The charts that matter: Fed becomes more hawkish

Gold rose meanwhile the US dollar fell after a key Fed meeting. Here’s what else happened to the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

On the cover of this week’s magazine, what new listing rules in London mean for your money. UK regulators hope that weaker listing rules will attract more tech listings and rejuvenate a declining

stockmarket. Perhaps they should pay more attention to other growth sectors, reports Simon Wilson.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If you’re not already a subscriber, sign up here and get your first six issues free.

This week’s podcast features Steen Jakobsen of Saxo Bank about his annual “outrageous predictions” – and how reality is proving a match for anything he can come up with. Find out what he says here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: US inflation is at a near-40-year high. So why are markets so calm?

- Tuesday Money Morning: In defence of fossil fuels

- Wednesday Money Morning: UK inflation hits a 30-year high – but will the Bank of England raise interest rates?

- Thursday Money Morning: The US central bank is winding down QE faster than planned – so why are markets bouncing?

- Friday Money Morning: The Bank of England clearly still doesn't believe inflation is here to stay

- Cryptocurrency roundup: Selling Tesla “merch” for dogecoin

Now for the charts of the week.

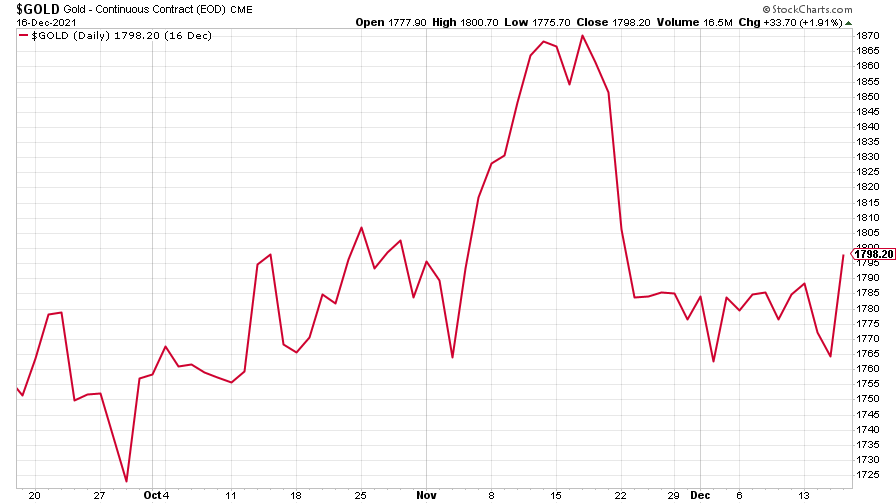

Gold rose as the US dollar retreated after the US central bank, the Fed, announced it is ending its Covid-19 bond purchases by March.

(Gold: three months)

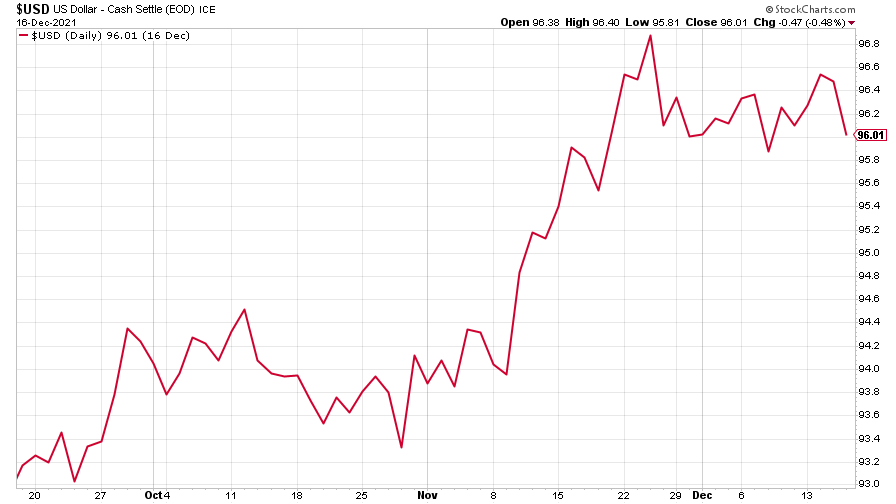

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) fell from a three-week high this week after the Fed said it is targetting three rate hikes in 2022 and is looking to end its bond buying by March.

