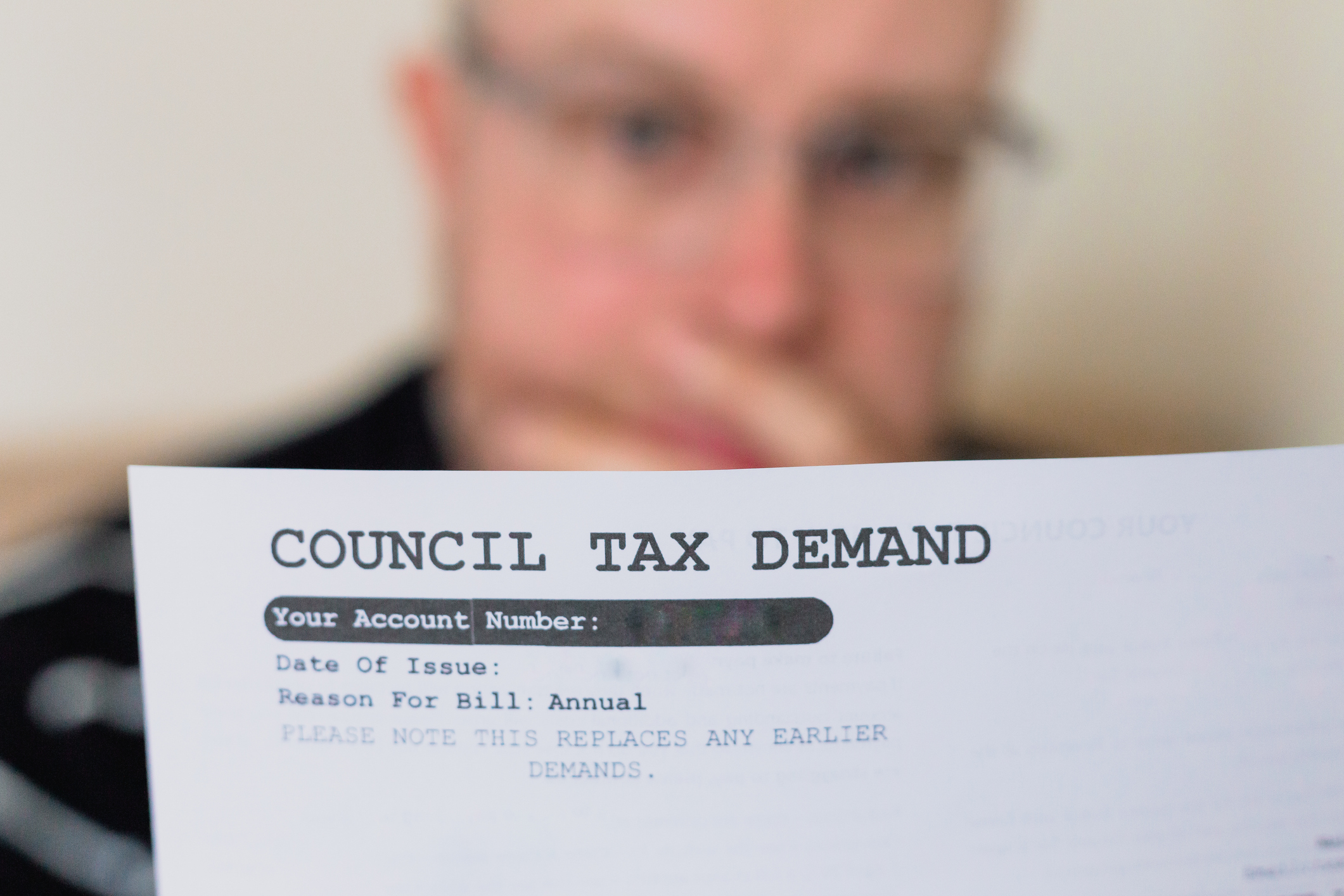

Council tax bills in worst hit areas set to rise by £500 in the next four years

Branded the ‘ultimate stealth tax’, the council tax burden is increasing across the country, with some areas potentially having to find hundreds of pounds more a year to pay the bill

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Council tax bills in some parts of the UK could rise by as much as £500 by 2029/30, according to analysis of government plans.

There will be 28 areas where bills will be over £3,000 in 2029/30, the TaxPayers’ Alliance has found, with bills for Band D – the middle of the council tax bands – coming in at an average of around £2,750 across England.

Local authorities have been permitted to increase council tax bills by up to 5% over the next three years, documents released as part of the June Spending Review showed.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Beyond that level – which is already higher than the Consumer Prices Index measure of inflation – councils have to hold a referendum. But a number of councils have previously been given an increased ceiling, due to financial pressures, and parish councils have no referendum cap.

Plus it could be that spending cuts to other government departments, like the Home Office, could be made up by increasing the police precept in council tax bills.

Taking all these factors into account, the TaxPayers’ Alliance has analysed what potential increases could mean for council tax billpayers – and which areas of the country could be hardest hit as a result of the changes.

Elliot Keck, head of campaigns at the TaxPayers’ Alliance, told the Telegraph, which first reported the figures: “Council tax is the ultimate stealth tax, given the way in which successive governments have piled on responsibilities to town halls without the resources to pay for them but with the permission to hike bills for residents.

“And this government clearly intends to continue this trend by allowing years of above-inflation council tax rises, further increasing the crippling tax burden on British families and workers.”

Where council tax could rise most

Gateshead tops the list for biggest likely increase with typical bills – that is for council tax Band D properties – expected to be £567 higher in 2028/29.

If maximum increases were imposed, the bill for a Band D home would rise from £2,578 to £3,145 in the borough.

Residents in Band D homes could also expect increases of more than £500 by 2029/30 in Bristol (£549) Rutland (£550) and Nottingham (£563).

Taxpayers in Dorset, Hastings, Oxford and Newark and Sherwood could also see increases of more than £500.

The highest council tax bills could be in Rutland, where charges are expected to increase from the current rate of £2,671 to £3,221 by 2029/30.

“By the end of this parliament, the grim milestone of the first £3,000 Band D council tax bill will have been reached,” Keck said.

“Labour should impose lower, inflation-linked referendum caps on councils and aim for national solutions to crises such as that around social care.”

For the very poorest, the council tax burden has roughly doubled to approach close to five per cent of income over the last 20 years, according to the Resolution Foundation.

The amount of council tax you pay is based on the value of the property you live in. Each property is placed in one of eight bands and these reflect what a home might have sold for in April 1991.

Even if the property you live in was built recently, its band is based on an estimation of what its value would have been in 1991.

The Treasury has been approached for comment.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Laura Miller is an experienced financial and business journalist. Formerly on staff at the Daily Telegraph, her freelance work now appears in the money pages of all the national newspapers. She endeavours to make money issues easy to understand for everyone, and to do justice to the people who regularly trust her to tell their stories. She lives by the sea in Aberystwyth. You can find her tweeting @thatlaurawrites

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how