Can anything stop the dollar’s devastating bull run?

The US dollar has been on a massive bull run for the last year or so. Commodity prices are sliding, and the euro – maybe even the pound – could hit parity. But when it turns there will be mad scramble, says Dominic Frisby. Here, he looks at what might halt the runaway dollar.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

We suggested a couple of weeks back that oil might be the next market to drop and so it has turned out.

Both Brent and West Texas Intermediate are back below $100 a barrel, and they join the metals on the downward slope.

The euro, and maybe even the pound, could hit parity with the US dollar

Metals have been battered even harder, with silver – as often seems to be the way – leading the fall downwards.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

How can silver be trading below $20 an ounce? How can platinum be below $850?

I’m not saying they aren’t going lower; they probably are. But there will come a time in the future when we’ll be wondering how on earth it was possible to buy these metals at these prices.

Silver below $20. Platinum below $850 – platinum is half the price of gold!

Remember when nickel went to $100,000 per tonne? It’s $21,000 now.

Wheat’s at $800; it was $1,300 in March. Corn, oats, soybeans, lumber – you name it, there’s carnage.

Never underestimate the bust-to-boom-to-bust potential of raw material markets, I guess is the lesson. They always seem to return whence they came.

With this rout in commodities prices, this inflationary episode could yet prove to be transitory. (I stress I’m using the word inflation with its modern meaning: rising prices of goods in the CPI basket. The other kind of inflation – debasing money by creating too much of it – isn’t going anywhere).

The villain in the piece has been the US dollar. The dollar index is now at 107. Can it go higher? Maybe; it’s come a long way already.

In June of last year we thought it had made a double bottom at 89-90. 103 was the huge line in the sand – it got through that at the second attempt. 120 is the next big one. It really would be an outlier if it got there – but this is a time of outliers.

The euro is now $1.01. Parity beckons. In 2000, with the dotcom chaos, it got to $0.82 (this was also before it had fully launched across member states). Is it going there again? Again, it would be an outlier, but it’s possible.

The pound’s at $1.18. I wouldn’t rule out parity there either.

Could capitulation by the Bank of Japan mark the end of the dollar bull run?

But I will say this: “long dollar” is a crowded trade. Everybody’s talking about it. When it turns – and it will – there’s going to be a lot of money made on the other side of this trade. FX traders are going to be all over it. Long anything anti-dollar – gold, the euro, perhaps even the yen.

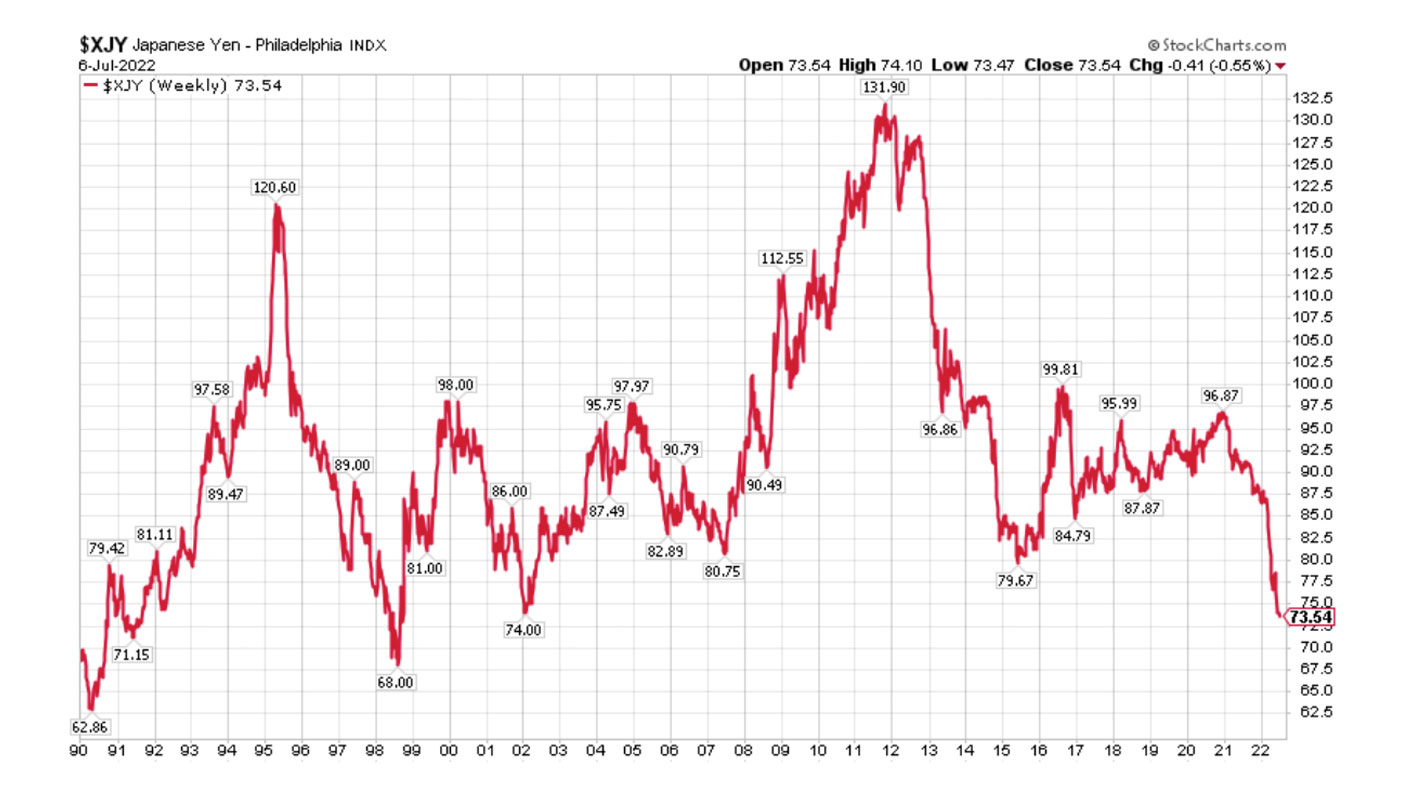

The yen’s at lows not seen since the Asian crisis of 1998. But could Japan have its own “Swiss bank” moment?

I’m referring to 2015, when Switzerland announced that it was going to abandon the franc’s peg to the euro (it was pegged at €1.20 to the franc) and the franc instantly shot up 20% as a result. That is an astonishing amount for a major currency.

The move destroyed many a forex trader’s fortune, not to mention the many people who had Swiss-denominated mortgages and other forms of debt. Many of them were from poorer nations with weaker currencies.

The yen is not pegged to any currency, but the Bank of Japan has committed to holding its benchmark ten-year government bond yield to 0.25%. With this so-called yield curve control, it pins down borrowing costs and “stimulates growth” (ergo causes asset price inflation – except that it hasn’t worked for years).

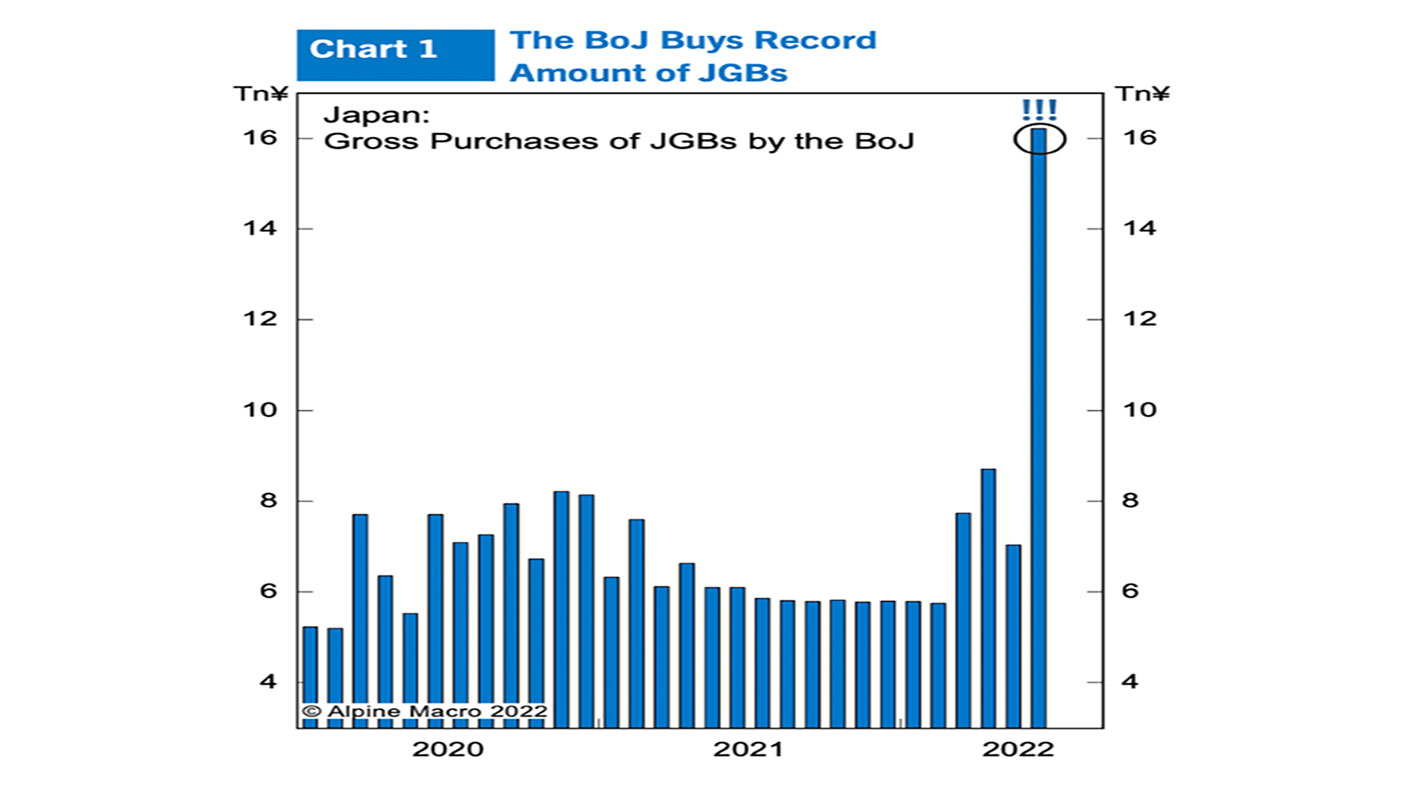

For decades now, shorting Japanese bonds (ie, betting on higher yields) has been the mother of all widow-maker trades. I’m not ready to fall into that trap, even if Japan’s buying of its own bonds has gone nuts – see the chart below.

The government now owns over 50% of its own bonds, and the rate of purchase has only accelerated as it tries to hold the ten-year yield at 0.25%, even as the rest of the developed world starts “quantitative tightening” (ie doing the opposite).

But even with private sector savings exceeding the fiscal deficit and so much government buying, Japan may have to stop defending the 0.25% mark. It may be because yields get too low relative to other nations. It may just be that inflation pushes it over the brink (and a weaker currency means higher inflation).

But, cripes, there is some reversal in the yen (and thus in the dollar) that is waiting to happen.

Here’s the yen since 1990 (when the red line falls, the yen is getting weaker – the Y-axis shows how many dollars you can buy for ¥10,000).

I don’t know when the dollar turns – but there’s going to be a mad scramble when it does.

Dominic will be performing his show, How Heavy?, a lecture with funny bits about the history of weights and measures, at the Edinburgh Fringe this August. You can get tickets here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Why you should keep an eye on the US dollar, the most important price in the world

Why you should keep an eye on the US dollar, the most important price in the worldAdvice The US dollar is the most important asset in the world, dictating the prices of vital commodities. Where it goes next will determine the outlook for the global economy says Dominic Frisby.

-

What is FX trading?

What is FX trading?What is FX trading and can you make money from it? We explain how foreign exchange trading works and the risks

-

The Burberry share price looks like a good bet

The Burberry share price looks like a good betTips The Burberry share price could be on the verge of a major upswing as the firm’s profits return to growth.

-

Sterling accelerates its recovery after chancellor’s U-turn on taxes

Sterling accelerates its recovery after chancellor’s U-turn on taxesNews The pound has recovered after Kwasi Kwarteng U-turned on abolishing the top rate of income tax. Saloni Sardana explains what's going on..

-

Why you should short this satellite broadband company

Why you should short this satellite broadband companyTips With an ill-considered business plan, satellite broadband company AST SpaceMobile is doomed to failure, says Matthew Partridge. Here's how to short the stock.

-

It’s time to sell this stock

It’s time to sell this stockTips Digital Realty’s data-storage business model is moribund, consumed by the rise of cloud computing. Here's how you could short the shares, says Matthew Partridge.

-

Will Liz Truss as PM mark a turning point for the pound?

Will Liz Truss as PM mark a turning point for the pound?Analysis The pound is at its lowest since 1985. But a new government often markets a turning point, says Dominic Frisby. Here, he looks at where sterling might go from here.

-

Are we heading for a sterling crisis?

Are we heading for a sterling crisis?News The pound sliding against the dollar and the euro is symbolic of the UK's economic weakness and a sign that overseas investors losing confidence in the country.