(DXY: three months)

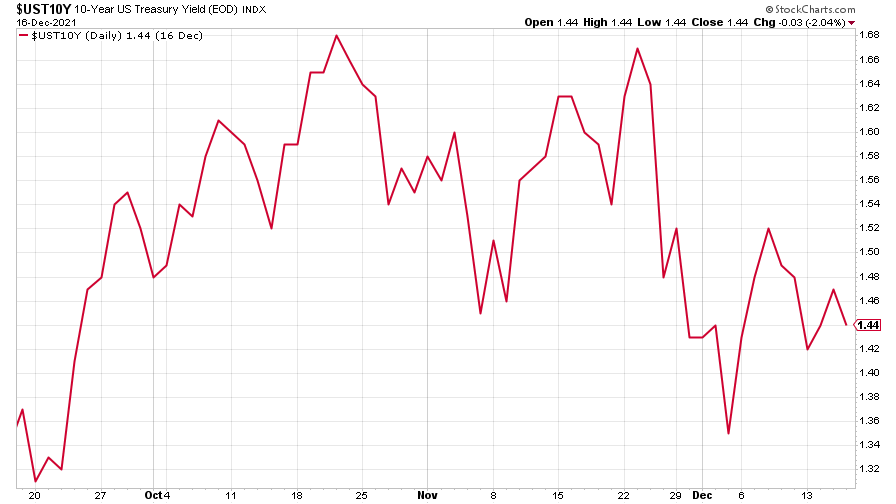

The yield on the ten-year US government bond edged higher after the Fed confirmed it is tightening monetary policy. Yields move inversely to bond prices.

(Ten-year US Treasury yield: three months)

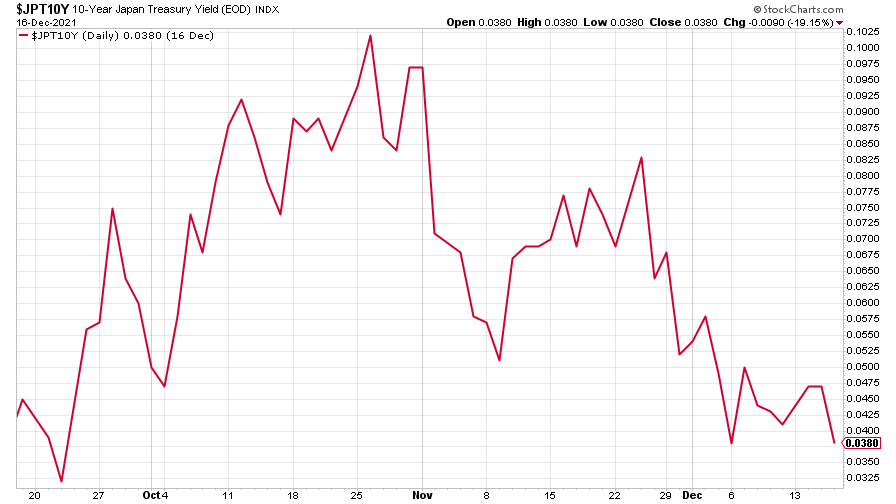

But the yield on the Japanese ten-year bond fell.

(Ten-year Japanese government bond yield: three months)

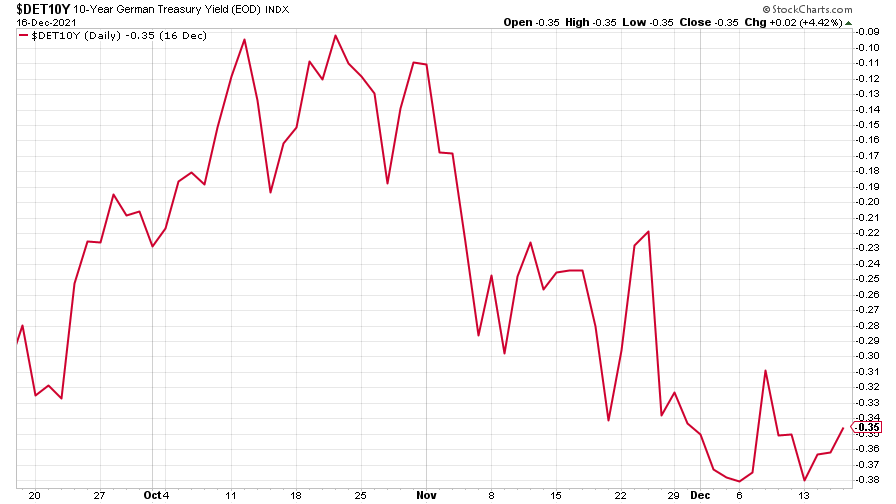

And the yield on the ten-year German Bund rose, in line with higher US yields as US data showed on Tuesday that US prices rose more than expected in November, suggesting that inflation may be high for some time to come.

