The gold price hits a high – there’s still time to buy

Gold closed at its highest ever level on Friday, but the price could keep rising as demand grows, argues Dominic Frisby.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The gold price printed its highest ever weekly close on Friday.

What do new highs usually lead to? Yup. More new highs.

Is it too late to buy? Nope.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Should you own some? Yup. Everyone should own some gold.

Put 5% of your net worth into gold and hope it doesn’t go up. That’s the old Wall Street adage that I am forever quoting, and I quote it again today.

Here are my latest thoughts on gold and the latest developments in the Great Unravelling.

The de-dollarisation trend continues

For the record, gold’s all-time high was $2,089. That came in August 2020, amidst the Covid money-printing bonanza. Get past that level and there really will be a lot of noise.

I have, as long time readers - or should I say sufferers? - will know, been wittering on about de-dollarisation since more or less the dawn of time. But the de-dollarisation narrative really seems to have taken hold these past few weeks and hit the mainstream.

Just this morning I read that French President, Emmanuel Macron, while in China at the weekend, said to President Xi. “I want to take the opportunity to insist on one point: we should not depend on the extraterritoriality of the US dollar.”

We can quibble over whether extraterritoriality is even a word, but the gist of his statement is pretty clear and it comes on the back of deals China has made in recent weeks with Russia, Brazil and Saudi Arabia to bypass the dollar and trade using the Chinese yuan.

At the “Russian Davos” – the St. Petersburg International Economic Forum – in New Delhi a fortnight ago, Russia’s State Duma Dep Chairman Alexander Babakov stated that a BRICS alliance was working on a new currency secured by gold and other commodities, including rare-earth elements.

Tucker Carlson of Fox News delivered an impassioned monologue on the subject last week, and it went viral garnering millions of views. “If you want the rest of the world to trust your currency, the last thing you would do is use it as a weapon or print too much of it”, he said.

“But if Mitch McConnell and Joe Biden and the rest of these reckless leaders have their way, an increasing number of countries will do what so many have already done, which is begin to reject the U.S. dollar and what will happen then?

“Well, all those dollars will come home and the value of our currency will plummet even further, and that will lead to poverty across the United States, and that will lead to the typical political and cultural volatility that inevitably follows economic collapse, disaster, and we've seen it before”.

It’s classic goldbug erotica. He even cited the fact that nobody knows how much gold is in Fort Knox because it has not been audited for generations.

Even Elon Musk has been tweeting about de-dollarisation, exporting inflation and the likelihood of bank runs accelerating.

I must say, I get a little bit concerned as narratives mature. The more widespread and well formed the story, the more likely it is about to run out of steam.

That said, the trend is strong and it’s up.

Gold miners are extraordinarily cheap

Another concern I have about this move is that woeful performance of the gold miners. In a trusty bull market, you want to see the miners leading the gold price higher. They are doing no such thing. The juniors (as measured by benchmark ETF, GDXJ) are a good 35% off their 2020 highs, and a quite astounding 70% off their 2011 highs at the climax of the last bull market.

One explanation for this is that their input costs – energy and equipment – are rising more than the gold price is rising, which impacts their profitability. Even so, you want to see miners behaving better than this. Maybe a break-out to new highs will give them the boost they need. Maybe they are forecasting a correction. Either way, you can’t argue with the fact that they are extraordinarily cheap.

Gold reserves are rising

I have written before about bearer assets – assets that are nobody’s liability. Gold is the most famous example.

Gold has existed since before the solar system was formed and it will exist long after the human race has shuffled off this mortal coil. It is Nature’s money, "a child of God,” according to an Ancient Greek lyric, and “neither moth nor rust devoureth it.” Spandau Ballet went with the rather more catchy “indestructible”.

