Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

On this week’s magazine cover we take a look at the legacy of Angela Merkel, Germany’s leader who is stepping down after 16 years. Her approval rating of 64% attests to her “steadying influence in an age of turbulence”, says Simon Wilson. But do her achievements live up to her ratings?

Our big investment feature this week is Stephen Connolly writing about cybersecurity. It’s fair to say that cybercriminals have never had it so good. The pandemic has pushed more of our lives online, and the internet has “never been a better hunting ground for data, money and weak access points in corporate networks”, he says.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So there are plenty of opportunities for investors in combatting them, and Stephen picks some of the best bets to buy now. If you’re not already a subscriber to MoneyWeek magazine, sign up here and get your first six issues free.

This week’s “Too Embarrassed To Ask” video explains what “moral hazard” is. The term comes from the insurance industry in the 18th century. But what does it mean today – and why is it still so relevant? Find out exactly what it means here.

And in this week’s podcast, Merryn talks to Gary Channon of Phoenix Asset Management about his investment style and the balance between diversification and performance. Plus, capital allocation and the firms that get it right – and the firms that don't. It’s a fascinating listen – hear what they have to say here.

Oh and John popped up on The Week Unwrapped podcast this week talking about gene editing, comedy copyright and “manifesting” – if you’re curious, have a listen here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: The UK stockmarket is cheap – but is it cheap for good reasons?

- Tuesday Money Morning: Has passive investing created a stockmarket bubble?

- Merryn’s blog: Why we will be reliant on fossil fuels for a long time to come

- Web article: Why are people panicking about fuel shortages?

- Wednesday Money Morning: The investment landscape is getting messy – what should you own now?

- Web article: What do higher oil prices mean for investors?

- Thursday Money Morning: Rising bond yields are unnerving markets and it could get worse before it gets better

- Web article: What is the US “debt ceiling” and what happens if it is not raised?

- Friday Money Morning: China’s energy crunch could export inflation around the globe

- Web article: Furlough is ending – will unemployment spike?

- Cryptocurrency roundup: Cryptocurrency roundup: bitcoin shrugs off China's ban

Now for the charts of the week.

The charts that matter

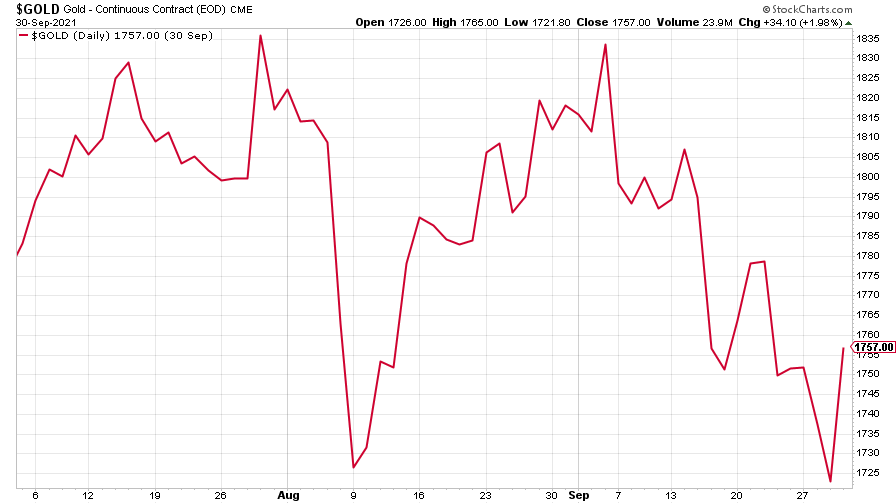

Gold fell further as concerns over tighter money continued, but it managed to rally towards the end of the week.

(Gold: three months)

