The charts that matter: China’s recovery bolsters the yuan

China's strengthening currency is a sign of confidence in the country's economic recovery. John Stepek looks at the yuan chart, and all of the others that matter most to investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

We’ve got a packed issue of MoneyWeek for you this week.

Peak oil demand – what does it mean for investors? Are office blocks a great contrarian bet on commercial property? What’s the best ethical bank account on the market right now? For the answers to these and plenty of other burning investment questions, grab your copy now.

We also have a guest piece from the brilliant James Ferguson of MacroStrategy Partnership, who explains exactly why the apparent “second wave” surge in Covid-19 figures is very different to the early days of the outbreak – and why we’re in danger of over-reacting as a result.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If you’re not already a subscriber, get your copy here.

On that last piece, in the latest MoneyWeek podcast, James discusses his story on Covid-19 and how he came to his conclusions with Merryn and I. It’s really fascinating – in fact, I think it might be one of the most important podcasts we’ve done this year. I urge you to have a listen here.

And if you’ve heard about “stock splits” in the news with Apple and Tesla recently, but you’ve no idea what it means, you’re in luck – our new “Too Embarrassed To Ask” video will explain everything to you, with the aid of pizza.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: Is it time to take profits on technology stocks?

- Merryn’s blog: Why you should stuff your end-of-pandemic portfolio with Chinese stocks

- Tuesday: Don’t be fooled by the illusion of safety in income

- Merryn’s blog: Why China appeals to good investors

- Wednesday: Here’s why you really should own at least some bitcoin

- Thursday: Central banks want politicians to take charge – but what will they do?

- Friday: Will a second wave of Covid lead to another stockmarket crash?

Now for the charts of the week.

The charts that matter

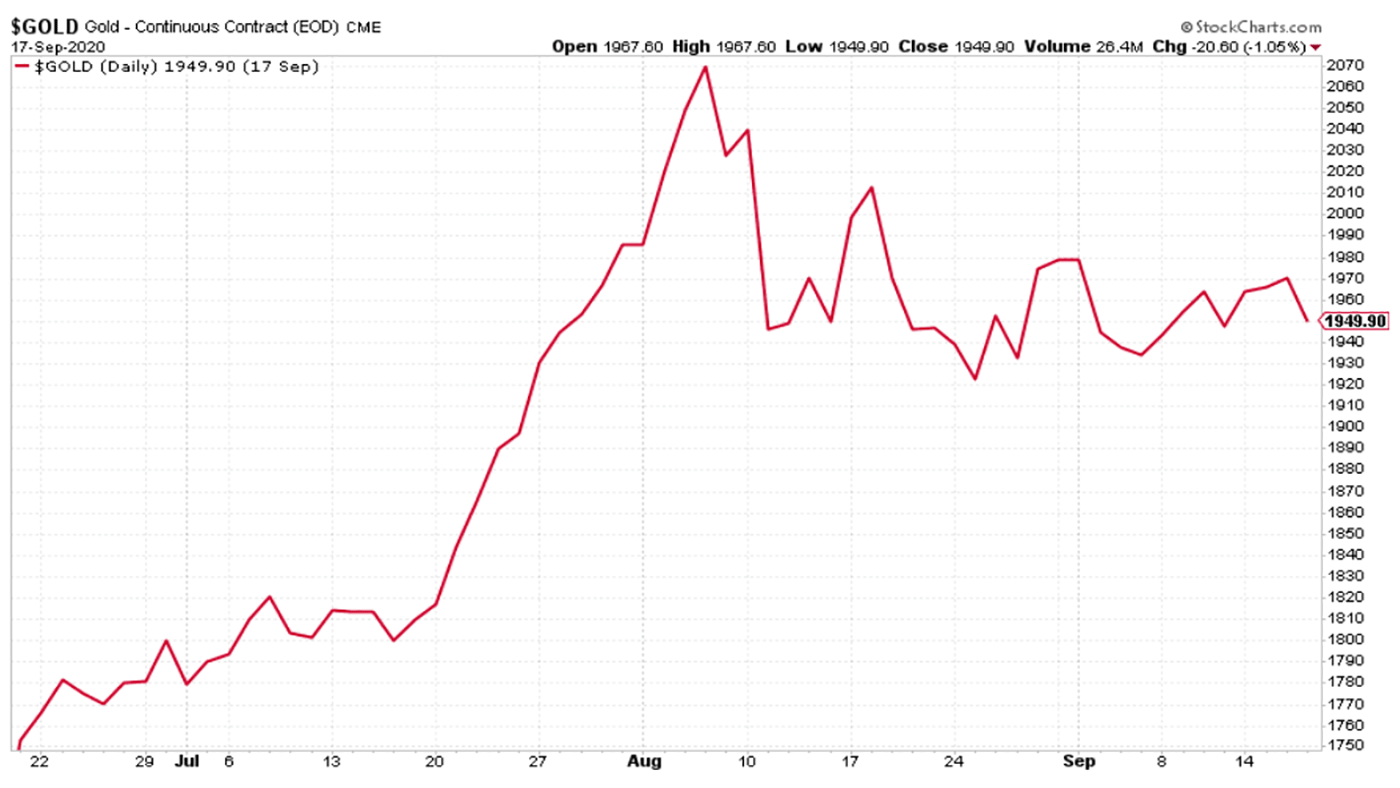

Gold lost ground this week as the Federal Reserve decided not to print any more money for the time being.

(Gold: three months)

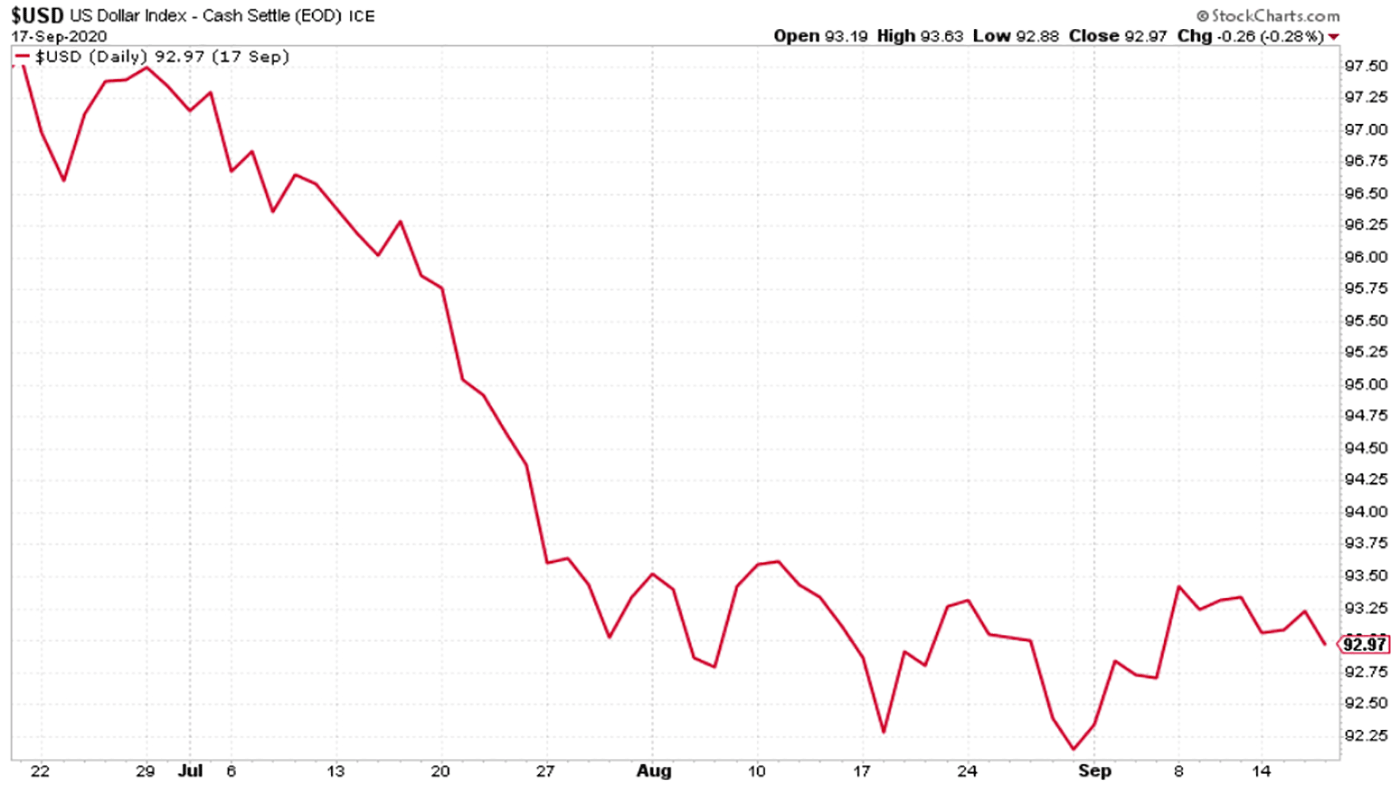

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) fell back again this week. It’s now been in a pretty tight range since the end of July. It’s worth keeping a close eye on – a weaker dollar is usually good news for financial markets.

