Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

This week, we’re looking at China. Not so very long ago, Chinese stocks looked like a good bet. The economy was booming, stocks were soaring (though many shares were mispriced, opening up all sorts of opportunities) and it offered diversification for your portfolio. But now? Things are different.

There are three distinct worries for investors, says Cris Sholto Heaton. The country’s passion for social control and its crackdown on dissent; state meddling in private businesses; and its deteriorating relations with the West. Some private sector businesses will undoubtedly do fine, but it may be increasingly hard to pick winners.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Cris looks at some of the best ways to do that for those of you determined to buy in.

If you’re not already a subscriber, sign up here and get your first six issues free.

This week’s guest on the MoneyWeek Podcast is someone with whom many of our readers may be familiar: Spencer Adair of the Monks Investment Trust. He tells Merryn about how he shuns “glamorous” growth to find solid “cockroach” companies that thrive over the long term while their competitors wither and die. Listen to what he has to say here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: Inflation is anything but transitory – here’s why

- Tuesday Money Morning: The UK jobs market is booming – so it’ll be hard to skip raising rates next month

- Merryn’s blog: Don’t worry about the global population explosion – it’s unlikely to happen

- Wednesday Money Morning: The most important price in the world is rising – investors beware

- Thursday Money Morning: Here’s why UK investors should keep an eye on New Zealand’s fight against inflation

- Friday Money Morning: Amazon, the great disruptor, might be about to turn payments upside down too

- Web article: The climate summit didn’t kill off coal – what stocks might benefit?

- Cryptocurrency roundup: China doubles down on crypto-ban

Now for the charts of the week.

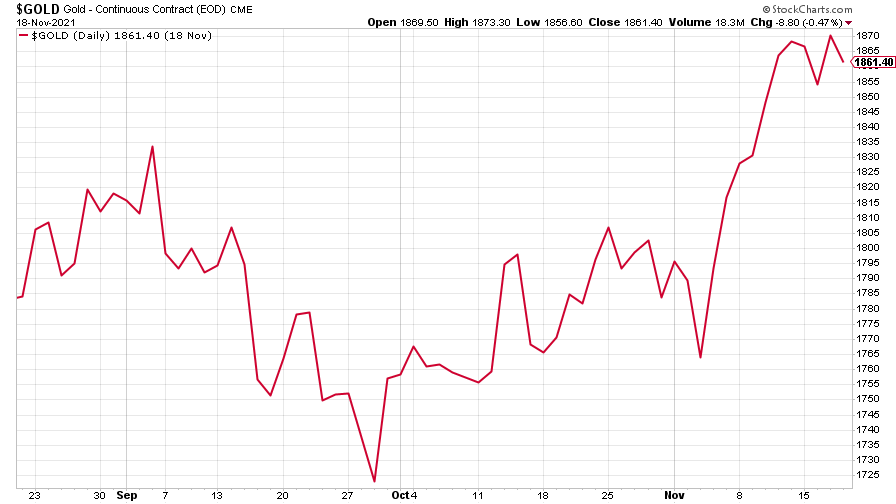

Gold kept hold of the previous week’s gains as investors continue to worry about inflation.

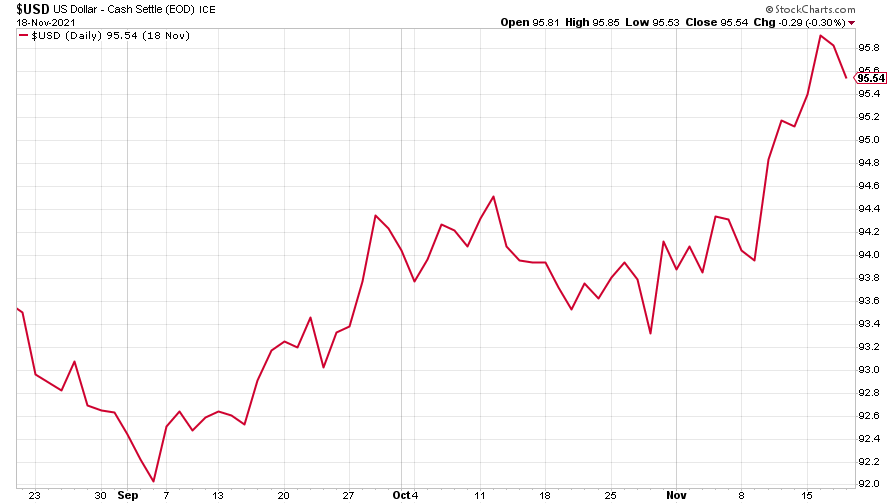

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) slipped a little, but the greenback’s rise is likely to continue, says Dominic, something that is causing a “fundamental shift in the investment landscape”.

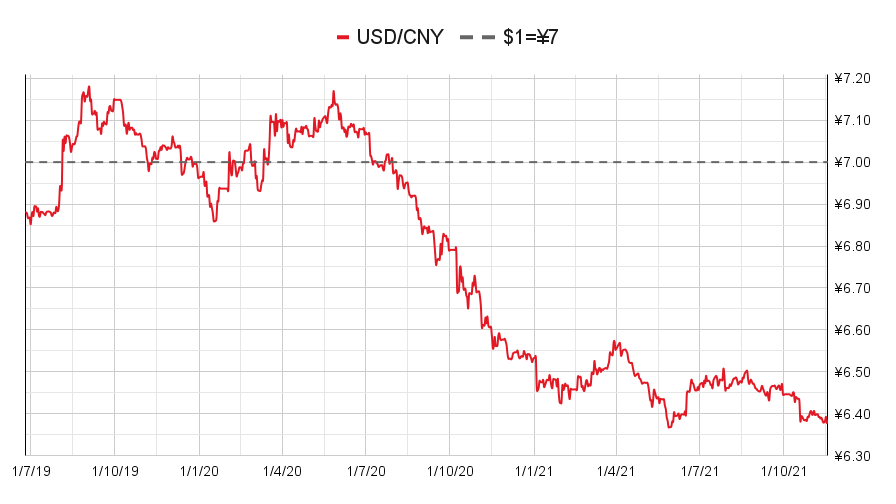

Despite the dollar’s strength, the Chinese yuan (or renminbi) firmed up against it (when the red line is rising, the dollar is strengthening while the yuan is weakening).

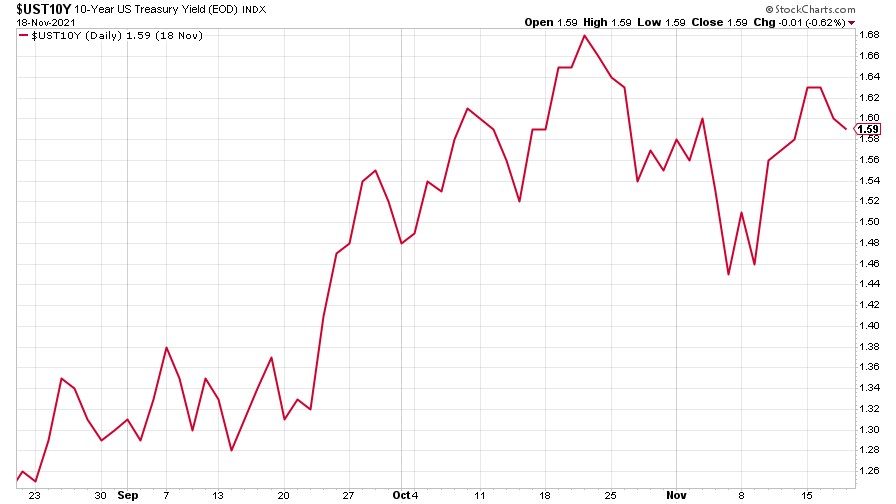

The yield on the ten-year US government bond dipped a little.

The yield on the Japanese ten-year bond rose slightly.

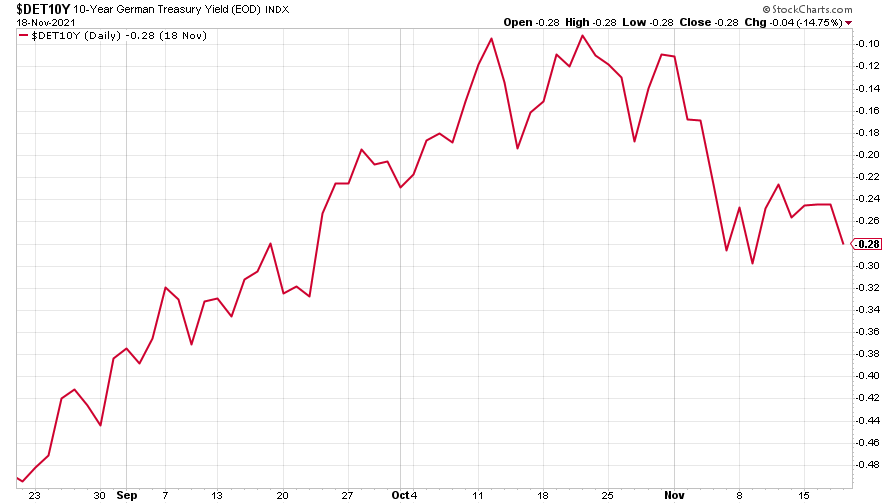

While the yield on the ten-year German Bund slipped further into negative territory.

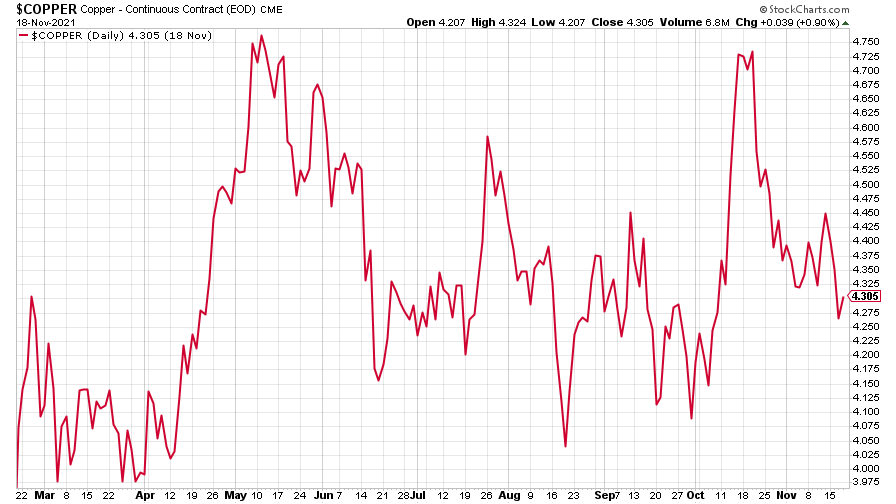

Copper is looking very volatile these days.

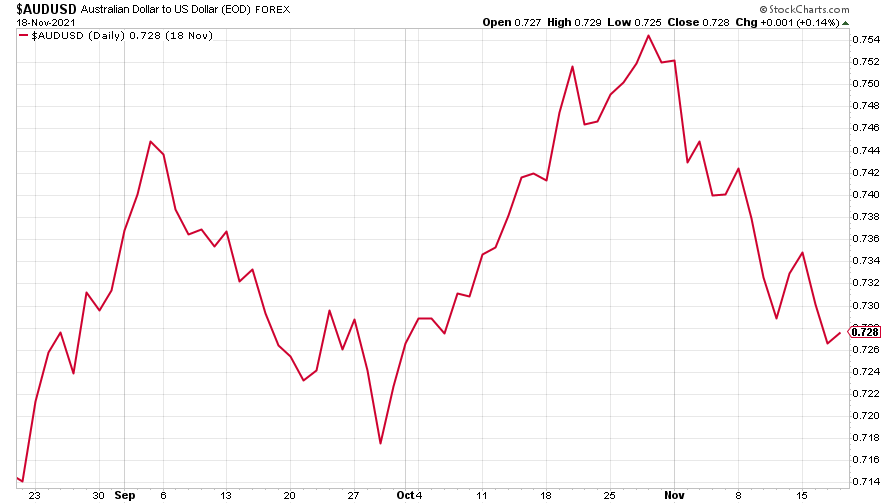

And the closely related Aussie dollar continued to fall against the US dollar.

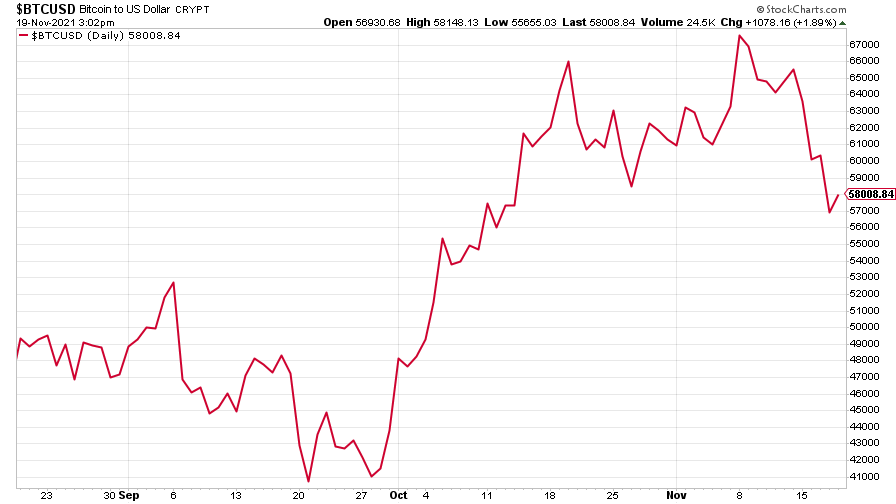

Bitcoin fell from its recent new high.

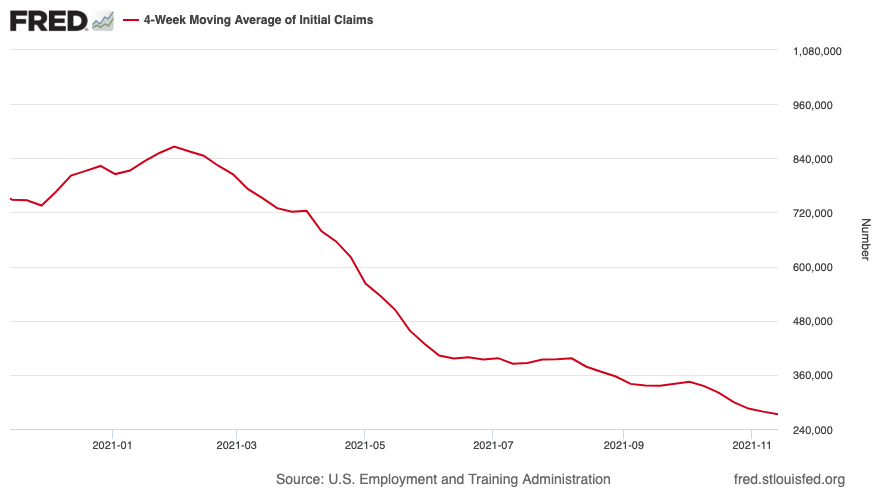

US weekly initial jobless claims fell by 1,000 to 268,000. The four-week moving average rose by 7,750 to 272,750.

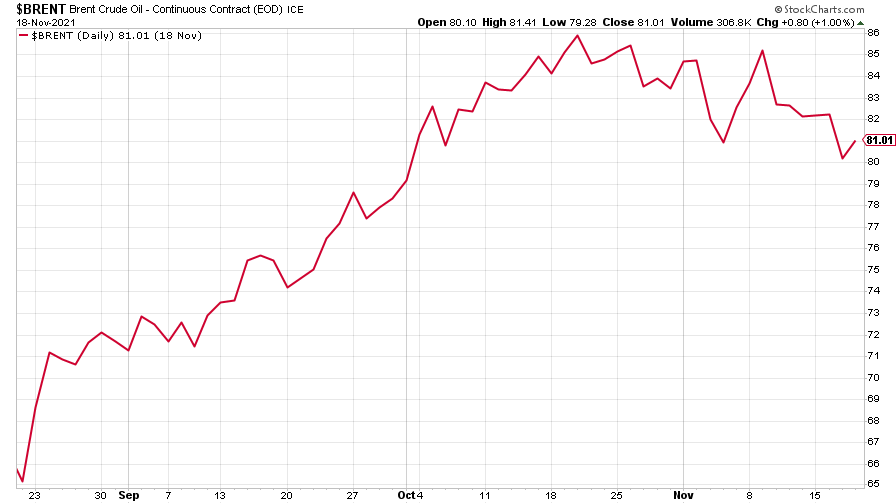

The oil price eased somewhat.

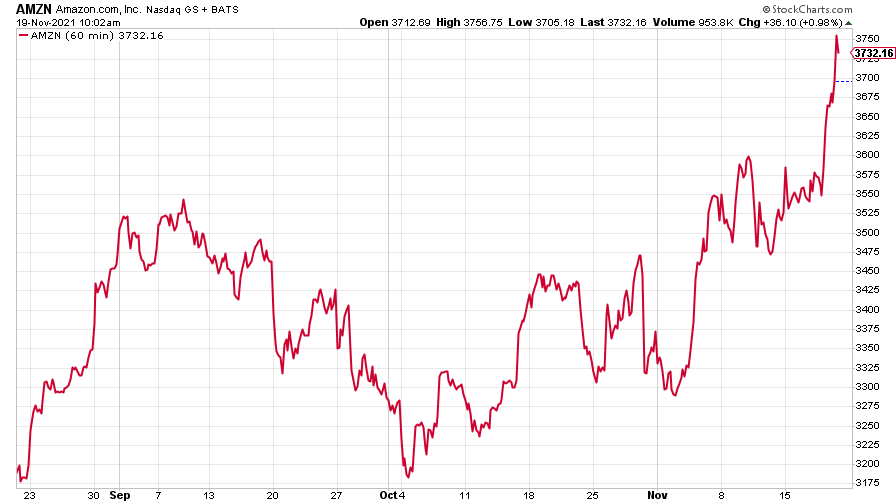

Amazon's share price took off in a week when it said it would soon no longer accept Visa credit cards for payment in the UK. Could investors be looking forward to the e-commerce giant disrupting finance, too? Visa’s share price fell by 5% on the news.

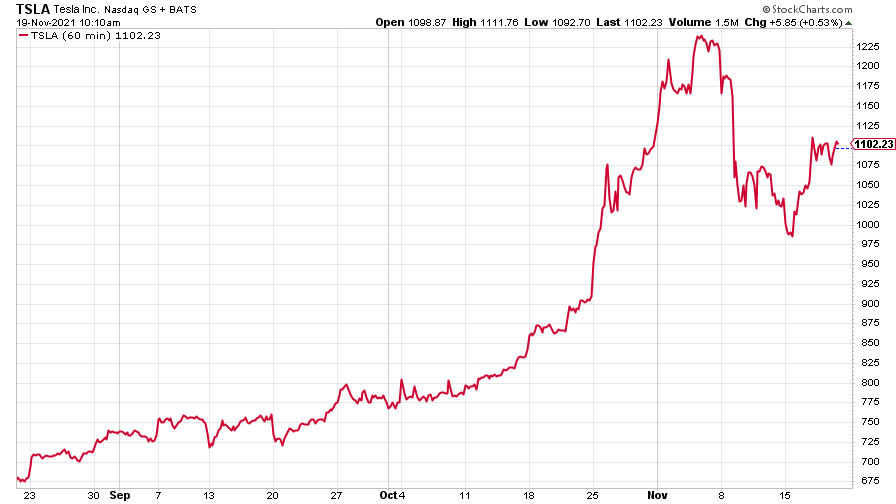

And Tesla looked to be recovering from the 10% rout prompted by Elon Musk’s most recent adventures on Twitter.

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.