Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome back.

This week, we’re looking at the labour shortage. Workers are leaving their jobs at an astonishing rate, especially in the US – 4.3 million of them in August, that’s 2.9% of the workforce. Simon examines what’s behind the mass resignations, and what it all means for the economy.

Elsewhere, Matthew Partridge looks at investing in railways. They had a dismal pandemic as people stopped commuting yet, even though it may be unlikely that we’ll fall back into the same working patterns, it’s not all doom and gloom. Railways aren’t all about commuters – governments want more of us to take the train for long-distance journeys, and rail-freight – which accounts for much of rail companies’ revenues – has been largely unaffected by lockdowns. There are plenty of opportunities for investors, and Matthew picks some of the best in this week’s magazine. If you’re not already a subscriber, sign up here and get your first six issues free.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Merryn is joined by Andrew Hunt in this week’s podcast. You may have seen his feature on fossil fuels in last week’s magazine. Andrew’s a “deep value” investor, finding companies in the unfashionable corners of the market where many institutional investors fear to tread. He’s got lots of ideas on what to buy – listen to the what he has to say here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: The Brics never lived up to their promise – but is now the time to buy?

- Tuesday Money Morning: Index tracker funds won't shield your wealth from inflation – here's why

- Merryn’s blog: Is how much money a manager invests in their own fund really that important?

- Wednesday Money Morning: If you want to get exposure to bitcoin, I have this great idea for you

- Thursday Money Morning: Will the government’s green plans hit the price of your home?

- Friday Money Morning: Green finance is set to be the most powerful financial repression tool yet

- Cryptocurrency roundup: Cryptocurrency roundup: bitcoin hits a new record high

Now for the charts of the week.

The charts that matter

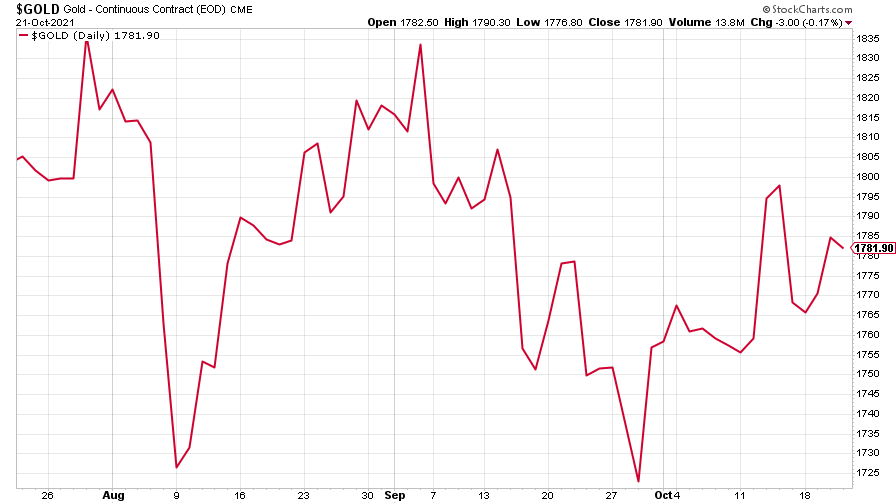

Gold attempted to regain lost ground, but can’t manage to get above $1,800 an ounce.

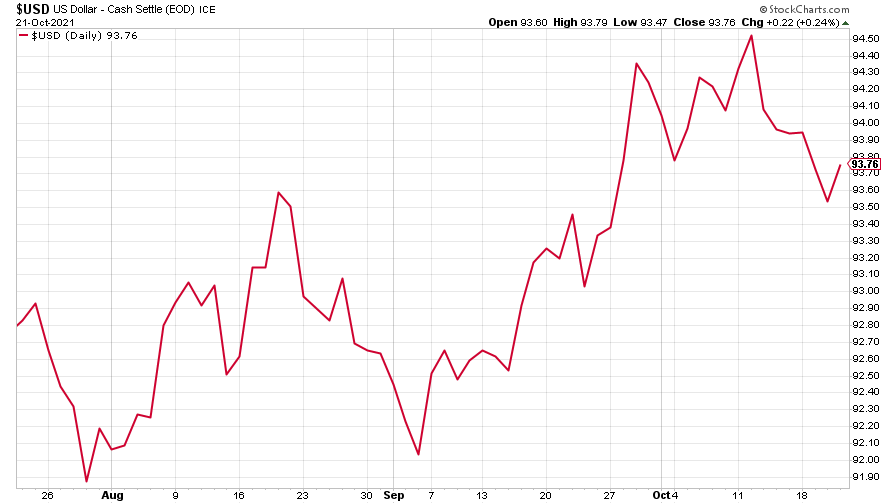

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) fell further, though it bounced towards the end of the week.

