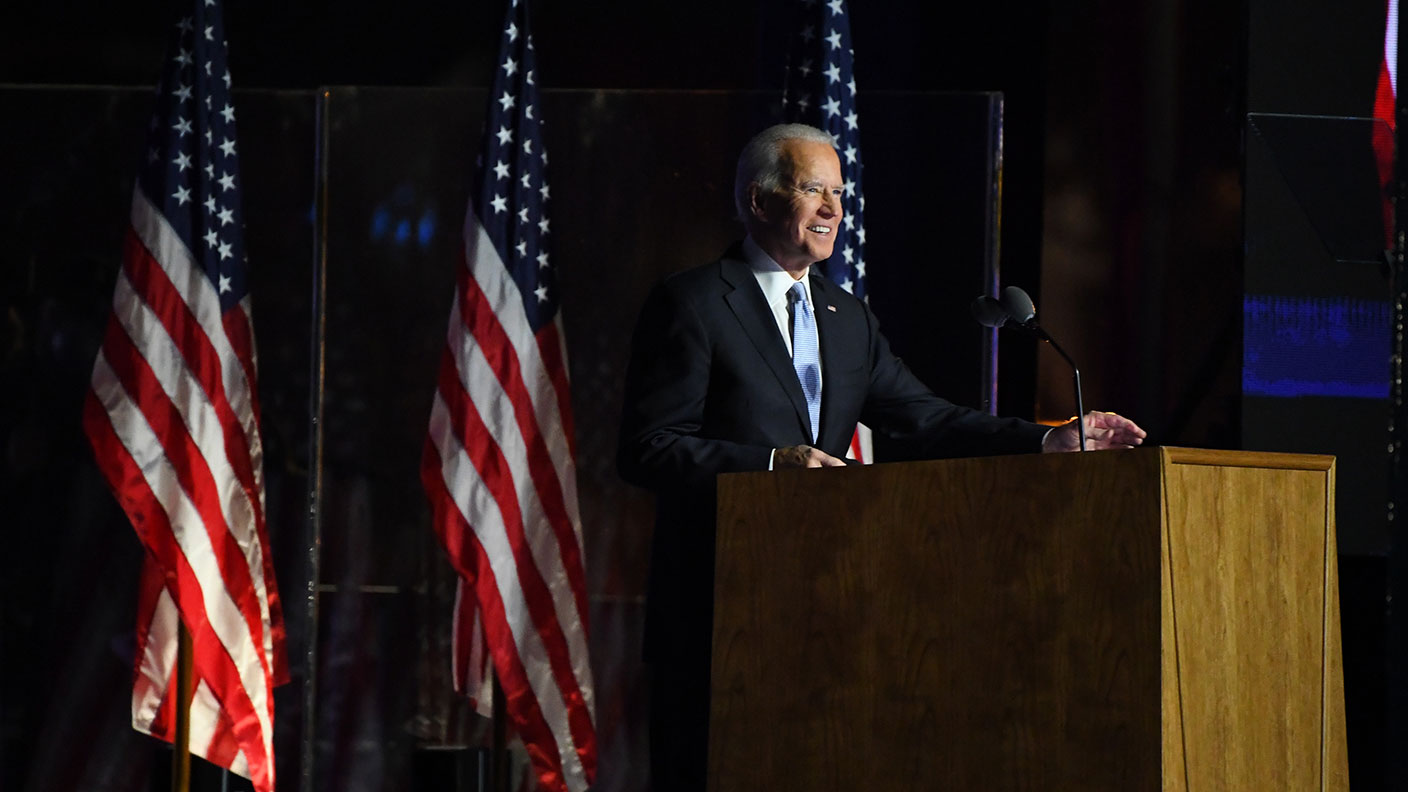

What does Joe Biden’s victory mean for your money?

The “likely” scenarios of a Joe Biden presidency are priced in, says John Stepek. The “unlikely” ones are not. Here's what might happen next to surprise investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The ‘i’s have not quite been dotted, and the ‘t’s haven’t all been crossed, and the man currently in the White House isn’t at all willing to accept the result – but it looks as though Joe Biden is almost certainly going to be US president from 2021.

So, assuming we get through the next couple of months without some wild, wild upset, what does that mean for your money?

The assumption for now is that there will be gridlock. So you have a divided government with a Democratic president, and a Republican majority in the Senate (although in January, there’s another election in Georgia which could tip the Senate into a tie).

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Gridlock is viewed as being good for markets, even now. The idea is that the government can’t do too much to mess things up. So Biden can’t pursue the more ambitious/extreme (depending on your politics) elements of the Democrat agenda, but equally you don’t have radical surprises from the Republican side either.

Also, markets are just relieved that there’s a result. Donald Trump might not want to go quietly, but it’s clear to everyone else that there’s a winner now, and it’s just a matter of getting through the admin of making him president.

So where might this view be wrong? No one can predict the future. But it’s worth considering different scenarios, so that you’re prepared for them. And it’s particularly worth looking at “unlikely” scenarios. Why? Because the “likely” scenarios are priced in; the “unlikely” ones are not, so those are the ones that can either wipe you out or make your fortune.

So what might happen next to surprise investors? When considering the actions that politicians or central bankers (or human beings in general) might take, you can generally assume that the average person (which is usually what matters) will follow the path of least resistance. So what is that path now?

What if the Trump era is erased?

There’s a lot of talk about how “Trumpism” is here to stay. Some are arguing that the 2024 candidate might even be Trump, or someone very like him.

I’m not sure that’s right – I suspect that Donald Trump made a lot of enemies in his own party. I suspect that for every Republican who thinks he was a genuine breath of fresh air, or that he represents the future for the party, there’s at least one more who went along with him through fear or tribal loyalty, and is now keen to put all that “unpleasantness” behind them.

The path of least resistance during Trump’s reign was to support him. The path of least resistance for many, following his downfall, is to desert him and go back to business as usual. Populism might be popular with some of the people, but it can be a real headache for a comfortable mid-ranking career politician.

There are parallels with the Labour party over here. There was a group of die-hard Jeremy Corbyn supporters who will never stop believing in him. Then there was a larger group of Labour party politicians who went along with him, but never felt comfortable doing so, for a wide range of reasons.

The one key thing that has happened in both countries as a result of populism is that the political mood music has swung decisively in favour of government spending, rather than any attempt at fiscal conservatism. And, in fact, it’s probably more correct to say that the causality runs in both directions – it’s reflexive. After all, in the States, the first prominent populist movement of this era, the Tea Party, was all for slashing government spending.

So, say you’ve got a sizeable group of Republicans who want to disavow Trump and wipe the slate clean. And you’ve got a pair of political parties who are broadly open to more government spending – all they disagree on is whether or not you need to bother soaking the rich to pay for it.

That’s a recipe for a much more consensual Senate than anyone might imagine right now. If the Democrats can give way on the tax-raising side of things, then everyone might be happy to wave through more spending than expected. That would get the reflation trade going even faster than perhaps markets expect right now.

Clearly, this is just one scenario. We’ll be looking at other potential scenarios – both bullish and bearish – in this week’s issue of MoneyWeek, out on Friday. Subscribe now to get your first six issues free.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?