The pound is looking promising – against one major currency in particular

The pound is having a good year against the dollar and the euro. But it is against the Japanese yen where things look most promising. And this trend could go on for years, says Dominic Frisby.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I haven’t covered sterling for a while – partly because I don’t want to jinx it – but I can ignore it no longer. Today we look at the British pound. It is having a good year.

We will start with its performance against the dollar and the euro. But it is the pound against the Japanese yen that I am really interested in. I’ve been studying the price action since the 1990s, and there is quite an exciting observation that I would like to share with you.

The pound has had a solid run, and it looks set to continue

The standard benchmark by which we look at the pound is “cable” – the pound versus the US dollar – so-called after the first transatlantic cables were laid under the Atlantic in the 1860s, enabling the London and New York exchanges to reliably and quickly relay currency prices (one tends to forget the role that communication technology has played in the evolution of money).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Having begun 2021 at $1.35, cable hit a high of $1.42 late last month. But dollar strength of late has seen the pound slide back to $1.39. This is a bull market that began last March, and the recent action seems to be a fairly standard pullback from overbought levels. Historically however, that zone – a couple of cents either side of $1.40 – has been a pivot point of support and resistance, and it will probably be so again.

The pound has had a rip-roaring start to the year against the euro as well, going from €1.10 in January, to touching €1.17 this morning. Longer-term the bull market is not so clear cut, but I would hope to see this above €1.20 later in 2021, with all the usual forecast volatility along the way.

One issue I have with cable however, and to an extent the pound-euro exchange rate, is that forex (foreign exchange) pricing is greatly influenced by the actions taken by the central bank of the larger economic bloc. Utterances by the US Federal Reserve can have a greater effect on the cable price than utterances by the Bank of England. It’s not always the case, of course, but often.

As a result I have a fondness for pairs where relative GDP is closer. That brings me to the pound versus the Japanese yen.

The pound could rise much further against the Japanese yen

Though not so dissimilar in terms of landmass, Japan’s population is roughly twice that of the UK (126 million compared to 63 million) and its GDP is around $5trn, when the UK’s is closer to $3trn. Nevertheless, it will do.

Despite the daily and weekly volatility of forex, in the longer term you will often see broader trends that can go on for many years – ride these and you can make a lot of money. This is very much the case for the pound against the yen.

