Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

On this week’s cover we’ve got Boris Johnson as the Fat Controller of Britain’s railways – and HS2 in particular – as the always-in-doubt high-speed link to Leeds gets binned and replaced with empty promises of “levelling up” rail in the north. Simon Wilson looks at the controversial project and asks if cancelling a big chunk of it is a mistake and if the government will end up doing a U-turn on its U-turn.

Our main investment feature this week is on digital healthcare. The sector has been “a compelling investment theme” for years, says Stephen Connolly, but the Covid pandemic has provided huge impetus to the industry and we are now at “the start of a long-term growth trend”. Stephen looks at the key areas, and picks some of the best stocks and funds to buy now.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Elsewhere, Philip Pilkington explains what to buy when markets inevitably crack under the weight of inflation; David Stevenson picks some of the latest ETFs on offer; and Cris Sholto Heaton looks at inflation linked-bonds and explains why, at current prices, you may end up “locking in a loss”.

If you’re not already a subscriber, sign up here and get your first six issues free.

Podcast fans are in for a treat this week as we have not one but two episodes for you. First, Merryn talked to Tim Hayes of Ned Davis Research who, in contrast to many of our recent guests, is bullish on the US and European equities, but not too fond of UK stocks. Find out what he has to say here.

Merryn’s second guest this week is Vivek Ramaswamy who takes aim at what he calls the “woke industrial complex” and explains why he thinks big fund managers are using ESG investing to undermine the foundations of democracy. This one has already had some rave reviews on Twitter, with one reader calling it “one of the best podcast guests I’ve ever heard.” Listen to Vivek here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: What will long-term mortgages mean for the UK housing market?

- Tuesday Money Morning: Why Britons are much wealthier than we think

- Merryn’s blog: The power of passive investing – for good and bad

- Wednesday Money Morning: What do Turkey’s tumbling lira and America’s oil raid have in common?

- Thursday Money Morning: Now might be a good time to stock up on platinum – while nobody cares about it

- Web article: What Europe’s fourth wave of Covid means for investors

- Web article: What Bulb Energy’s collapse means for you

- Friday Money Morning: What would another lockdown mean for markets?

- Cryptocurrency roundup: Black Friday crypto crash

Now for the charts of the week (which unfortunately only go up to Wednesday this week due to America's Thanksgiving holidays).

The charts that matter

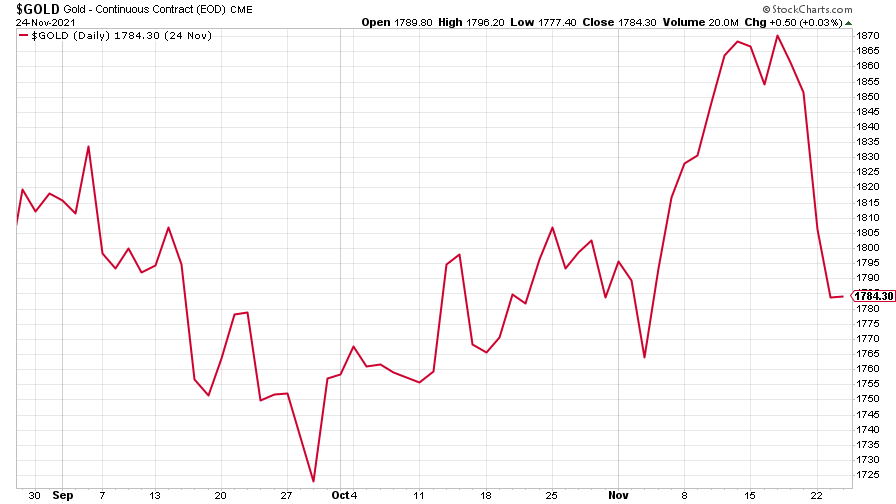

Gold gave up most of its recent gains though it rebounded towards the end of the week, particularly as markets took fright at the latest Covid outbreak.

