The charts that matter: a bigger, better vaccine and a promotion for Tesla

John Stepek looks at how the week’s events have affected the charts that matter the most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. The good news is that we got another, bigger and better vaccine this week. The bad news is that in the UK, chancellor Rishi Sunak is fretting about how to pay for all these lockdowns – and it seems he has his eyes on your assets.

If you want to get an idea of how the chancellor’s capital gains tax musings could affect your portfolio, now’s a good time to start reading MoneyWeek – get your first six issues free here.

Make sure you make time to listen to Merryn’s podcast this week. She talks to one of the best Japan analysts out there – Peter Tasker – all about life in Tokyo and about why you should follow Warren Buffett’s lead and invest in the Japanese market.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And I was on a podcast with The Week Unwrapped team this week, talking about China’s big trade deal, among other things. Have a listen here.

Our latest “Too Embarrassed To Ask” video tackles the topical subject of “bubbles”. We all think we know what a bubble is – but pinning them down (no pun intended) is surprisingly difficult. Find out why here.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: How green bonds will fund the coming energy transition

- Merryn’s blog: Why investors should take investment trusts up on their free lunches

- Tuesday: The market reaction to the vaccine shows the value of contrarian thinking

- Wednesday: Could bitcoin really go to $300,000?

- Thursday: RCEP: what the world’s biggest free-trade deal means for your money

- Friday: Could the spat between the Fed and Trump’s Treasury derail markets?

Now for the charts of the week.

The charts that matter

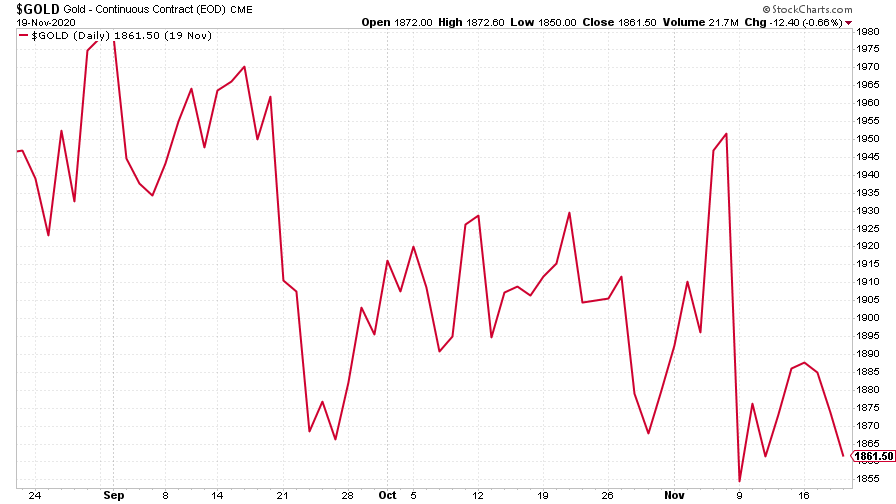

Gold had another uninspiring week. While precious metals should eventually benefit from reflation, gold has enjoyed a very strong run this year and needed to consolidate. And do most people want to be holding more gold when risk appetite is picking back up? For now, the answer is no.

(Gold: three months)

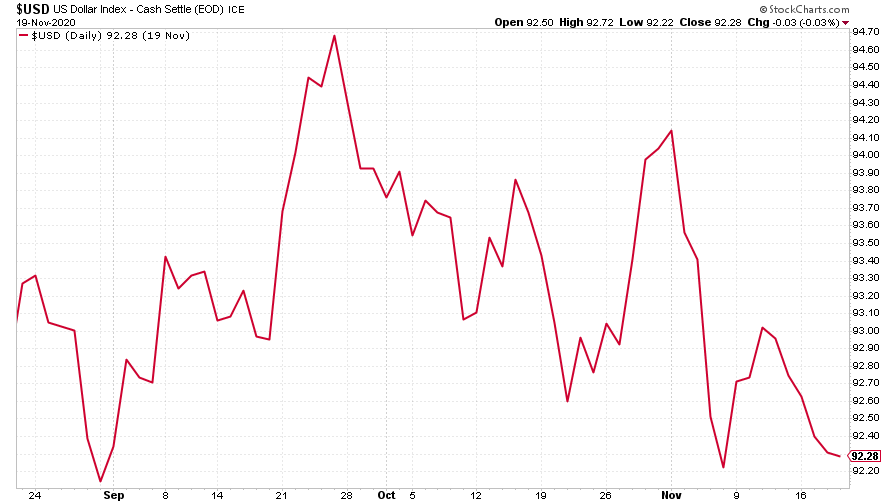

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) fell again. It’s very close to falling through the 92 level, which would be a pretty big deal from a technical analysis point of view – worth watching, even if you think “charting” is a load of hocus pocus.

