Camellia: an unusual tea producer that rewards patient investors

Camellia is shedding its eclectically diverse portfolio of assets to concentrate on its strengths. For investors willing to embrace its quirks, it offers a rare opportunity

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Camellia (Aim: CAM) is an unusual business, often flying under the radar as a throwback to a bygone age. This British holding company, incorporated in 1889, once boasted a sprawling empire. Now, it’s streamlining into a focused agricultural player with a clear strategy, substantial cash reserves, and still trading below its book value. For investors willing to embrace its quirks, Camellia offers a rare opportunity: a modernising business with a robust balance sheet, actively working to close the gap between its market price and intrinsic worth.

Camellia has a storied past

Camellia has a history that stretches back to the Victorian era and the British Empire. But much of its greatest expansion occurred between the 1960s and 1980s when it grew into the world’s largest private producer of teas. Today, it employs more than 78,000 people across its global estates that produce a variety of agricultural products. Tea accounts for roughly 80% of group turnover, complemented by other crops, such as avocados and blueberries.

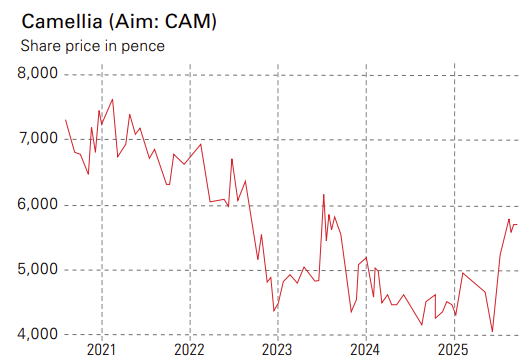

Beyond agriculture, Camellia’s past was eclectic, encompassing private banking, a Bermuda-based insurance company, small engineering companies and an extensive collection of fine art, manuscripts and stamps. Its former headquarters, Linton Park in Kent, bears little resemblance to a corporate office, having once been a stately home, which has been on the market since 2022. This sprawling, diversified portfolio diluted focus, and management struggled to translate its assets into shareholder value. By the early 2020s, the share price was languishing, trading around 4,000p, well below its book value, which included both cash and tangible assets.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Camellia's global footprint

Camellia’s tea operations are vast and geographically diverse, reflecting its long history in the industry. It owns some of the world’s most iconic tea estates, spanning more than 34,000 hectares of mature tea plantations. Its operations are spread across two continents. In India, its estates produce both whole leaf and CTC black teas and include renowned Darjeeling gardens such as Castleton, Margaret’s Hope and Badamtam. Neighbouring Bangladesh is another key tea-producing region for the group. In Africa, the firm has a large presence in Kenya and Malawi. This global spread helps mitigate regional risks, such as adverse weather and political instability.

Camellia's modern overhaul

In recent years, Camellia has embarked on a determined modernisation programme, formalised in its “value enhancement plan” (VEP). The company is shedding non-core assets to focus on sustainable agriculture. This transformation began with the disposal of its art and stamp collections. It moved to a regular business park to offload its property portfolio, including Linton Park.

The most significant divestment was the agreement to sell its 37% stake in insurance group BF&M for $100 million (£75 million), strengthening the balance sheet significantly. These moves have left Camellia with net cash and liquid investments exceeding £100 million. The aim is to improve operating results, reduce risk through diversification and invest in agricultural growth opportunities.

Despite these efforts, Camellia’s share price remains stubbornly low, trading at a fraction of its book value. This discount is partly because of broader challenges in the Aim market and the company’s complex structure – the Camellia Foundation charity, for example, is the majority shareholder, which previously owned 52% of the common equity.

Yet management is committed to closing this valuation gap. The VEP is specifically designed to generate value and sustainable profitability, including a restarted dividend and a return of £18.9 million to shareholders by acquiring up to 350,000 shares at £54 per share. The Camellia Foundation did not tender any of its shares and consequently has seen its ownership of the business rise to almost 60%, entrenching the minority status of the remaining shareholders.

Risks and rewards

Camellia faces inherent risks. The tea market is volatile, swayed by weather, labour issues and global supply chains. A 2020 lawsuit alleging human rights abuses by its Kakuzi division, settled for £4.6 million, highlighted emerging-market reputational risks. Currency fluctuations and political instability in Bangladesh and Malawi also pose challenges. Furthermore, its unusual ownership structure, tied to the Camellia Foundation, raises questions about governance.

However, these risks are arguably priced into the current valuation. The VEP actively aims to mitigate operational and climate-related challenges. With a considerable cash position and management executing a formal value-creation plan, Camellia offers a compelling risk-reward profile. This cash pile provides flexibility for investments in high-margin crops and efficiency projects (such as solar and mechanisation), alongside direct shareholder returns. The decentralised model fosters resilience, allowing subsidiaries to adapt swiftly to local challenges.

Camellia is a rare opportunity for patient investors. Management’s explicit commitment to narrowing the valuation gap, combined with exposure to growing markets for tea and speciality crops, makes it an intriguing prospect. Camellia promises outsized returns as its modernisation strategy bears fruit.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jamie is an analyst and former fund manager. He writes about companies for MoneyWeek and consults on investments to professional investors.

-

Can US small caps survive the software selloff?

Can US small caps survive the software selloff?US stocks have made their worst start to a year since 1995 relative to a global benchmark. But experts think some sectors of the market are still worth buying.

-

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of Kefalonia

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of KefaloniaTravel Eliamos Villas Hotel & Spa on the Greek island of Kefalonia is a restful sanctuary for the mind, body and soul

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton