Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome back.

This week, we’re looking at China. Not so very long ago, Chinese stocks looked like a good bet. The economy was booming, stocks were soaring (though many shares were mispriced, opening up all sorts of opportunities) and it offered diversification for your portfolio. But now? Things are different.

There are three distinct worries for investors, says Cris Sholto Heaton. The country’s passion for social control and its crackdown on dissent; state meddling in private businesses; and its deteriorating relations with the West. Some private sector businesses will undoubtedly do fine, but it may be increasingly hard to pick winners.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Cris looks at some of the best ways to do that for those of you determined to buy in.

If you’re not already a subscriber, sign up here and get your first six issues free.

This week’s guest on the MoneyWeek Podcast is someone with whom many of our readers may be familiar: Spencer Adair of the Monks Investment Trust. He tells Merryn about how he shuns “glamorous” growth to find solid “cockroach” companies that thrive over the long term while their competitors wither and die. Listen to what he has to say here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: Inflation is anything but transitory – here’s why

- Tuesday Money Morning: The UK jobs market is booming – so it’ll be hard to skip raising rates next month

- Merryn’s blog: Don’t worry about the global population explosion – it’s unlikely to happen

- Wednesday Money Morning: The most important price in the world is rising – investors beware

- Thursday Money Morning: Here’s why UK investors should keep an eye on New Zealand’s fight against inflation

- Friday Money Morning: Amazon, the great disruptor, might be about to turn payments upside down too

- Web article: The climate summit didn’t kill off coal – what stocks might benefit?

- Cryptocurrency roundup: China doubles down on crypto-ban

Now for the charts of the week.

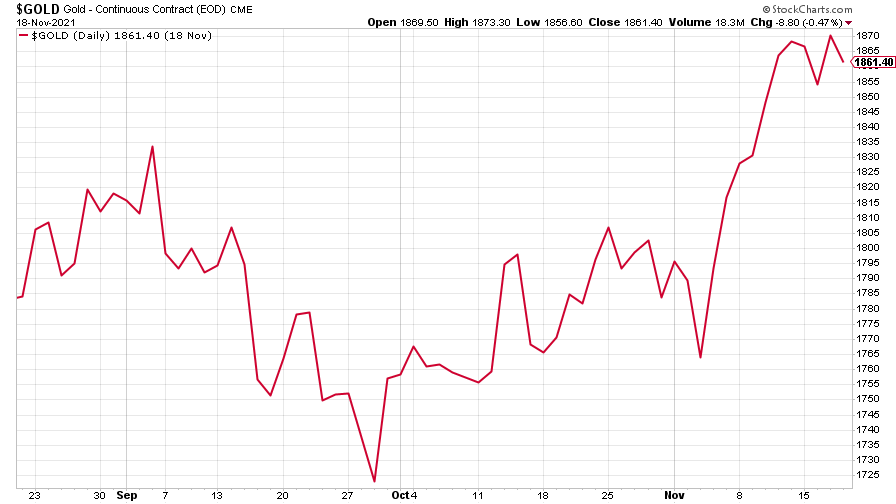

Gold kept hold of the previous week’s gains as investors continue to worry about inflation.

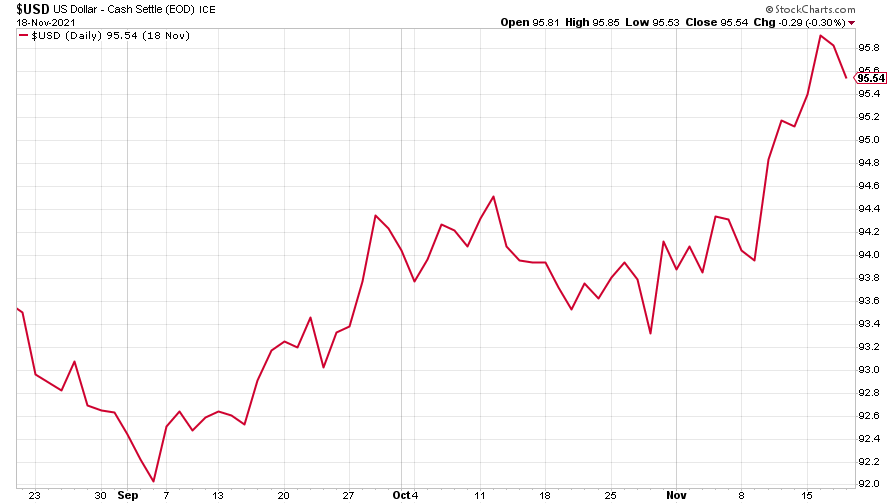

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) slipped a little, but the greenback’s rise is likely to continue, says Dominic, something that is causing a “fundamental shift in the investment landscape”.

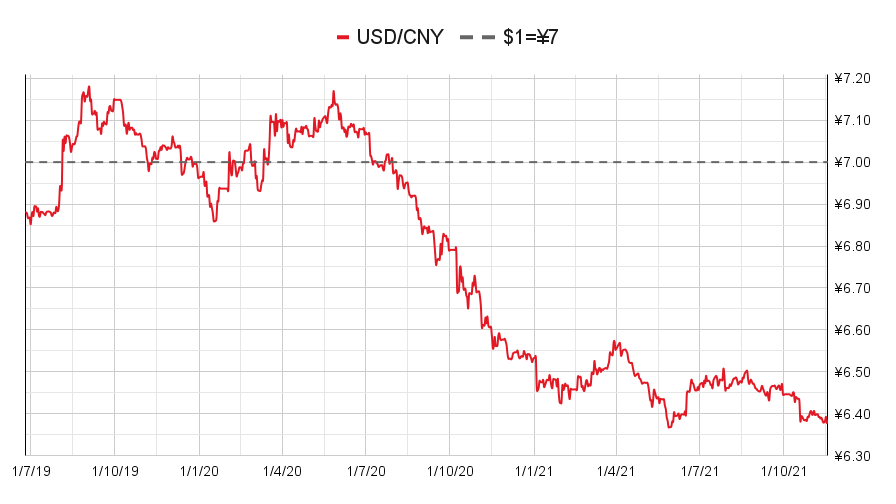

Despite the dollar’s strength, the Chinese yuan (or renminbi) firmed up against it (when the red line is rising, the dollar is strengthening while the yuan is weakening).

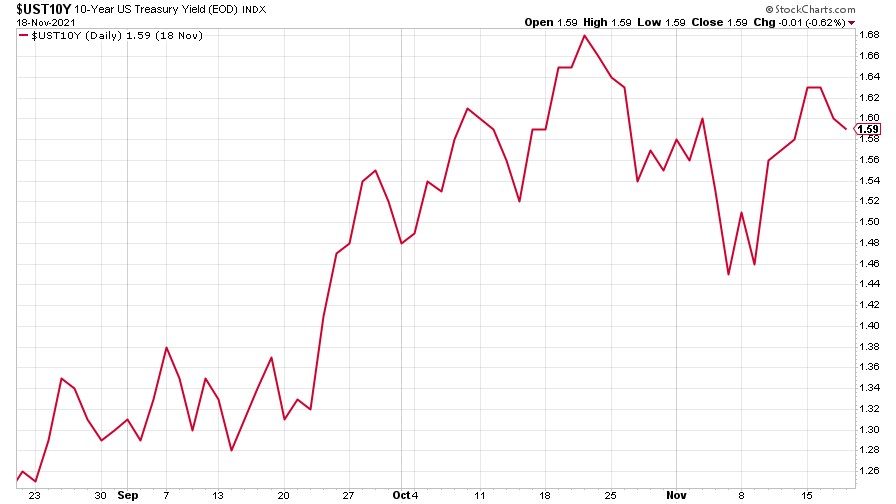

The yield on the ten-year US government bond dipped a little.

The yield on the Japanese ten-year bond rose slightly.

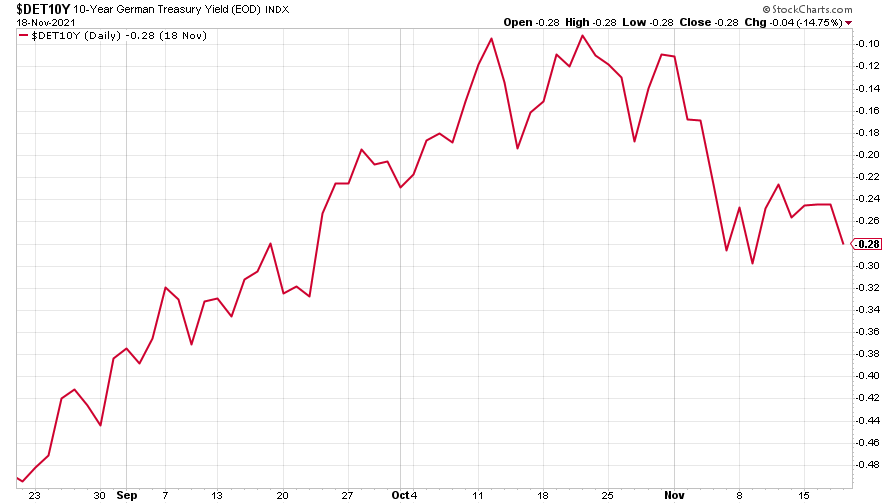

While the yield on the ten-year German Bund slipped further into negative territory.

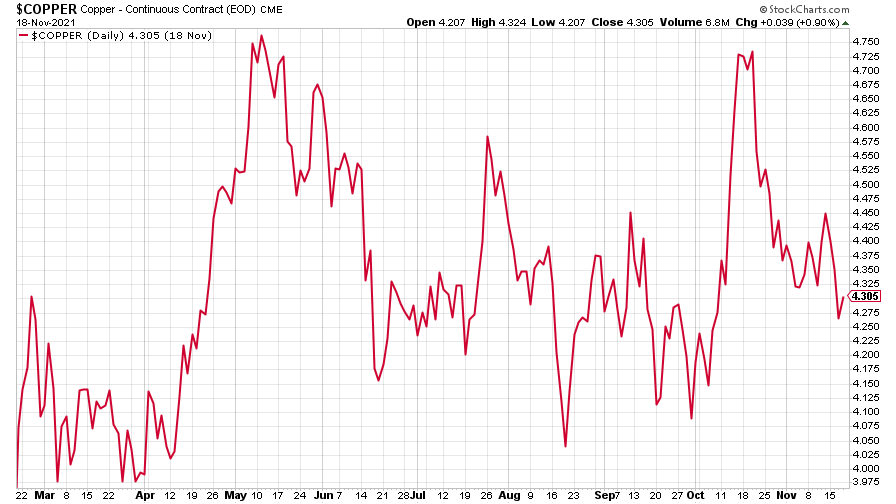

Copper is looking very volatile these days.

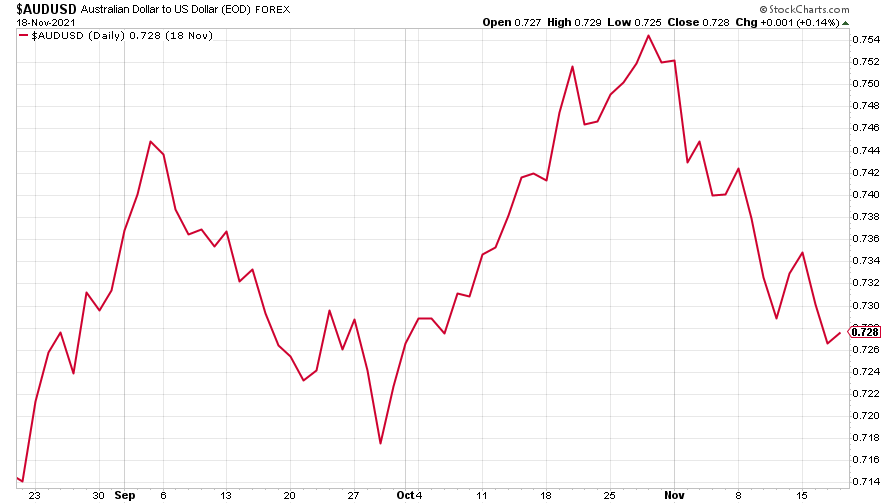

And the closely related Aussie dollar continued to fall against the US dollar.

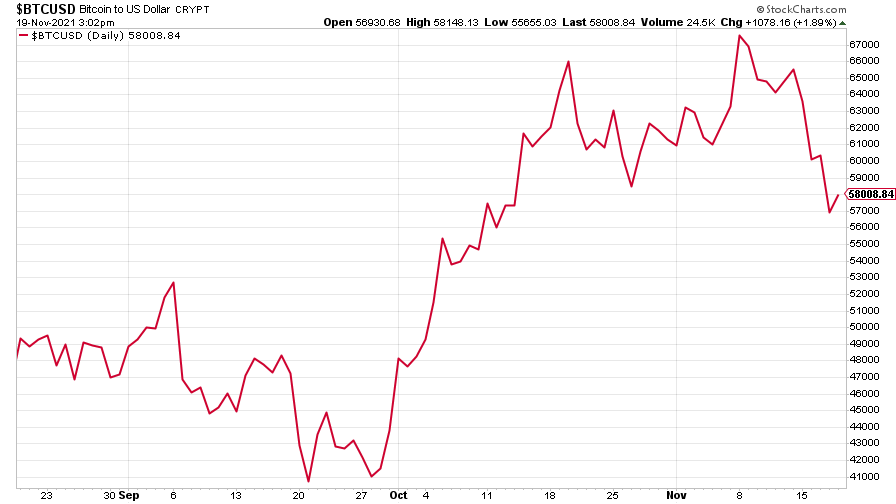

Bitcoin fell from its recent new high.

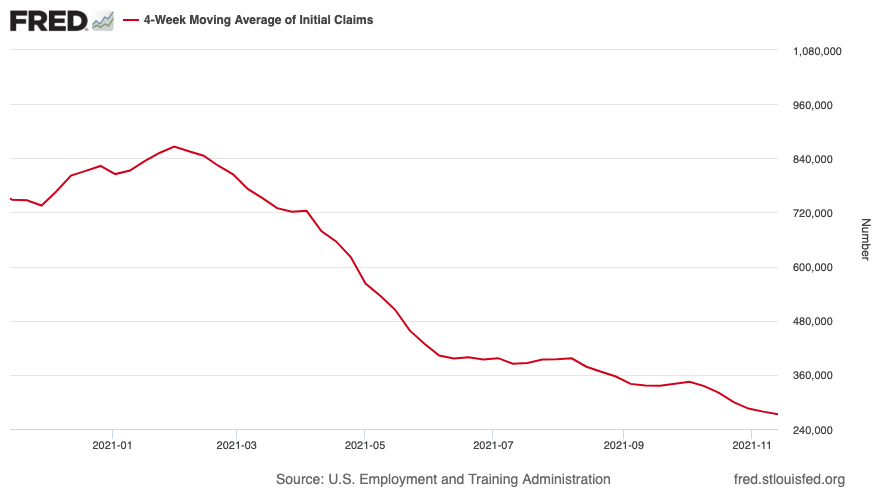

US weekly initial jobless claims fell by 1,000 to 268,000. The four-week moving average rose by 7,750 to 272,750.

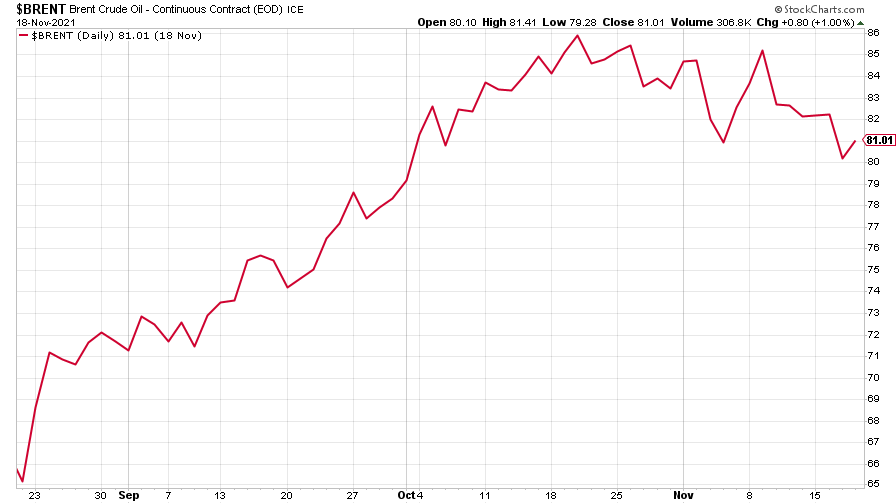

The oil price eased somewhat.

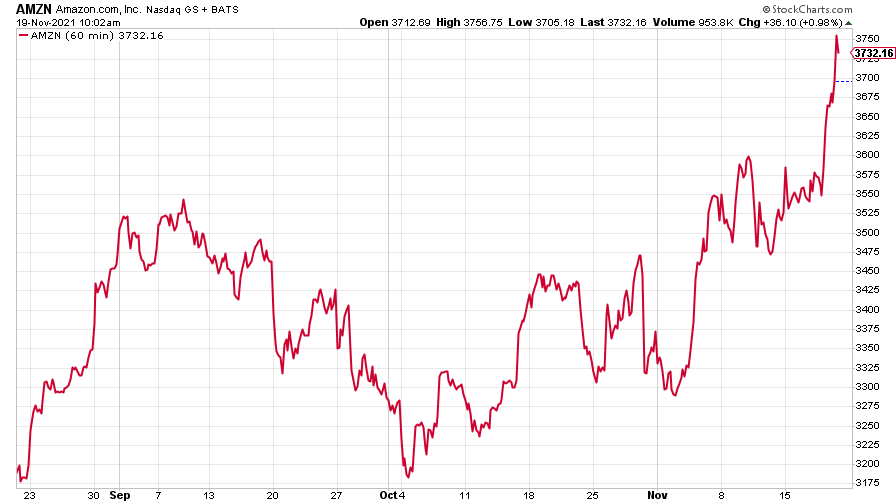

Amazon's share price took off in a week when it said it would soon no longer accept Visa credit cards for payment in the UK. Could investors be looking forward to the e-commerce giant disrupting finance, too? Visa’s share price fell by 5% on the news.

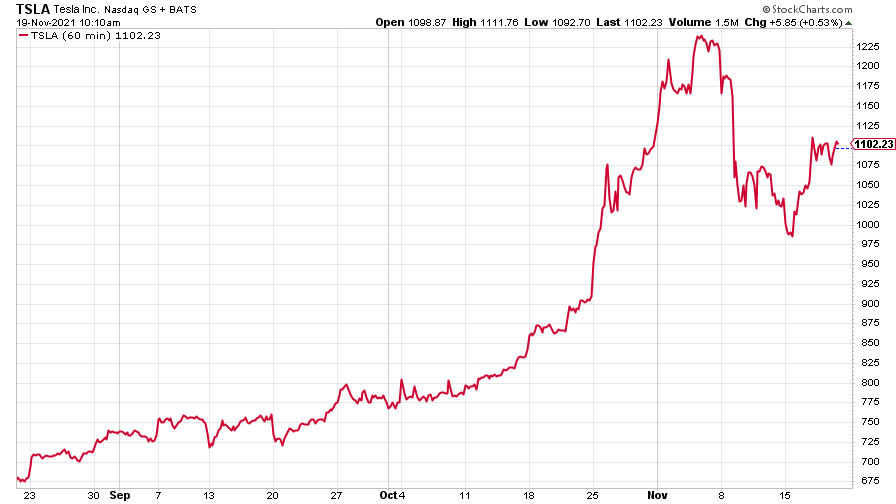

And Tesla looked to be recovering from the 10% rout prompted by Elon Musk’s most recent adventures on Twitter.

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.