The charts that matter: the turning point?

As news of a vaccine sends markets soaring, JohnStepek loks how it's affected the charts that matter the most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

What a week. Forget the US election, the vaccine was the big news. Markets exploded higher and all the major trends of the last few years – decades even – turned around on their heads. Is this the start of something bigger? We look at that question in more detail in this week’s issue of MoneyWeek magazine. If you haven’t already subscribed, you know what to do – get your first six issues free here.

And I hope you watched Merryn’s interview with Jim Mellon last weekend and acted on at least some of his tips on Monday morning, because by Monday evening you’d have been a lot better off. That said, if you missed it, it’s still well worth watching – Jim didn’t just talk about Covid recovery candidates, he also discussed some of the most important trends of the next two decades. Catch up with the interview here.

Also, you should listen to Merryn’s podcast this week with well-known value fund manager, Alex Wright of Fidelity, where they discuss some of the biggest opportunities in UK markets right now.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Bitcoin has had a cracker of a week (like many other assets) – so if you have no idea what bitcoin is or how it works, now might be a good time to start learning. Luckily that’s the subject of our two-minute “Too Embarrassed To Ask” primer video this week.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: Why an ESG approach is particularly suited to bond investors

- Biden’s win: What does Joe Biden’s victory mean for your money?

- The vaccine: What the market reaction to the Covid vaccine news tells us about the “new normal”

- Merryn’s blog: The US election shows that what markets really like is certainty

- Tuesday: What the return of the “old normal” could mean for your money

- Wednesday: You may not have heard of royalty companies, but they’re a great way to invest in gold

- Thursday: The UK housing market is booming – here’s one thing that could slow it down

- Friday: This week’s rally in value stocks is just the beginning

Now for the charts of the week.

The charts that matter

We started the week wondering how markets would react to the gradual unfolding of the US election. Come Monday afternoon (UK time) the election was forgotten. It was all about the vaccine and the sudden rush of “risk-on” sentiment it engendered.

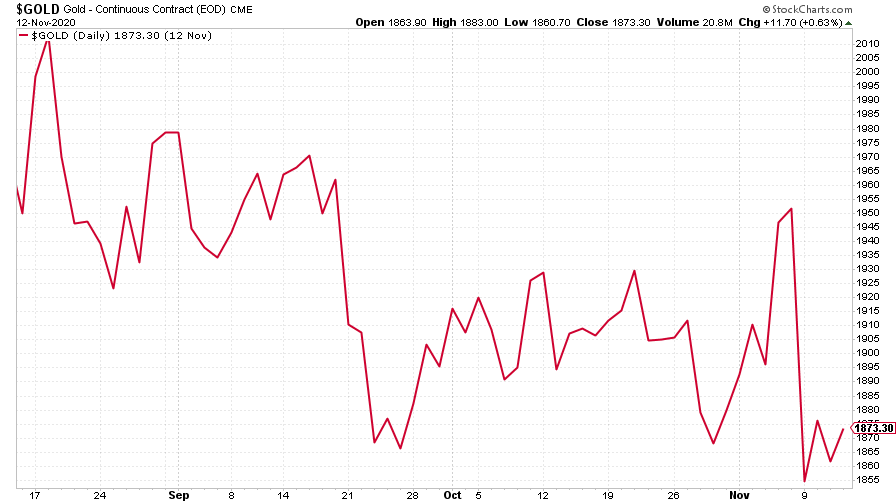

So that was bad news for gold. Having surged above $1,950 an ounce on the rather less decisive than expected US election result, it promptly tanked by about $100 an ounce, before leveling out and starting to clamber back. As I said in Money Morning, there were various reasons for the drop in precious metals – none of them permanent, I’d suggest.

(Gold: three months)

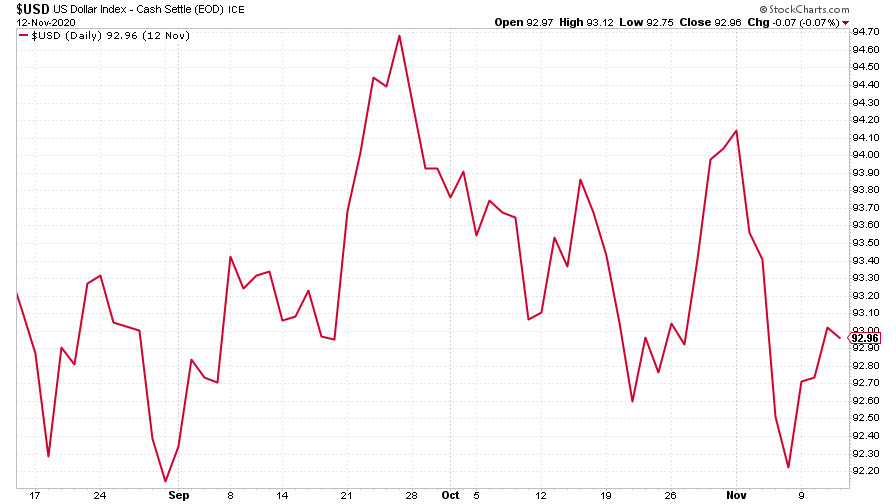

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) rallied a little on news of the vaccine but remains well below its most recent peak.

(DXY: three months)

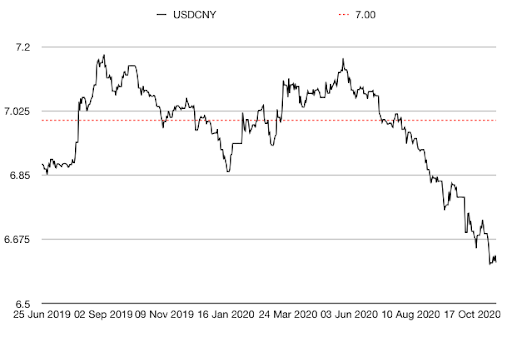

The Chinese yuan (or renminbi) was broadly flat against the US currency (when the black line below rises, it means the yuan is getting weaker vs the dollar).

(Chinese yuan to the US dollar: since 25 Jun 2019)

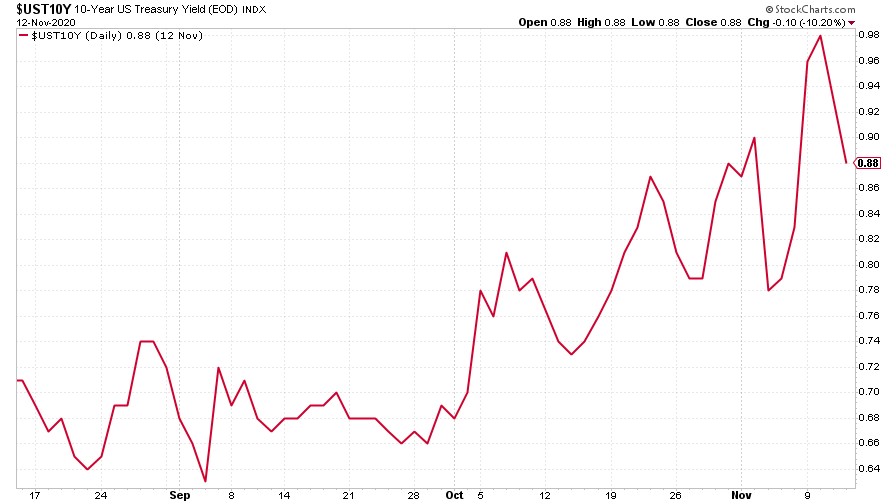

The yield on the ten-year US government bond moved higher on the vaccine news as investors embraced risk.

(Ten-year US Treasury yield: three months)

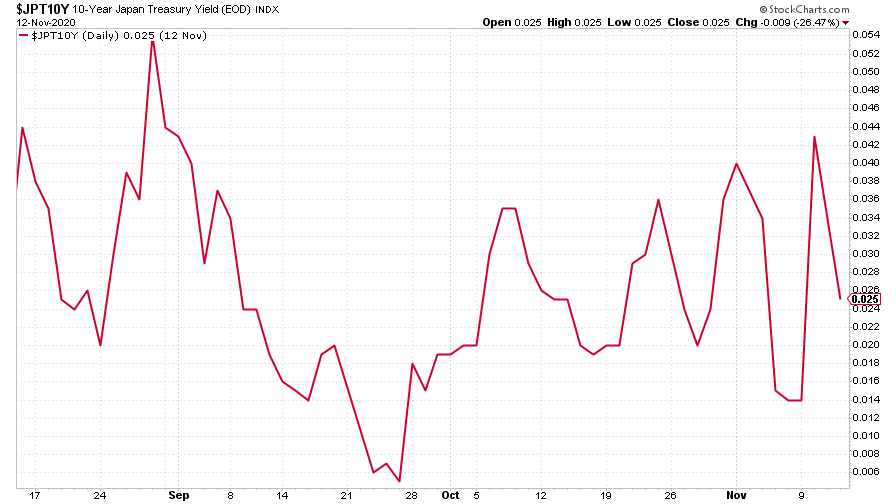

The yield on the Japanese ten-year is still snugly wedged at zero, held there by the Bank of Japan.

(Ten-year Japanese government bond yield: three months)

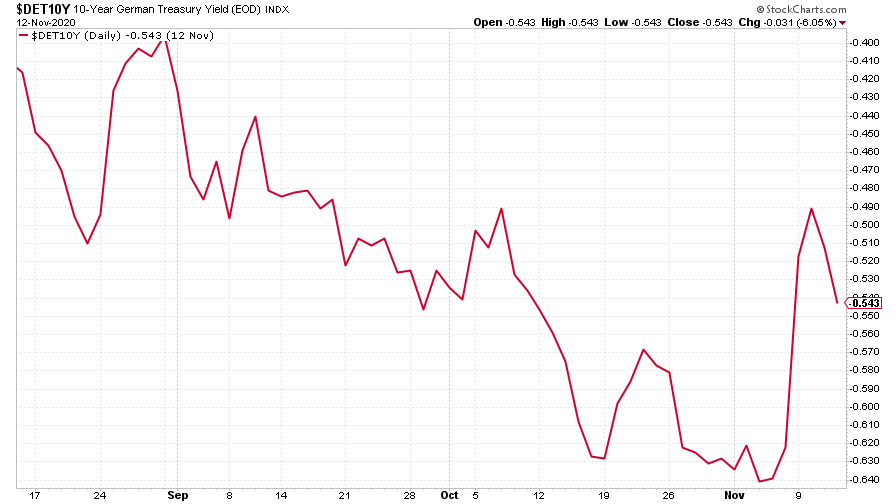

The yield on the ten-year German Bund followed the US ten-year higher, although it remains deep in negative territory.

(Ten-year Bund yield: three months)

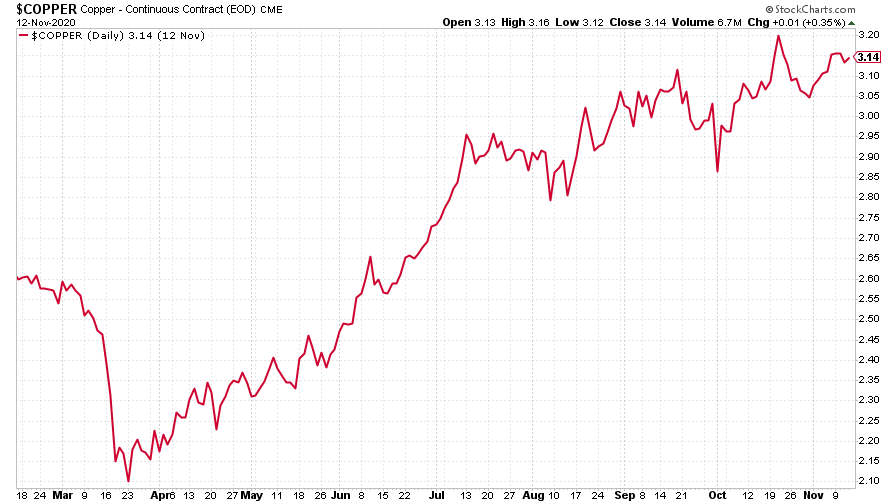

Copper moved a little higher having already enjoyed a very strong run this year.

(Copper: nine months)

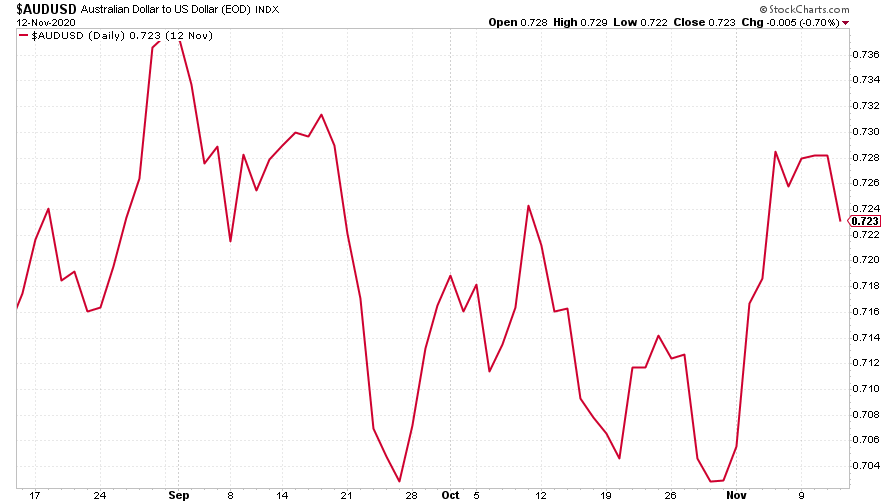

The Aussie dollar was a little lower against the US dollar.

(Aussie dollar vs US dollar exchange rate: three months)

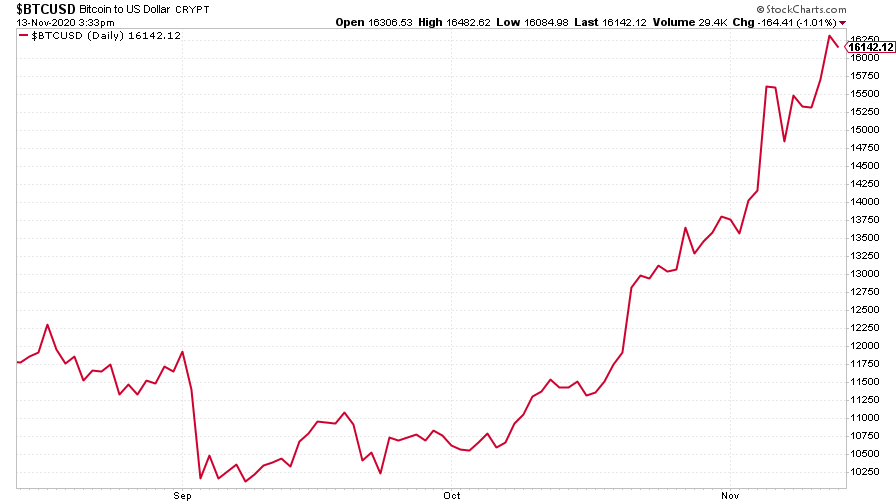

Cryptocurrency bitcoin managed to maintain its recent winning streak and clawed above $16,000 a coin this week. Is it time for a breather? Wouldn’t surprise me.

(Bitcoin: three months)

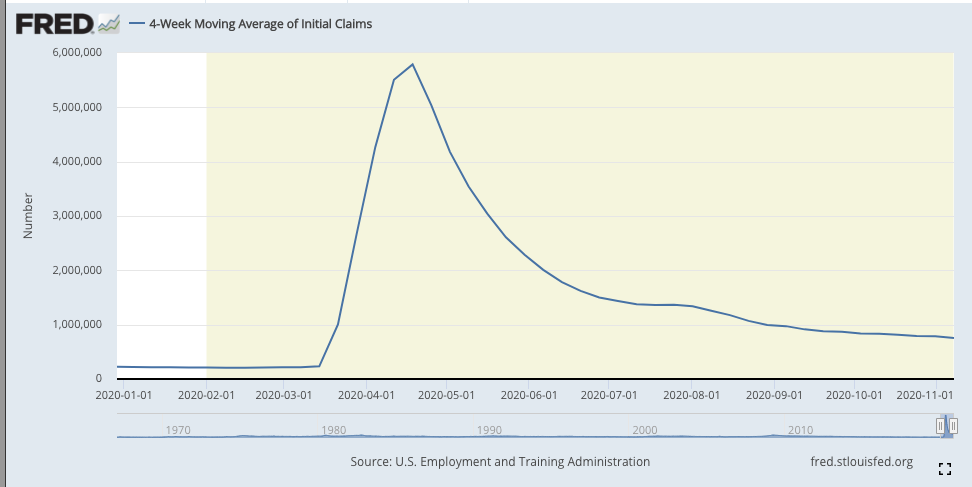

US weekly jobless claims fell to 709,000 which was lower than expected (analysts had forecast about 730,000) and down from 757,000 last week. The four-week moving average fell to 755,250 from 788,500 previously.

