The US dollar is rising to dangerous levels – here’s what to do about it

The US dollar is back on the rise as panicky investors head for safety. That’s rattling markets across the world, says Dominic Frisby. Here’s how to cope.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

After a month or so of welcome respite, the dreaded US dollar has got stronger again.

It really is the scourge of everything.

Stockmarkets have been walloped, the yen, pound and euro have been walloped, and commodities have been walloped.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Let’s look at a couple of charts.

The dollar just keeps marching higher

The US dollar index shows the dollar against the currencies of its major trading partners – the yen, the euro and so on – so it is perhaps the most useful vehicle to study the dollar.

Given the magnitude of foreign exchange markets and the fact the US dollar is the global reserve currency, I see its price as the most important price in the world.

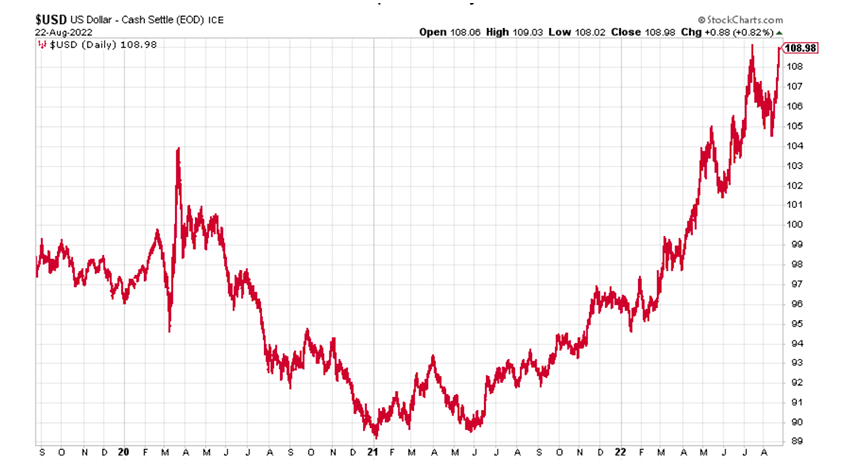

Here we see the US dollar index over the past three years.

You can see that textbook double bottom it made in 2021, with the pattern completing in June. We were warning about it – see here and here – and we ask ourselves, yet again, why it is that we are so unable to heed our own advice.

Since then, through all of the financial and inflationary turmoil of the past year, it has marched inexorably higher. Now it’s retesting its highs around 109.

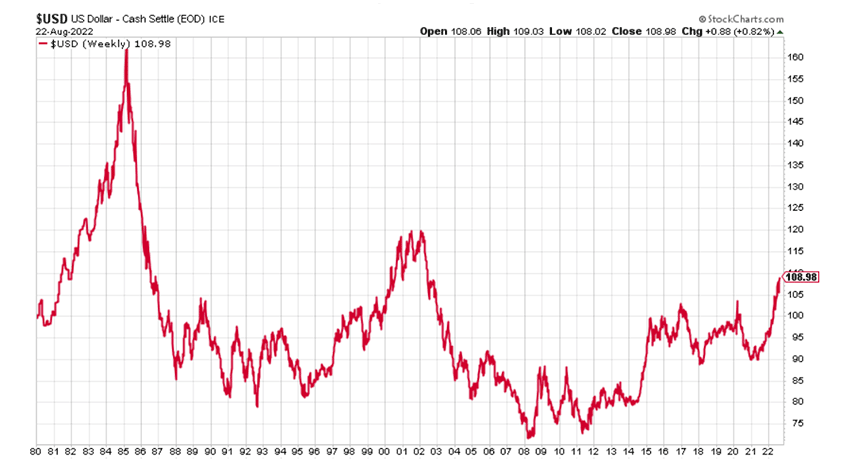

My stated fear for some time is that it goes to 120. Why 120? There is some history there.

Here is the dollar since 1980. You can see that 120 is the level it got to shortly after the turn of the century – and where it peaked around 2001-2002, helping to usher in that epic bull market in commodities.

It actually got to 165 in 1985 – after Fed chair Paul Volcker tightened a lot quicker and harder than anybody else – (not unlike what is happening now). The G5 nations – France, Germany, Japan, the UK and the US – then agree to weaken it so as to reduce the mounting US trade deficit. What followed were epic bull markets in both the Japanese yen and the German mark, and the stage was set for Japan’s “lost decade”.

This agreement was known as the Plaza Accord. I don’t think we are quite at Plaza Accord levels of concern yet, by the way.

Heaven knows what happens to the UK and Europe if the dollar goes to 165 again. But if it gets through 109, I would say 120 is back on the cards, possibly even this year, more likely early next.

The US dollar is the best of a bad bunch

The euro just slid below parity with the dollar yesterday. The last time that happened was around the turn of the century (when it got to €0.82). It’s at 20 year lows. The pound’s at $1.17 – that’s flash crash, Theresa May Conservative Party Conference depths of rubbish.

The reasons the US dollar is rising are fairly obvious. Capital is panicking and the dollar is the first place it goes to in a panic. It should be gold that capital flees to, really, but it isn’t. It’s the dollar.

Then there’s the fact that the Federal Reserve Bank, America’s central bank, is tightening faster and more aggressively than the Bank of Japan, the Bank of England or the European Central Bank. Europe and the UK, meanwhile, have a plethora of gas-related problems and looming winter crises that they could do without.

Forex-wise, the US dollar is the best house in a bad neighbourhood. You could say the same about its economy more generally.

Yesterday was a grim day in the stockmarket, but there were some observations I was happy to make. First, that base metals – copper, zinc, tin, iron ore, and so on – which took one hell of a beating in June, actually held up quite well. That would suggest that they may have already made their lows.

The action in precious metals – platinum and silver especially – over the past week has been less encouraging. Ditto bitcoin.

Oil, meanwhile, looks like it is making an interim bottom and turning up. The last thing central planners want now is higher oil prices, but the market gods will care very little about that.

Might be time to load up again on oil stocks if you are not already loaded. But more broadly speaking, these are risky markets, to put it mildly. Stay defensive, conserve capital, hunker down and await more benevolent financial climates.

Dominic will be performing his lecture with funny bits, How Heavy?, about the history of weights and measures at the Museum of Comedy in London on September 28 and 29. You can buy tickets here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Why you should keep an eye on the US dollar, the most important price in the world

Why you should keep an eye on the US dollar, the most important price in the worldAdvice The US dollar is the most important asset in the world, dictating the prices of vital commodities. Where it goes next will determine the outlook for the global economy says Dominic Frisby.

-

What is FX trading?

What is FX trading?What is FX trading and can you make money from it? We explain how foreign exchange trading works and the risks

-

The Burberry share price looks like a good bet

The Burberry share price looks like a good betTips The Burberry share price could be on the verge of a major upswing as the firm’s profits return to growth.

-

Sterling accelerates its recovery after chancellor’s U-turn on taxes

Sterling accelerates its recovery after chancellor’s U-turn on taxesNews The pound has recovered after Kwasi Kwarteng U-turned on abolishing the top rate of income tax. Saloni Sardana explains what's going on..

-

Why you should short this satellite broadband company

Why you should short this satellite broadband companyTips With an ill-considered business plan, satellite broadband company AST SpaceMobile is doomed to failure, says Matthew Partridge. Here's how to short the stock.

-

It’s time to sell this stock

It’s time to sell this stockTips Digital Realty’s data-storage business model is moribund, consumed by the rise of cloud computing. Here's how you could short the shares, says Matthew Partridge.

-

Will Liz Truss as PM mark a turning point for the pound?

Will Liz Truss as PM mark a turning point for the pound?Analysis The pound is at its lowest since 1985. But a new government often markets a turning point, says Dominic Frisby. Here, he looks at where sterling might go from here.

-

Are we heading for a sterling crisis?

Are we heading for a sterling crisis?News The pound sliding against the dollar and the euro is symbolic of the UK's economic weakness and a sign that overseas investors losing confidence in the country.