The charts that matter: markets cheer Powell’s inaction

Markets were holding their breath for most of the week ahead of the Fed's Jackson Hole Symposium but in the end they cheered Chair Jay Powell's inaction. Here’s what’s happened to the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

In this week’s magazine, we explore the investment opportunities in outsourcing. The sector has seen more than its fair share of blunder and scandal, to the benefit of neither shareholders nor voters – and yet slow but steady improvements mean now may be the time to invest, says Jonathan Compton. Find out what he has to say in this week’s magazine – if you’re not already a subscriber, sign up for MoneyWeek magazine now.

This week’s “Too Embarrassed To Ask” video looks at metaverse. The term “metaverse” sounds like something out of a science fiction novel (and it is). But what does it actually mean (it’s not just crypto though that’s involved)? Find out here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And in the podcast this week, Merryn and John talk about what lies behind the shortages we’re facing in everything from chicken to microchips – is this really a once-in-a-lifetime disaster, or is it just because we’re suddenly paying a lot more attention to how the supply chain works? We also look at why now might be a good time to follow private equity into the UK. Find out what they have to say here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: What income investors should learn from the Covid-19 pandemic

- Tuesday Money Morning: What PayPal’s foray into cryptocurrencies means for your money

- Wednesday Money Morning: Boom, bust - what's next for bitcoin?

- Thursday Money Morning: The UK is cheap - you should invest some of your money there.

- Friday Money Morning: Will Jerome Powell lay out a tapering timetable today? Probably not

Now for the charts of the week. The big event turned out to be a more dovish-than-expected speech from Jerome Powell at Jackson Hole, last thing on Friday.

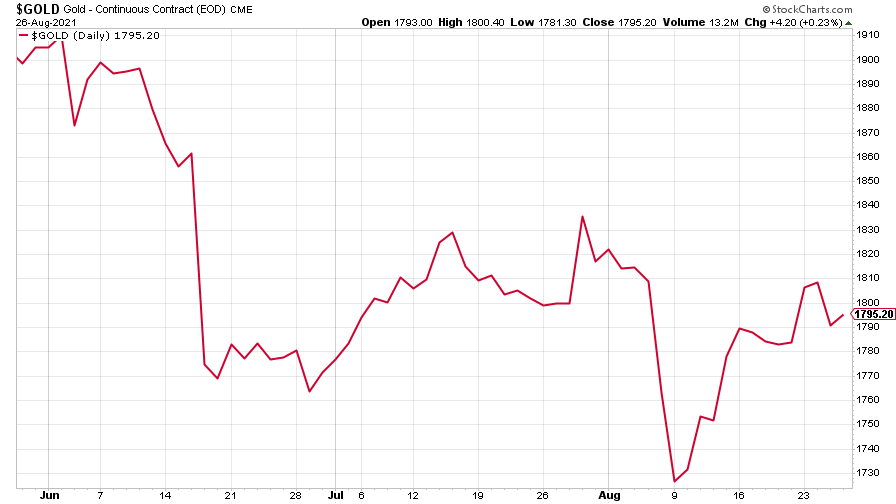

Gold rose this week as investors bet that rising Covid-19 cases could deter the US Federal Reserve from announcing taper plans at the Jackson Hole Symposium – which, as it turns out, is what happened.

(Gold: three months)

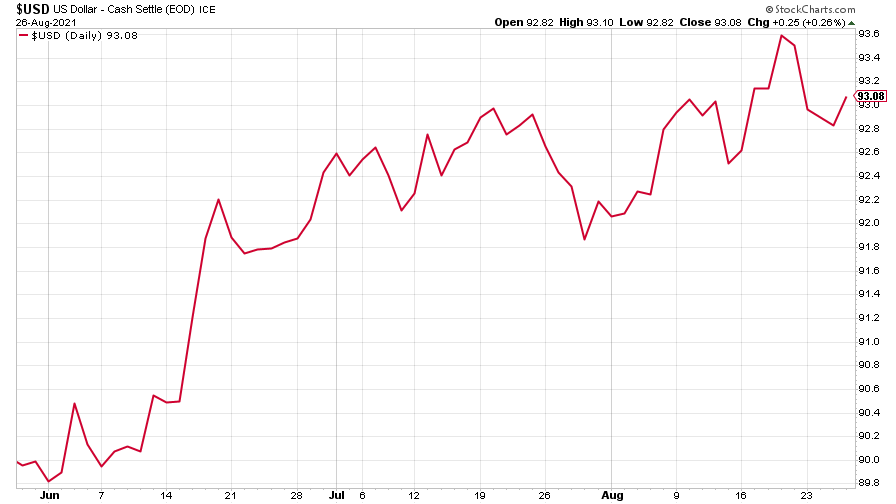

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) rose ahead of Powell���s speech but lost ground in its wake as Powell noted that interest rates weren’t likely to rise in anything like the near future.

(DXY: three months)

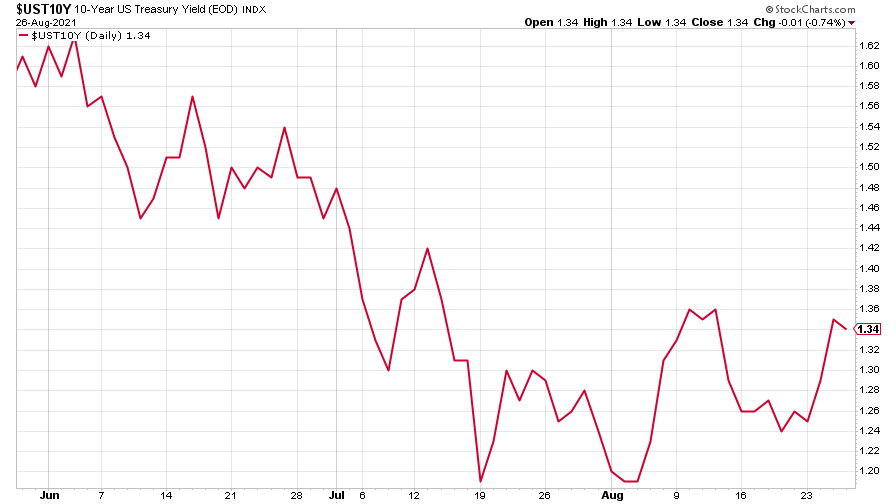

The yield on the ten-year US government bond was higher ahead of the speech (yields move inversely to the price of bonds).

(Ten-year US Treasury yield: three months)

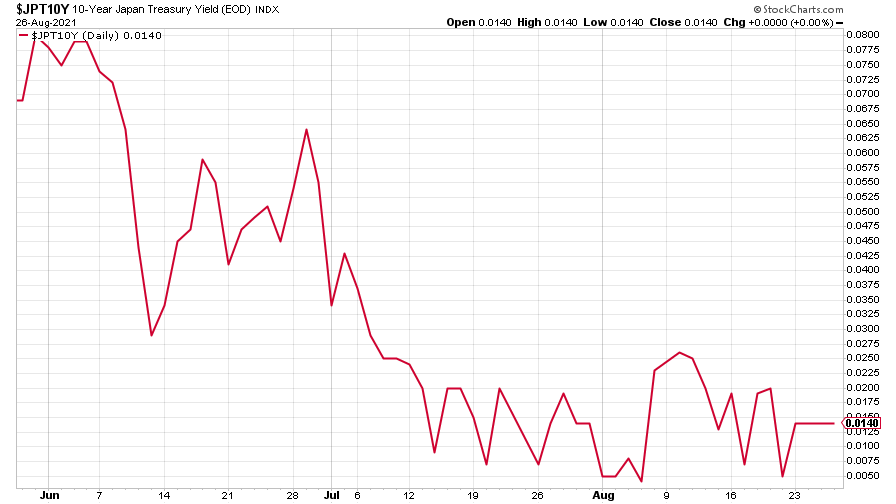

The yield on the Japanese ten-year bond also rose a little ahead of Jackson Hole.

(Ten-year Japanese government bond yield: three months)

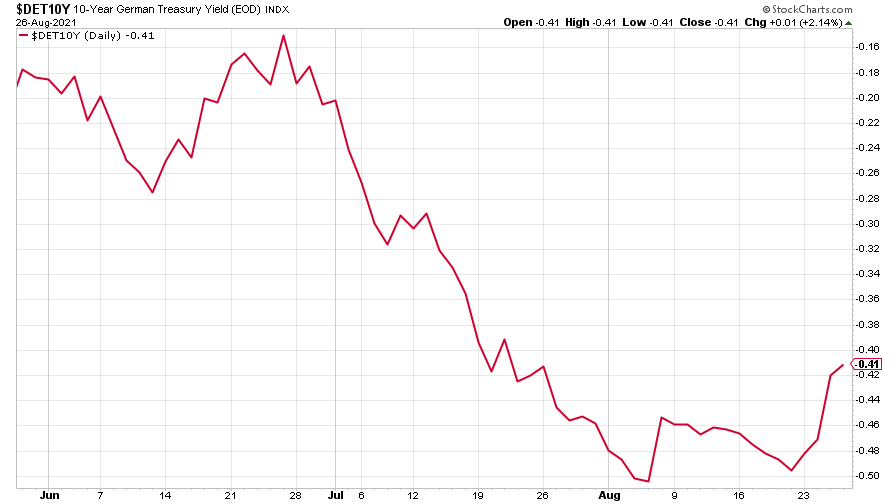

And the yield on the ten-year German Bund followed the direction of US bonds.

Ten-year Bund yield: three months)

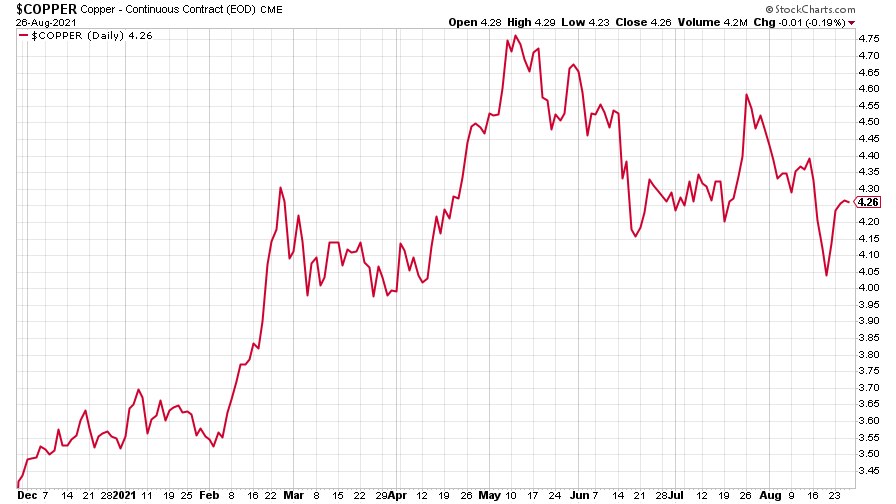

Copper prices were steady ahead of the Fed's symposium and then jumped higher as the dollar fell back on Powell’s relaxed tone.

(Copper: nine months)

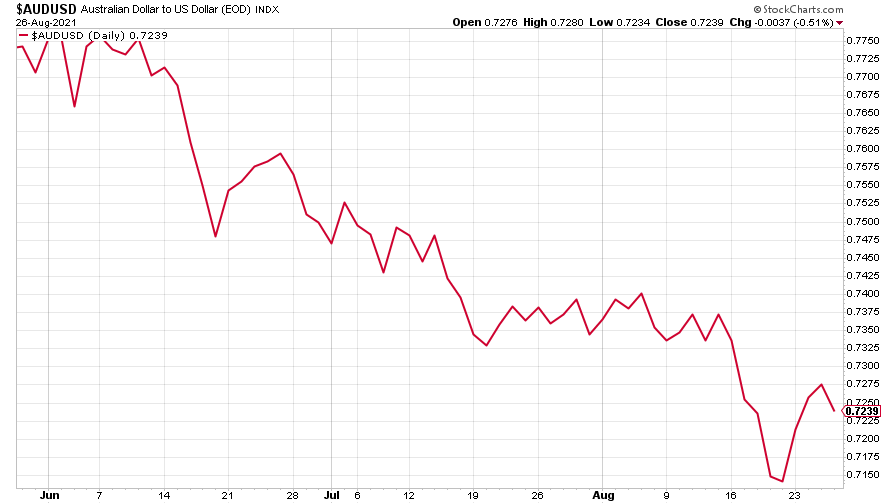

The closely-related Aussie dollar rose over the course of the week.

(Aussie dollar vs US dollar exchange rate: three months)

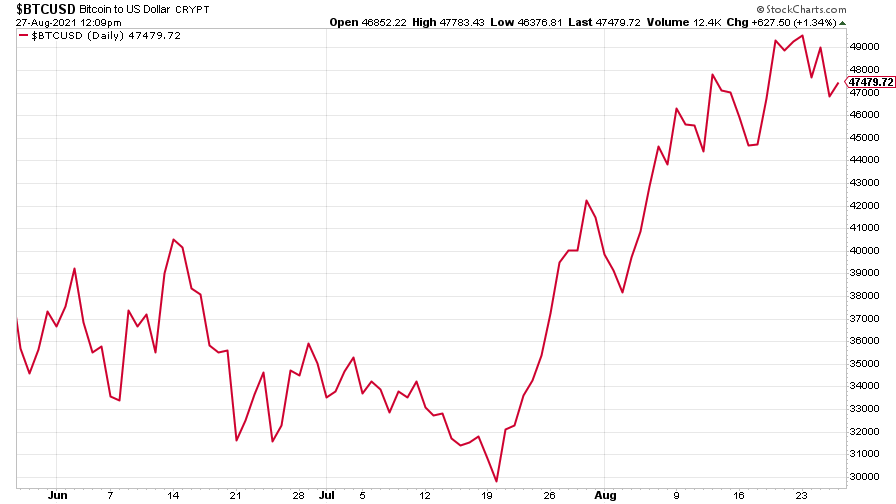

Bitcoin rose a little after the crypto market received a boost on news that PayPal, one of the world's largest payment processors, is allowing UK account holders to buy and sell crypto.

(Bitcoin: three months)

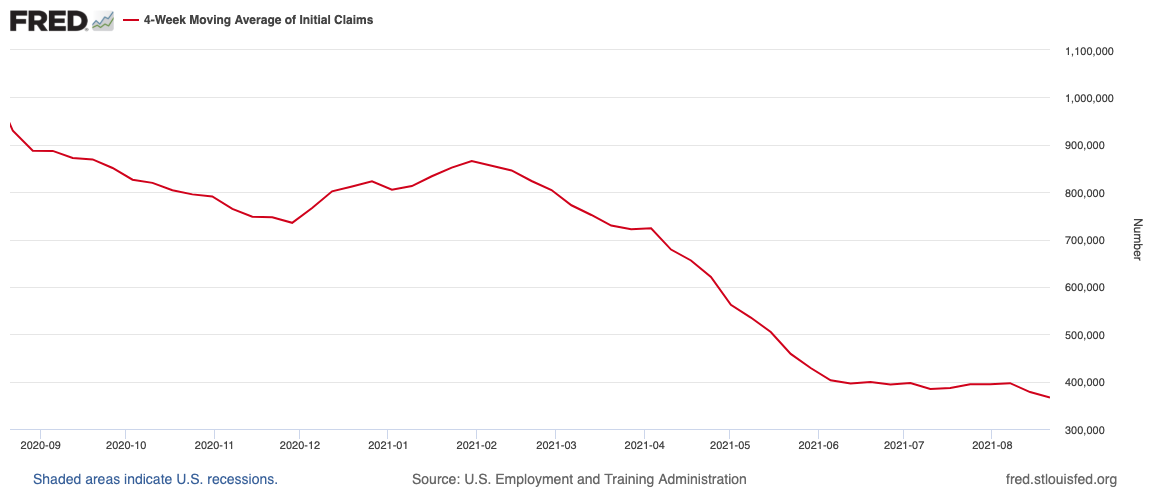

US weekly initial jobless claims' 4-week moving average was 366,500, a decrease of 11,500 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500

(US initial jobless claims, four-week moving average: since Jan 2020)

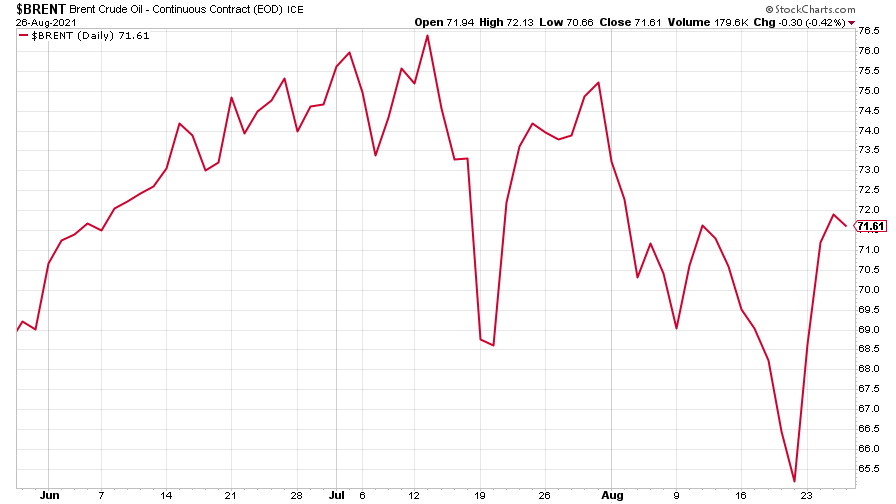

The oil price rose for most of the week after US government data indicated fuel demand shot up to its highest level since before the pandemic began.

(Brent crude oil: three months)

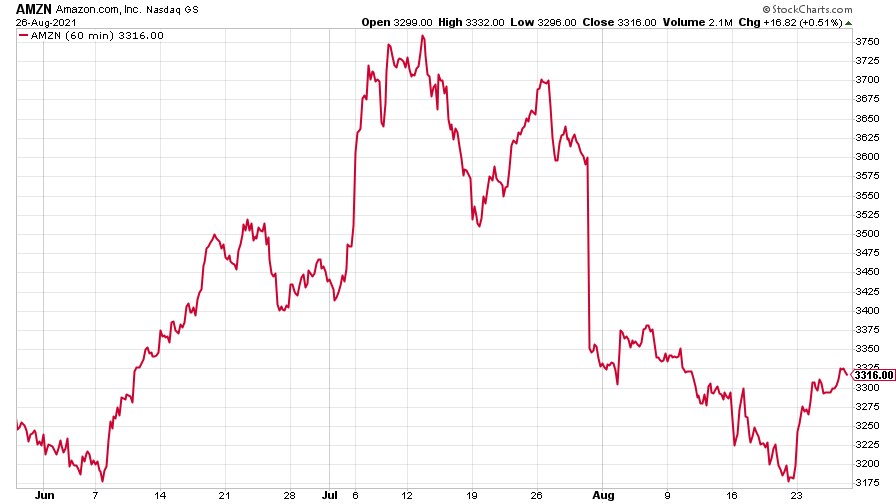

Amazon rose on the previous week, slightly reversing the recent decline.

(Amazon: three months)

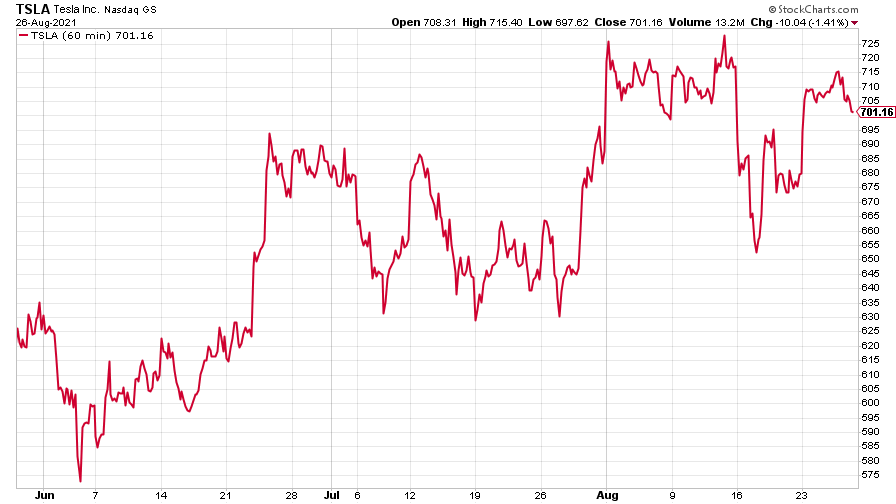

And Tesla remained volatile, ending the week little changed.

(Tesla: three months)

Have a great weekend. There won’t be a Money Morning on Bank Holiday Monday but we’ll be back on Tuesday.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Saloni is a web writer for MoneyWeek focusing on personal finance and global financial markets. Her work has appeared in FTAdviser (part of the Financial Times), Business Insider and City A.M, among other publications. She holds a masters in international journalism from City, University of London.

Follow her on Twitter at @sardana_saloni

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?