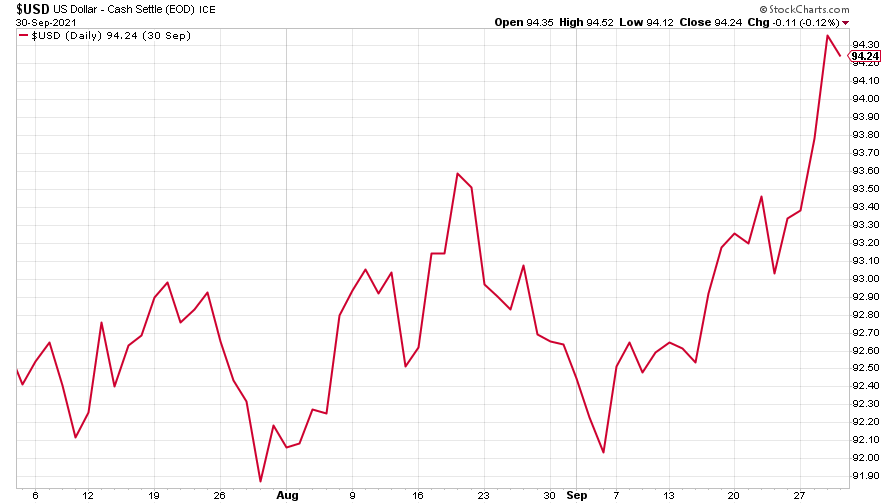

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) shot up, perhaps in a reaction to the US Federal Reserve taking on a more hawkish tone on monetary stimulus, which also helped to push bond yields higher.

(DXY: three months)

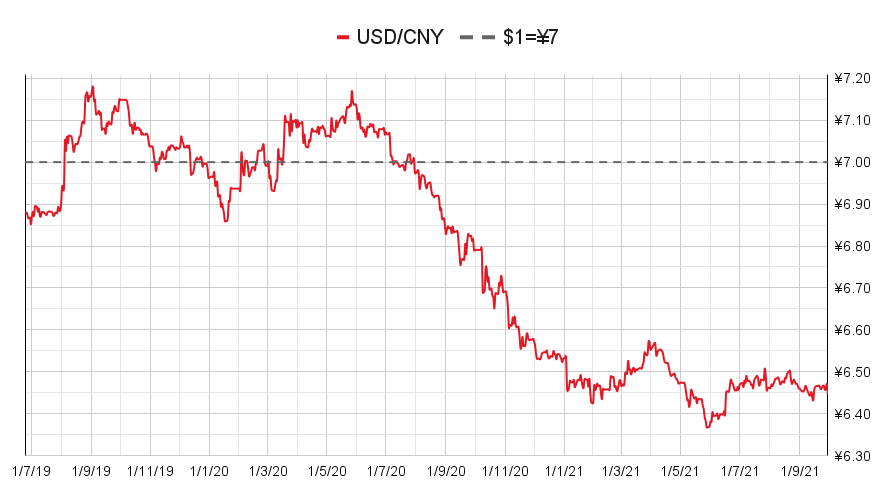

The Chinese yuan (or renminbi) continued to tread water (when the red line is rising, the dollar is strengthening while the yuan is weakening).

(Chinese yuan to the US dollar: since 25 Jun 2019)

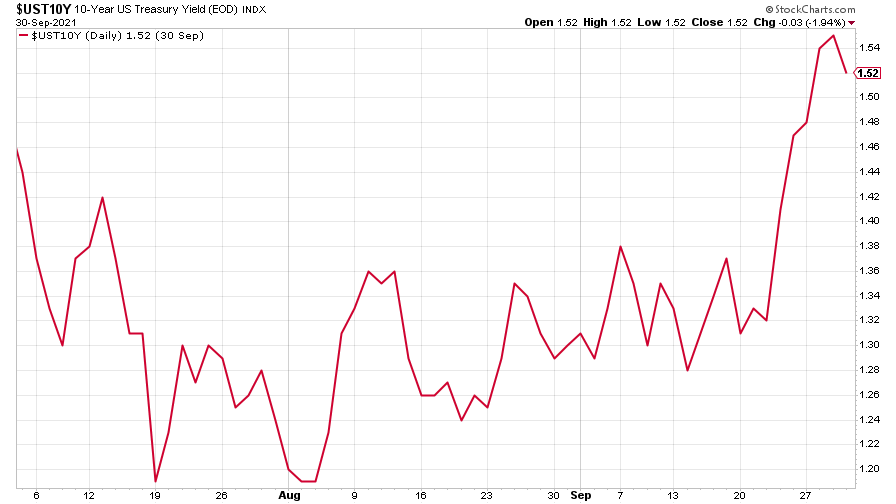

The yield on the ten-year US government bond burst higher as the spectre of inflation (and higher interest rates) raises its head again.

(Ten-year US Treasury yield: three months)

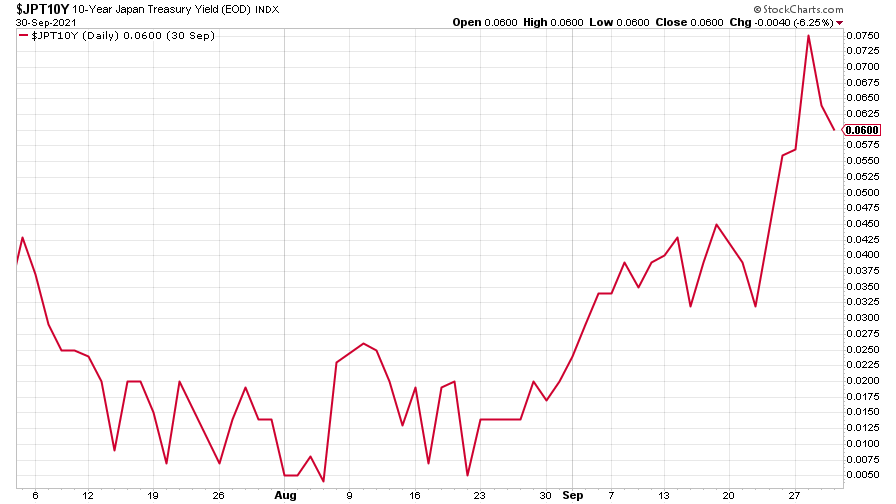

The yield on the Japanese ten-year bond saw a similar jump, tailing off towards the end of the week.

(Ten-year Japanese government bond yield: three months)

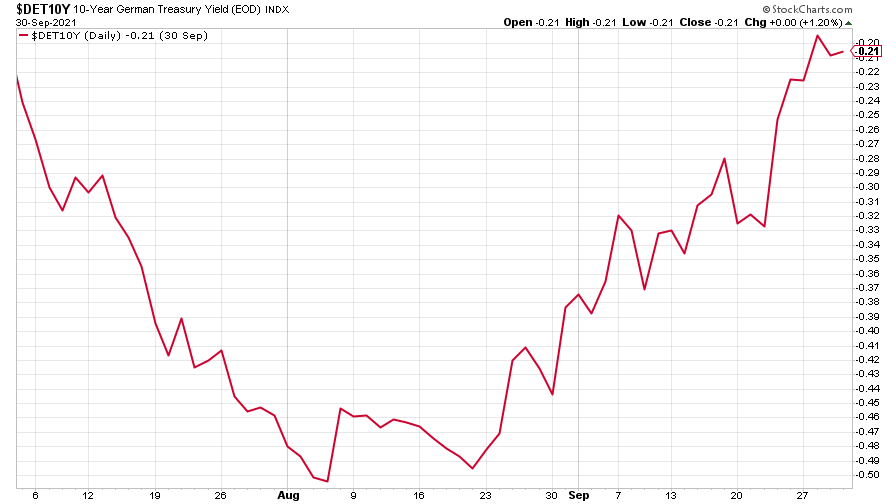

And even the yield on the ten-year German Bund joined in, though it’s still in negative territory, if only just.

(Ten-year Bund yield: three months)

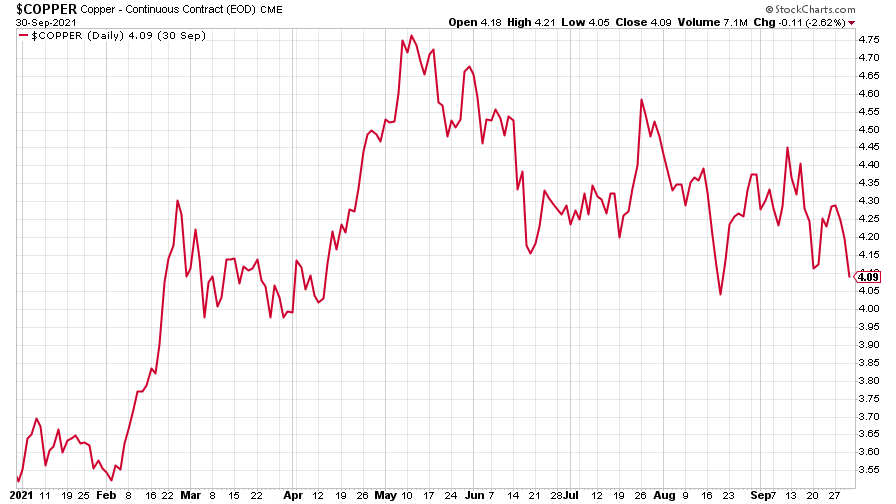

Copper dropped.

(Copper: nine months)

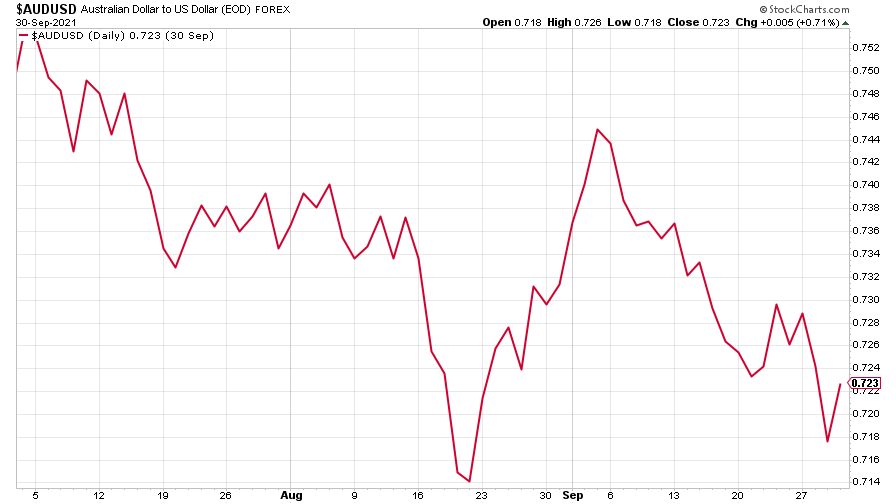

The closely-related Aussie dollar slid against the US dollar.

(Aussie dollar vs US dollar exchange rate: three months)

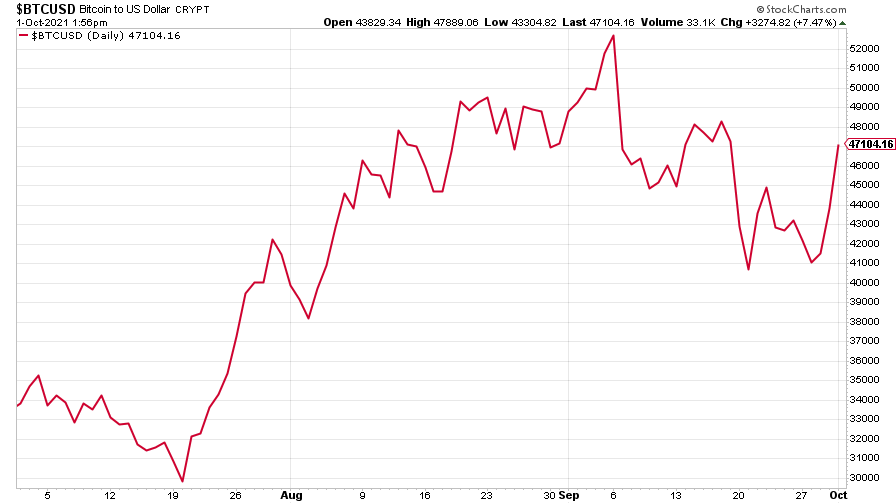

Bitcoin defied China’s total ban on cryptocurrency transactions to register a near-7% rise on the week.

(Bitcoin: three months)

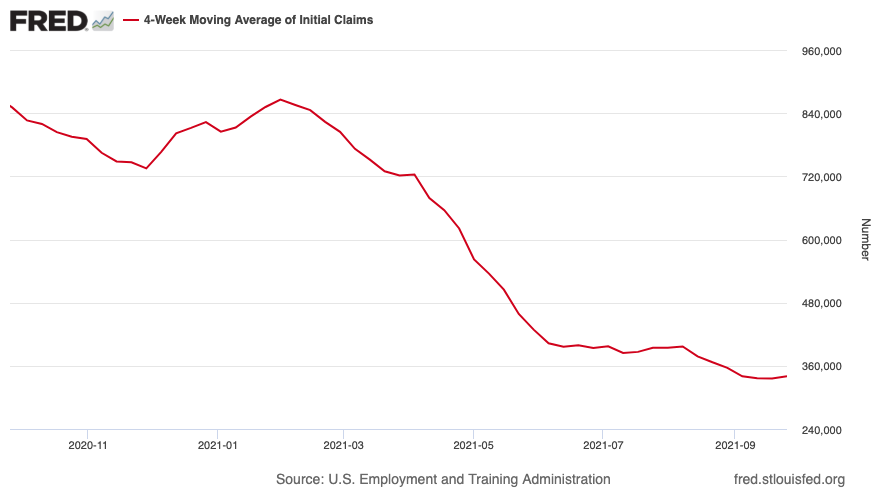

US weekly initial jobless claims rose by 11,000 to 362,000. The four-week moving average rose by 4,250 to 340,000.

(US initial jobless claims, four-week moving average: since Jan 2020)

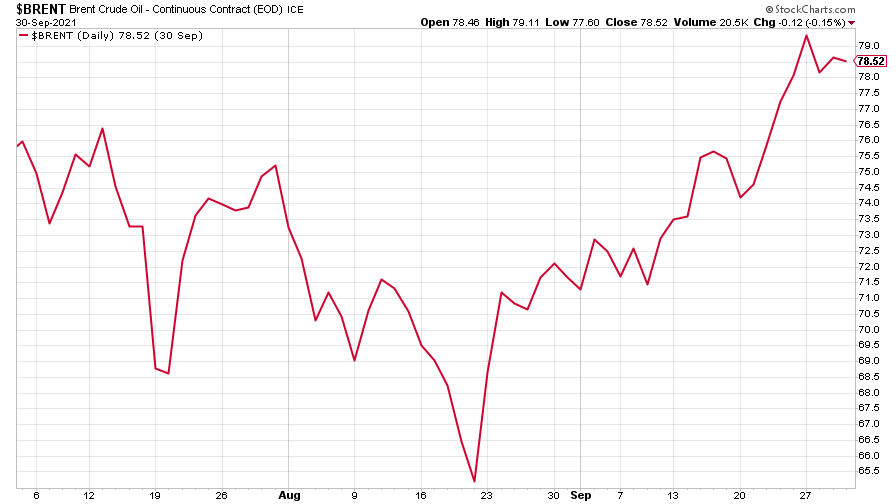

The oil price briefly hit over $80 a barrel – its highest in three years – as energy prices continued to dominate the headlines.

(Brent crude oil: three months)

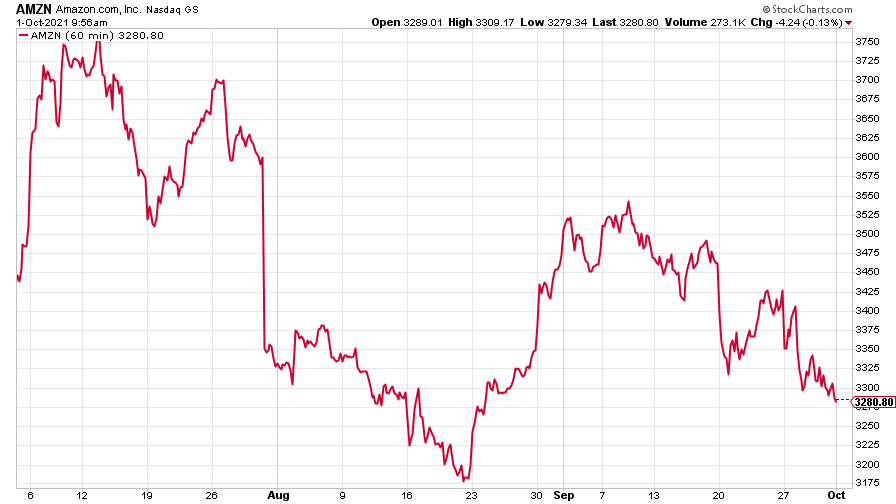

Amazon saw its share price slide as wider markets fell.

(Amazon: three months)

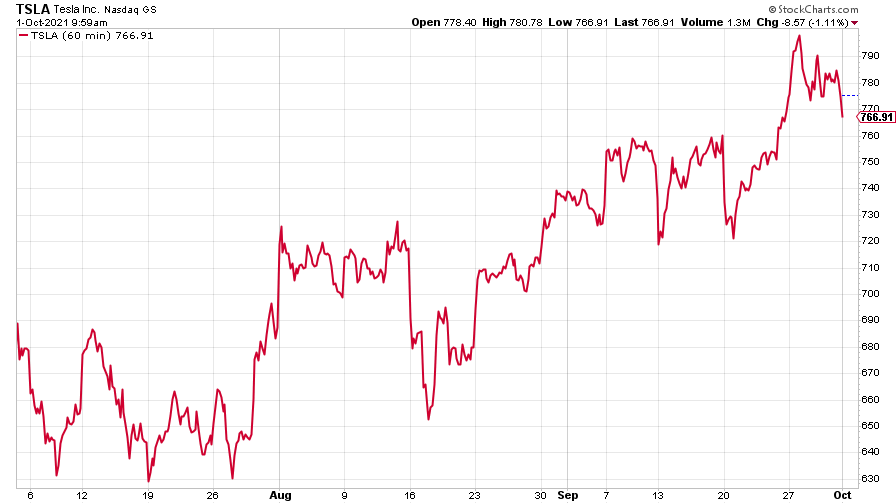

Tesla, however, had another remarkably good week.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.