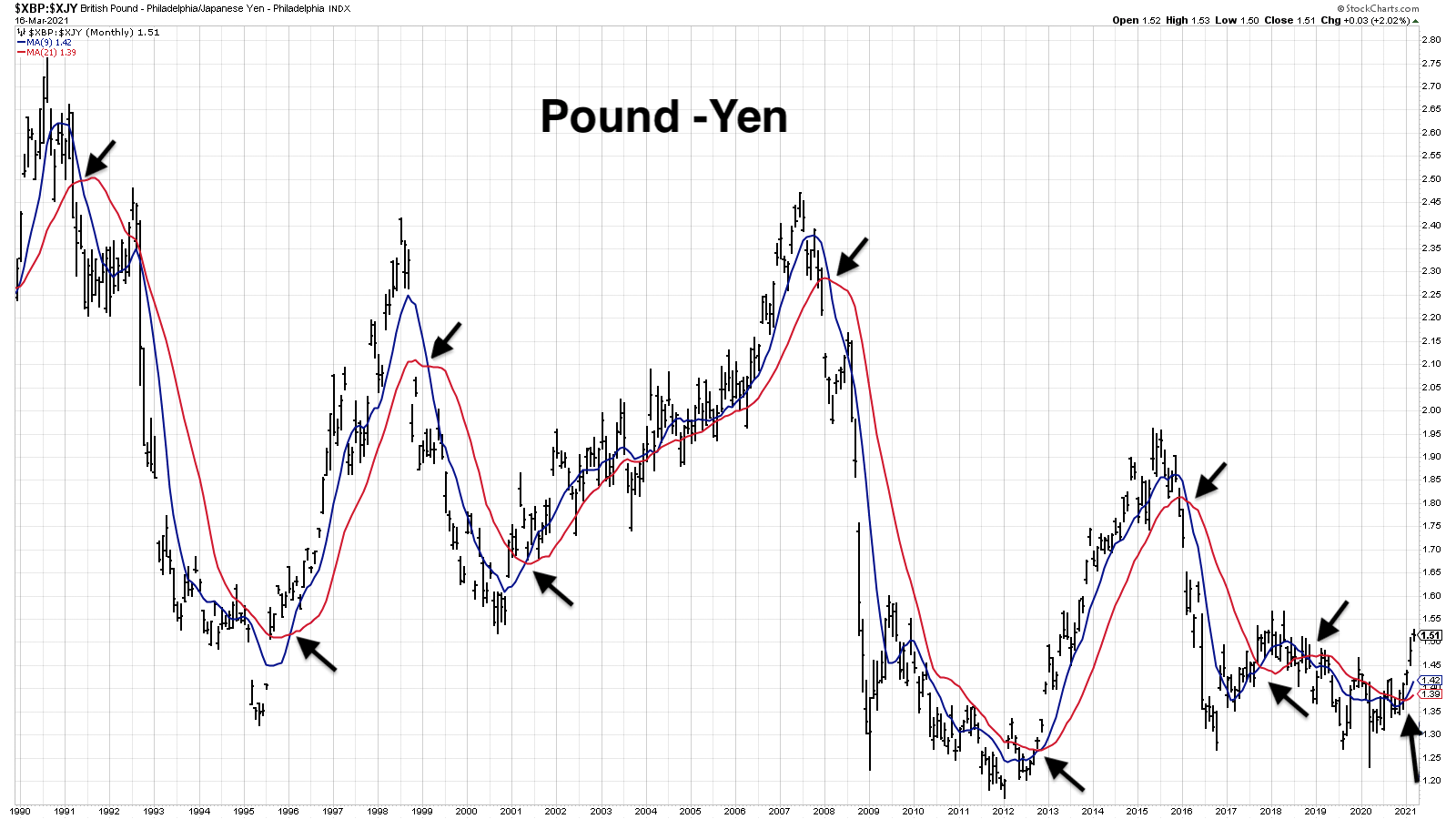

Below I have posted a monthly pound-yen chart which goes back to 1990. In addition to the price in black, I have plotted the nine and 21-month moving averages in blue and red. These strip out the volatility and show you the broader trend.

You can read about my moving average crosses system here. This is a simple trend-following system that removes the need for any kind of fundamental analysis. In fact, the less knowledge you have about the underlying markets, the better the system works. Your only care is the direction in which a market is trending.

The longer-term changes in trend can be marked by the moving average crosses – when the shorter-term moving average (in this case the nine-week) crosses through the longer-term MA. I have marked these changes in trend with black arrows. You can see that there have been only ten of these major trend changes since 1990 – on average, one every three years in other words. The pound-yen pair can trend for many years in one direction or the other.

From 1990 to 1996 the direction was down. From 96 to 98 it was up. The next three years were down. The bull market from 2000 to 2007 lasted seven years, then we got five years of bear market that took us to 2012. These are long, tradable cycles which mean you don’t have to get involved in daily noise. The four years from 2012 to 2016 saw another bear market. Two years of bull market followed, from 2016 to 2018, and two years of bear market from 2018 to 2020.

These signals are lagging indicators. They don’t mean “run out and buy as soon as you read this”. But they do serve to show you where we are in the grand scheme of things. Until 2016, these signals only occurred once every several years.

The point I want to make is that late in 2020 we got another of these crosses, marking another change in trend from bear to bull market. Look at the past and at how long these cycles can go on for, and you start to get quite excited about the possibilities.

Currently the pound sits at ¥151. It has had a bonanza run from late 2020, as it has against the dollar and the euro, no doubt because there is finally Brexit clarity. I see some resistance at the 2018 highs of ¥156. After that there is a fairly clear run to above ¥190, I’d say.

We tend to have a low opinion of our country because of the endless flow of bad news our media pumps out. But other countries have exactly the same problem of self-esteem, and, perceived from abroad, the UK is not at all a bad place to be. Even after the run it’s had, the pound is only at its 2000 lows. There is a lot of potential upside. It’s not like the Bank of Japan isn’t printing.

So ¥150-¥156 is a resistance area, and I expect some range-trading here. But the short-term trend is up. And the monthly moving averages, as shown above, are signalling that the long-term trend has changed too.

Let’s see where we are in a couple of years.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is now out in paperback at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?

-

Why you should keep an eye on the US dollar, the most important price in the world

Why you should keep an eye on the US dollar, the most important price in the worldAdvice The US dollar is the most important asset in the world, dictating the prices of vital commodities. Where it goes next will determine the outlook for the global economy says Dominic Frisby.

-

What is FX trading?

What is FX trading?What is FX trading and can you make money from it? We explain how foreign exchange trading works and the risks

-

The Burberry share price looks like a good bet

The Burberry share price looks like a good betTips The Burberry share price could be on the verge of a major upswing as the firm’s profits return to growth.

-

Sterling accelerates its recovery after chancellor’s U-turn on taxes

Sterling accelerates its recovery after chancellor’s U-turn on taxesNews The pound has recovered after Kwasi Kwarteng U-turned on abolishing the top rate of income tax. Saloni Sardana explains what's going on..

-

Why you should short this satellite broadband company

Why you should short this satellite broadband companyTips With an ill-considered business plan, satellite broadband company AST SpaceMobile is doomed to failure, says Matthew Partridge. Here's how to short the stock.

-

It’s time to sell this stock

It’s time to sell this stockTips Digital Realty’s data-storage business model is moribund, consumed by the rise of cloud computing. Here's how you could short the shares, says Matthew Partridge.

-

Will Liz Truss as PM mark a turning point for the pound?

Will Liz Truss as PM mark a turning point for the pound?Analysis The pound is at its lowest since 1985. But a new government often markets a turning point, says Dominic Frisby. Here, he looks at where sterling might go from here.

-

Are we heading for a sterling crisis?

Are we heading for a sterling crisis?News The pound sliding against the dollar and the euro is symbolic of the UK's economic weakness and a sign that overseas investors losing confidence in the country.