The charts that matter: the Fed puts the cat right in among investors’ pigeons

With the US Federal Reserve signalling its relaxed attitude to inflation, markets went a little haywire towards the end of this week. Here’s what happened to the charts that matter the most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome back.

The cover of this week’s bumper magazine issue proclaims “FTSE 10,000”. That might sound a little crazy, but Matthew Lynn doesn’t think so – he says the British blue-chip index is “about to get a big boost”. Find out why in this week’s mag. Matthew Partridge takes a long look at the gambling industry, which is currently undergoing a “regulatory and technological revolution” and is growing at a rapid pace – Matthew picks the best bets in the sector.

And it’s our annual ISA issue, too, so we’ve got ten pages of information on everything from Junior Isas to venture capital trusts and Sipps, and why you shouldn’t write off the humble cash Isa yet. Oh – and we’ve updated our model investment trust portfolio, too. If you’re not already a subscriber, sign up now and get your first six mags (plus a beginner’s guide to bitcoin) free.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This week’s “Too Embarrassed To Ask” video explains what the classic “60/40” portfolio is. You can watch the video here.

And in the podcast, Merryn talks to Calum Bruce of the Ediston Property Investment Company about how the commercial property sector – and retail in particular – has coped with Covid lockdowns and how it can evolve to cope with the new, post-Covid landscape. Have a listen to that here.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: It's a big week for the US Federal Reserve – and for markets

- Monday web article: What are NFTs and why are they so popular?

- Merryn’s Blog: If you’re looking for an “ESG” investment, why not try oil stocks?

- Tuesday: “The economics of investing in bonds has become stupid”

- Tuesday web article: What’s behind the meteoric rise in obscure cryptocurrency Cardano?

- Wednesday: The pound is looking promising – against one major currency in particular

- Thursday: How long can the Federal Reserve keep markets happy?

- Thursday web article: The collapse of Football Index: what can investors learn?

- Friday: Oil, bonds and tech stocks tumble – what’s going on?

- Merryn’s blog: We almost ditched this investment trust from our model portfolio. We’re glad we didn’t

Now for the charts of the week.

The charts that matter

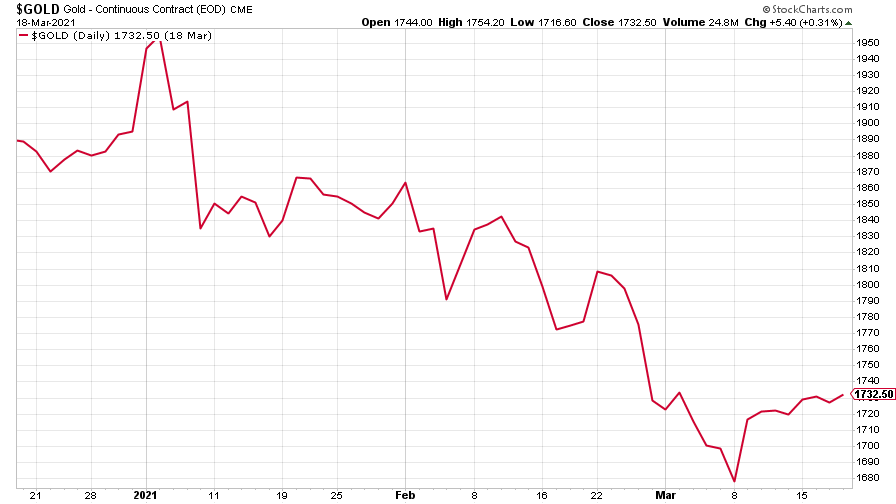

Gold continues to meander along, picking up slightly from its recent lows, seemingly oblivious to all that’s going on in the world around it.

(Gold: three months)

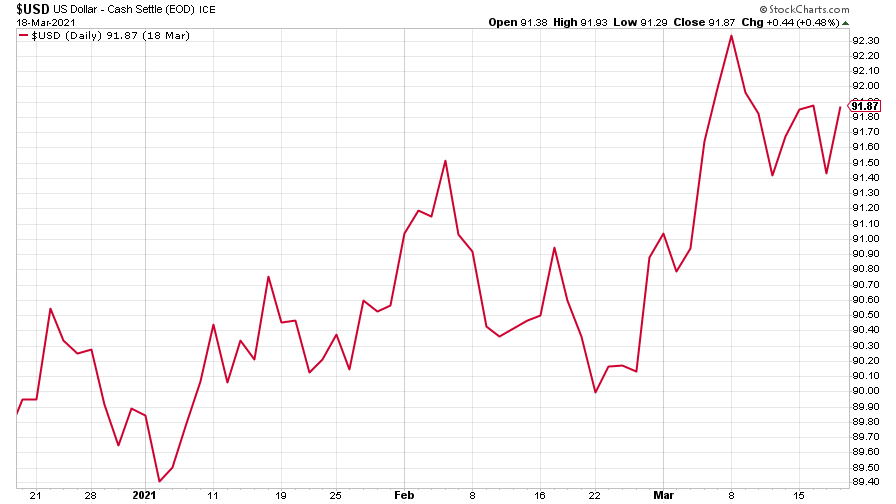

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) is having a rather volatile time of things, dipping after the Fed’s Jerome Powell said interest rates would be going nowhere, but rallying since.

(DXY: three months)

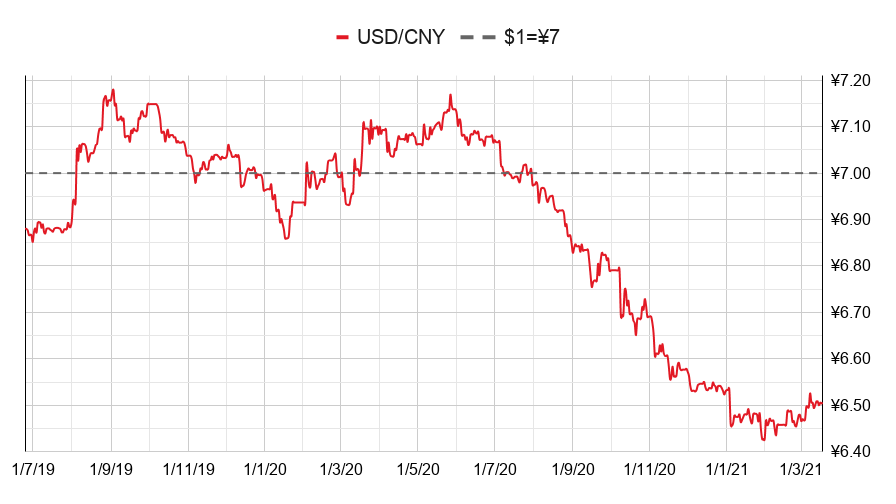

The Chinese yuan (or renminbi) continued its drift upwards against the dollar (when the red line is falling, the yuan is strengthening).

(Chinese yuan to the US dollar: since 25 Jun 2019)

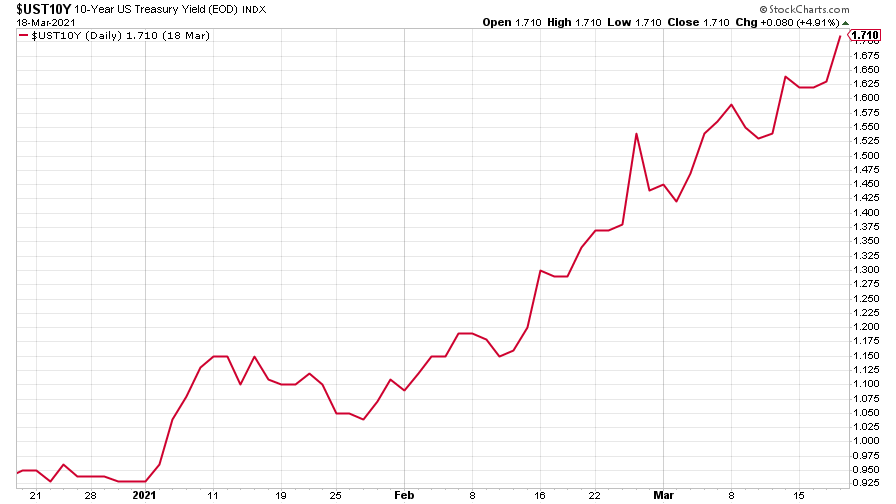

The yield on the ten-year US government bond was back on the rise, reacting to Jerome Powell’s pronouncements in the week.

(Ten-year US Treasury yield: three months)

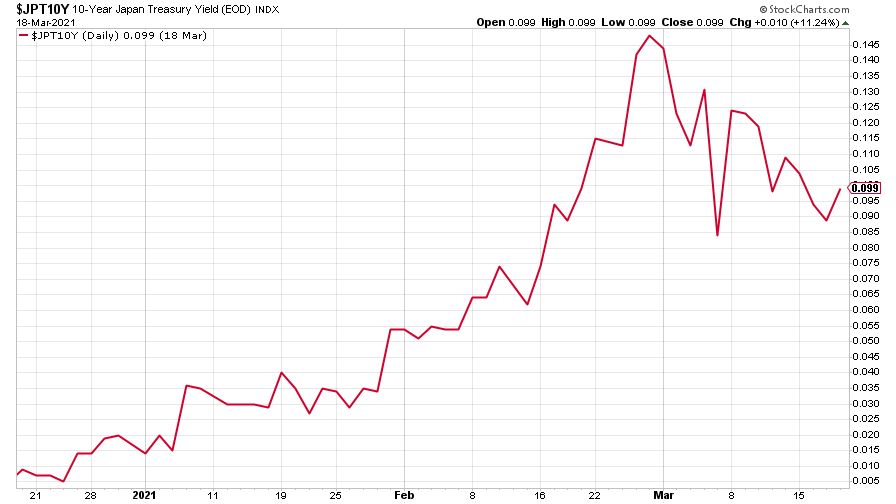

The yield on the Japanese ten-year bond bounced a little.

(Ten-year Japanese government bond yield: three months)

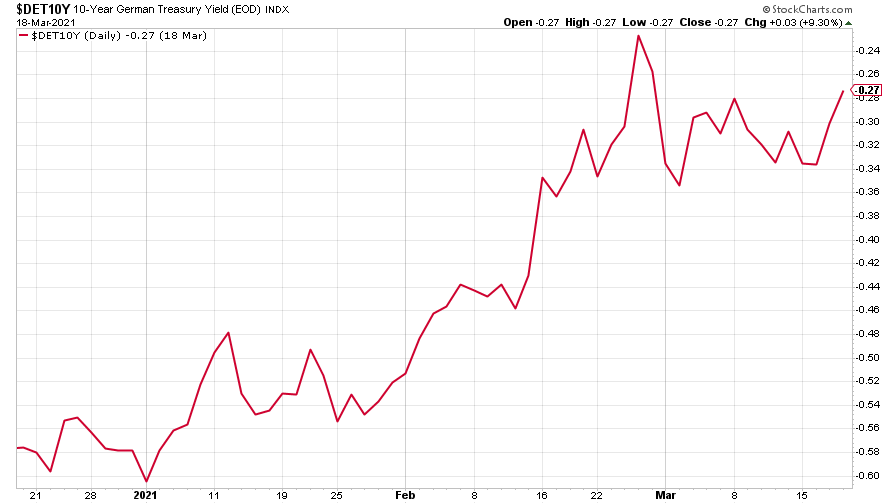

And the yield on the ten-year German Bund was back on the rise, too.

(Ten-year Bund yield: three months)

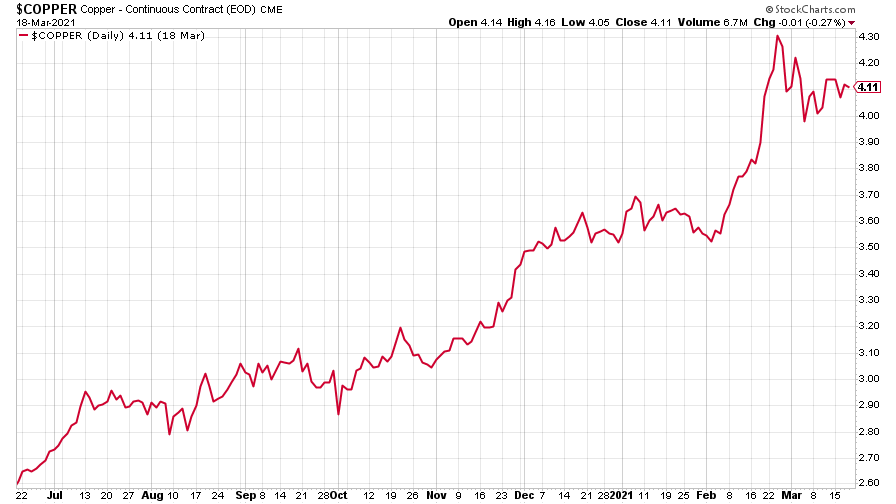

Copper continued to consolidate after its recent big drop.

(Copper: nine months)

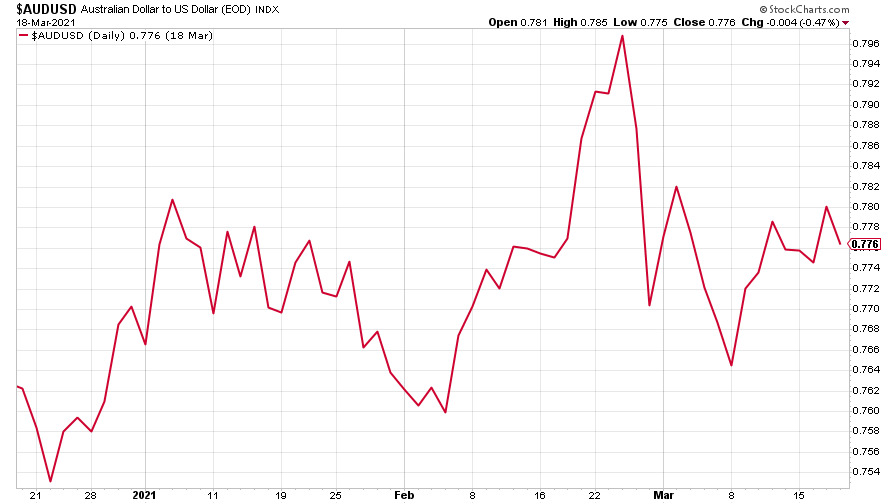

The Aussie dollar traded in sympathy with the copper price.

(Aussie dollar vs US dollar exchange rate: three months)

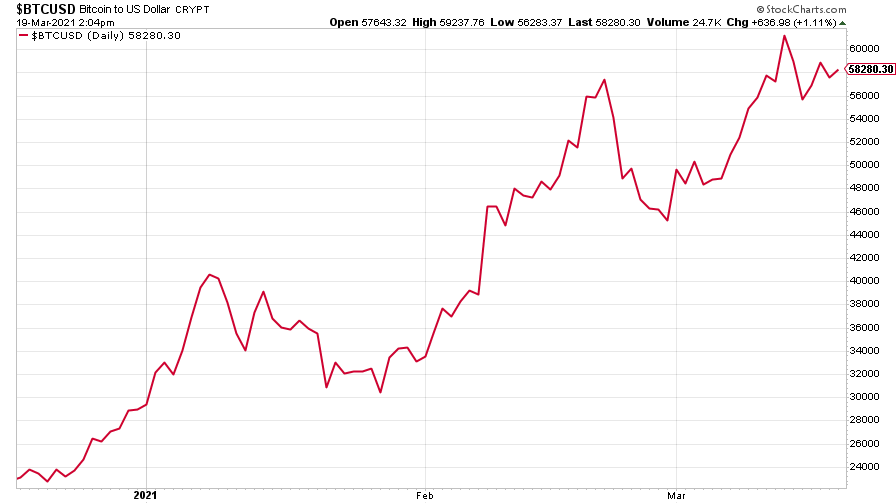

Cryptocurrency bitcoin had a little scare, but continues its seemingly unstoppable climb higher –though it remains just off its recent $60,000-plus high.

(Bitcoin: three months)

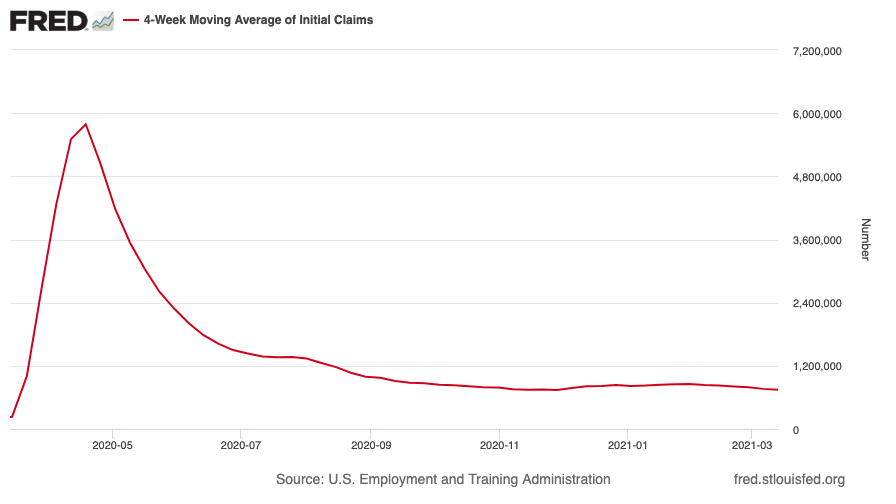

US weekly jobless claims rose by 45,000 to 770,000, compared to 725,000 last week (revised up from 712,000). The four-week moving average fell to 746,250 from 762,250 (which was revised up from 759,000) the week before.

(US jobless claims, four-week moving average: since Jan 2020)

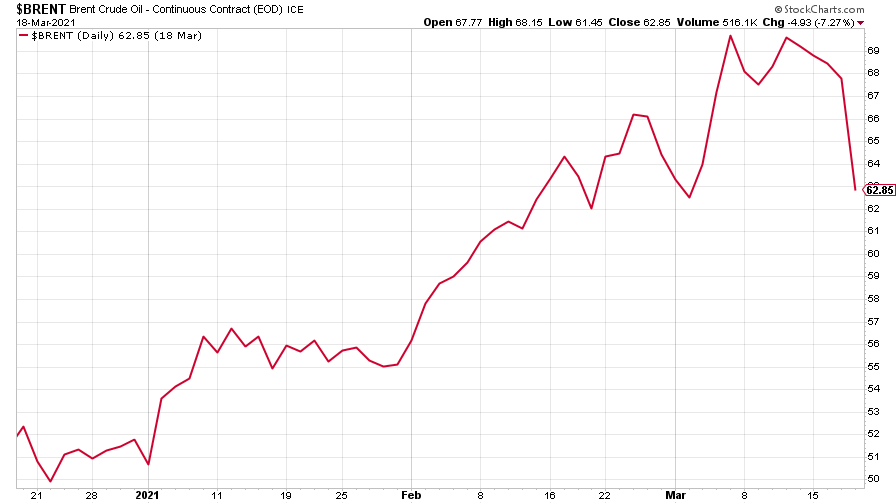

The oil price (as measured by Brent crude) took a big hit.

(Brent crude oil: three months)

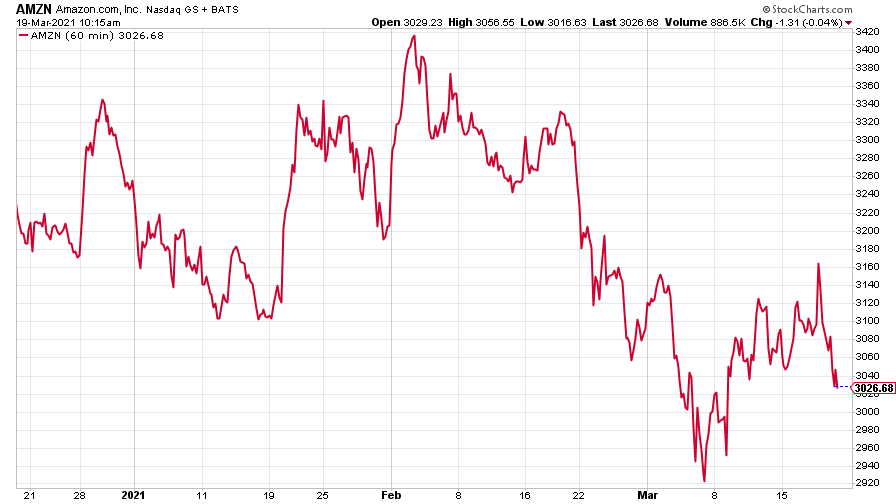

Amazon –along with the wider tech-heavy Nasdaq index –sold off heavily too after the Fed signalled its indifference to rising inflation, something that bodes ill for the growth stock boom.

(Amazon: three months)

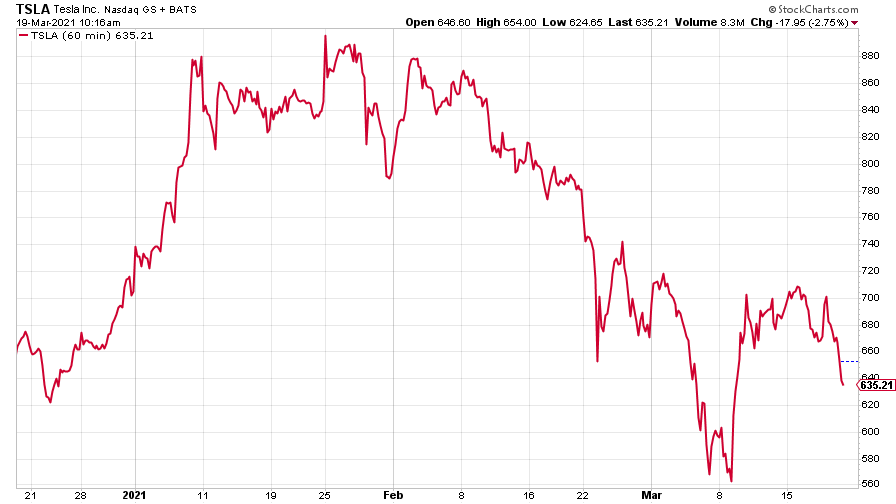

Tesla joined in the general tech-induced panic, too.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.