(US jobless claims, four-week moving average: since Jan 2020)

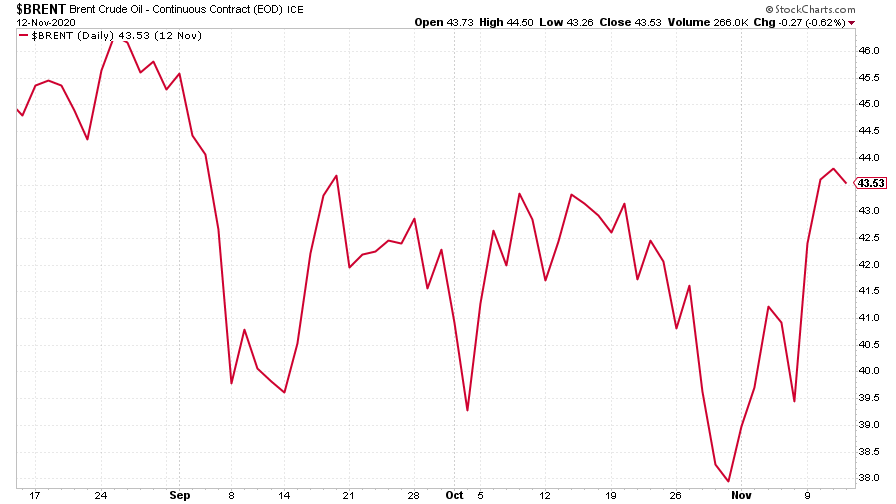

The oil price (as measured by Brent crude) soared on hopes that a vaccine will mean an earlier end to lockdowns and therefore more travel sooner than expected.

(Brent crude oil: three months)

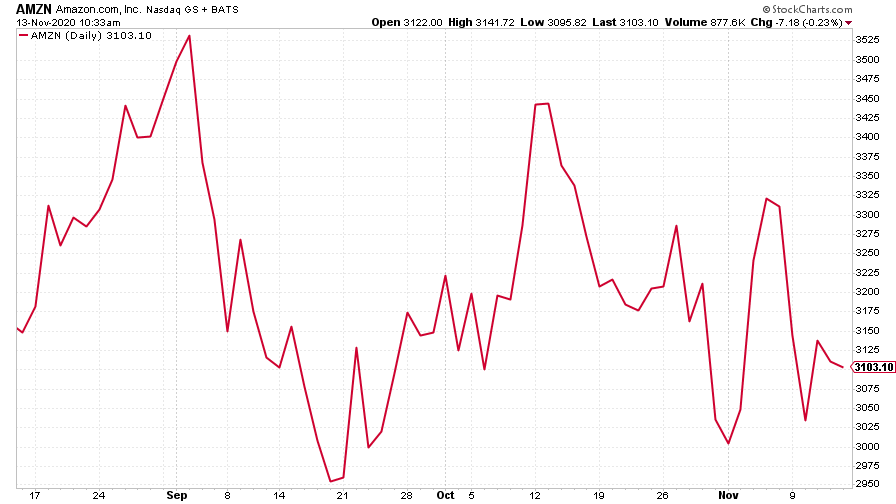

Like the rest of the Big Tech stocks, Amazon struggled this week. Why? Because higher interest rates, and the sense of growth returning, means people want to be exposed to the “high-risk” cheap stuff, rather than the “safe” expensive stuff.

(Amazon: three months)

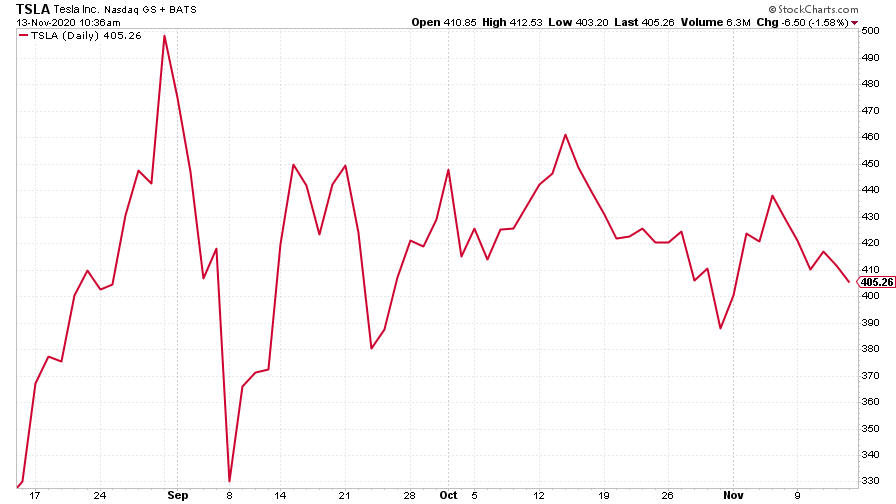

Tesla had a similar showing this week, dipping amid the rotation towards more cyclical “value” stocks.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.