(Ten-year Bund yield: three months)

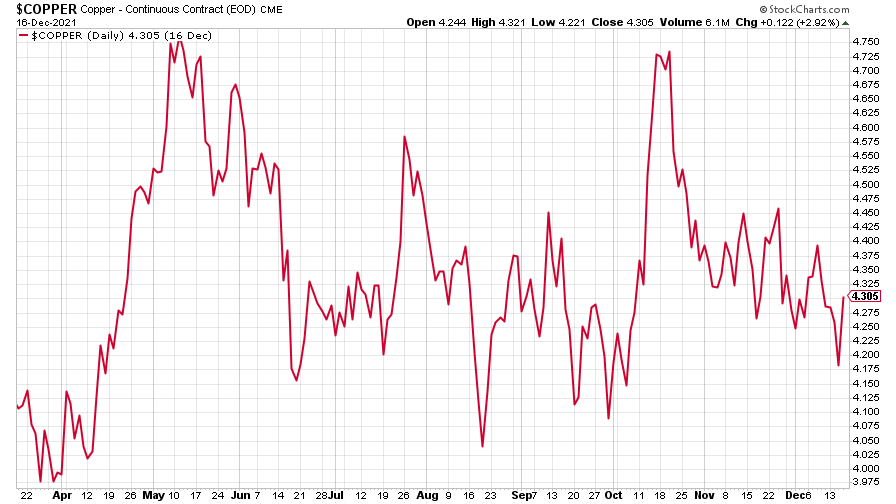

Copper prices rose from the previous week.

(Copper: nine months)

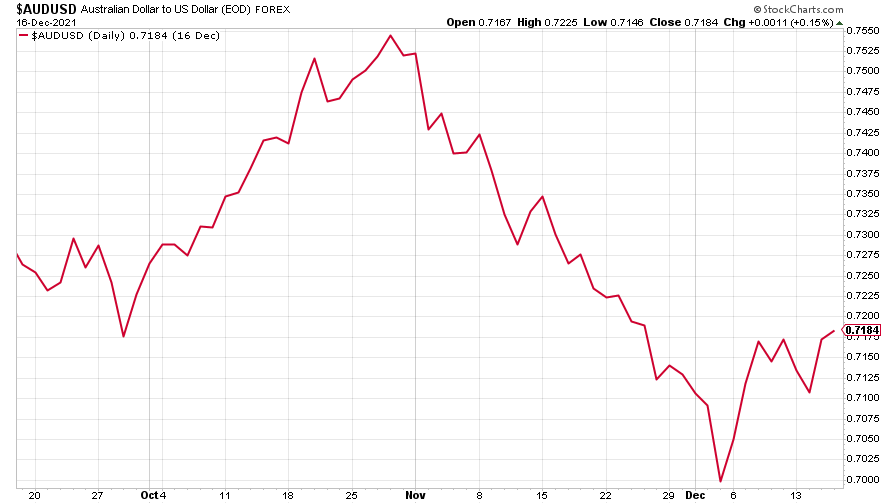

And the closely-related Aussie dollar rose after strong jobs data made it more likely the central bank will also taper its pandemic-era bond buying in early 2022, following the Fed.

(Aussie dollar vs US dollar exchange rate: three months)

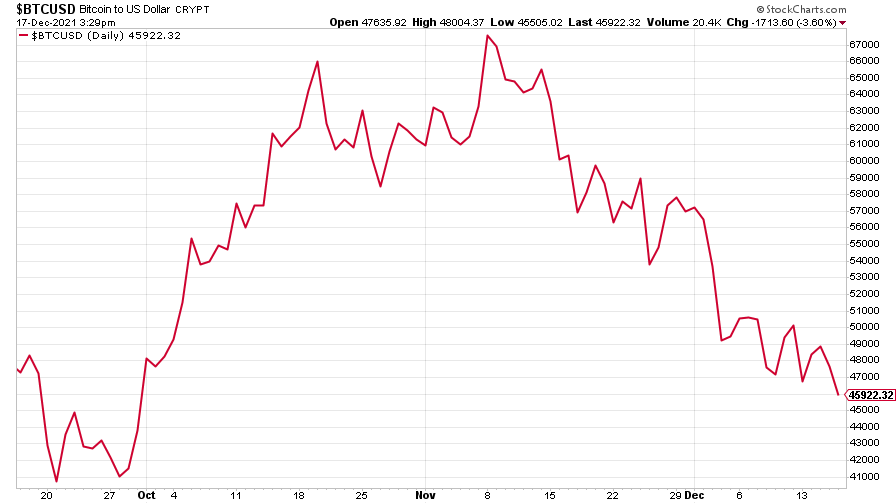

Bitcoin fell as markets got wobbly after the Fed meeting.

(Bitcoin: three months)

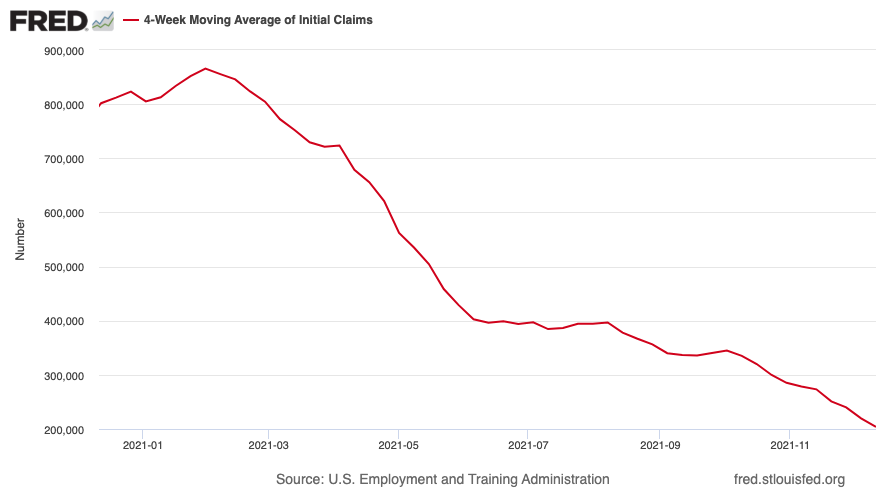

US weekly initial jobless claims rose by 18,000 to 206,000. The four-week moving average was 203,750, a decrease of 16,000 from the previous week's revised average.

(US initial jobless claims, four-week moving average: since Jan 2021)

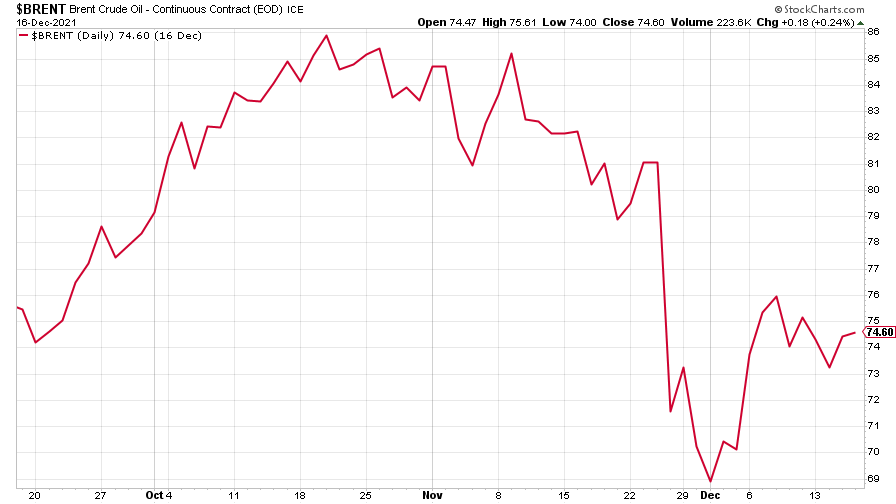

Brent rose as falling stockpiles and as upbeat predictions from the Fed offset Omicron fears.

