Will the government’s green plans hit the price of your home?

UK house prices are still rising fast. But the government’s plan to reach net-zero carbon emissions could halt that – for some of us, at least. John Stepek explains why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Quick thing before we get started this morning – have you had a look at the agenda for the MoneyWeek Wealth Summit this year yet? If not, have a look and get your ticket here.

It’s going to be packed with expert views on the most important investment topics of the day, including everything from the energy transition to the death of the 60/40 portfolio to investing in cryptocurrencies.

Don’t miss it – it’s virtual this year, so you don’t even have to trek down to London to get involved!

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Now for this morning’s article – and it’s back to good old house prices.

We got the latest figures from the Land Registry yesterday. These are the least timely house price figures, but that’s because they’re based on real, done-and-dusted transactions, whereas all the other price indicators are taken somewhere further up the transaction chain.

You know all that stuff about how the end of the stamp duty holiday was going to poleaxe house prices? Total nonsense, as it turns out.

House prices are still rocketing

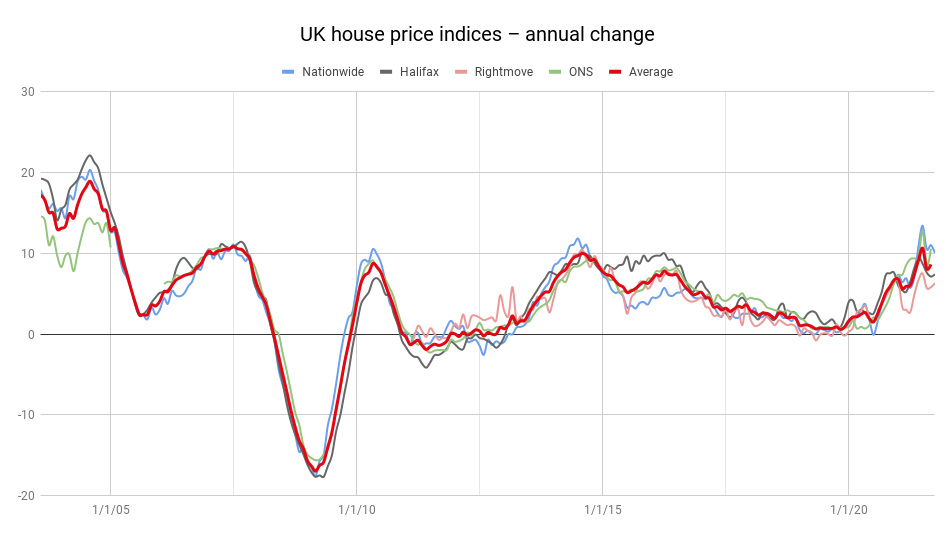

House prices UK-wide rose by 10.6% in the year to August. That was an increase from 8.5% in the year to July.

We could pore over the data for ages. I’m not going to. Suffice to say prices are rising everywhere. Even London is recovering its mojo after losing out during the great pandemic exodus.

Also, this isn’t an outlier. All the other housing market measures point to house prices continuing to rise strongly, despite changes to stamp duty and also despite signs of a return to working in the office.

What’s driving this? The big relocation is presumably still one factor. But by now you’d think that pandemic-related migration from city to country would be starting to tail off, or at least reached its maximum point.

Instead, the big issue for house prices, as we’ve noted over and over again here, is interest rates. Or more specifically, the cost and availability of mortgage loans.

Mortgages – despite heavy hints from the Bank of England that interest rates will have to rise soon – have never been cheaper. That might well change shortly, particularly as gilt yields have been going up (the yield on UK government debt and the rate on the average mortgage loan are connected, because the gilt yield affects the price at which the bank can borrow the money it then lends to you).

However, competition is also heating up in the mortgage market. So while the Bank of England might be keen to push up the key interest rate, battles for customers will tend to suppress mortgage costs in the meantime. We saw this during the last boom and bust. The Bank was raising rates, but you could still get your 125% mortgage with few questions asked.

And while the Bank of England is talking about raising interest rates, there’s quite a jump between raising rates and doing something that might result in a housing market crash. There’s no way the Bank (or the government) wants to see that.

So is there anything that could make the housing market wobble?

Right now, I’m not expecting any big change to the trajectory of house prices. But there is one thing worth watching in the medium term, and that’s the government’s drive to make us all more carbon neutral.

How carbon reduction plans could affect house prices

This may seem odd. How could the drive to make Britain “greener” affect your house price?

Well, one of the government’s proposals for getting us all to “net zero” carbon emissions is to make it harder or more expensive to get mortgages on energy-inefficient homes.

Way back in 2007 – almost at the peak of the last housing bubble, ironically enough – the government of the day introduced energy performance certificates (EPC) as part of the home-buying process.

I’m not sure how much attention people pay to them when they’re buying a house. I suspect that if you were to plot the time that the average home buyer spends worrying about each part of the process, the EPC would rank somewhere within the bottom 10%.

That looks set to change – not overnight perhaps, but the government’s aim is for all homes to meet EPC band C by 2035. Given that the average home in England and Wales at the moment is rated “D”, that implies a certain amount of upgrade work that needs to be done.

So how is the government going to encourage this “retro-fitting” of Britain’s housing stock? One way is to make it harder to get a mortgage on an energy-inefficient house. With that in mind, the government will be looking at ways to encourage lenders (with targets, quite possibly) to make more loans to “green” homes.

As a result, those who live in, or who want to buy, energy-inefficient homes will have to upgrade them, or see the value of their property fall. Either the homes will be less attractive to buyers, or the buyers who do decide to buy them will need to spend so much extra money on upgrades that they’ll be unable to pay as much for the house.

Now none of this is going to happen overnight, but what’s interesting to me is that the mere prospect of it happening is bound to do two things. Firstly, it’ll make individuals pay more attention to EPCs. Secondly, it’ll make lenders start to consider a new set of risks when lending on less energy-efficient properties.

Will that chilling effect be sufficient to put a dent in the market? Probably not yet, bar a few specific cases. In fact if you’re a first-time buyer it sounds like you’ll just be getting a load more cost dumped on you.

But if you’re inclined to be a property investor, for example, or if somewhere at the back of your mind, you’re relying on the value of your home for a downsizing or retirement strategy (as Sarah Coles of Hargreaves Lansdown points out, this could “have far-reaching consequences” for those living in old family homes that end up needing a lot of work), this is definitely something to take into account.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.