Why you should keep an eye on the US dollar, the most important price in the world

The US dollar is the most important asset in the world, dictating the prices of vital commodities. Where it goes next will determine the outlook for the global economy says Dominic Frisby.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I've said it before and I'll say it again - the US dollar is the most important price in the world.

The dollar is the global reserve currency, the international money of default.

Global commerce thinks in dollars.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It’s the pricing mechanism for essential materials. Commodities like oil, copper, gold and wheat, are traded in US dollars.

The majority of international debt - and there is even more debt than essential commodities - is traded in dollars. The IMF thinks in dollars.

It’s a determinant of international capital flows: is money flowing from or to the United States, the largest economy in the world (just)?

I can get all idealistic and say the world would be a better place if gold had this role. It should. It’s independent. It gives no nation or government exorbitant privilege. It lasts longer. It has a proven history. Its purchasing power doesn’t get steadily eroded. New gold supply matches population growth. That kind of stuff.

But the reality is that the US has got the gig, largely by having such a strong army, and also for the fact that so many around the world trust in America. (I would argue that trust is not what it was. It’s fading. But when push comes to shove it still has the gig).

A strong US dollar should be good for international stability, and thus good for America’s reputation. But the US government likes to print, spend, and then export the inflation and debasement. You just need to look at what it does to know what it prioritises.

The US dollar and the global economy

When the dollar is weak, asset prices rise – and the policy-making world sure does love a bit of asset-price inflation. Borrowing is cheap, house prices go up, stock prices go up, bond prices go up, energy and metal prices go up. The party keeps on rocking. Everybody feels wealthy.

But when the dollar is strong, the world gets the jitters. It starts to think that the asset price bubble that has been inflating since August 15, 1971, might be about to pop.

Those in charge may talk tough. They wear smart, plain suits and look respectable. But then they usually start printing again.

Here’s the thing though. The dollar has just hit an inflection point. It comes to them every now and then. And when it does, it pays to take heed.

Despite the experience of day traders, where prices flicker at you and fortunes are made and lost in tiny fluctuations, if you zoom out a bit, the dollar tends to trend for months at a time, if not years.

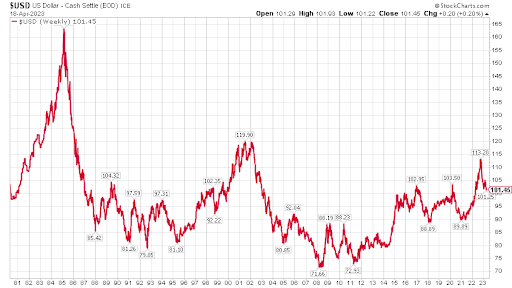

The US index (the dollar versus the currencies of its major trading partners) hit a high in 1985. It got so high, in fact, the G5 nations signed the Plaza Accord to get the price back down again. The eventual low did not come until 1992, seven years later.

This wasn’t a one-directional thing, except for the first move. There were counter-trend rallies that lasted several months.

Long-term dollar trends

In fact, the process of making a low lasted from 1988 to 1995. It made a low, rallied a bit, made another low and so on. It took time in other words.

But then from 1995, the dollar rallied - with the usual drawn-out countertrend moves - all the way to 2001. With the dot-com bust, 9-11, the Iraq War and all the rest of it, the dollar then saw seven years of a bear market and in 2008 it made another low. The price was 71. It rallied for several months, then declined for several months, eventually retesting the low in 2011.

So the bull trend, the bear trend and the process of making lows and highs can each take many years. If you, as an investor, trader or portfolio manager, were able to catch these trends - and be in and out of the market at the right time - you would have been able to magnify your returns many times.

The low in 2011 was 72. Many years of a bull market - with the usual drawn-out countertrend moves - followed before the dollar index eventually peaked in September last year at 114.

Here’s the long-term chart that illustrates what I have just described:

When it changes direction, this lumbering beast likes to put in double tops and double bottoms, more than any asset I can think of. Sometimes triple tops and bottoms. It reaches a level, then re-tests it, and then sometimes re-tests it again.

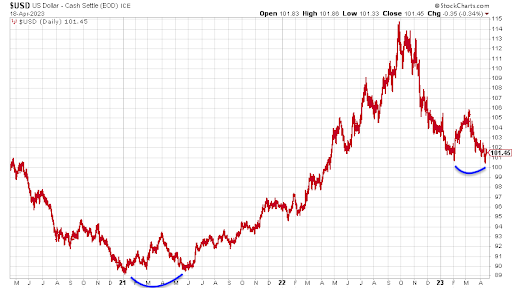

Here’s the thing. It might be putting in one such double bottom now.

The pain, especially of commodity prices, has been relieved somewhat these last few months as the US dollar has come off. This last month has felt particularly good with gold and silver both strong.

But the dollar index hit a low at 101 in early February. It rallied for a few weeks, then came off again. It’s retesting that low now.

Does the US dollar now rally?

I have to say it would be quite normal behaviour for it to do that from here.

I have heard a lot of excitement about silver, for example. You know my cynicism about that metal. Too much excitement and euphoria usually mean declines are upon us. In fact, in the last few days, I have taken a small short against silver in my spread-betting account.

I’m not forecasting the beginning or end of a major dollar cycle. But I do think, assuming 100 on the US Dollar Index holds, we might see a reversal in the dollar that could last several weeks or months.

It comes, interestingly, just as gold is re-testing its highs.

It’s all about that 100-101 level.

More from MoneyWeek:

- 10 dirt-cheap Reits to buy now

- Can you profit from Airbnb with your spare room?

- The best cities for buy-to-let investors

- Will IHT be cut?

- Share tips of the week

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What is FX trading?

What is FX trading?What is FX trading and can you make money from it? We explain how foreign exchange trading works and the risks

-

The Burberry share price looks like a good bet

The Burberry share price looks like a good betTips The Burberry share price could be on the verge of a major upswing as the firm’s profits return to growth.

-

Sterling accelerates its recovery after chancellor’s U-turn on taxes

Sterling accelerates its recovery after chancellor’s U-turn on taxesNews The pound has recovered after Kwasi Kwarteng U-turned on abolishing the top rate of income tax. Saloni Sardana explains what's going on..

-

Why you should short this satellite broadband company

Why you should short this satellite broadband companyTips With an ill-considered business plan, satellite broadband company AST SpaceMobile is doomed to failure, says Matthew Partridge. Here's how to short the stock.

-

It’s time to sell this stock

It’s time to sell this stockTips Digital Realty’s data-storage business model is moribund, consumed by the rise of cloud computing. Here's how you could short the shares, says Matthew Partridge.

-

Will Liz Truss as PM mark a turning point for the pound?

Will Liz Truss as PM mark a turning point for the pound?Analysis The pound is at its lowest since 1985. But a new government often markets a turning point, says Dominic Frisby. Here, he looks at where sterling might go from here.

-

Are we heading for a sterling crisis?

Are we heading for a sterling crisis?News The pound sliding against the dollar and the euro is symbolic of the UK's economic weakness and a sign that overseas investors losing confidence in the country.

-

Netflix has plenty of life in it yet – here's how to trade the shares

Netflix has plenty of life in it yet – here's how to trade the sharesTips Netflix still has plenty of scope for growth, says Matthew Partridge, and the shares are reasonably priced. Here's how to play the Netflix share price.