The most important price in the world is rising – investors beware

The US dollar is rising fast – and that’s caused a fundamental shift in the investment landscape, says Dominic Frisby. Here, he explains what that means for you.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

There has been a fundamental shift in the investment landscape, a shift that has meant making money these past few months has become that much harder.

It explains the slowdown in commodities, the general choppiness and lack of clear trend elsewhere. It perhaps also explains some of the price action we have seen in bitcoin and ethereum.

I am talking, of course, about the US dollar – it’s going up.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The US dollar is on the comeback trail

The change in trend can be traced back to the end of May. Your intrepid author, like the most hawk-eyed and investigative of journalists, was on the case: “Everything hinges on the direction of the US dollar” we declared, and today we look at our portfolios, and at what we wrote, and wonder why we didn’t listen.

The US had reached one of those important inflection points. If it had broken below 88-89, then we would be in crack-up boom territory, and we would see most assets rising ballistically. But if 88-89 on the index held, the party would probably be over.

Unfortunately, it held.

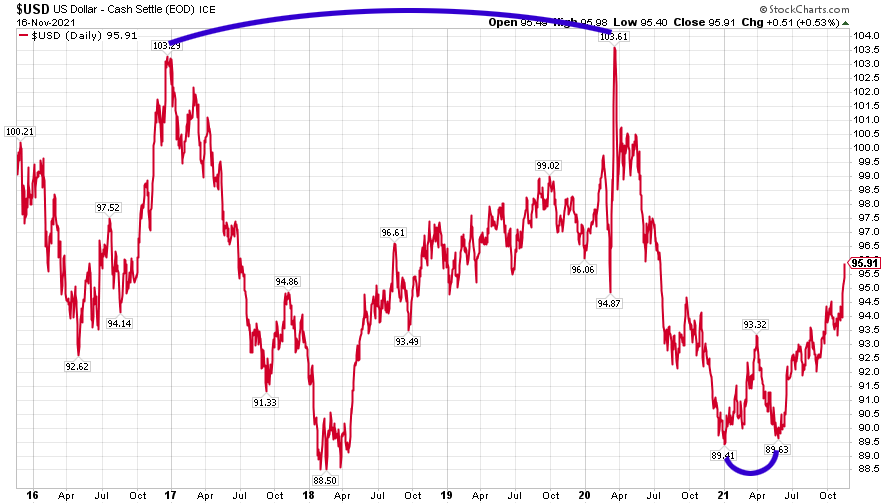

So let’s take a look at the offending chart. It shows the US dollar against a basket of the currencies of its major trading partners (the euro, the yen, etc) over the last six years.

There are two or three observations to make about this most important of prices.

First, the clear range in which it is trading: 103 marks the top of the range and 88-89 the bottom. That number, 103, is a significant price point; the dollar peaked at 103 at the height of the Corona Panic in March 2020, and it peaked there in 2017 at the end of Barack Obama’s presidency and at the beginning of Donald Trump’s.

We hit the bottom of the range after the money printing bonanza of 2020. We re-tested that level six months later – and it held. We got a textbook “W bottom” and since then the US dollar has been in a bull market.

The 88-89 level also marked the bottom of that range back in winter 2018 after Trump’s first year.

We are now in the middle of the range, but the current trajectory is sharply up. Going forward, we can probably expect some sharp moves in both directions – just to make everybody’s life difficult – but with the broader general direction being higher.

“How can it be in a bull market with all the money they’re printing?” you may ask. Well, everybody else is printing more, I guess is the answer.

The obvious target is 100 and, on the current trajectory, we will probably get there some time next year.

We may even see 103 in the event of some kind of extreme event.

Sterling takes a beating, helped by its hapless steward

The price action of the US dollar, I suppose the largest market in the world, explains capital flows and thus the price action of so many other assets. Sterling, for example, has been hopeless since June, sliding from 1.43 to 1.34.

The hapless Bank of England has much to answer for here. CPI, the current measure of inflation, is at a ten-year high of 4.2%. The Bank of England meanwhile says that inflation is transitory and keeps rates on hold.

CPI was arguably only introduced as it made inflation look as if it was lower than under the previously-used measure RPIX which, as John Stepek pointed out on Twitter this morning, is now at a 30-year high – RPIX (retail prices excluding mortgage interest costs) is now at 6.1%. It was 6.2% in August 1991.

If the base rate reflected actual inflation, oof, there would be carnage. So the Bank of England won’t ever allow that to happen – at least not voluntarily.

Nevertheless US dollar strength or weakness is the far greater determinant of cable (the US dollar vs sterling exchange rate) than is action, or lack of it, by the Bank of England, because the former is a far bigger market. Anyway, I digress.

Gold is doing something rather unusual

The rising US dollar also explains the relative underperformance of gold and silver. Precious metals go up when the dollar is weak, and vice versa. Everybody knows that.

Yes, but, no, but – they don’t always; there are exceptions, and we seem to be in one of those exception periods now. From August 2018 through to the corona panic of March 2020, gold actually rose in tandem with the US dollar, albeit from extremely oversold levels ($1,200 gold). In the second half of 2020 gold fell as the US dollar fell.

In 2021 normal service resumed. Gold fell as the dollar rose. It rose as the dollar fell. But since early September, the two have been rising together. I’m not quite sure what to make of it yet, but broadly speaking a gold price that is rising as the US dollar is rising is, I’d say, a good sign for gold investors.

The easy profits of 2020, when everything went up as money was printed, are behind us. Thanks to a rising dollar, the investment landscape has changed. It’s got harder. We need to be more selective. Markets are choppier.

This might even be one of those rare times when gold miners do well. Nevertheless, onwards we trudge.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is now out in paperback at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Should you sell your Affirm stock?

Should you sell your Affirm stock?Affirm, a buy-now-pay-later lender, is vulnerable to a downturn. Investors are losing their enthusiasm, says Matthew Partridge

-

Profit from pest control with Rentokil Initial

Profit from pest control with Rentokil InitialRentokil Initial is set for global expansion and offers strong sales growth

-

In the money: how my trading tips fared in 2025

In the money: how my trading tips fared in 2025The success of the open positions offset losses on closed ones, says Matthew Partridge

-

Coreweave is on borrowed time

Coreweave is on borrowed timeAI infrastructure firm Coreweave is heading for trouble and is absurdly pricey, says Matthew Partridge

-

Circle sets a new gold standard for cryptocurrencies

Circle sets a new gold standard for cryptocurrenciesCryptocurrencies have existed in a kind of financial Wild West. No longer – they are entering the mainstream, and US-listed Circle is ideally placed to benefit

-

Profit from other investors’ trades with CME Group

Profit from other investors’ trades with CME GroupCME Group is one of the world’s largest exchanges, which gives it a significant competitive advantage

-

Investors need to get ready for an age of uncertainty and upheaval

Investors need to get ready for an age of uncertainty and upheavalTectonic geopolitical and economic shifts are underway. Investors need to consider a range of tools when positioning portfolios to accommodate these changes

-

How much gold does China have – and how to cash in

How much gold does China have – and how to cash inChina's gold reserves are vastly understated, says Dominic Frisby. So hold gold, overbought or not