LVMH is set to prosper as the wealthy start shopping again

After two years of uncertainty, the outlook for LVMH is starting to improve. Is now a good time to add the luxury-goods purveyor to your portfolio?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

During the pandemic, profits across the global luxury sector jumped as consumers, unable to spend their disposable income elsewhere, splashed out on high-end purchases. This pulled forward a lot of demand, and over the following years, sales flagged. The S&P Global Luxury index of the 80 largest publicly traded companies engaged in the production or distribution of luxury goods jumped 65% between the beginning of 2020 and the end of 2022. From January 2023 to today, it’s added just 2% excluding dividends.

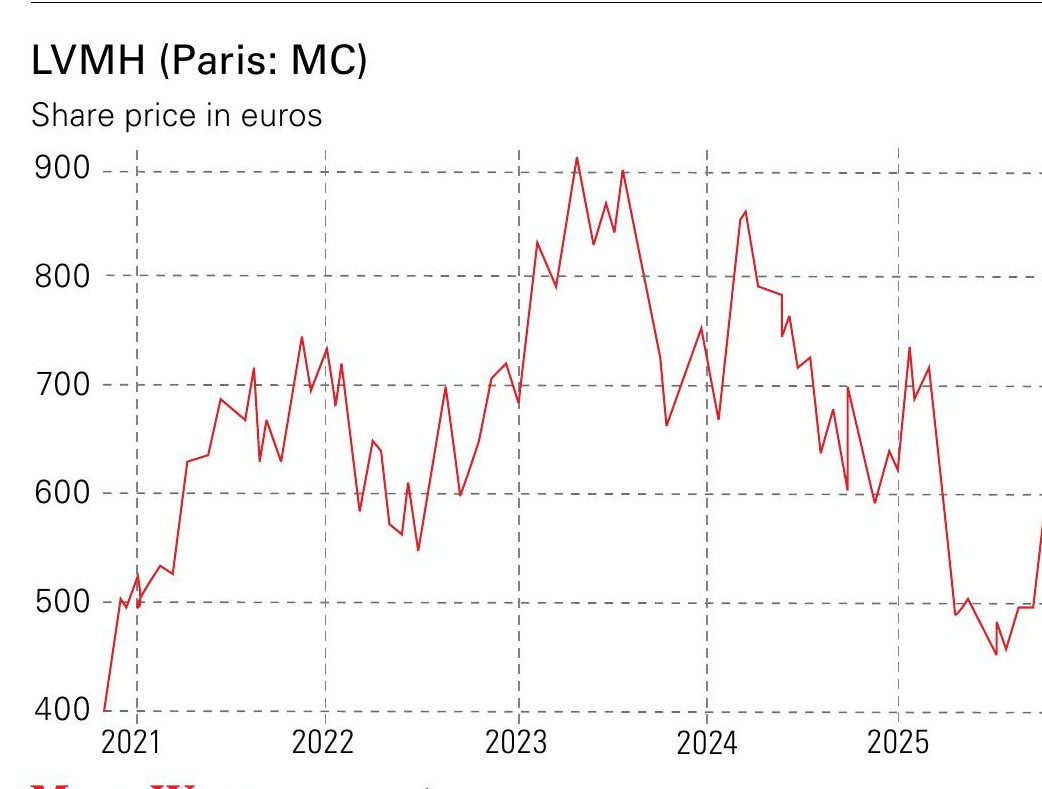

LVMH (Paris: MC), the world’s largest luxury-goods group, managed to buck the trend until mid-2023, when industry headwinds finally started to affect the group. Revenue fell 2% in 2024 and net income slumped 17%. The decline continued in the first half of 2025. Revenue declined 4% in the first six months of the year and net income fell 22%. However, there are signs that the worst of the slump is coming to an end – and the world’s largest luxury group is ideally placed to ride the recovery.

The tide turns for LVMH

For the third quarter, LVMH reported group sales of €18.3 billion, down 4% year-on-year, but 0.6% ahead of analysts’ consensus. Growth returned in the US market and Asia ex-Japan. Japanese sales declined 13%, but were stronger than the previous decline of 28%. European sales fell 2%, faster than the 1% recorded in the second quarter. One of the most interesting spots was China. Mainland China returned to positive growth in the quarter with management flagging the success of The Louis, a ship-shaped Louis Vuitton store, cafe and exhibition in Shanghai. Local Chinese consumption grew by mid-to high-single digits; Chinese tourists’ spending improved, but remained down by double digits.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

LVMH’s results confirm that some level of stability has returned to the market and, for the time being at least, consumers’ spending on luxury goods has stabilised. In a recent note on the luxury sector, analysts at JPMorgan concluded that while “trends remain challenging” across Asia, North America is picking up due to “healthy spending among Americans across income groups, supported by strong equity markets and wealth creation”. It’s the high-end American consumer who is set to pick up the slack for the rest of the world.

According to Berenberg research, the “top-quintile” earners in the US are expected to see the largest benefit from Donald Trump’s recent swathe of tax cuts, with a projected 3.4% increase in after-tax income for the richest. The top 0.1% will see an average federal tax saving of $286,440. The spending power of the top 1% will also benefit from the recent equity rally and lower interest rates. High-net-worth households own the majority of US assets, with the top 1% holding 28% of the total.

This trend was apparent in the results of LVMH’s peer Hermès (Paris: RMS). The firm is more focused on the top segment of the market than LVMH, which has a more diverse portfolio, but its results showed where the strongest demand is emerging. In the third quarter, sales grew 10% excluding headwinds from foreign exchange, with US sales up 14% and Asian sales 6%. Sales of its bags and watches rose 13% and 9%, respectively; perfume sales fell 7%.

LVMH’s fashion and leather-goods arm, the group’s largest, which includes brands such as Christian Dior and Givenchy, and makes up around half of sales, was the worst-performing segment in the first nine months of 2025. But the group’s watches and jewellery arm, which includes Tiffany, grew 2% organically year on year.

LVMH’s strength lies in its diversification globally and across product lines. The group’s management structure also aligns with the quality-first approach to luxury retailing. Bernard Arnault took over LVMH in 1989 and he remains the largest shareholder. He’s inserted his family into key management roles and continues to build his stake on weakness. Under Arnault’s stewardship, LVMH has prioritised investment in brands over short-term margin protection. Some selective deals have also been explored. The latest rumours are around a sale of its 50% stake in Fenty Beauty, which it co-owns with Grammy Award winner Rihanna. Fenty Beauty, which generated around $450 million of net sales in 2024, could be valued at between $1 billion and $2 billion.

Should you add some luxury to your portfolio?

The market is also waiting to see if LVMH makes a bid for Armani. Giorgio Armani’s will named LVMH as a preferred buyer for a minority stake in Armani (along with EssilorLuxottica and L’Oréal) and the deal would make a good fit for the luxury giant. Berenberg has estimated the business could be worth as much as €5 billion-€7 billion, easily affordable for LVMH, and it would boost the group’s exposure to the affordable-luxury market. There could also be scope for the group to improve Armani’s profitability and margins through its economies of scale and its existing distribution networks.

Analysts have thrown their weight behind LVMH in recent months. UBS has upgraded the stock to “buy” and said “we believe that the self-help measures introduced… combined with strict cost management and slowing space expansion, will drive a stabilisation in margins in 2025 and a return of positive… momentum” in earnings per share. Berenberg too has cited self-help measures and stability in key markets as reasons for optimism. As headwinds become tailwinds, it could be time to add some luxury to your portfolio.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems