Everything hinges on the direction of the US dollar right now

Gold has had a very good spring. But as Dominic Frisby explains, the direction of the dollar is key to determining what is next for both gold and silver.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

We are at a huge inflection point for the US dollar, right here and now.

It’s one of those “does it go higher or lower?” moments.

The ramifications are considerable – for most things, but especially gold and silver...

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Gold has had a rather pleasant spring

Gold has quietly had an extremely good spring.

Coming off a textbook “W bottom” in March at $1,675 per ounce, it has marched over $200 higher through April and May, reaching $1,920 yesterday, where it has inevitably stumbled.

Why do I say inevitably? Because $1,920 was the price it reached in 2011 after ten years of bull market, one of the most epic bull markets in gold’s history. It’s a high that stood for nine years, until it was eventually – though only briefly – overcome last year.

It’s such an obvious and long-term price point that gold was bound to at least stutter there, as it did yesterday.

Gold looks very good, it has to be said. It’s grinding upwards. All the moving averages – short, intermediate and long-term are sloping upwards. We have a nice trend – and you know what I think about trends.

Silver too is looking very good, and it’s not often you hear me saying that. Currently at $28 an ounce, if it can get above $30 then a run to $50 looks like it’s on the cards.

Even the ratio of gold-to-bitcoin is looking good (as far as the old money advocates are concerned), turning up after forming what looks like a long-term low over the spring.

That would be part of this rotation we have been observing – from digital into physical, from growth into value, from new economy to old, from tech to commodities.

I view, as regular readers will know, the incredible growth seen in tech stocks since the 1980s as a function of the vast scalability of digital tech. One upload to Spotify or iTunes is, effectively, the same as getting a million or a billion vinyl records pressed in the 1970s.

Money has poured into tech because of the quick returns it offers. And for the most part, as a result, tech has outperformed.

Yet within that broader trend there have been windows when the physical economy has shone more brightly. The ‘80s and ‘90s were all about tech, but then between 2000 and 2003 “physical” outperformed.

The rest of the ‘00s saw roughly equal performance, then in 2009 tech began to outperform again and that remained the case for over 10 years.

Now, however, ‘physical’ seems to be entering into one of its rare periods of outperformance, probably at least in part as a result of 10 years of underinvestment.

Gold’s recent outperformance, especially versus bitcoin, would be a part of that recent rotation. So would the recent rallies in commodities.

Tech will win in the end. Its scalability is just astonishing. But that doesn’t mean physical can’t have a couple of years in the investment sun.

What will it be: the revenge of the real? Or the triumph of tech?

But real investment life is never as straightforward as articles about it might make it seem. The big potential fly in the ointment of this theory is the US dollar.

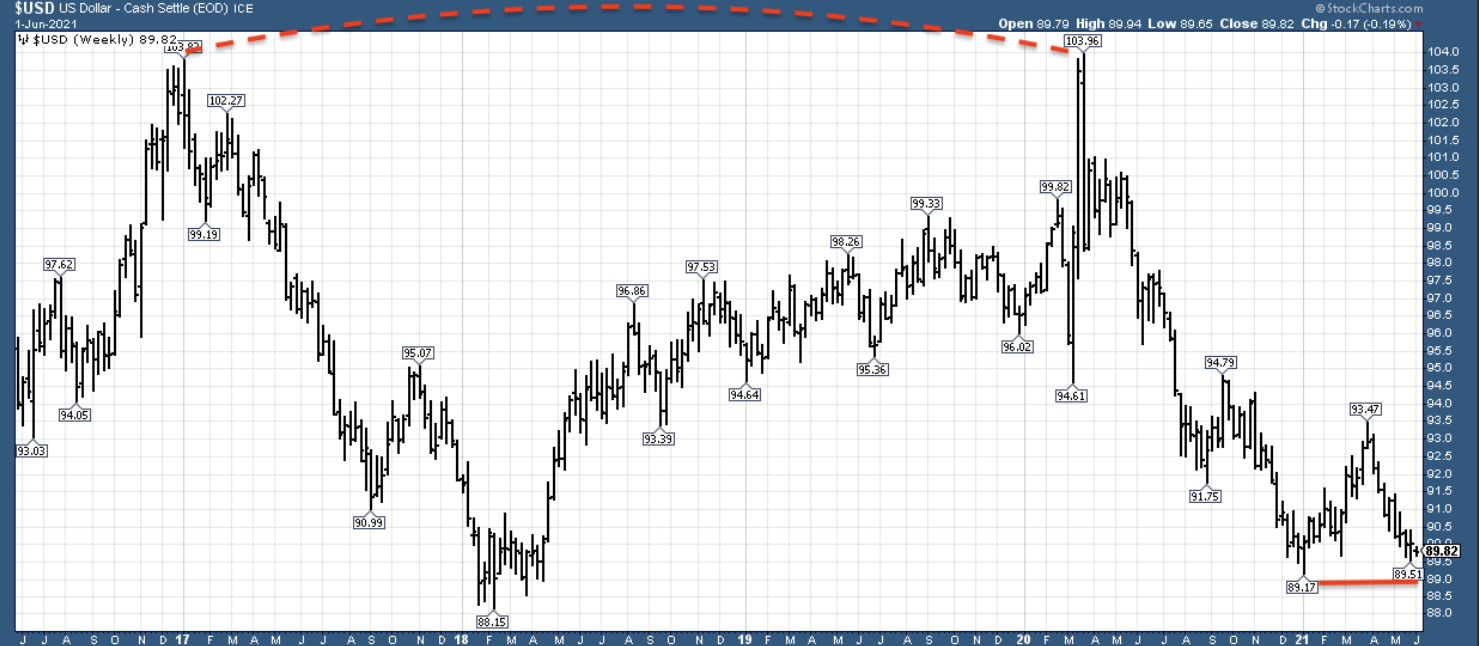

We can explain recent investment trends as a “great rotation” from tech to physical or some such. But really, much of it has just been a function of the US dollar – which is still the single most important price in the world – having had a rotten couple of months, and a rotten last three quarters in 2020. The US dollar index (which measures the value of the US dollar versus the currencies of its major trading partners) peaked at 103 at the height of the Corona Panic in March 2020. This was the same peak it hit in 2017 at the end of Barack Obama’s presidency and at the beginning of Trump’s.

We got a huge, multi-year “double top” – an “M” – and since then it’s been in freefall, ending 2020 at 89.

We had a relief rally to 93 which lasted up until March. Since then, it’s been in freefall again. Now we are back at 89, retesting the lows. These are the same lows which held in early 2018, and from which a huge relief rally followed – a two-year bull market in the US dollar.

Here’s a five-year chart.

The fate of the US dollar at 88-89, the level it is currently re-testing (that thick red line), determines the entire investment outlook for the next two years.

If 88-89 holds, then it might be time to discard the “Great Rotation” theory. The secular bull market we appear to be at the beginning of in commodities may be off as well.

If we fall below that level, however, the party’s on. Buy metals – base and precious – buy oil, buy the pound even. They’ll all go higher, a lot higher. Inflation, inflation, inflation.

What do you think? Does 88-9 hold? Do we rebound here?

Perhaps we pause for breath here, and then head lower?

Or perhaps it gives way straight away?

Bottom line: it’s a trend, and the current direction is down.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is now out in paperback at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.