(DXY: three months)

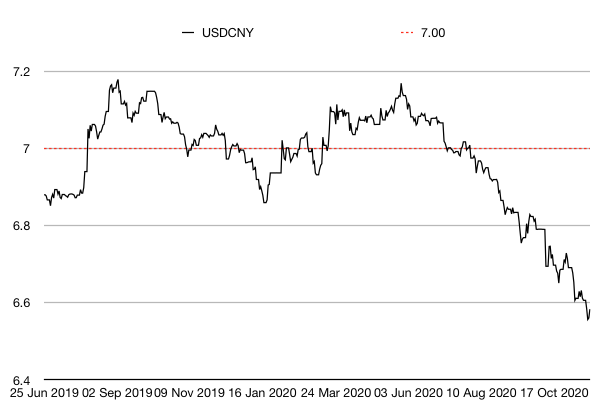

The Chinese yuan (or renminbi) strengthened further against the US currency (when the black line below rises, it means the yuan is getting weaker vs the dollar). Overall, a weaker dollar is good news for risk assets, as in effect it means that global monetary policy is getting looser.

(Chinese yuan to the US dollar: since 25 Jun 2019)

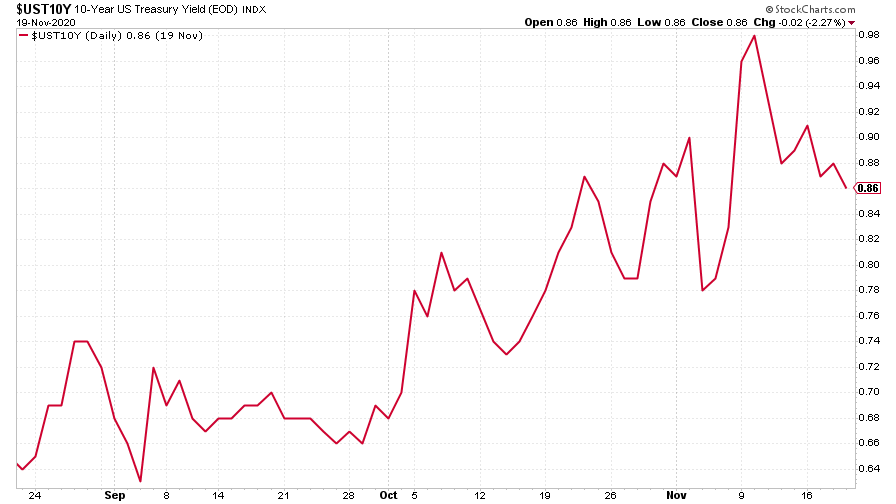

The yield on the ten-year US government bond drifted lower, belying the “risk-on” mood.

(Ten-year US Treasury yield: three months)

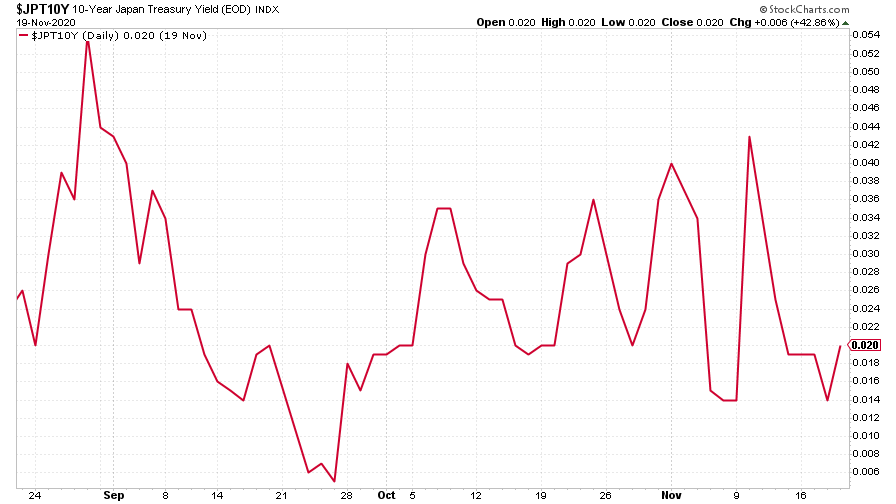

The yield on the Japanese ten-year stayed at zero, as always.

(Ten-year Japanese government bond yield: three months)

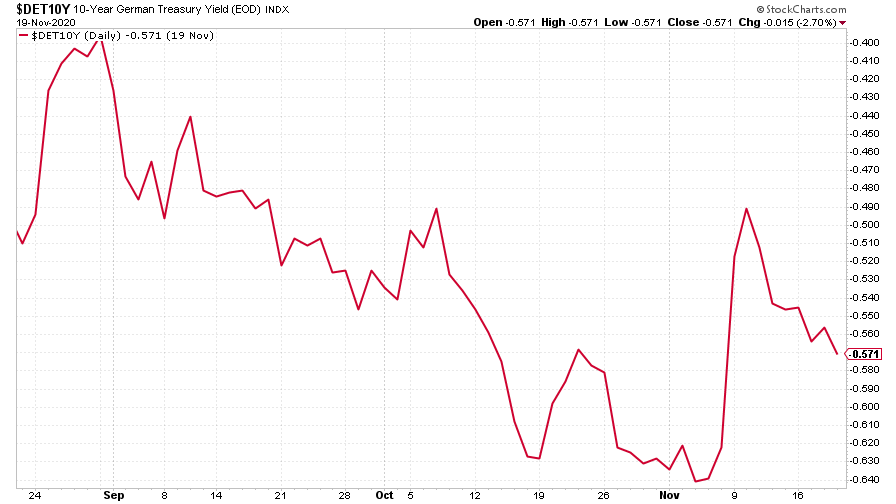

And the yield on the ten-year German Bund followed the US ten-year lower.

(Ten-year Bund yield: three months)

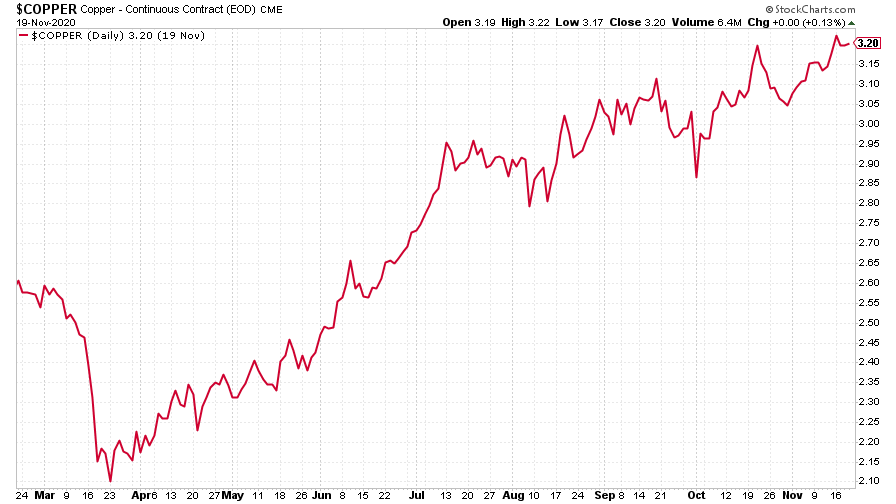

Copper continued to climb as the reflation trade (which includes buying commodities in the hope and expectation of a big rebound in economic growth next year) remained the name of the game.

(Copper: nine months)

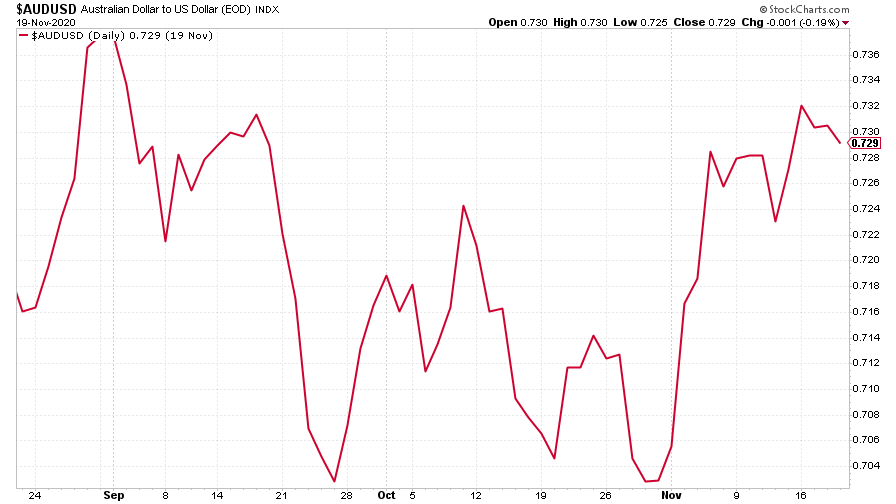

The Aussie dollar was barely changed against the US dollar.

(Aussie dollar vs US dollar exchange rate: three months)

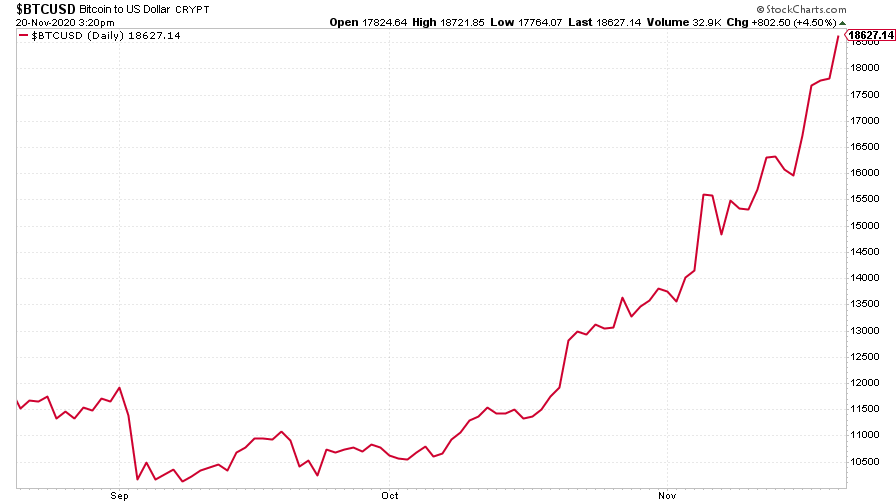

Last week I wondered if it was time for cryptocurrency bitcoin to take a breather. It clearly wasn’t. It now looks as though it might be gearing up for a pop at the all-time high, although compared to one investment banker’s guess this week, $20,000 is nothing compared to where bitcoin might end up.

Interestingly enough, that came almost three years ago, roughly when we stuck bitcoin on our Christmas cover – a classic example of the cover story indicator at work. (For what it’s worth, there are no plans yet to put bitcoin on the cover this year – but let’s see what happens over the next couple of weeks.)

(Bitcoin: three months)

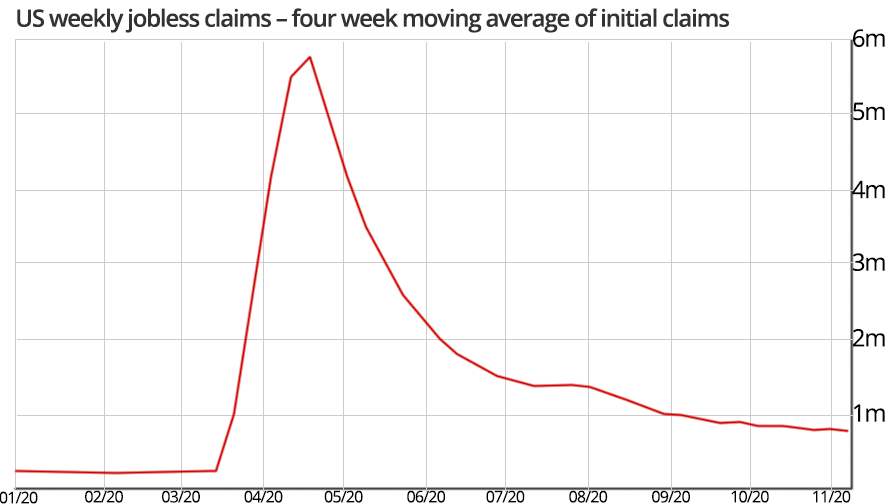

US weekly jobless claims rose to 742,000 which was higher than expected (analysts had forecast about 710,000) and up from 709,000 last week. That said, continuing claims have fallen to a new post-pandemic low of 6.37 million. The four-week moving average fell to 742,000 from 755,750 previously.

(US jobless claims, four-week moving average: since Jan 2020)

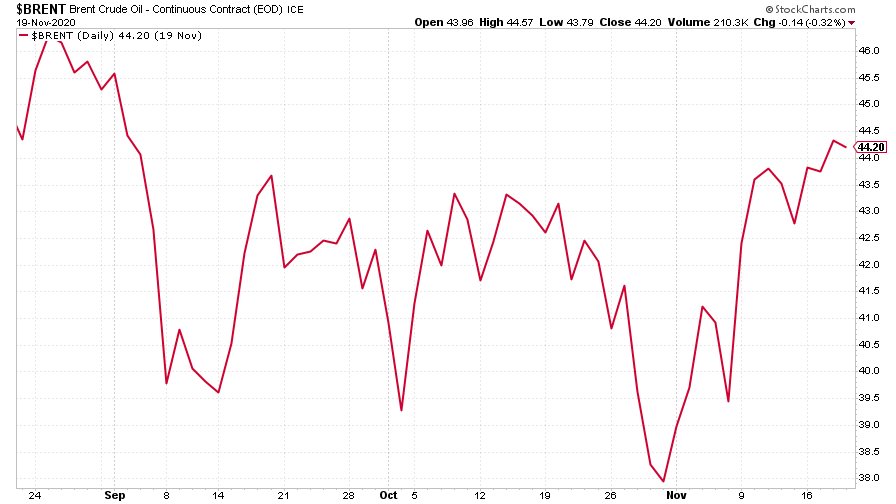

The oil price (as measured by Brent crude) continued to grind higher this week. News of a second vaccine helped, but on the other hand, rising coronavirus figures in the US are not exactly bullish for oil demand.

(Brent crude oil: three months)

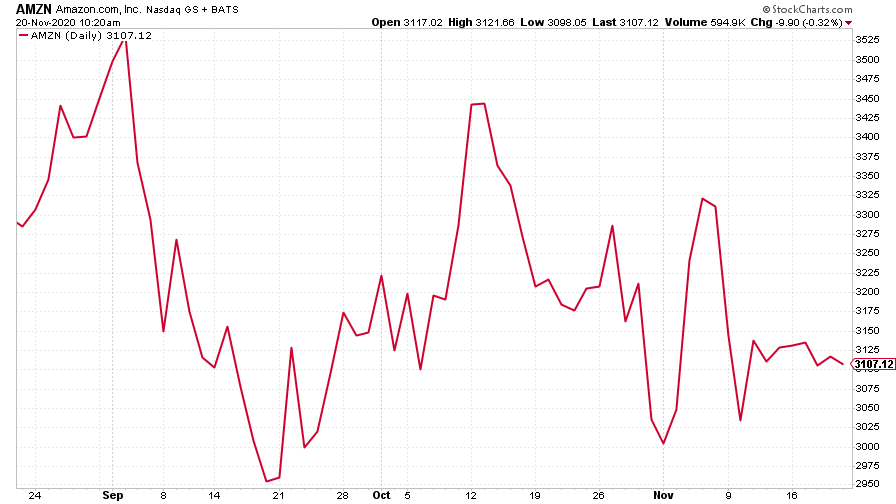

Amazon was little moved this week. With the vaccine around the corner, investors are growing less keen on “safe” Big Tech and more keen on “risky” traditional beaten-down assets.

(Amazon: three months)

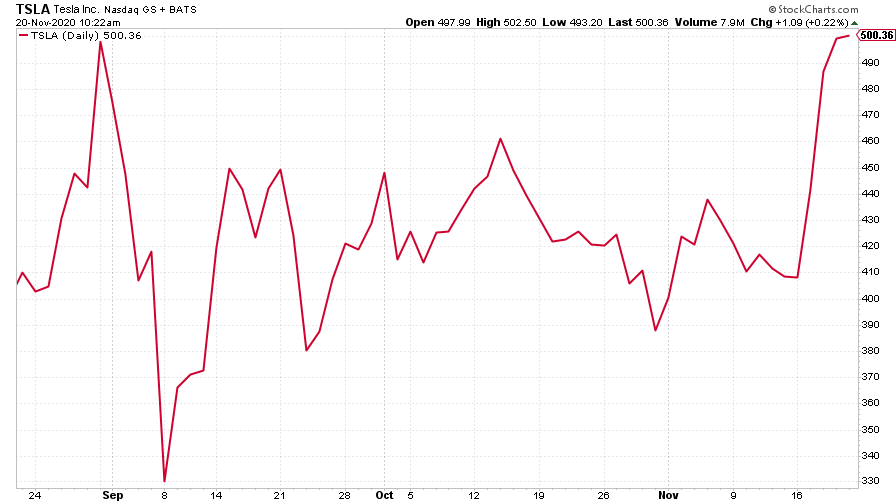

Tesla by contrast, hit a fresh all-time high this week, rising by around 20% on Monday’s news that it will join the S&P 500 next month. That means lots of tracker funds will have to buy it, and quite a lot of it, because it’s going straight into the top ten when it enters the index.

To be very clear, the electric car manufacturer is wildly expensive and its current valuation is only justifiable based on a future that we can barely glimpse right now (a world of self-driving cars sold on a subscription basis, where Tesla is effectively Apple). Will that world arrive? Maybe. Am I keen to bet on it with my own money? Not right now.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.