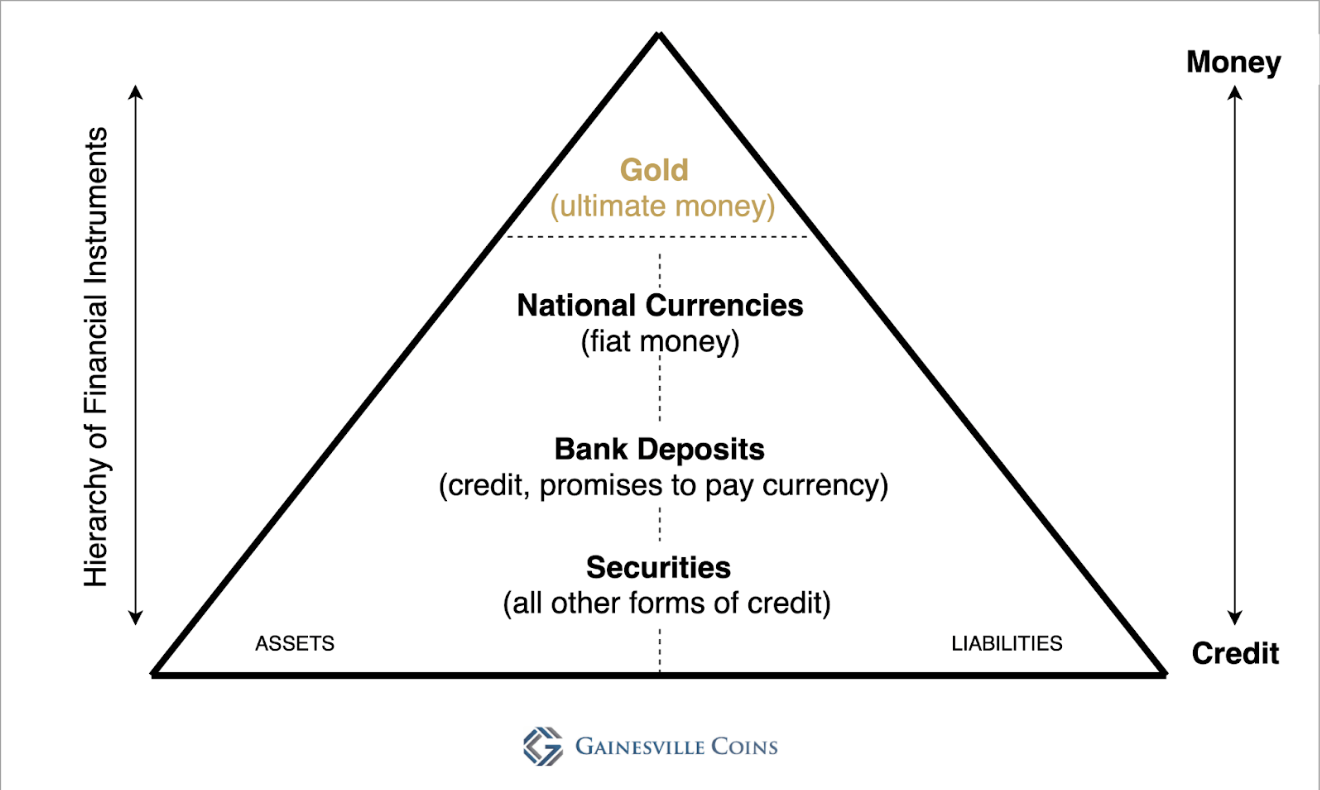

“Money is gold, and nothing else,” the financier JP Morgan once said (this is one of the most misquoted lines on the internet - here we quote him correctly). Everything else, as James Turk argues in his latest book Money and Liberty, be it dollar, pound, silver, or crypto, even the mackerel that sometimes changes hands in American prisons, is currency. Most currency is credit. Money in the bank, as few seem to realise, is credit.

That is why gold sits at the top of the hierarchy of financial instruments, as we see from this slide from analyst Jan Nieuwenhuijs.