(Brent crude oil: three months)

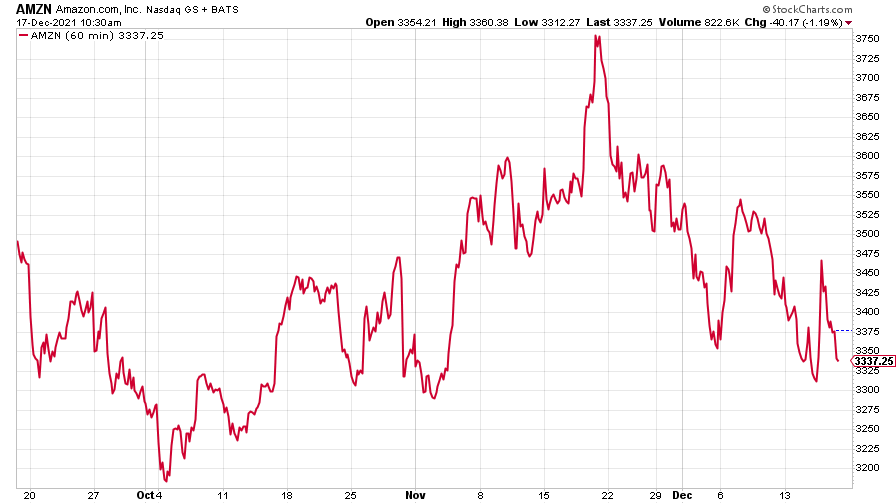

Amazon fell, as the Fed's decision caused big tech shares to tumble on Friday.

(Amazon: three months)

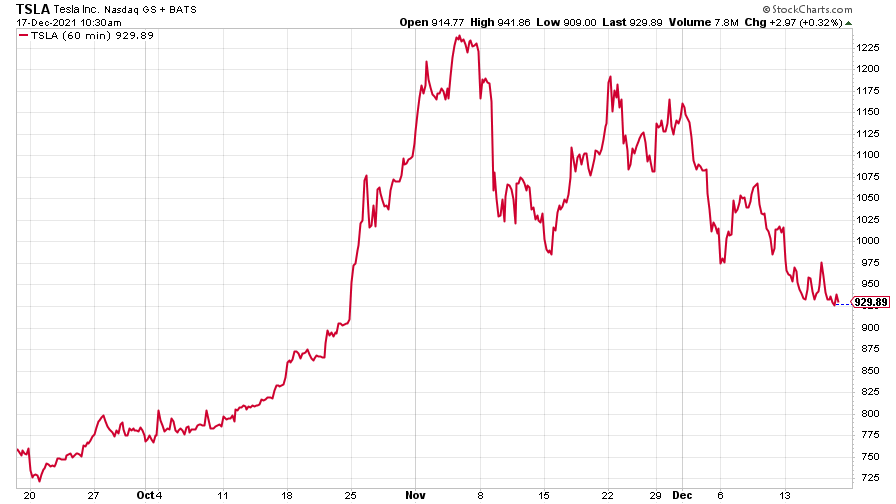

(Tesla: three months)

Tesla was little changed from the previous week.

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Saloni is a web writer for MoneyWeek focusing on personal finance and global financial markets. Her work has appeared in FTAdviser (part of the Financial Times), Business Insider and City A.M, among other publications. She holds a masters in international journalism from City, University of London.

Follow her on Twitter at @sardana_saloni

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

'Governments are launching an assault on the independence of central banks'

'Governments are launching an assault on the independence of central banks'Opinion Say goodbye to the era of central bank orthodoxy and hello to the new era of central bank dependency, says Jeremy McKeown

-

Do we need central banks, or is it time to privatise money?

Do we need central banks, or is it time to privatise money?Analysis Free banking is one alternative to central banks, but would switching to a radical new system be worth the risk?

-

Will turmoil in the Middle East trigger inflation?

Will turmoil in the Middle East trigger inflation?The risk of an escalating Middle East crisis continues to rise. Markets appear to be dismissing the prospect. Here's how investors can protect themselves.

-

Federal Reserve cuts US interest rates for the first time in more than four years

Federal Reserve cuts US interest rates for the first time in more than four yearsPolicymakers at the US central bank also suggested rates would be cut further before the year is out

-

The Bank of England can’t afford to hike interest rates again

The Bank of England can’t afford to hike interest rates againWith inflation falling, the cost of borrowing rising and the economy heading into an election year, the Bank of England can’t afford to increase interest rates again.