How Germany became the new sick man of Europe

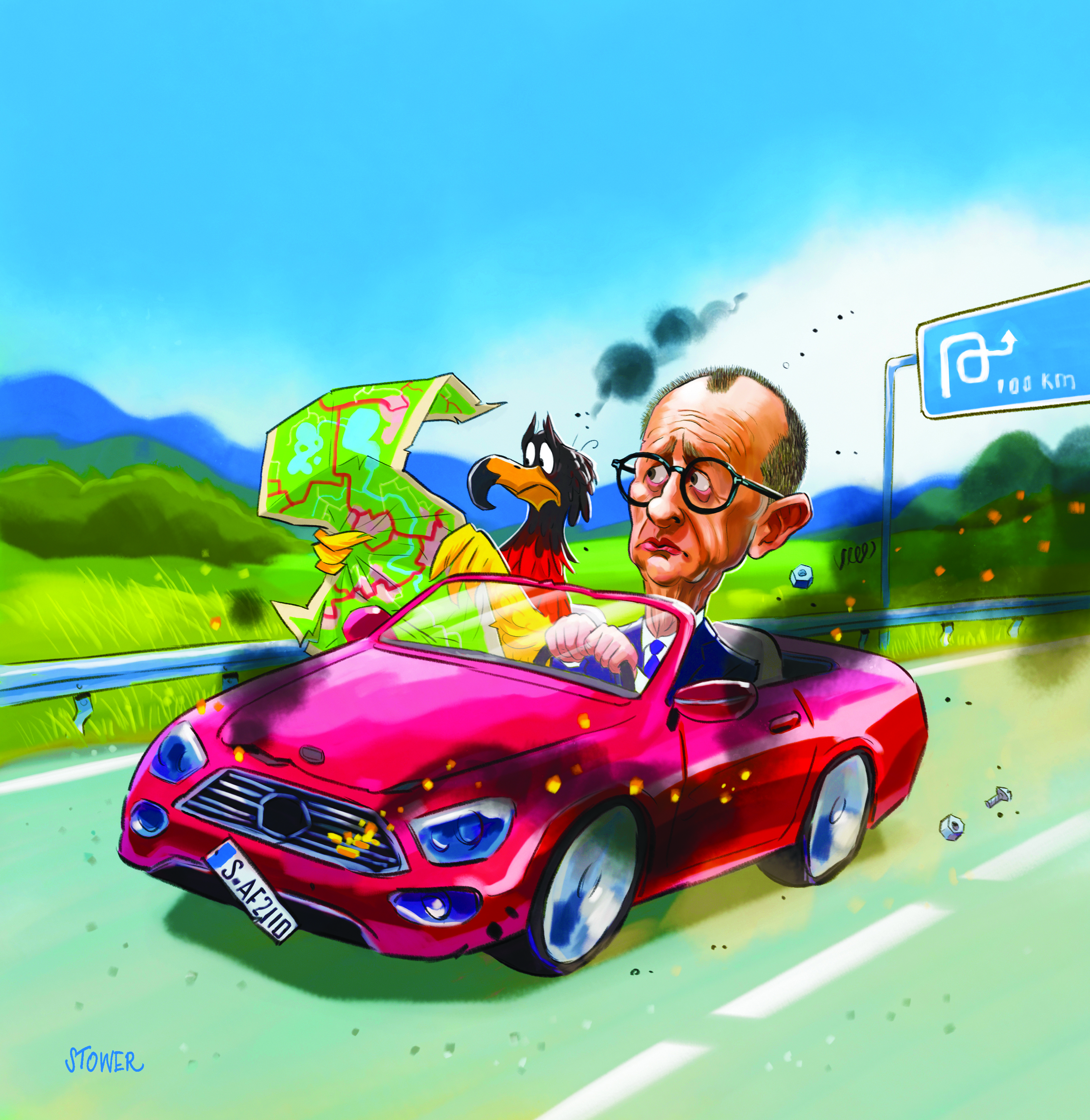

Friedrich Merz, Germany's Keir Starmer, seems unable to tackle the deep-seated economic problems the country is facing. What happens next?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

What’s going on in Germany?

The nation has a newish leader, elected on a wave of muted enthusiasm – or at least a sense that he couldn’t be as bad as the last lot – but who has quickly proved a disappointment in office. His government is looking weaker by the day, and he seems unable to tackle the deep-seated economic problems the country is facing. So yes, that’s Keir Starmer, of the British centre-left. It’s also Friedrich Merz, of the German centre-right. After just six months in power, Merz’s coalition is beset by infighting, policy deadlock and sliding poll ratings. His CDU/CSU bloc (the coalition’s biggest party) hasn’t slumped as dramatically as Labour. But its support has fallen to 25%, a historic low for the nation’s dominant party of government, and it’s now polling behind the far-right AfD. Six months in, fewer than one in five Germans wish to see Merz stand again next time. “There has never been such widespread dissatisfaction with a government in such a short period of time,” says Forsa pollster Manfred Gullner.

Why all the gloom?

Largely, it’s a growing realisation that the government will not be strong enough to tackle Germany’s fundamental economic and fiscal problems. Growth in GDP has been all but flat for three years and there was initial optimism that the Merz government might give it the kick-start it needs. In the spring, Merz (as chancellor-elect) used the outgoing Bundestag to negotiate and push through a historic package of fiscal reforms that partially untethered Germany from its self-imposed constitutional “debt brake”. The brake limits public borrowing to 0.35% of GDP in any given year, but it has now been lifted for infrastructure and defence spending (but not other areas). His government embraced a kind of Keynesianism, creating a €500 billion infrastructure and climate fund, and announced much higher defence spending. There were hopes that this bold stroke might stimulate growth and presage further reform. There are, however, big problems.

What problems is Friedrich Merz's government facing?

Political weakness. It looks increasingly likely that Merz, who turned 70 this month, may well have pushed through his most consequential reform before he even became chancellor. In that outgoing Bundestag, Germany’s centrist parties still had the two-thirds majority needed to amend the constitution. By contrast, Merz’s coalition has a very slim majority, making similarly radical constitutional change highly unlikely. Meanwhile, that coalition is already publicly fracturing on traditional left-right lines. For example, Merz (a fiscal hawk by instinct, despite his debt brake) warns that the country has been “living beyond its means” for years, and the finance ministry has warned of a €172 billion hole in its spending plans for the rest of the decade. Merz is trying to lay the ground for major reforms to pensions and the wider welfare state, which account for 31% of GDP, one of the highest levels in Europe. But Barbel Bas, his SPD (social democrat) labour and social affairs minister, publicly dismissed the chancellor’s recent big speech on the subject as “bullsh*t”. It doesn’t augur well.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What are the other problems?

There are big question marks over whether the spending reforms already passed will drive robust growth. Defence spending is unlikely to do much in the long-term. Infrastructure spending has a greater multiplier effect, but the €500 billion package is not as big as it sounds: it’s spread out over 12 years, and the German press reports that some of the funding earmarked for infrastructure is in fact being diverted to cover day-to-day spending. There is scepticism about the state’s capacity to deploy money swiftly or direct it towards productivity-enhancing projects. Merz’s “autumn of reforms” has also disappointed, consisting of tinkering around the edges of welfare benefits.

What’s the bigger picture for the German economy?

That the economy has been stagnant for the whole of this decade. The country has been battered by geopolitical headwinds: Russia’s war in Ukraine and the energy-price spike, aggressive Chinese competition in traditional German manufacturing sectors – including cars, where China dominates in electric vehicles – and Donald Trump’s trade wars. All these have helped undermine the export-led model that underpinned Germany’s prosperity; manufacturing still accounts for one-fifth of the country’s gross value added. Industrial production is no higher than it was in 2005 and “many of Germany’s economic core strengths have turned into vulnerabilities”, says Marcus Berret of Munich-based consultants Roland Berger. Those include a “large industrial base that is hard to decarbonise, a high dependence on exports at a time when globalisation is under threat, and a mighty vehicle industry having to write off 140 years of internal combustion-engine expertise”. Meanwhile, Germany’s technology and digital sectors remain underwhelming. But the government, like its predecessors, shows few signs of dealing with these issues.

Could Friedrich Merz get a grip?

After shrinking for the past two years, most analysts expect growth to be a miserly 0.2% this year. Stronger growth is forecast in 2026, but projections have become more pessimistic. Last week, Merz’s own team of advisers downgraded their forecast for 2026 growth to below 1%. Businesses’ confidence has slumped and unemployment is rising (to almost three million, its highest rate in 14 years). A couple of years ago, The Economist ruffled feathers in Berlin by dubbing Germany the new “sick man of Europe”, arguing that for years Germany’s outperformance in old industries papered over its lack of investment in new ones. An obsession with fiscal prudence led to too little public investment and investment in digital technologies as a share of GDP is woefully low; less than half that in the US or France. Germany’s reliance on imported energy (70% of the total) and its ageing population make it ill-equipped for the future. Is Merz the man to turn all this round? On the evidence of his first six months, it seems very unlikely.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

How Canada's Mark Carney is taking on Donald Trump

How Canada's Mark Carney is taking on Donald TrumpCanada has been in Donald Trump’s crosshairs ever since he took power and, under PM Mark Carney, is seeking strategies to cope and thrive. How’s he doing?

-

Why it might be time to switch your pension strategy

Why it might be time to switch your pension strategyYour pension strategy may need tweaking – with many pension experts now arguing that 75 should be the pivotal age in your retirement planning.

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn