Could bitcoin really go to $300,000?

Bitcoin is off on one of its periodic rocket rides. And while you may think it’s a bubble, says Dominic Frisby, its potential is so enormous that you have to have some exposure.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

I got my Tuesday afternoon email from John yesterday: “OK for tomorrow’s Money Morning? What do you want to cover?”

I tinkered with the idea of platinum – I haven’t covered it for a while and it’s had something of a turnaround since the Great Rotation began last week.

But really there’s one big story. It’s a story I’ve been banging on about for as long as I can remember (2013 was the first time I covered it in MoneyWeek) and that is bitcoin. It’s off on one of its rocket rides.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

How high could bitcoin go on this bull run? One banker says $318,000

I’ve been a bitcoin bull since forever. So much so that I wrote a book about it in 2014 – the first book on bitcoin by a recognised publisher, so I’m told. But I’ve been particularly bullish about it this year.

When coronavirus hit and central banks decided they were going to solve the situation with unprecedented use of their money printers, I urged readers into bitcoin and gold – money that politicians can’t debase. I’ve not stopped saying, “make sure you own bitcoin!” all year.

The way to play bitcoin has been to acquire as much as is humanly possible – whether by buying, mining or working for it. Then hold onto it for dear life. Buy, hold, forget. What was less than a dollar in 2011 was then worth tens of dollars. Then hundreds of dollars. Then thousands. Today it sits at $18,200.

But in its evolution it has displayed a repeating pattern. It rallies hard and fast for six months to a year and its price multiplies many times over. There is a speculative frenzy. Then the bubble goes pop.

Each time, bitcoin falls hard and fast, and gives back maybe three quarters of the gains it just made, although it remains several times higher than when it started. Then we have a year or two of consolidation. Everybody forgets about it – and then it goes off on one of its runs again.

In 2011, it went from $0.20 to $32 – then collapsed all the way to $2. In 2013, it went all the way to $1,200 – before collapsing back to $200. In 2017 it went to $20,000 – before collapsing back to $3,000. And here we are three years on, in another one of those periods of consolidation, closing in on the old highs of $20,000.

Where does it go once/if it gets past $20,000? $318,000, says Citibank analyst Tom Fitzpatrick. Not some random off the internet. But an analyst from reputable, respectable Citibank.

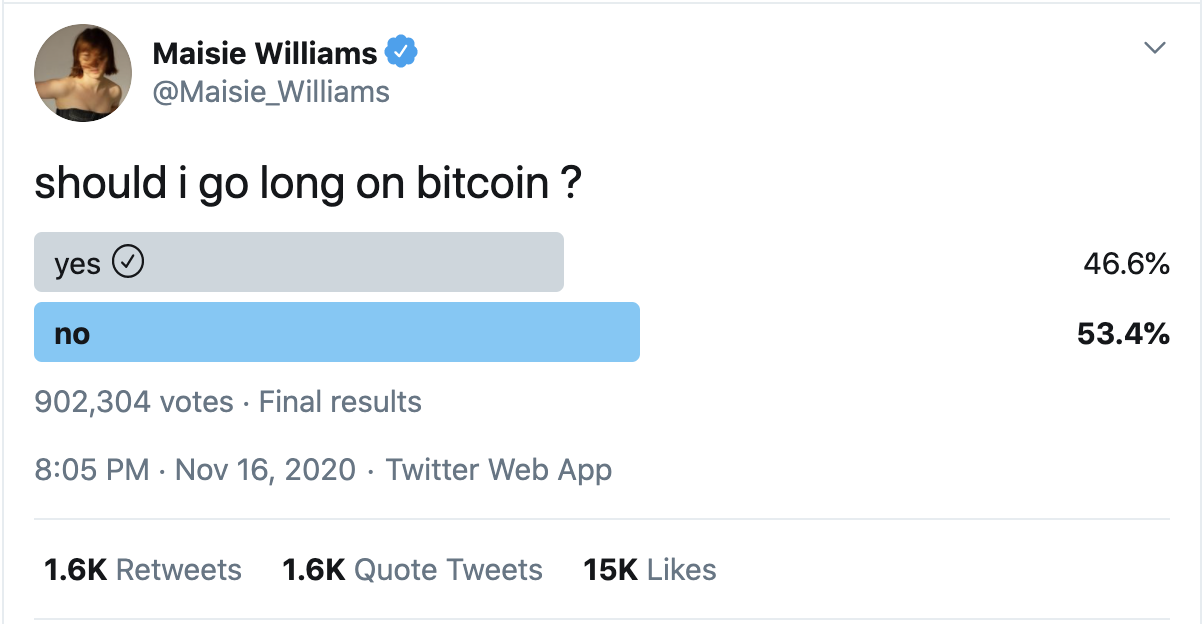

This contrarian indicator is saying that bitcoin is still a ‘buy’

These kinds of predictions are normally a warning. But then I saw this on Twitter yesterday from actress Maisie Williams. If you don’t know Maisie Williams she played Arya in Game of Thrones and is very much one of the cool kids.

When an actress such as she is asking about an investment, that would normally be a “sell” signal. It’s a classic shoe-shine boy moment. (Joe Kennedy – JFK’s dad – claimed he knew to get out of the stockmarket in 1929 because he started getting stock tips with his shoe shine).

But this is bitcoin. First up, it’s one of the few investments in history where ordinary people were ahead of the institutions – that’s the beauty of its open-source evolution. In bitcoin’s case when the institutions (eg Citibank!) start tipping it, that’s your shoe-shine boy moment.

But look at the response Williams got. And her following is young people – and bitcoin, as a new tech, has been very much an investment for the young and tech savvy (oldies prefer gold); 53.4% said don’t buy bitcoin, while only 46.6% said she should. Bitcoin’s almost as divisive as Brexit!

If a figure closer to 80% were saying “buy”, I would take that as a sell signal. But the majority is against – that means there are plenty more potential buyers still out there who don’t own yet. It means there is plenty more potential upside in this run.

I shall be watching that $20,000 level like a hawk. The way things are going we could even see it today. Bitcoin is really moving. That’s the thing, as I often say. You want to accumulate during those periods of consolidation, when it’s loathed. When the rocket launches, such as now, it moves so fast it’s hard to get a seat. Bitcoin’s doing what it always does. It’s going to the moon. Then it will come back down again. Probably to a level considerably higher than where it took off.

To those who say it’s a bubble, I say this: it is a new tech. You always get bubbles around new technologies – railways, the internet, it doesn’t matter. What’s more, bubbles accelerate investment. The tracks were laid thanks to the railway bubbles of the 1800s, the cables were laid because of dotcom.

It’s tulips, you say! Well here we are nearly 400 years after the tulip mania of 1637 – and Holland still rules the roost in the global flower market. A bubble is nothing more than a bull market in which you don’t have a position. Of course it’s a bubble. It’s the ultimate bubble. It’s a new tech that is also a new system of money. Even Marvel Comics would struggle to design a prototype that is any more bubbly than that.

Bubble or not, bitcoin’s potential is so enormous, you have to have some exposure. Just in case its biggest advocates are right.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is now out in paperback at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

The markets say sell, but should investors listen?

The markets say sell, but should investors listen?Analysis As fear grips markets around the world, investors need to have an honest conversation about what they’re comfortable with owning.

-

As global powers fight it out, commodity prices are set to rocket

As global powers fight it out, commodity prices are set to rocketAnalysis Commodity prices have been held down by globalisation. This trend is now rapidly reversing.

-

Is gold cheap relative to equities?

Is gold cheap relative to equities?Analysis Dominic Frisby looks at the Dow-gold ratio and explains why gold is starting to appear inexpensive compared to equities.

-

Are we heading for a commercial property crash?

Are we heading for a commercial property crash?Analysis The pandemic has reduced the demand for office spaces and permanently changed the office environment. But John Stepek says rising interest rates are a bigger threat to commercial property right now.

-

Is the oil market heading for a supply glut?

Is the oil market heading for a supply glut?Analysis Many people assume that the high oil price is here to stay – and could well go higher. But we’ve been here before, says Max King. History suggests that supply will increase to more than meet demand.

-

Why has the Terra stablecoin broken its US dollar peg and should you care?

Why has the Terra stablecoin broken its US dollar peg and should you care?Analysis The Terra stablecoin is supposed to match the value of the US dollar – but its value has crashed. John Stepek explains what it means for you and your investments.

-

Alphabet and Microsoft look like gems in the rubble of the tech sector

Alphabet and Microsoft look like gems in the rubble of the tech sectorAnalysis Tech stocks have fallen hard this, with the Nasdaq index down 22% since November. But both Alphabet and Microsoft are still both worth a look, says Rupert Hargreaves.

-

The UK’s new energy strategy has been revealed – here’s how you can profit

The UK’s new energy strategy has been revealed – here’s how you can profitTips The UK has just released details of its long-term energy strategy, which emphasises offshore wind power. Rupert Hargreaves explains how you can invest.