The power of passive investing – for good and bad

The rise of passive funds has made investing simple and cheap for millions of people. But it comes with huge consequences for markets, the economy and your wealth, says Merryn Somerset Webb.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Would you trust a computer with your money? That was the question posed on the cover of The Statist magazine in 1966. It seems like a silly question now, but don’t forget how enormously times have changed.

The same magazine also wondered if it was a good idea to pay workers with cheques. Sure, it saved on the hours spent collecting cash from the bank, guarding it, checking it, sorting it and putting it in wage packets, but, in the UK at least, it came with legal problems: the 1831 Truck Act, designed to prevent payment in “scrip”, demanded that all workers were paid with the “coin of the realm”. And not all workers were mad for it, as it transferred the work of cash collection from the bank to them.

It would only work, said The Statist, if bank accounts became widely used, adding: “Perhaps the womenfolk will have some influence on this.”

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

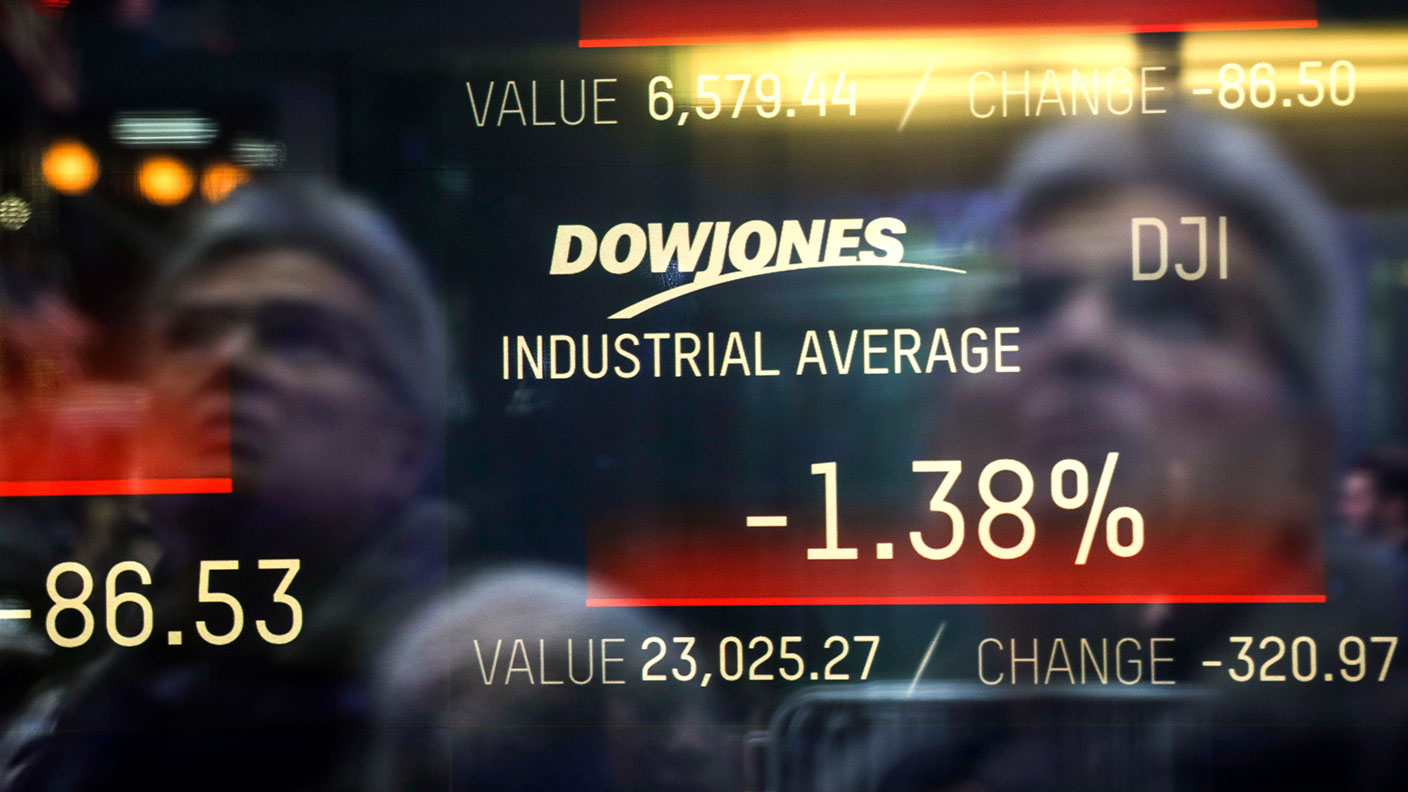

The shift to passive investing has huge consequences

Back to your money and computers. The article was written as 200 financial analysts gathered at a conference in Noordwijk in the Netherlands to discuss the huge computers they had left behind in their offices and the extent to which those machines might be better at picking portfolios than people. Not everyone was having it: naysayers pointed out that there was no way to program the “attributes of an agile human mind into a computer”.

In the 50-plus years since, the naysayers have comprehensively lost the argument. Almost all investors trust computers with at least some of their savings; a good 40% of US assets are now passively managed. Most evidence suggests the agile human mind is not required: after fees, the average passively run fund tends to outperform the average actively-run fund.

You can fiddle around with numbers and regions and find data to blur this a little: active investment works better outside the US and ordinary investors tend to congregate in the better-performing active funds. But whatever you might think of it, the shift has had huge consequences. It has made investing simple and cheap for many millions of people – and that’s a good thing – but it also has given immense power to the big passive managers. In the US, one of BlackRock, Vanguard or State Street is the largest single shareholder in the majority of big companies. That might not be so good.

Does passive investing drive inflation?

There is also a chance that the rise of passive investing is one of the many factors driving a new bias to inflation globally.

This could happen in two ways. First, it might reduce competitive pressure in the market. Active investors aim to pick winners; if they want to hold an airline, for example, they will look for the one they think is the best and root for it to outperform others.