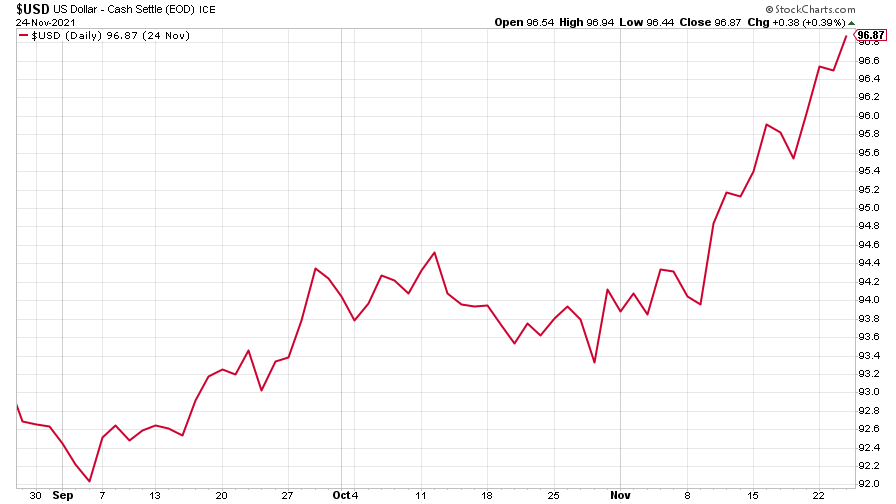

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) meanwhile, continued its rise.

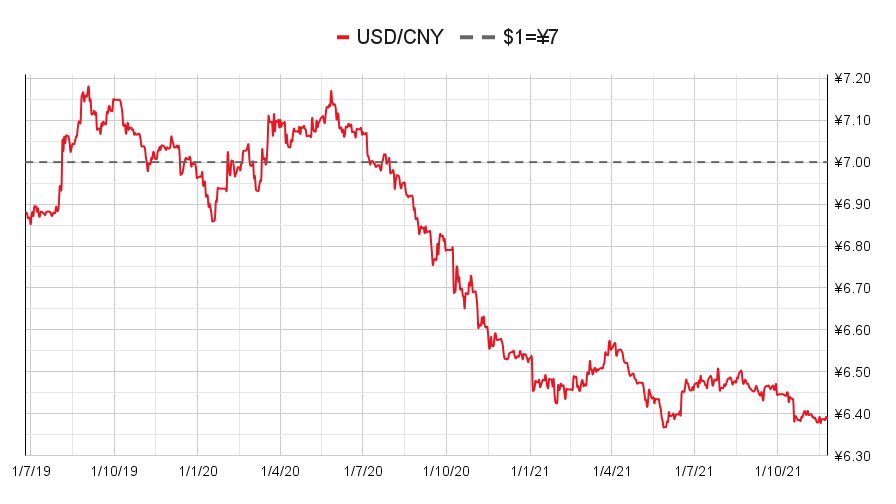

But the dollar’s strength failed to have much effect on the Chinese yuan (or renminbi) which firmed up against it (when the red line is rising, the dollar is strengthening while the yuan is weakening).

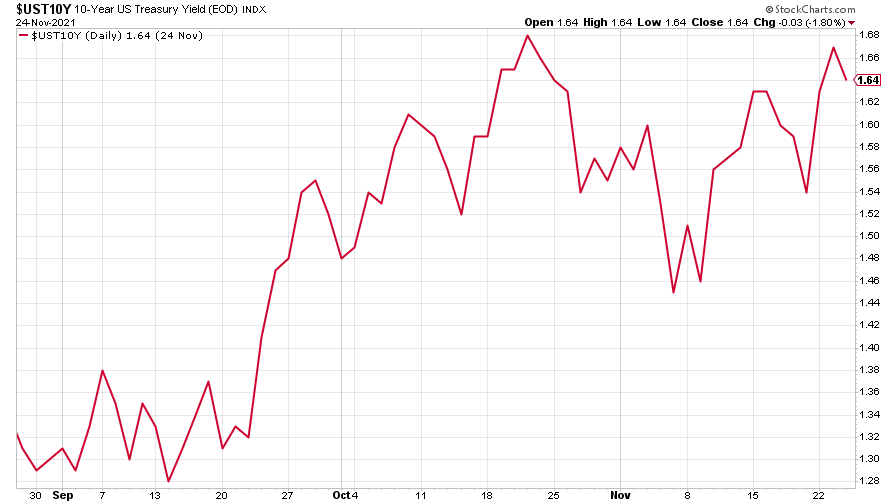

The yield on the ten-year US government bond dipped a little after further rises.

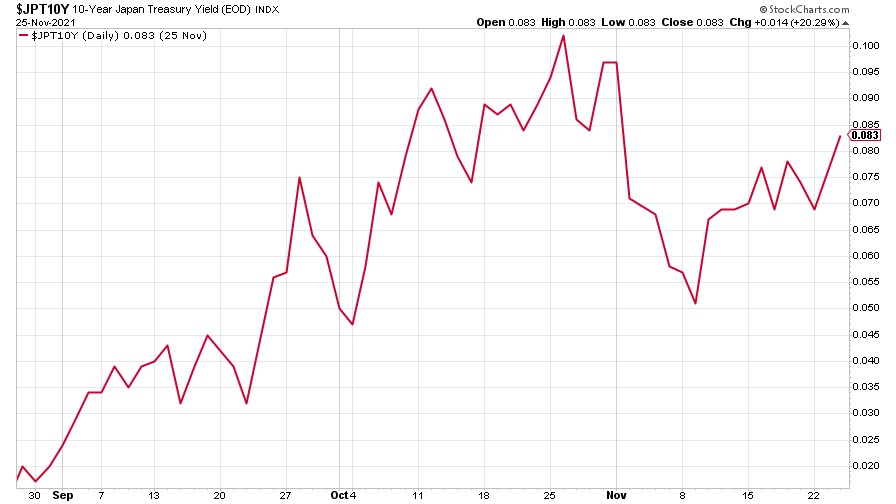

The yield on the Japanese ten-year bond rose.

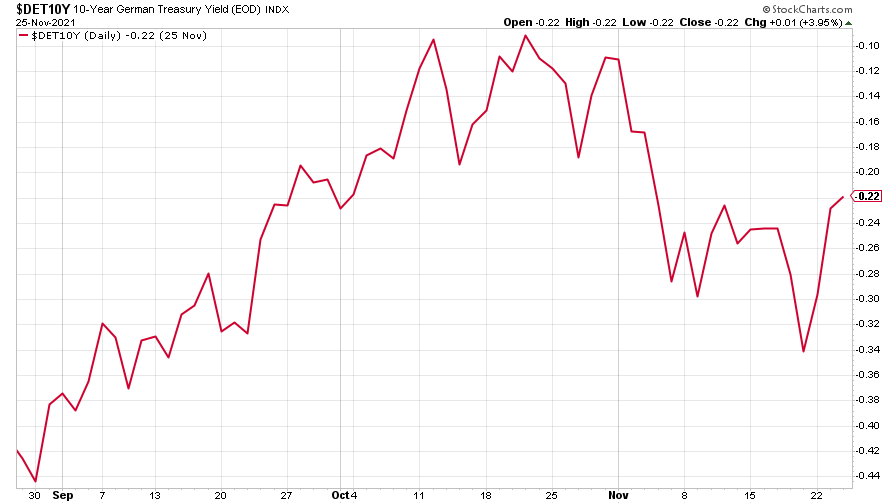

And the yield on the ten-year German Bund bounced.

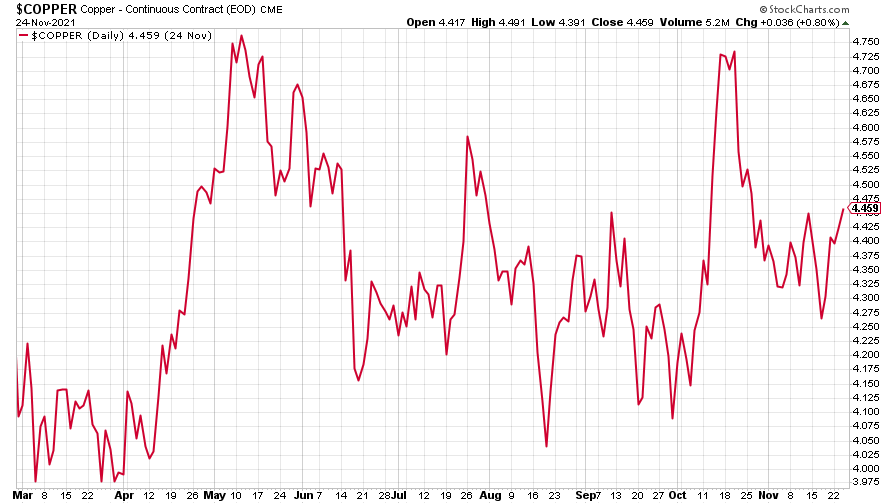

Copper continued its volatile march sideways.

