What's in store for sterling?

Sterling has displayed a repeated cycle with the US dollar. Dominic Frisby looks at what that is and how investors can play that trend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today’s missive is not so much of the “urgent, act now” variety.

Rather it’s a “keep an eye out for this one over the next year or so”.

That doesn’t make it any less important. There just isn’t quite the same urgency to be reaching for the sell button.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So we are talking sterling today - the Great British pound. Specifically, Frisby’s Flux - a long-term cycle I have identified in the pound that, periodically, I come back to.

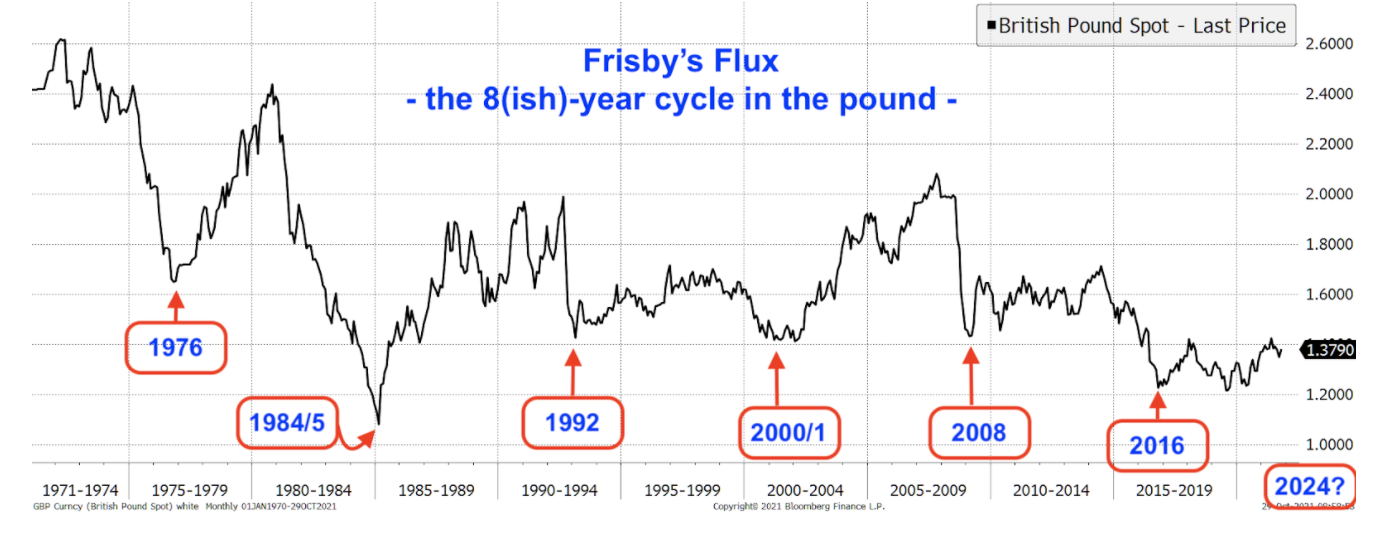

The fundamental observation is this. If you look at cable (the pound vs the US dollar) over the last 50 years, you will notice that it has displayed a regular, repeating pattern - a cycle.

So what is that cycle?

Sterling’s repeating cycle

Every eight years it sells off to a major low. The last one came in 2016 - shortly after Theresa May's speech at the Conservative Party Conference when she infamously lost her voice. It was dubbed the Flash Crash.

That means a year or two earlier, you want to be reaching towards the sell button. According to this cycle, the next major low comes in 2024.

I last covered this subject in 2019, advising that “come say 2021 or 2022 we should be looking to go short again with the eventual low targeted some time in 2024”. That’s why I bring this up today. Over the next year, perhaps, we should see a major high and use the opportunity to offload. In fact, it’s possible we have already seen the high.

If this all sounds a little bit Mystic Meg, that’s because it is. Getting wedded to the idea of an inevitable cycle never made anyone rich. In fact, such a practice can lead to bad decisions. There are cycles in markets, just as there are cycles in life, but they don’t always adhere to the calendar. It’s all too easy to look back at history, find some arbitrary pattern, and declare it a cycle. Harder to actually manage it in real time.

I would say that cycles are more something to have at the back of your mind, while investing, rather than at the front. But they can still help you gauge where you are in the grand scheme of things.

Sterling has collapsed due to a number of events

So, if you cast your eye over the chart below of the pound vs the dollar since 1970, you will note that every eight years the pound makes a significant low.

The major news events that accompanied these lows were as follows.

1976 was the year of the IMF (International Monetary Fund) crisis. At one point inflation reached 24% - there were no cheap imported goods from China to hide behind back then. Dennis Healey, the Labour Chancellor, went cap in hand to the IMF and borrowed US$3.9bn, at the time the largest loan ever requested. From high to low, sterling lost around 40%.

But it recovered. By the early 1980s sterling was back above $2.40. Then came the miners’ strike, the Falklands War and, probably more significantly in forex terms, the Plaza Accord. The pound lost 55% - by forex standards one heck of a drop. The US dollar was extraordinarily strong - so much so that France, Germany, Japan, the US and the UK colluded to depreciate it with the Plaza Accord of 1985.

But again sterling would recover. By the early 1990s it was back above $2.

But, as night follows day (almost) we got another sell-off in 1992. Black Wednesday, when the Bank of England took the UK out of the European Exchange Rate Mechanism (ERM) and George Soros famously made the killing selling the pound that would seal his reputation. The pound went from $2 to $1.40 for a 30% loss.

Again it rallied, only to sell-off eight years later in 2000-01 with the dotcom collapse. There was another rally. By 2007 the pound was north of $2.10.

Then we got the financial crisis of 2008 and the pound lost 35%, hitting a low of $1.36.

It rallied. Then came Brexit, the incompetent handling of it, and the subsequent sell-off in the autum of 2016 to around $1.12 (this figure varies according to different data feeds).

Those 2016 lows were re-tested in 2018 and since then the pound has rallied, albeit anaemically, to above $1.43.

Today we sit around $1.37.

Have we already seen the highs for this part of the cycle? It’s possible. There’s a lot of resistance in the low $1.40s, for sure. The pound will really struggle to get above there, unless there is some kind of overriding weakness in the US dollar.

But if this cycle remains true then we should be looking for new lows in sterling come 2024.

How to play this?

You can sell sterling in the forex markets and buy the dollar. Or buy non-sterling denominated assets - gold, bitcoin, foreign stocks, foreign real estate, foreign bonds.

Come the declines of 2024 you buy Britain again.

There are a lot of reasons to go against this logic, not least that, on a relative basis, the UK is cheap - at least its companies and its currency are. So any sell off would come from cheap levels, not the lofty heights above $2 whence many previous declines have emanated.

As I say, don’t get too wedded to cycles. They are just a useful tool to have at the back of your mind.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is now out in paperback at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Why you should keep an eye on the US dollar, the most important price in the world

Why you should keep an eye on the US dollar, the most important price in the worldAdvice The US dollar is the most important asset in the world, dictating the prices of vital commodities. Where it goes next will determine the outlook for the global economy says Dominic Frisby.

-

What is FX trading?

What is FX trading?What is FX trading and can you make money from it? We explain how foreign exchange trading works and the risks

-

The Burberry share price looks like a good bet

The Burberry share price looks like a good betTips The Burberry share price could be on the verge of a major upswing as the firm’s profits return to growth.

-

Sterling accelerates its recovery after chancellor’s U-turn on taxes

Sterling accelerates its recovery after chancellor’s U-turn on taxesNews The pound has recovered after Kwasi Kwarteng U-turned on abolishing the top rate of income tax. Saloni Sardana explains what's going on..

-

Why you should short this satellite broadband company

Why you should short this satellite broadband companyTips With an ill-considered business plan, satellite broadband company AST SpaceMobile is doomed to failure, says Matthew Partridge. Here's how to short the stock.

-

It’s time to sell this stock

It’s time to sell this stockTips Digital Realty’s data-storage business model is moribund, consumed by the rise of cloud computing. Here's how you could short the shares, says Matthew Partridge.

-

Will Liz Truss as PM mark a turning point for the pound?

Will Liz Truss as PM mark a turning point for the pound?Analysis The pound is at its lowest since 1985. But a new government often markets a turning point, says Dominic Frisby. Here, he looks at where sterling might go from here.