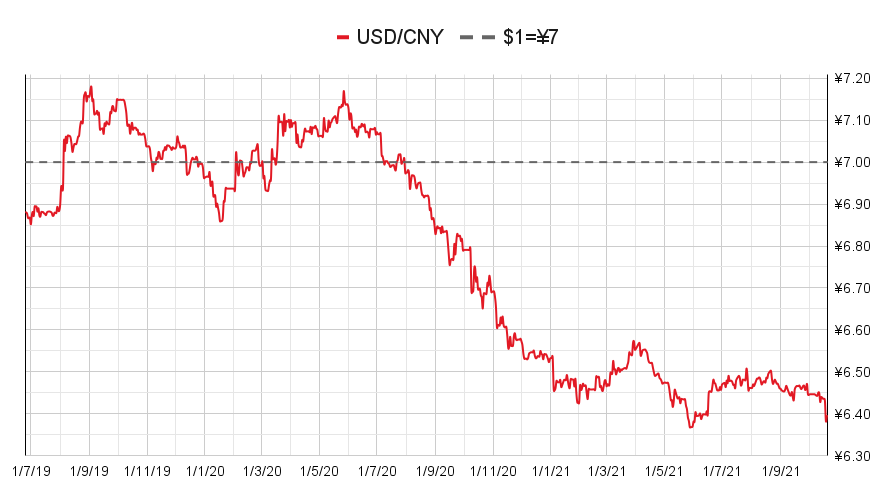

The Chinese yuan (or renminbi) strengthened further against the dollar (when the red line is rising, the dollar is strengthening while the yuan is weakening).

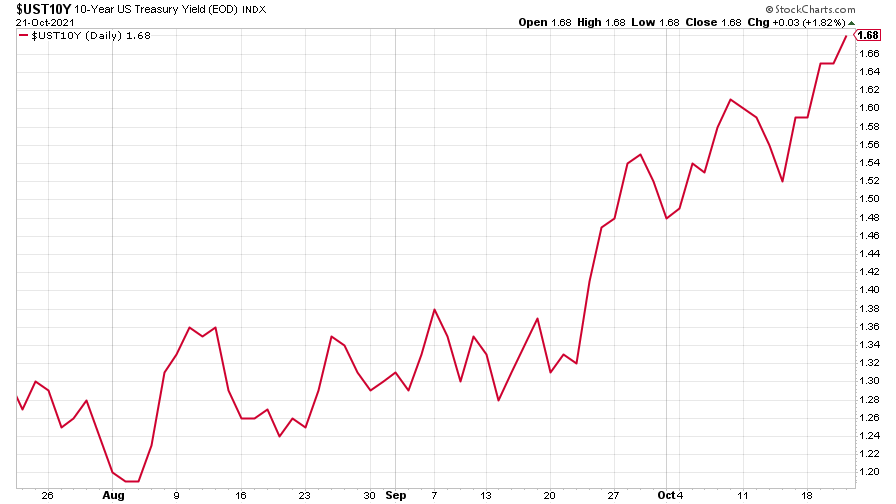

The yield on the ten-year US government bond started climbing again after dipping last week.

(Ten-year US Treasury yield: three months)