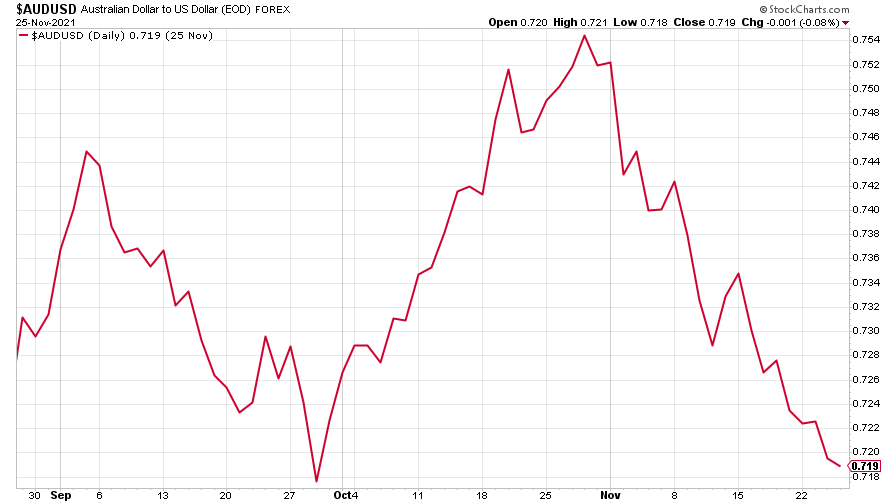

And the closely related Aussie dollar fell further against the US dollar.

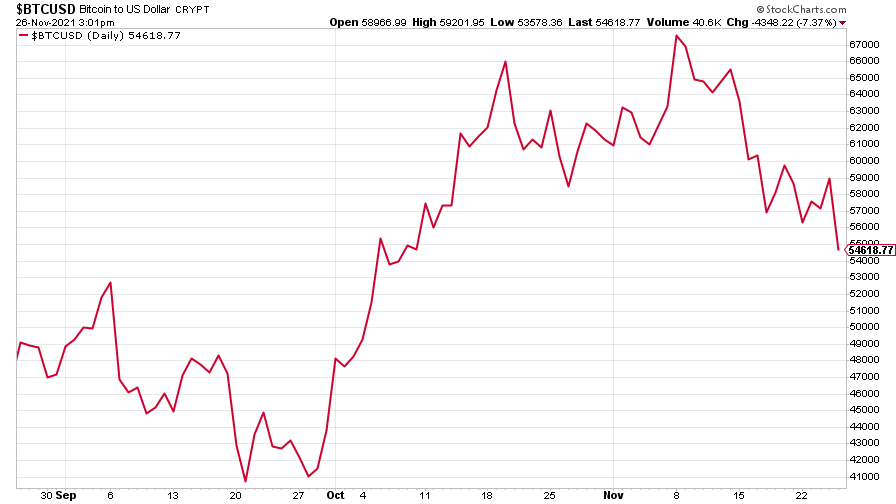

Bitcoin continued to slide along with the wider cryptocurrency sector.

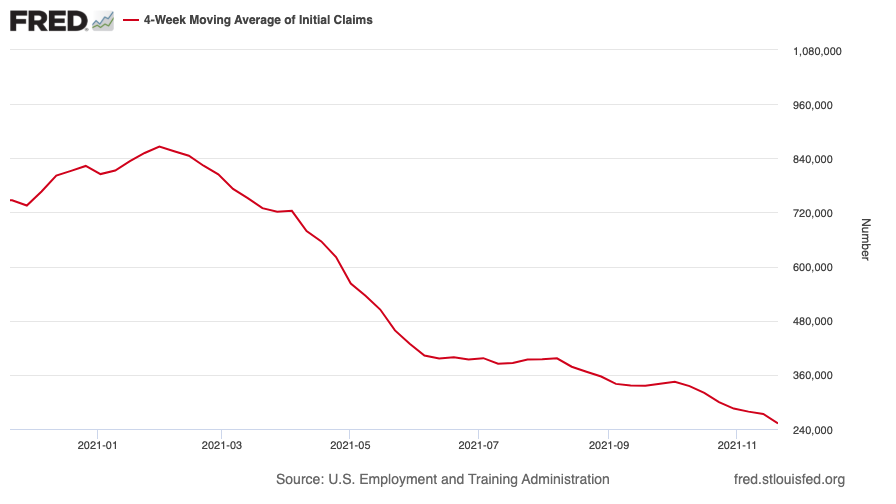

US weekly initial jobless claims fell by 71,000 to 199,000 – its lowest level since 15 November 1969 (when it was 197,000). The four-week moving average fell by 21,000 to 252,250, its lowest since 14 March 2020.

