Is Donald Trump putting the US dollar in danger?

Donald Trump's administration sees one of its greatest advantages – the US dollar – as a burden. Gold is the obvious beneficiary, says Cris Sholto Heaton.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The Trump administration increasingly seems convinced that the US dollar’s status as the world’s reserve currency is a burden, not the “exorbitant privilege” that it is often said to be. Key economic advisers such as Stephen Miran believe that the persistent strength of the dollar has driven the deindustrialisation of the American economy by making exports less competitive.

Economists can legitimately debate this. There could even be a smidgen of truth in it, although blaming the rest of the world conveniently ignores poor decisions willingly made by US corporations and politicians. However, treating the dollar’s unique status and strength as yet another example of America being ripped off ignores some obvious benefits.

These include higher margins and lower inflation, but even more important is the impact on markets. The role of the dollar means that Treasuries have been the global reserve asset, which will have made it cheaper for the government to fund itself. Yet there are hints that this is now going into reverse.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The end of American exceptionalism

The most common theme among investors outside the US is that American exceptionalism is over. The rest of the world has been rattled by poor governance, soaring deficits and growing fears of some new anti-foreigner measures (section 899, a provision in the new budget bill that would increase taxes on US income for foreign investors, is constantly mentioned).

It would be a huge exaggeration to say that investors are fleeing the US, but it is clear that they are reconsidering the structural overweight to American assets that most have. The consequences go beyond Treasuries, since other US assets also benefit from strong demand. For example, reserve currency status has also created a huge cost of capital advantage for US companies, argues Alec Cutler of Orbis. This will now shrink, he says – another reason, on top of high valuations and soaring capital expenditure for big tech, why US stocks will enjoy fewer advantages in future.

Disorderly change

Still, this sounds like a gradual change – a reason to be less bullish on the US, but not a source of vast upheaval. While the dollar’s share of central bank reserves has declined from 60% in the early 2000s to about 46% now, according to the European Central Bank, it is dominant in payments (almost 90% of currency trades involve it). It is impossible to imagine a rapid move away from the dollar: no other currency has the same liquidity and market depth.

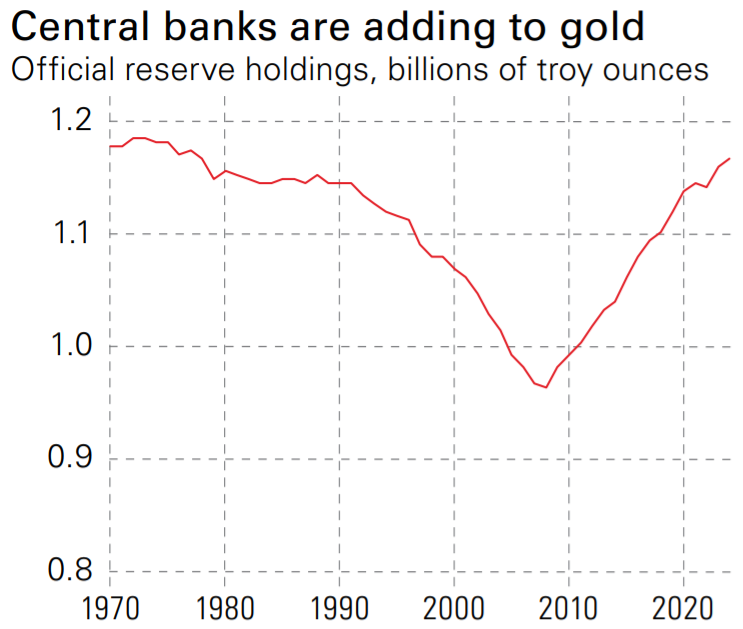

Yet the unpredictability of the US government – the risk that it will destroy one of its strengths because it sees it as a weakness – means that we can’t dismiss this risk. Sometimes, disorderly change is forced on us. This may be one reason for gold’s continued strength. The trend in reserves since 2008 (see chart) points to demand for a reserve asset that no government controls. Donald Trump will probably accelerate that shift.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China