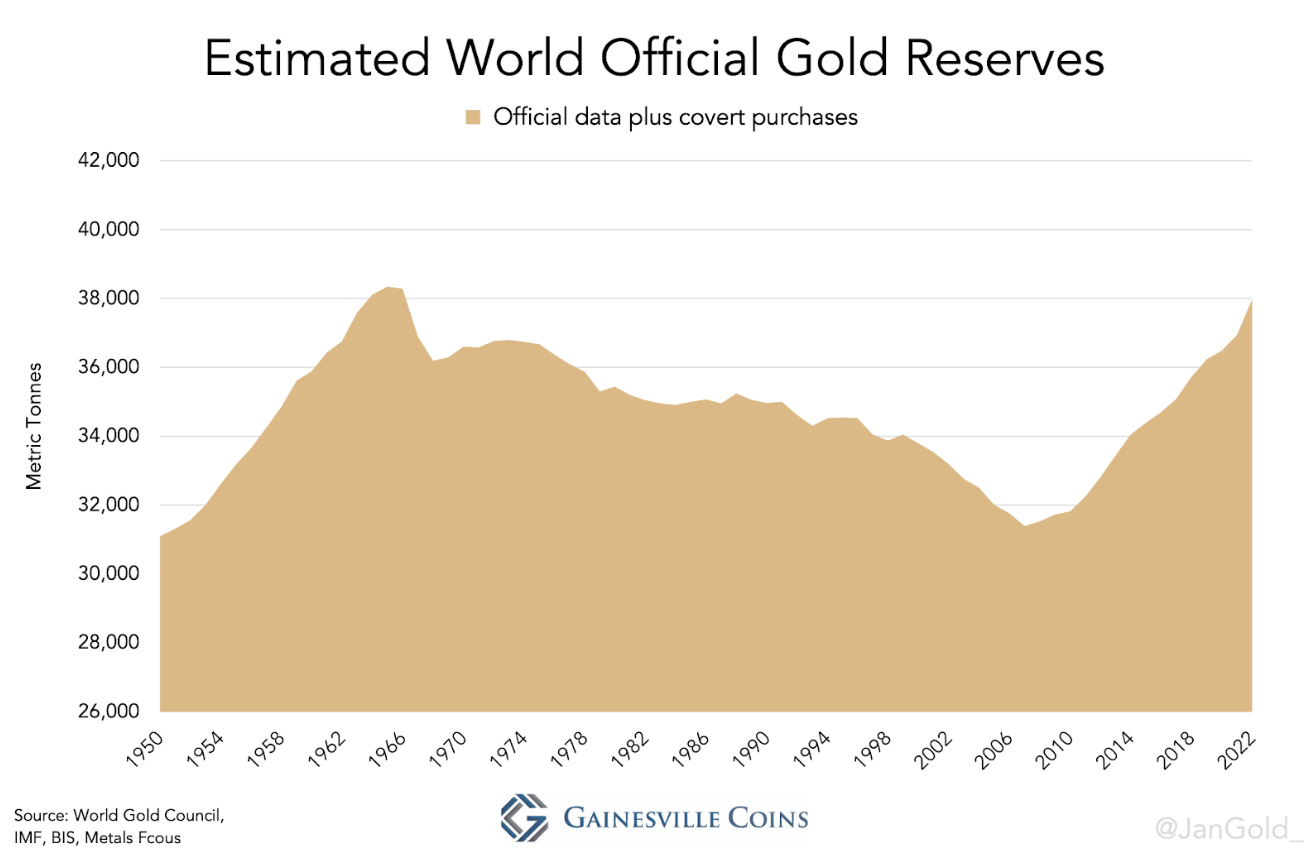

In the same article, in which he makes a case for $8,000 gold, Nieuwenhuijs presents international reserves. You can see how central banks have been increasing their reserves since the financial crisis of 2008. You can also see that accumulation has accelerated this past year, when central banks have been buying gold at the fastest rate since the 1960s.

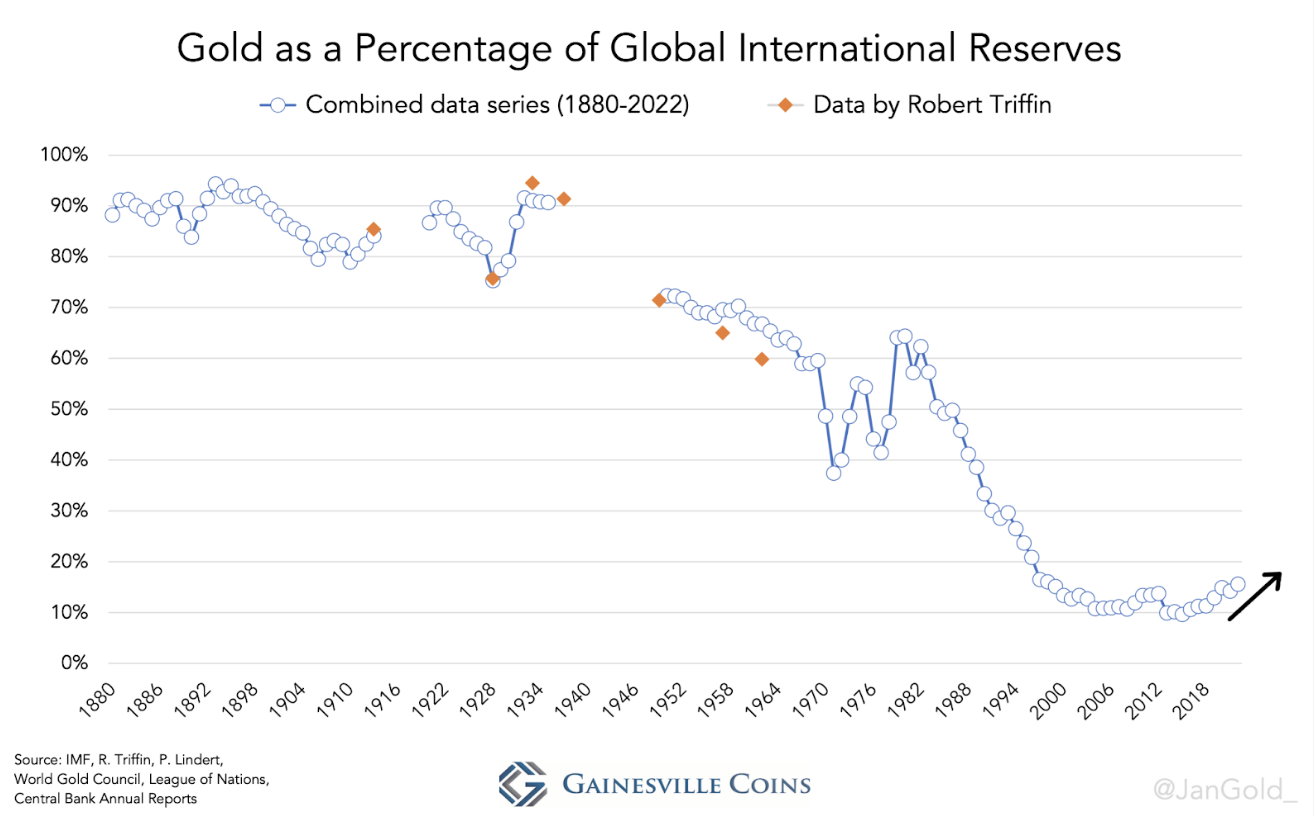

Perhaps more significantly, it’s not just international gold reserves that are increasing, but, since 2018, gold holdings relative to other assets have also turned up.

We are nowhere near the Bel Epoq levels where this chart begins, but the fact that we have turned up is I think significant.

What is being planned?

Moreover, the above data all assume China has been transparent about its gold holdings, which it has not been. China’s gold holdings are, I have argued, probably ten times higher than they say they are.

I keep saying it. We are in interesting times. Own some gold. And hope it doesn’t go up.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.