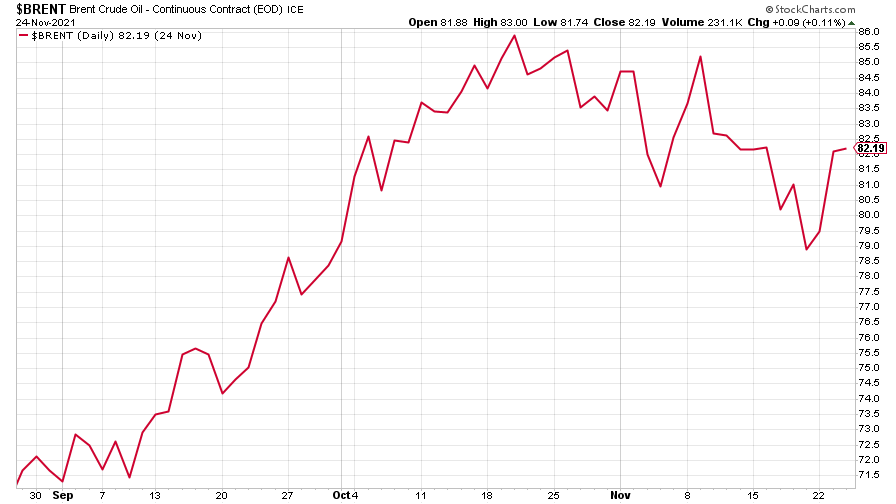

The oil price recovered after its earlier dip.

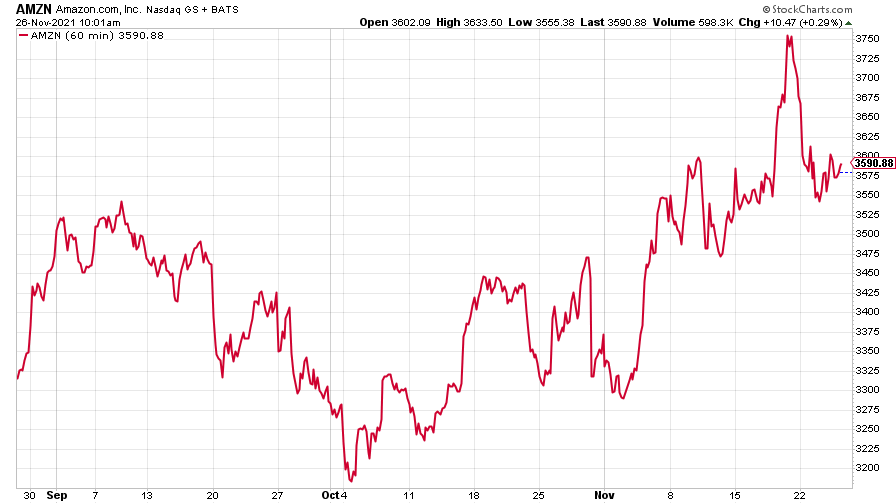

Amazon's share price crept up slightly.

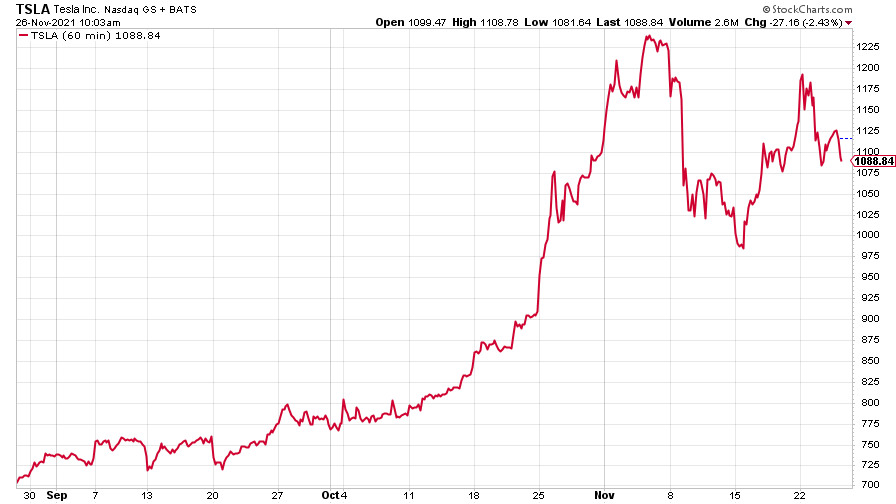

While Tesla paused its recovery.

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.