Is the UK housing market doomed to stagnation?

Housing is the mirror image of Britain’s moribund stock market. A crash would be the best outcome

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

When I began contributing to MoneyWeek two decades ago, Britain was in the middle of a property mania. Flipping houses was the path to rapid riches. TV shows were full of people renovating flats to sell – often spending more than they earned back. Financial-advice columns were stuffed with those who wanted to gear up their buy-to-let portfolio to buy more, or had already borrowed too much and were panicking.

Today, Britain is still obsessed with property, but the mood is very different. It’s not simply that investing in property is less appealing due to tax changes and new laws. There has finally been some long-overdue realisation that expensive housing is a curse that holds back the economy, not a source of good fortune.

Still, I am not as confident as Matthew Lynn that property prices are going to plummet to reasonable valuations. Houses are not like most assets: many people buy once they can afford to because they are tired of renting sub-standard properties or because they want to be certain of housing costs for later in life – even if they think prices are expensive. Unless interest rates soar (which seems unlikely) or supply vastly increases – and the government doesn’t have the appetite to provide the state backing needed – a crash is less probable than a long stagnation.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Housing market stagnation

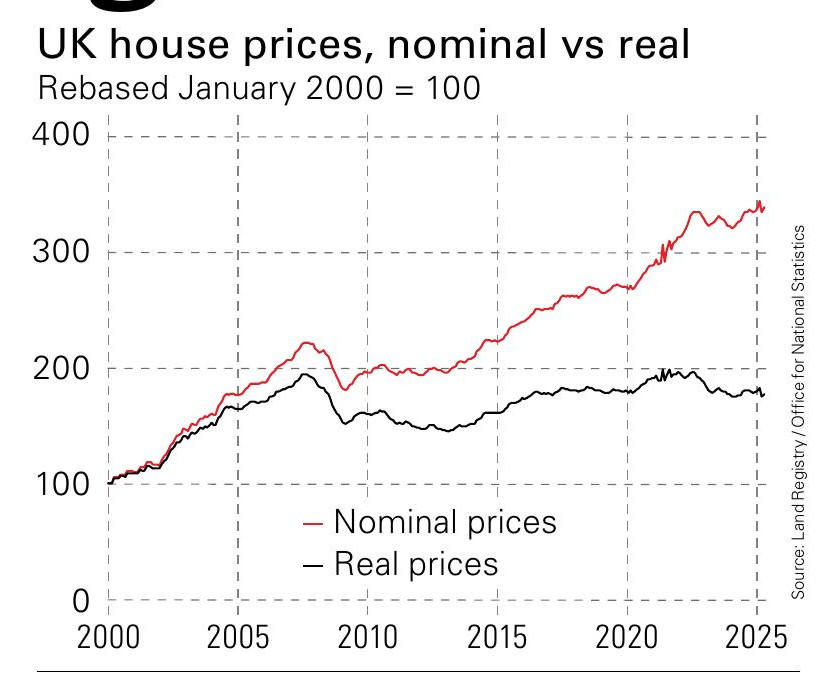

In fact, quiet stagnation is what we have been seeing for a while. For this, refer to the Land Registry data: it is much less timely than other indices (sales can take a very long time to be added) and so doesn’t show turning points well, but it provides the most comprehensive view of long-term trends.

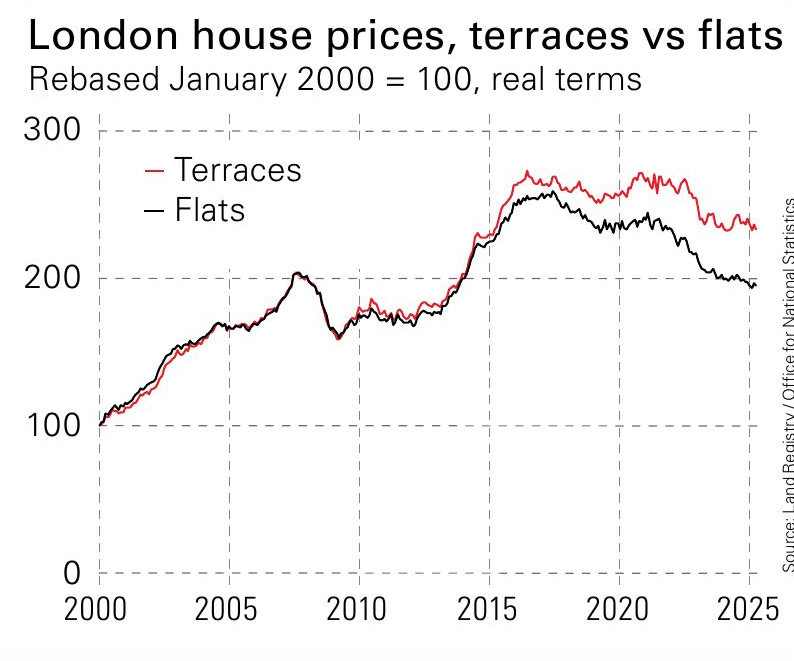

These series show that house prices have risen strongly in nominal terms since the global financial crisis. Yet adjust for inflation and it’s a different story – real house prices are now below where they were in 2007. Of course, housing is not one market; property type and location are critical. Look at London and we see stagnation since 2016 but also a gulf opening up between terraced houses and flats. Still, even flats are only back to 2007 levels in real terms, when they were already unprecedentedly expensive relative to incomes. Britain’s financial centre has a stagnant yet still-overpriced housing market and a shrinking yet arguably undervalued stock market. No wonder the mood is so bleak.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn

-

ISA reforms will destroy the last relic of the Thatcher era

ISA reforms will destroy the last relic of the Thatcher eraOpinion With the ISA under attack, the Labour government has now started to destroy the last relic of the Thatcher era, returning the economy to the dysfunctional 1970s

-

'Expect more policy U-turns from Keir Starmer'

'Expect more policy U-turns from Keir Starmer'Opinion Keir Starmer’s government quickly changes its mind as soon as it runs into any opposition. It isn't hard to work out where the next U-turns will come from