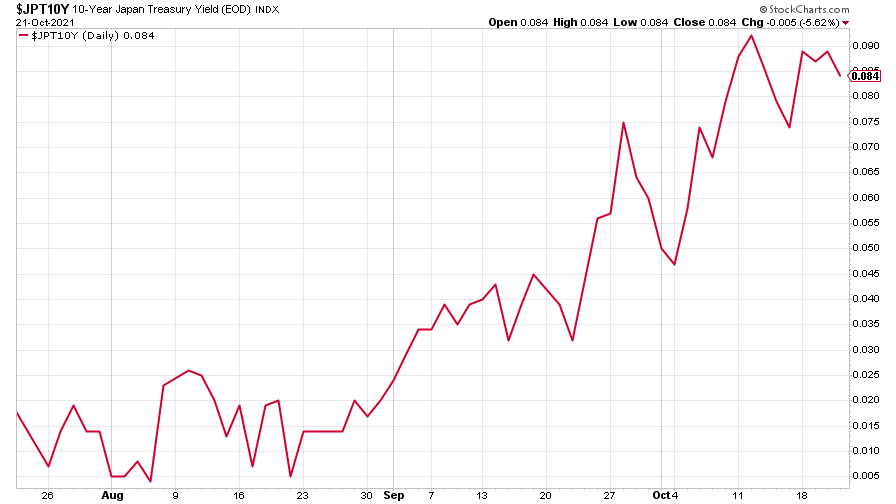

The yield on the Japanese ten-year bond tailed off after earlier gains.

(Ten-year Japanese government bond yield: three months)

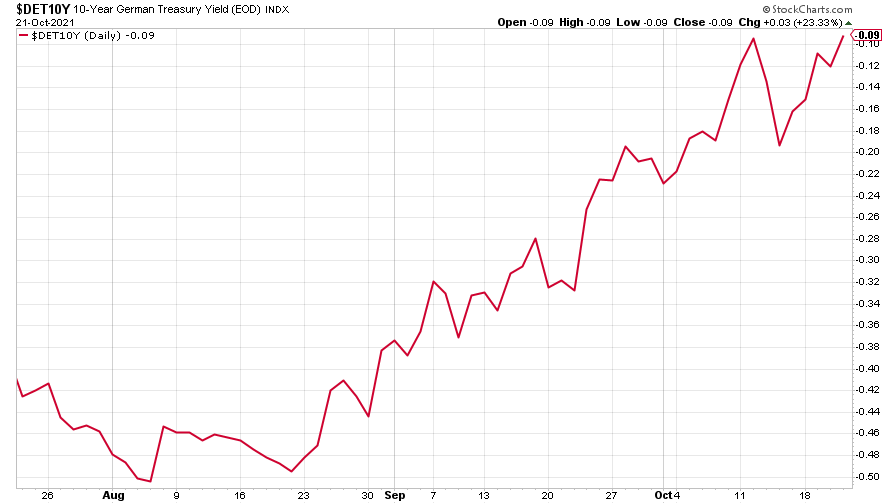

And the yield on the ten-year German Bund climbed tantalisingly close to positive territory, bubbling under at -0.09%.

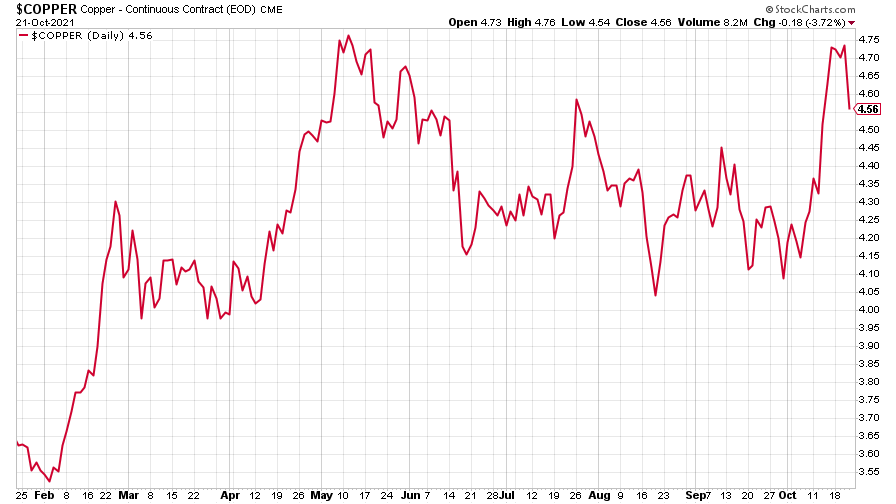

Copper dropped – could the supply squeeze be fading?

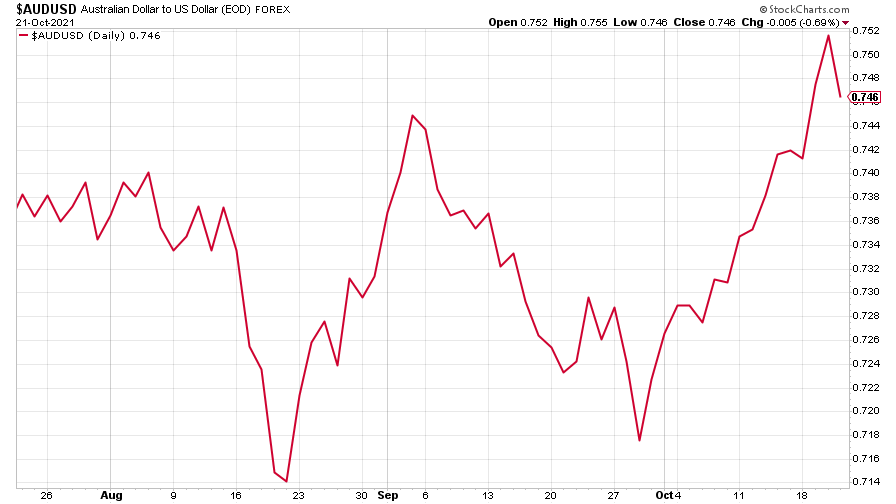

The closely-related Aussie dollar mirrored copper’s movements.

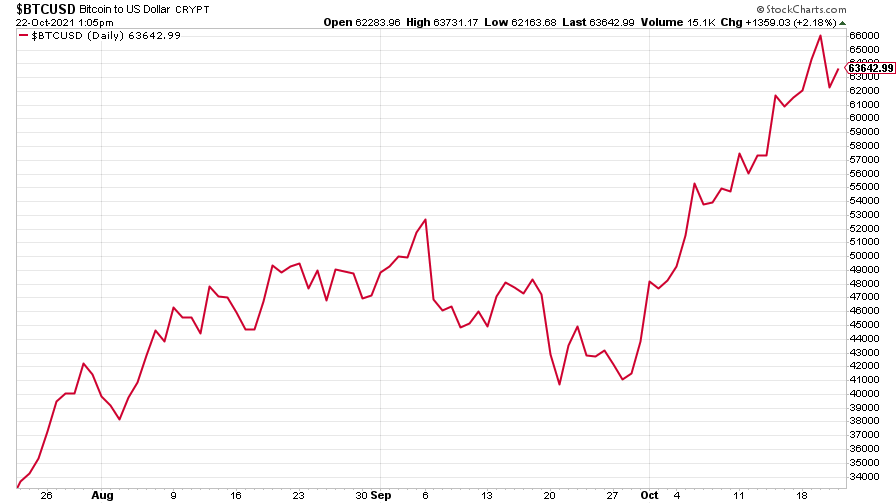

Bitcoin investors were cheering as the cryptocurrency surpassed its previous highs to hit over $67,000.

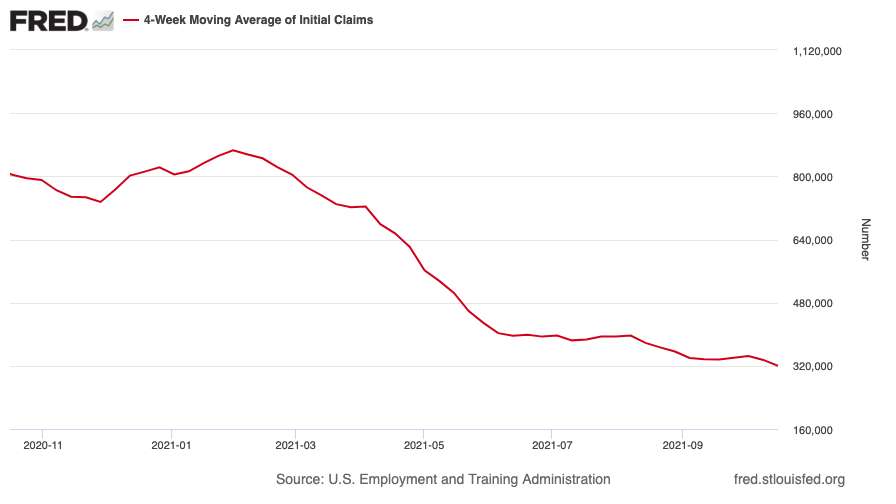

US weekly initial jobless claims fell by 6,000 to 290,000. The four-week moving average fell by 15,250 to 319,750.

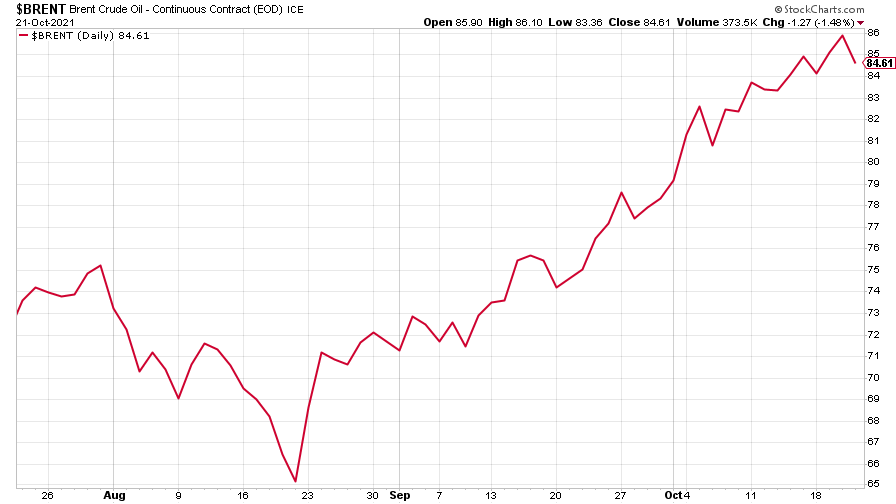

The oil price continued to head higher.

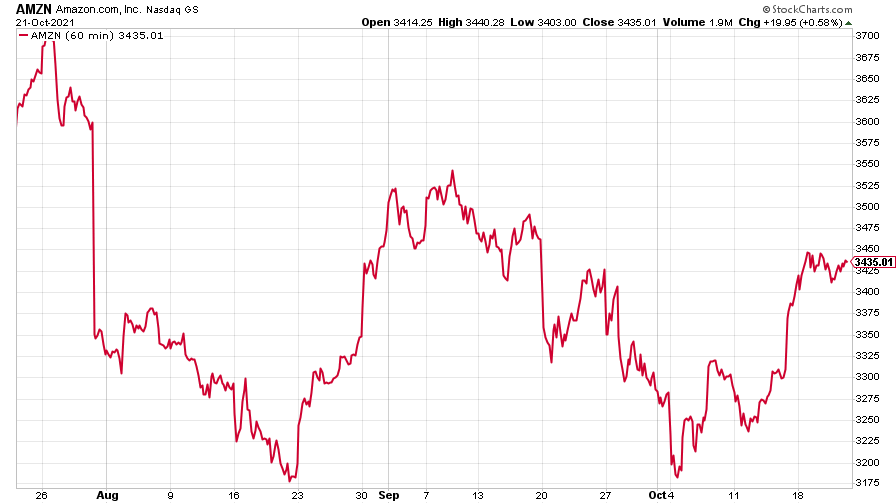

Amazon saw a strong rally.

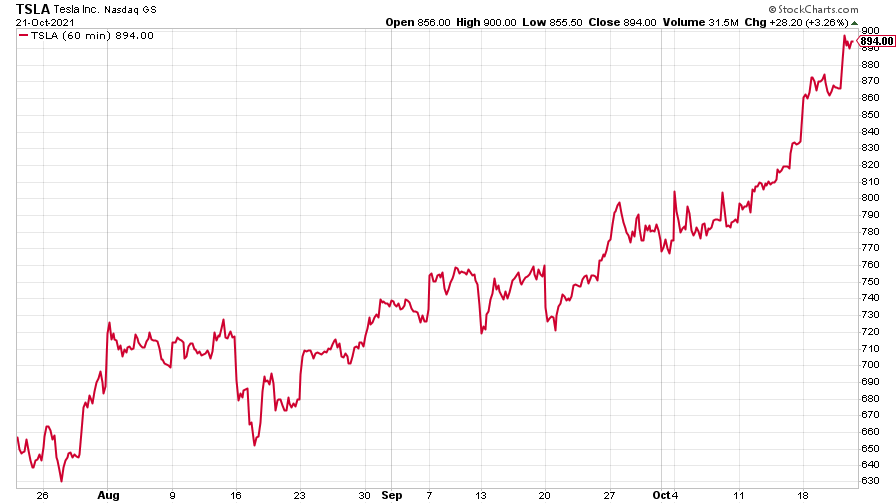

Tesla continued its seemingly unstoppable rise, hitting $894.

Have a great weekend.

Ben

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.