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

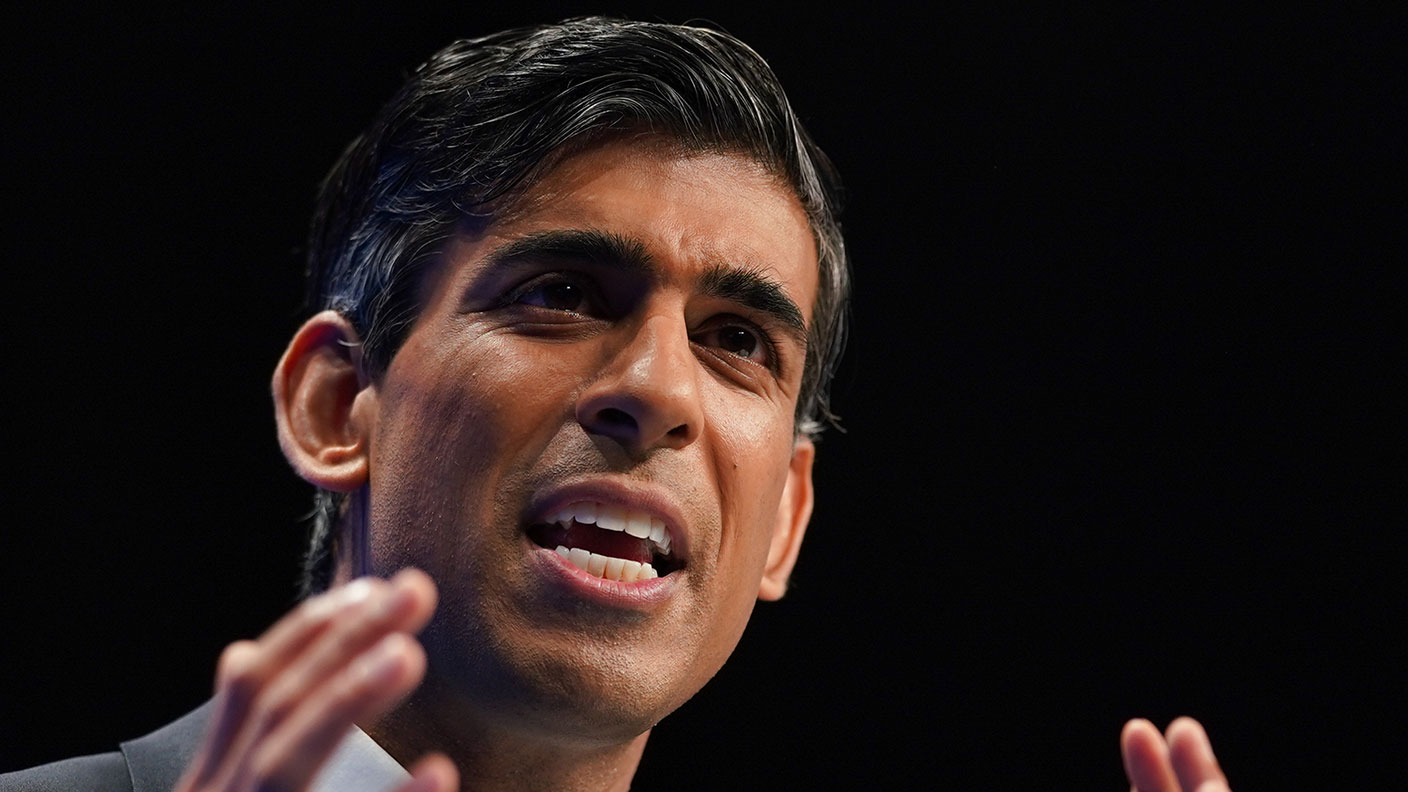

When chancellor Rishi Sunak was splashing the cash last year, he was cheered to the rafters and instantly catapulted to the status of next prime minister.

Only a few of us groused about the huge extravagance of the spending, wondered how cost effective it would prove and how much would be dissipated in waste and fraud.

Once started, Sunak seemed unable to stop increasing and extending his schemes.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It was reminiscent of the song in Evita; “when the money keeps rolling out, you don’t keep books, you can tell you’ve done well by the happy grateful looks, accountants only slow things down, figures get in the way…now cynics claim a little of the cash has gone astray, but that’s not the point my friends.”

Only in September, when both employers’ and employees’ national insurance rates were increased by 1.25 percentage points, did the penny drop that the Fundaçion Boris Johnson didn’t have all that money to spend...

Boris Johnson is rather too keen on splashing the cash

Rishi Sunak actually started to raise taxes to pay for his pandemic largesse last year, increasing corporation tax and freezing personal tax allowances, but few noticed. Corporation tax was increased again in March to 25% – but people think that a victimless tax.

Ostensibly, the £12bn national insurance increase was to solve the problem of the funding of social care, diverted in the short term to the NHS. Having closed operating theatres during the pandemic and left hospitals up to 40% unoccupied, the health service faces a huge and wholly predictable backlog. As Merryn pointed out, social care could more fairly have been funded by a national equity draw-down scheme from the housing wealth of those who moved into care.

So far, the government has broadly got away with it in electoral terms. Focus groups and opinion polls told the government that the public would support tax increases if the proceeds were spent on social care and the NHS.

But what, many Conservatives are now wondering, if they find out that it is really to plug the holes in the public finances caused by mis-spending? And what if people say they are supportive of tax increases only until they notice the hole in their monthly pay-checks?

Resistance to the Peronism of the prime minister is growing in the Conservative party, on the back-benches, in government and in the cabinet. They don’t want to see what they regard as the party of sound finance and low taxes, the natural party of government, hijacked, as the Republican party in the United States has been, by a leader who appears to take his inspiration from Latin America.

Things are better than expected, but the UK’s finances are still very fragile

Sunak’s latest budget shows that he can see which way the wind is blowing. He has been helped by public finances being less bad than expected – borrowing in the first half of 2021/2 was £108bn, half that of last year, leaving debt at 95.5% of GDP. Since 40% of this debt is held by the Bank of England, net government debt is less than 60% of GDP – though there is always a risk of the Bank having to start selling that debt to curb monetary growth.

Further help has come from the forecast of the Office for Budget Responsibility (OBR) that the economy will return to its pre-pandemic level by the end of the year and then continue to grow. The OBR expects government borrowing to drop to pre-pandemic levels, £41bn pre-additional spending, by 2024/5. With inflation persisting (4% in 2022), borrowing would be just 1.5% of GDP.

This allowed Sunak to indulge his Peronist boss with some extra spending and tax concessions to grab the headlines, appease the vested interests and impress the focus groups. Inevitably, extra billions are being thrown at the NHS and education in the probably futile hope that some of it sticks to services. The problem is that the extra spending is to be financed by revenue forecasts that could be fallible.

Many will be disappointed that the chancellor ignored the siren voices calling for higher capital gains tax, stamp duty and estate duty; the further erosion of tax breaks on pensions, an additional wealth tax and a special anti-America tax on tech giants. The chancellor presumably knows that these tax increases would raise far less than the Treasury estimates.

More importantly, the relentless rise of property valuations and stock markets means that receipts from existing wealth taxes will continue to rise exponentially. For example, the £6bn raised from death duties last year is increasing by 20% per annum.

Things could still turn out just fine – but there are serious risks ahead

Sunak seems determined to get the public finances back on a sound footing. Among the most interesting of his comments was “my goal is to reduce taxes. By the end of this parliament, I want taxes to be going down, not up.” If he succeeds in this, he may be able to reverse some of the tax increases and either secure the government’s re-election or give himself a chance of leading his party in opposition. There are, however, pitfalls ahead.

An economic slow-down next year could turn into recession, exacerbated by tax increases and productivity-sapping government spending. The funding of social care hasn’t been resolved; the problem has merely been postponed. The NHS consumes ever increasing amounts of taxpayers’ money with little to show in terms of improving outcomes. The funding of a bloated higher education sector through loans that will never be repaid has been a financial disaster. Badly-needed changes to business rates and housebuilding have been kicked into the long grass

The transition to electric vehicles means that the £37bn raised by fuel and excise duties will have to be replaced. A higher rate of VAT on electricity would be logical, but would break another election pledge. Finally, President Biden and the Democrats look unable to implement their plan to increase corporation tax from 21% to 28%. This makes the UK’s proposed increase to 25% counter-productive in terms of revenue.

All this has to be done through a spend-thrift Prime Minister and a civil service whose first instinct is always to raise taxes. As Sir Humphrey Appleby famously expostulated to his junior in Yes, Prime Minister, “it’s not taxpayers’ money, Bernard, it’s our money.” Sunak still has a mountain to climb.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Max has an Economics degree from the University of Cambridge and is a chartered accountant. He worked at Investec Asset Management for 12 years, managing multi-asset funds investing in internally and externally managed funds, including investment trusts. This included a fund of investment trusts which grew to £120m+. Max has managed ten investment trusts (winning many awards) and sat on the boards of three trusts – two directorships are still active.

After 39 years in financial services, including 30 as a professional fund manager, Max took semi-retirement in 2017. Max has been a MoneyWeek columnist since 2016 writing about investment funds and more generally on markets online, plus occasional opinion pieces. He also writes for the Investment Trust Handbook each year and has contributed to The Daily Telegraph and other publications. See here for details of current investments held by Max.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Was Margaret Thatcher great for Britain?

Was Margaret Thatcher great for Britain?The 'Iron Lady’ would be celebrating her 100th birthday this month. Margaret Thatcher rose to power in 1979 as the first ever female prime minister and was one of the most controversial leaders in history, but how did her policies shape today’s finances?

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Conservatives pledge to cut National Insurance again – how much could you save?

Conservatives pledge to cut National Insurance again – how much could you save?News A 2p reduction in National Insurance is a key feature of the Tory’s general election manifesto.

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon