Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

On the cover of this week’s magazine, we’ve got the tortoise and the hare. In our cover story, Richard Beddard looks at UK plodders – solid, dependable, un-hyped companies that get on with making money quietly while the fashionable new startups on the block zoom around all over the place shouting about how brilliant they are. When you’re buying shares, says Richard, you need to balance quality and price. Richard picks five slow and steady blue-chip stocks to buy for the long run.

If you’re not already a subscriber, sign up here and get your first six issues free.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This week’s podcast features George Maher. It’s a little different this week in that George isn’t a fund manager talking about his investment style and what he’s buying now. George is an actuary – someone who looks at risk. He’s written a book – Pugnare – about the fall of the Roman Empire and the decisions its leaders made that led to its demise – and the rather worrying parallels with the decisions our leaders are making today. Find out what he says here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: Has the “jam tomorrow” bubble popped already?

- Tuesday Money Morning: High house prices are bad news for us all

- Merryn’s blog: Five books to make you think this Christmas

- Wednesday Money Morning: We’re at another turning point in the 100-year cycle of money – here’s what to do

- Thursday Money Morning: What tightening Covid rules mean for your money

- Friday Money Morning: Evergrande has finally officially defaulted – what does that mean for your money?

- Cryptocurrency roundup: IMF calls for global crypto-regulation

Now for the charts of the week.

The charts that matter

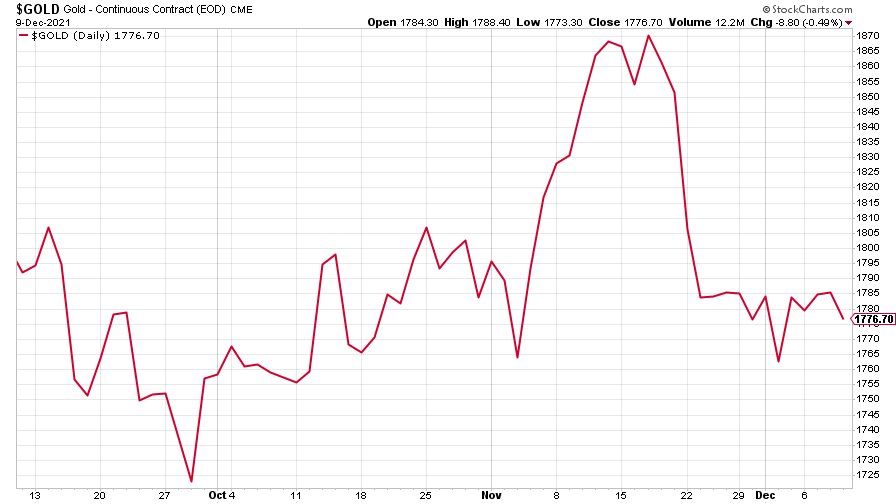

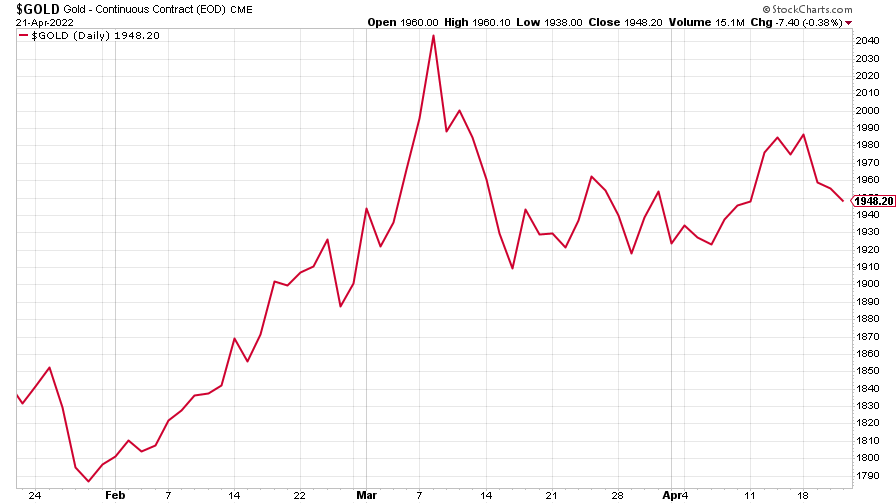

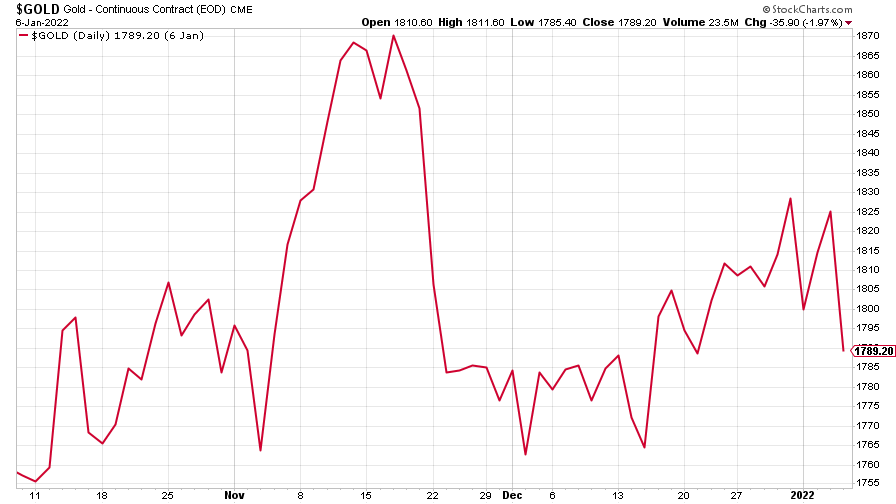

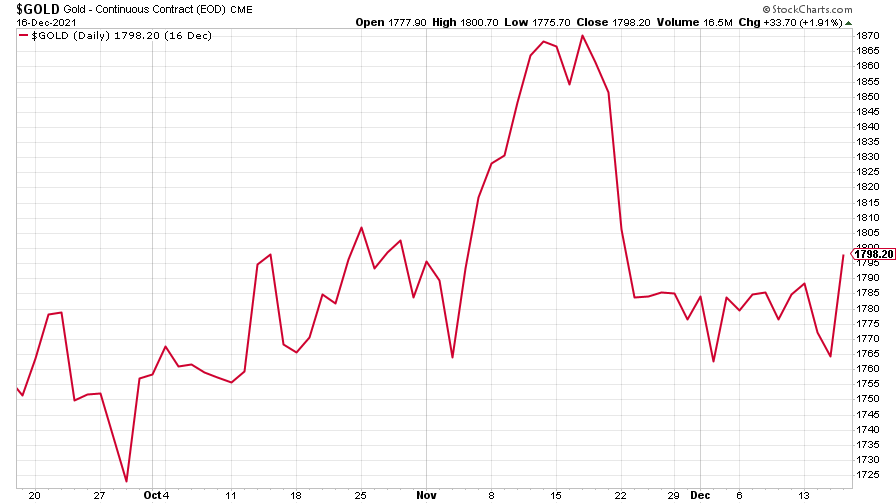

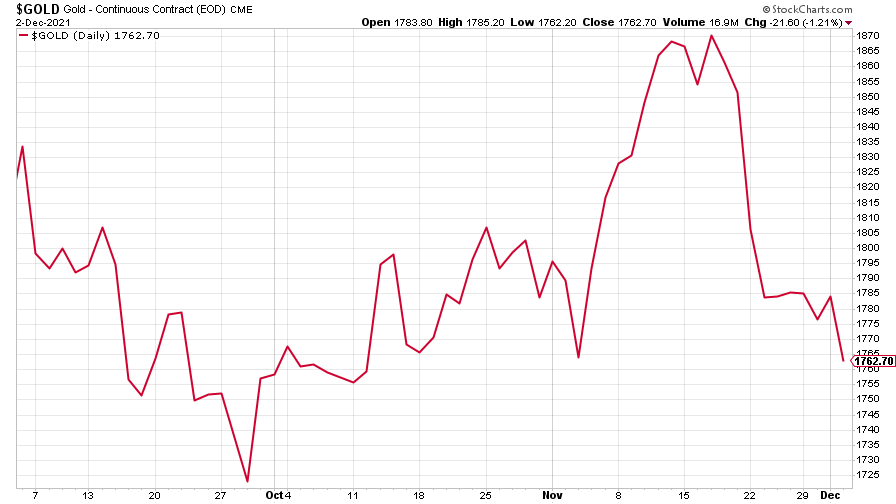

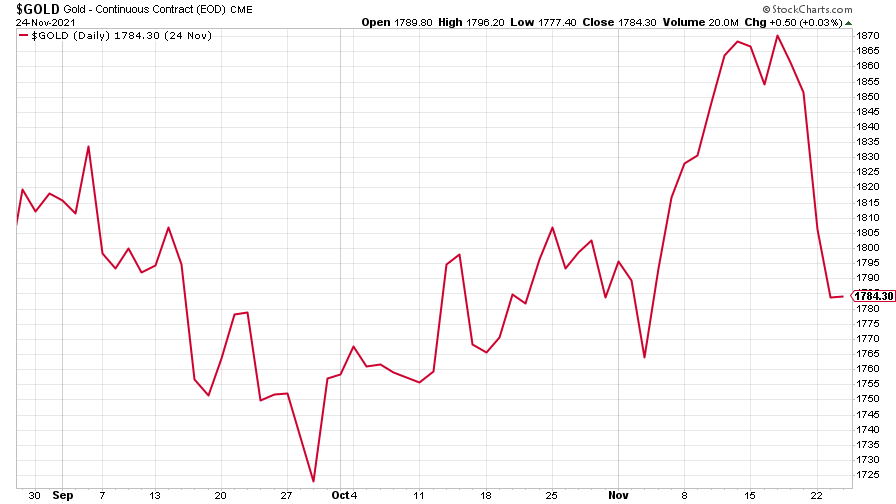

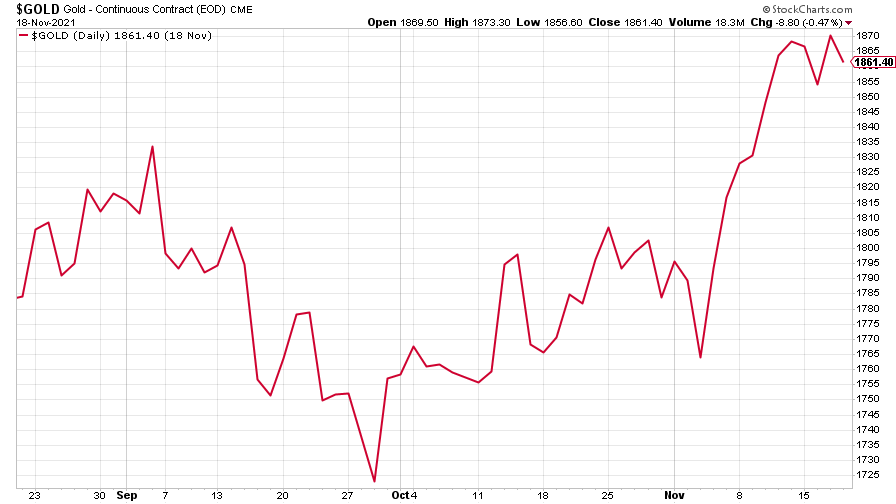

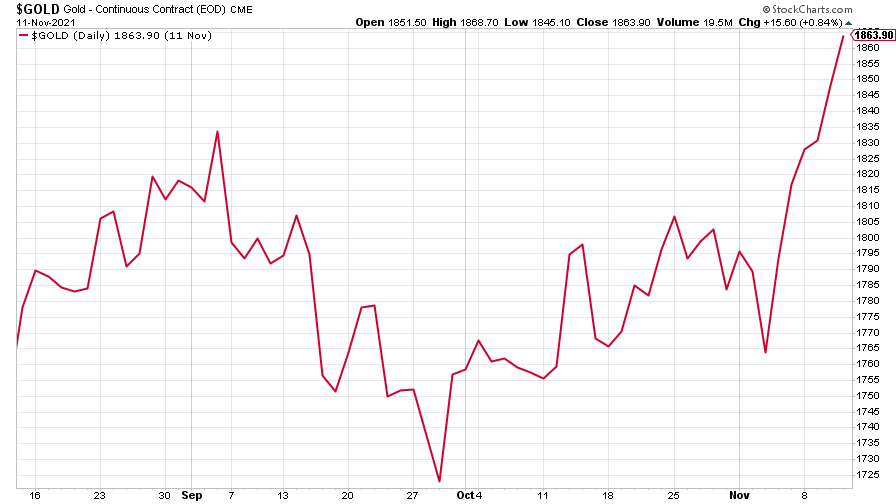

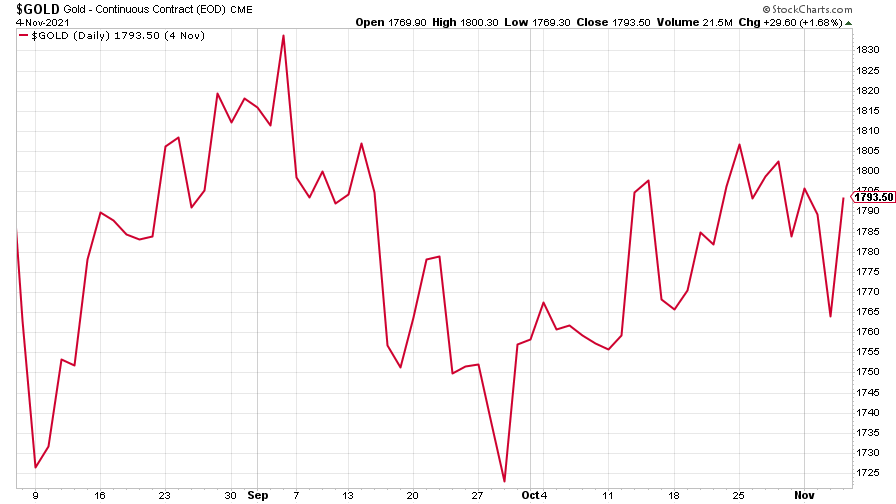

Gold recovered some of the previous week’s losses, but dropped back again towards the end of the week.

(Gold: three months)

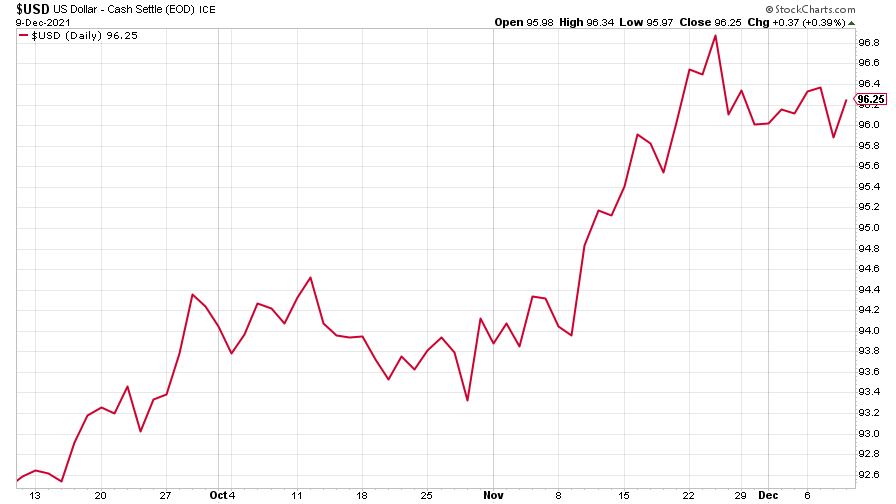

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) took a breather in its long climb.

(DXY: three months)

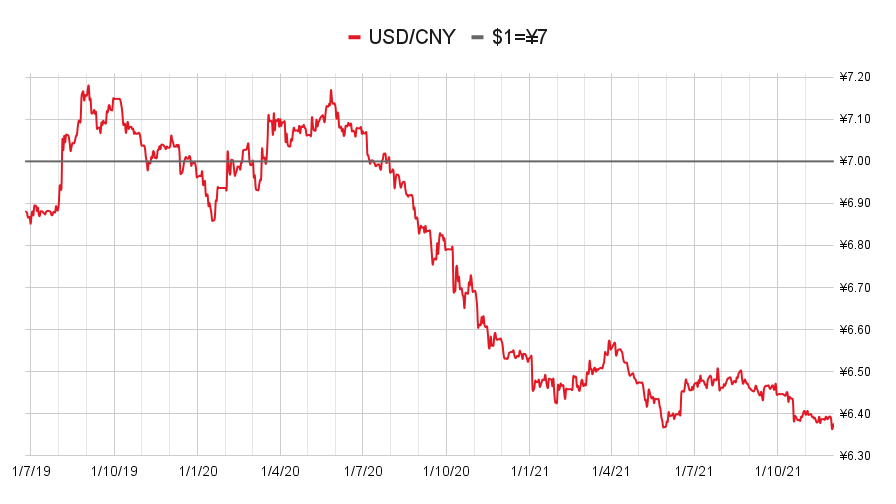

The Chinese yuan (or renminbi) strengthened a little (when the red line is rising, the dollar is strengthening while the yuan is weakening).

(Chinese yuan to the US dollar: since 25 Jun 2019)

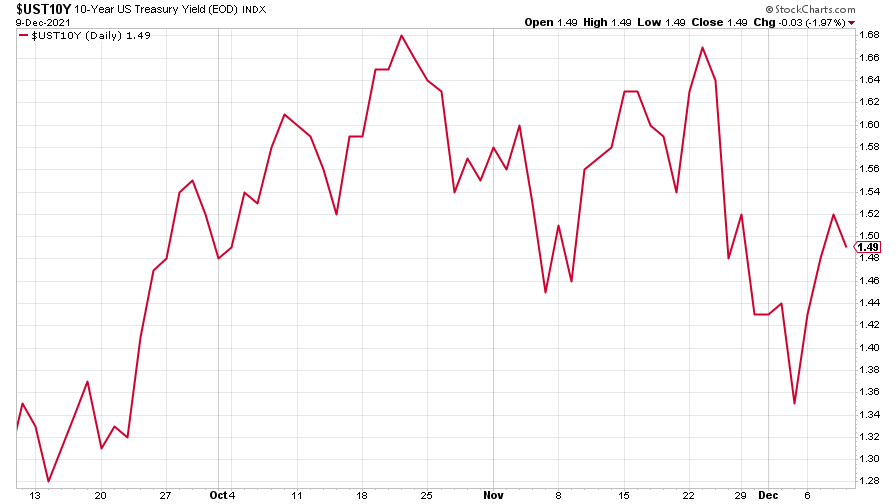

The yield on the ten-year US government bond arrested its decline.

(Ten-year US Treasury yield: three months)

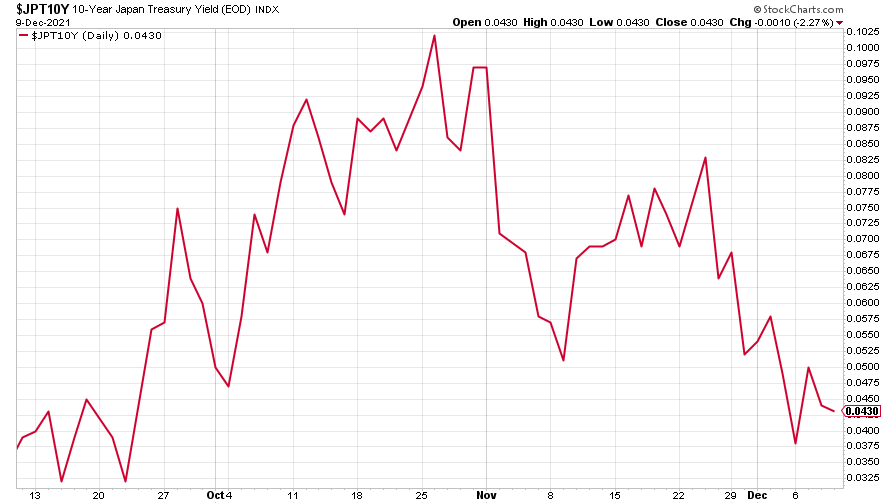

But the yield on the Japanese ten-year bond fell further.

(Ten-year Japanese government bond yield: three months)

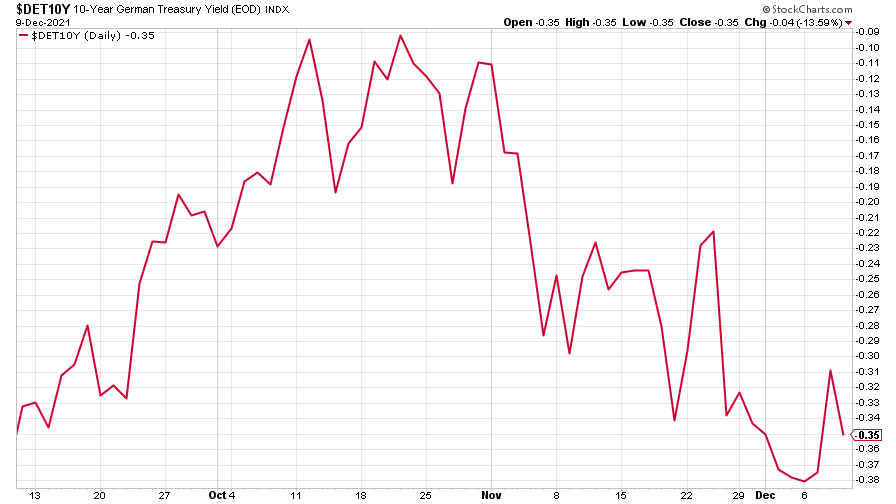

And the yield on the ten-year German Bund bounced back, only to lose much of its gains towards the end of the week.

(Ten-year Bund yield: three months)

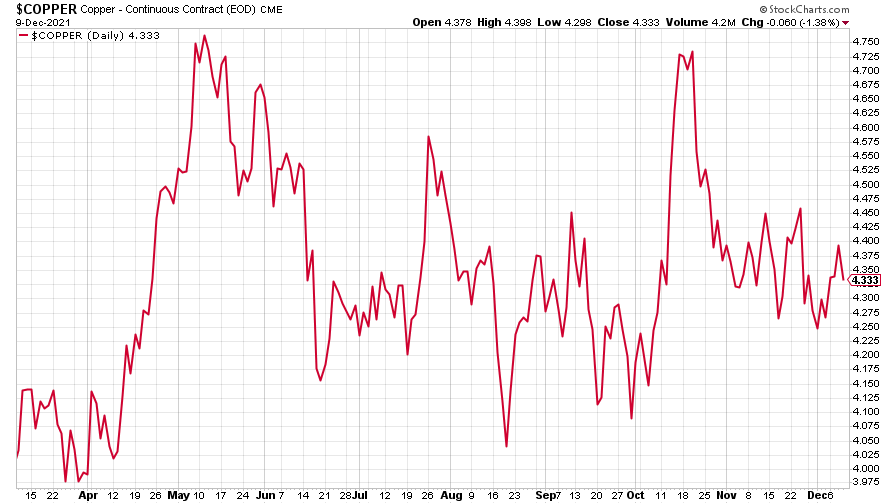

Copper rose from the previous week’s trough.

(Copper: nine months)

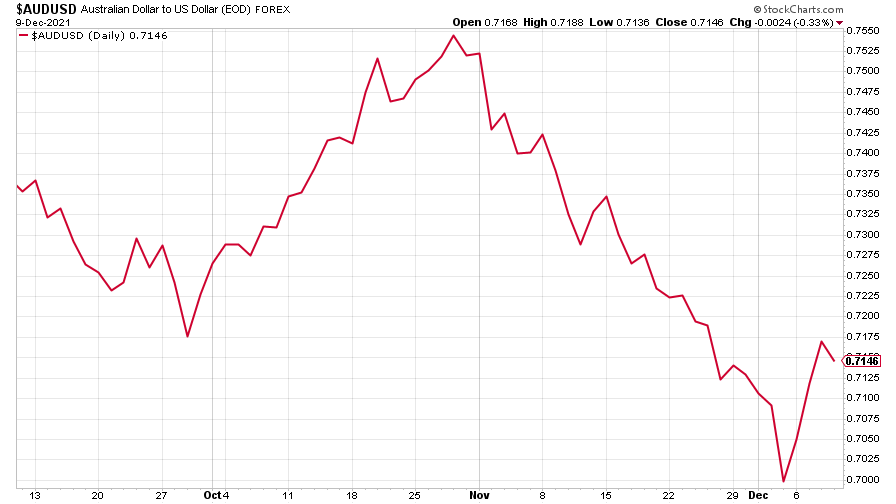

And the closely-related Aussie dollar bounced back in some style after a long decline.

(Aussie dollar vs US dollar exchange rate: three months)

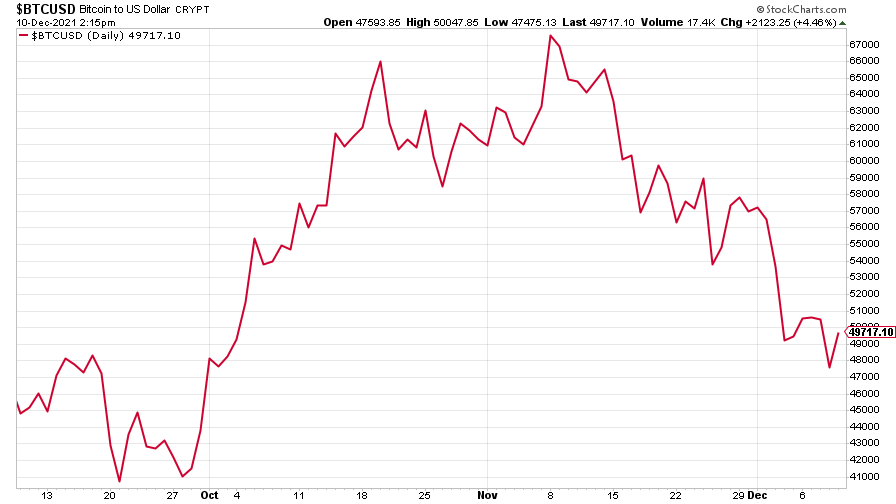

Bitcoin continued to decline, seeing 20% shaved off its market cap this week.

(Bitcoin: three months)

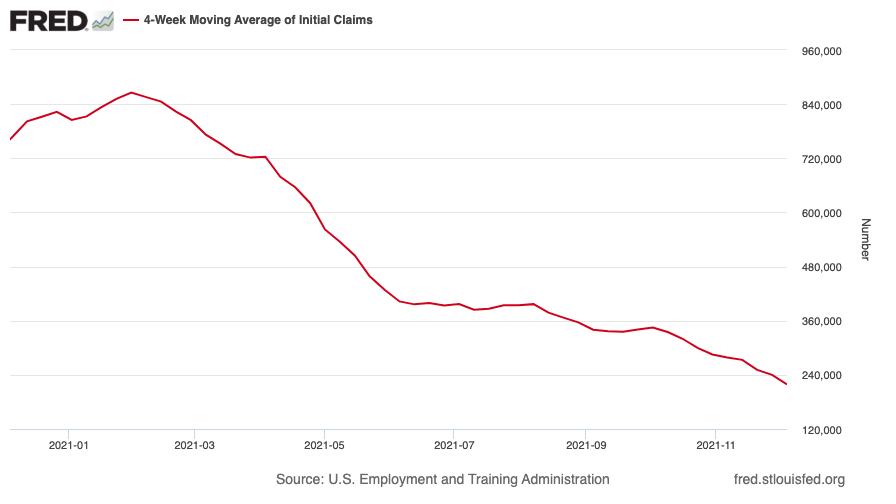

US weekly initial jobless claims fell by 43,000 to 184,000 –the lowest figure since September 1969, when it was 182,000. The four-week moving average fell by 21,250 to 218,750.

(US initial jobless claims, four-week moving average: since Jan 2020)

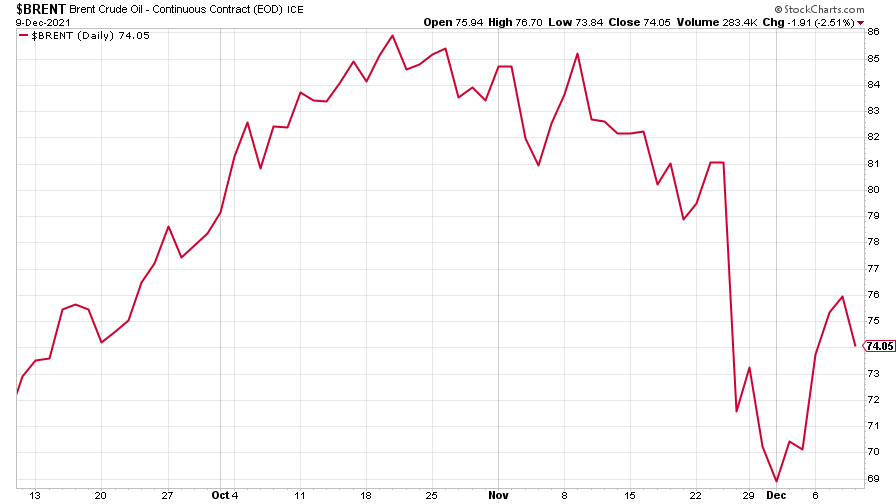

The oil price recovered from its previous week’s sharp drop.

(Brent crude oil: three months)

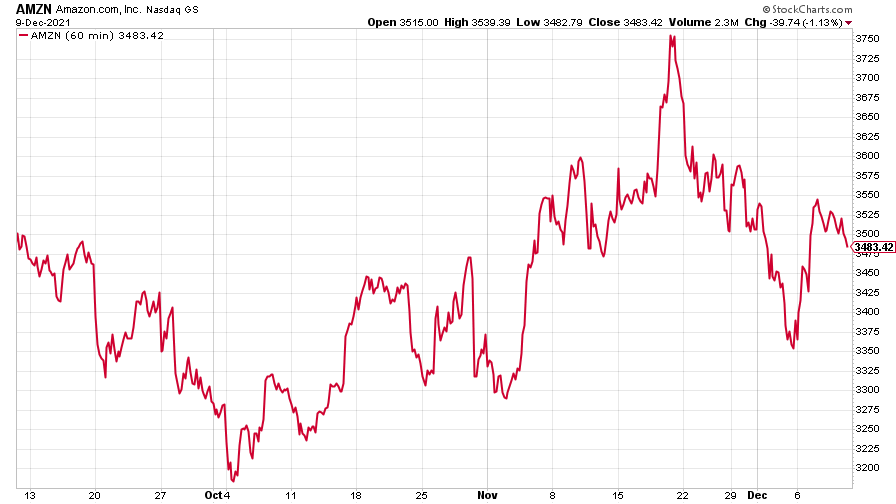

Amazon arrested its slide.

(Amazon: three months)

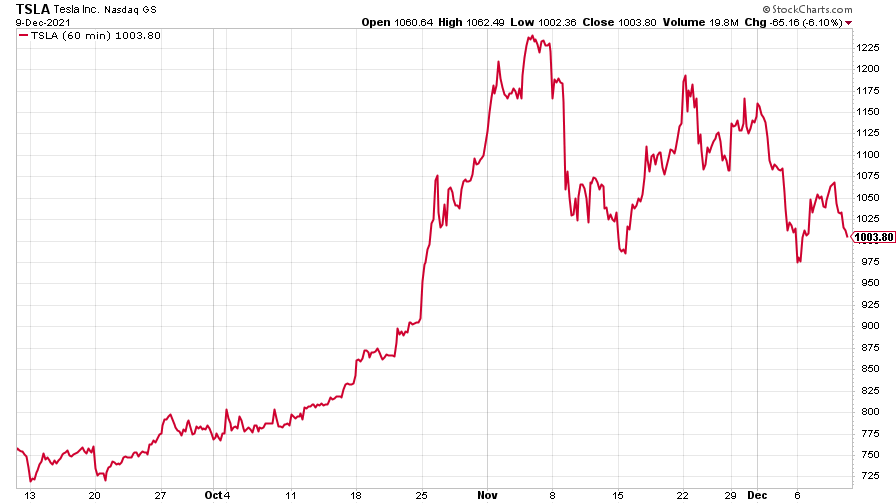

But Tesla headed lower.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

The charts that matter: bond yields and US dollar continue to climb

The charts that matter: bond yields and US dollar continue to climbCharts The US dollar and government bond yields around the world continued to climb. Here’s what happened to the charts that matter most to the global economy.

-

The charts that matter: markets start the year with a crash

The charts that matter: markets start the year with a crashCharts As markets start 2022 with a big selloff, here’s what happened to the charts that matter most to the global economy.

-

The charts that matter: Fed becomes more hawkish

The charts that matter: Fed becomes more hawkishCharts Gold rose meanwhile the US dollar fell after a key Fed meeting. Here’s what else happened to the charts that matter most to the global economy.

-

The charts that matter: omicron rattles markets

The charts that matter: omicron rattles marketsCharts Markets were rattled by the emergence of a new strain of Covid-19. Here’s how it has affected the charts that matter most to the global economy.

-

The charts that matter: the US dollar keeps on strengthening

The charts that matter: the US dollar keeps on strengtheningCharts The US dollar saw further rises this week as gold and cryptocurrencies sold off. Here’s how that has affected the charts that matter most to the global economy.

-

The charts that matter: gold hangs on to gains while the dollar continues higher

The charts that matter: gold hangs on to gains while the dollar continues higherCharts The gold price continued to hang on to last week’s gains, even as the US dollar powered higher this week. Here’s how that has affected the charts that matter most to the global economy.

-

The charts that matter: inflation fears give gold a much needed boost

The charts that matter: inflation fears give gold a much needed boostCharts US inflation hit its highest in 30 years this week, driving gold and bitcoin to new highs. Here’s how that has affected the charts that matter most to the global economy.

-

The charts that matter: a tale of two central banks

The charts that matter: a tale of two central banksCharts Government bond yields slipped around the world this week. Here’s how that has affected the charts that matter most to the global economy.