If the US dollar keeps rising from here, it’s going to hurt

The US dollar is on a bull run, sending every other asset into freefall. And it's at a particularly critical point right now, says Dominic Frisby. Here, he looks at where things stand, and what might come next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Stockmarkets have taken quite a tumble this past week or so, and there has been a great deal of noise about the end of the tech bubble. Even with some 70%-plus corrections, many tech companies’ valuations remain extraordinarily high.

What seems to have gone rather less reported is the extraordinary battering that metals have taken too. Whether base or precious, ferrous or platinum group, Russia-centric or dispersed, they have been walloped.

The reason? Their nemesis has risen.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The US dollar is the most important price in the world

We have been fretting about the US dollar for some time now on these pages. A year ago in June, we declared, “everything hinges on the direction of the dollar” and then in November we warned investors to “beware – the most important price in the world is rising”.

We were worried at first that it would rise, and then that it was rising. Well, talk about risen.

The US dollar has been, of late, doing its best impersonation of bitcoin on one of its bull runs. It’s gone parabolic and right now, it’s at a particularly critical juncture.

The problem with the dollar is that, when it rises, everything else tends to go down the Swannee – generally speaking, of course. It’s a bit of a chicken and egg job – I’m never quite sure if the dollar is rising because everything else is tanking, or if everything else is tanking because the dollar is rising.

In any case, we speculators prefer an environment in which asset prices rise and the dollar falls. We may give it the big one about the Federal Reserve’s money printing, but we still want them to do it if it means the well being of our portfolios is preserved –central bankers and politicians are not the only hypocrites!

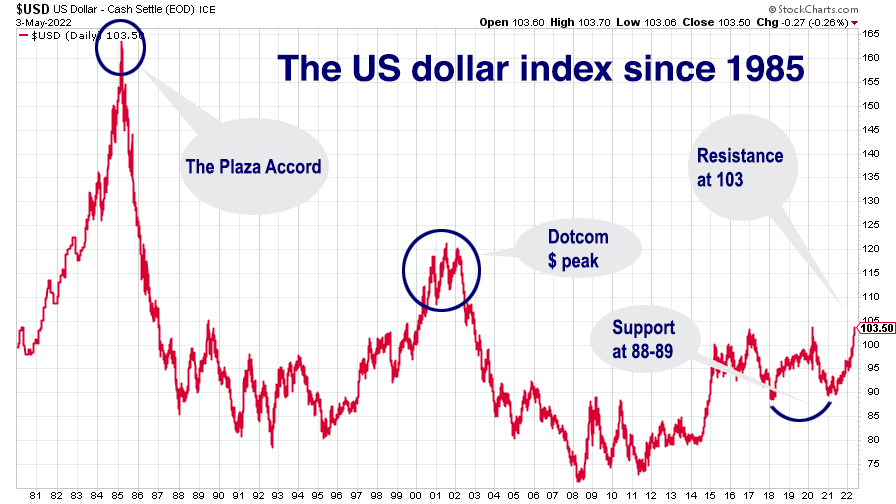

But back in June we identified two key levels for the US dollar: 88-89 and 103. This is the US dollar index we are talking about here; the US dollar measured against the currencies of its major trading partners – the euro and the Japanese yen mostly, with a bit of pound sterling, Swiss franc, Canadian dollar and Swedish krona thrown in.

The only currency that has been outperforming the dollar of late has been the Russian rouble. Go figure. But note that one is the petrocurrency and the other is gas money – fossil fuels pay. Indonesia should start demanding rupiahs for its coal (it’s the world’s largest exporter).

In any case, after its bonanza of the last 12 months, the dollar index now stands at 103. With the exception of the dotcom bust era of 2000-2002, this would be as high as it has been since 1985, when the G5 nations had to get together and agree the Plaza Accord to devalue it.

Yet even with its relative might, US inflation still stands at 8.5%. That’s fiat currency for you.

Investors should pray that the US dollar starts falling from here

I cannot stress enough what an important technical level 103 is. If the dollar goes above 103 and stays there, what is currently an eye-watering situation is going to become eye-bleeding.

If it makes a high here or does a false move and a fast one in the other direction, then the long metals, anti-US dollar, inflation trade is back on. In fact, it’s pretty extraordinary how well metals have done this past year, given US dollar strength. That’s shortages and years of under-investment for you. Wait and see what happens to them if the dollar starts falling!

Let’s take a look at the long-term chart of the US Index to give you an idea of where we are in the grand scheme of things.

This recent rally looks minuscule on the 40-year chart, but let me tell you, it’s been quite something. As anyone who followed it through 1984, 2008 and 2014 will tell you, parabolic US dollar moves can go on longer than you might think. But dollar moves also tend to end with spikes such as the one we have just seen. And 103 is an obvious place for a spike to end.

The Fed is likely to raise the federal funds rate by 50 basis points at its rate-setting meeting this week. That much is priced in already, I’d say. We’ll know more when Fed boss Jerome Powell makes his speech.

But one wonders if general geopolitical jitters are a bigger factor here. If we get a move above 103, and 120 comes back into the frame. That really would hurt. But in this increasingly nuts world, the only real surprise seems to be no surprises.

Dominic’s film, Adam Smith: Father of the Fringe, about the unlikely influence of the father of economics on the greatest arts festival in the world is now available to watch on YouTube.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Why you should keep an eye on the US dollar, the most important price in the world

Why you should keep an eye on the US dollar, the most important price in the worldAdvice The US dollar is the most important asset in the world, dictating the prices of vital commodities. Where it goes next will determine the outlook for the global economy says Dominic Frisby.

-

What is FX trading?

What is FX trading?What is FX trading and can you make money from it? We explain how foreign exchange trading works and the risks

-

The Burberry share price looks like a good bet

The Burberry share price looks like a good betTips The Burberry share price could be on the verge of a major upswing as the firm’s profits return to growth.

-

Sterling accelerates its recovery after chancellor’s U-turn on taxes

Sterling accelerates its recovery after chancellor’s U-turn on taxesNews The pound has recovered after Kwasi Kwarteng U-turned on abolishing the top rate of income tax. Saloni Sardana explains what's going on..

-

Why you should short this satellite broadband company

Why you should short this satellite broadband companyTips With an ill-considered business plan, satellite broadband company AST SpaceMobile is doomed to failure, says Matthew Partridge. Here's how to short the stock.

-

It’s time to sell this stock

It’s time to sell this stockTips Digital Realty’s data-storage business model is moribund, consumed by the rise of cloud computing. Here's how you could short the shares, says Matthew Partridge.

-

Will Liz Truss as PM mark a turning point for the pound?

Will Liz Truss as PM mark a turning point for the pound?Analysis The pound is at its lowest since 1985. But a new government often markets a turning point, says Dominic Frisby. Here, he looks at where sterling might go from here.

-

Are we heading for a sterling crisis?

Are we heading for a sterling crisis?News The pound sliding against the dollar and the euro is symbolic of the UK's economic weakness and a sign that overseas investors losing confidence in the country.