Passive investors make no such decision; they will hold all the airlines in an index and, rather than wanting one to do particularly well, they’ll want them all to do just fine. That’s not exactly the kind of attitude that encourages the competitive pressures that keep prices down.

But there’s also a second possibility here – passive investing is effectively momentum investing (as things get more expensive, the computers automatically buy more of them).

This creates an odd dynamic where expensive stocks get more expensive and cheap ones just stay cheap. That matters to value investors (they like to buy low and sell high, not buy low and hold low indefinitely), but it might also make a difference to prices.

In a letter to investors last year, David Einhorn of Greenlight Capital suggested that the low valuations of industrial companies might in themselves be inflationary. If traditional industrial companies have low valuations, and hence an implicitly high cost of equity, it makes sense for holders of the stock to demand that dividend payouts and share buybacks take priority over capacity expansion: if the market attributes little value to your business, why expand it?

That leads to continued under-investment and, due to lack of new supply, to “sustained higher prices in a number of industries”, wrote Einhorn. If prices stay high for a long time – so long that even the world’s central banks have to accept that inflation is not “transitory” – that dynamic will change – but it hasn’t yet.

Mining is the classic here – and copper in particular. At the time of Einhorn writing the letter, Greenlight held Canadian miner Teck Resources. It takes eight to ten years to develop a copper mine, and while there are a couple of new ones coming on in the next few years, supply will be shrinking by the middle of the decade – and that’s at a time when the demand for the green revolution to move faster and faster is turbocharging demand for copper, and other metals such as lithium. Expect prices to rise for some time.

There is a similar dynamic in US housebuilding, in air freight and all manner of commodities.

What to buy

There are two messages here. One is that we should buy companies in this situation; the cash they throw off will always be welcome and the remaining active investors in the fund management sector will eventually notice, particularly as the inflation numbers continue to surprise them. And when the tide turns, it will turn fast.

For metals you might look to Amati’s Strategic Metals Fund which covers the theme pretty well. I’ve also chatted to Spencer Adair, co-manager of the Monks Investment Trust (LSE: MNKS) (which I hold) along these lines recently: he has invested in aggregates business Martin Marietta for similar reasons. You can listen to that here on the MoneyWeek Podcast here.

Finally, don’t forget big oil: there’s a reason the Biden administration has asked China, India and Japan to coordinate the release of some of their strategic stockpiles of oil with the US – supply is a bit short.

The second message is less straightforward: perhaps we should not have trusted computers with quite so much of our money. There is still something to be said for the agile human mind.

• This article was first published in the Financial Times

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.