(DXY: three months)

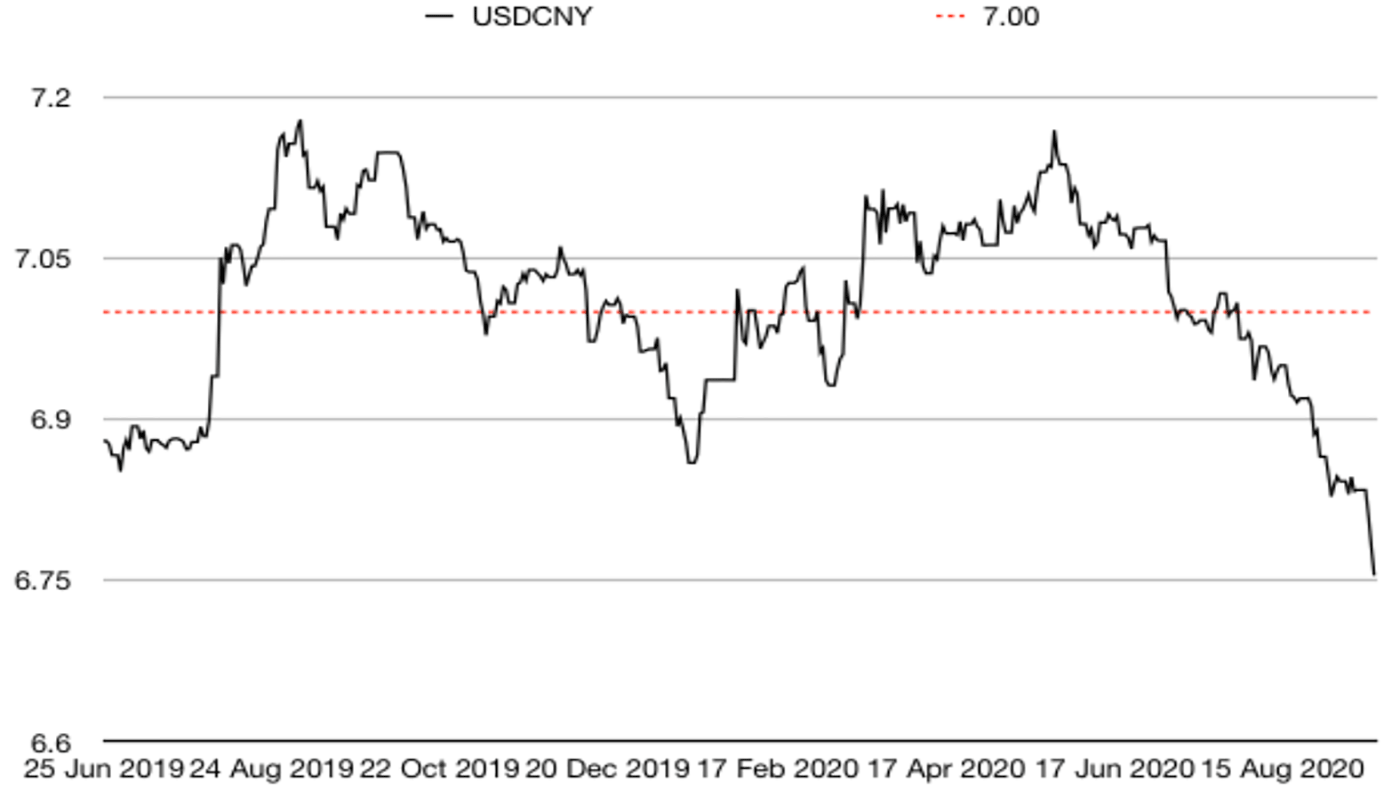

Interestingly, the Chinese yuan (or renminbi) just keeps getting stronger against the dollar (when the black line below falls, it means the yuan is getting stronger). It’s not just about the weak dollar. It’s clearly a sign of confidence in the Chinese economic recovery too. As Julian Evans-Pritchard of Capital Economics pointed out, despite all the trade tensions, Chinese exports have been doing well partly due to “surging demand for face masks and other goods linked to Covid-19.”

(Chinese yuan to the US dollar: since 25 Jun 2019)

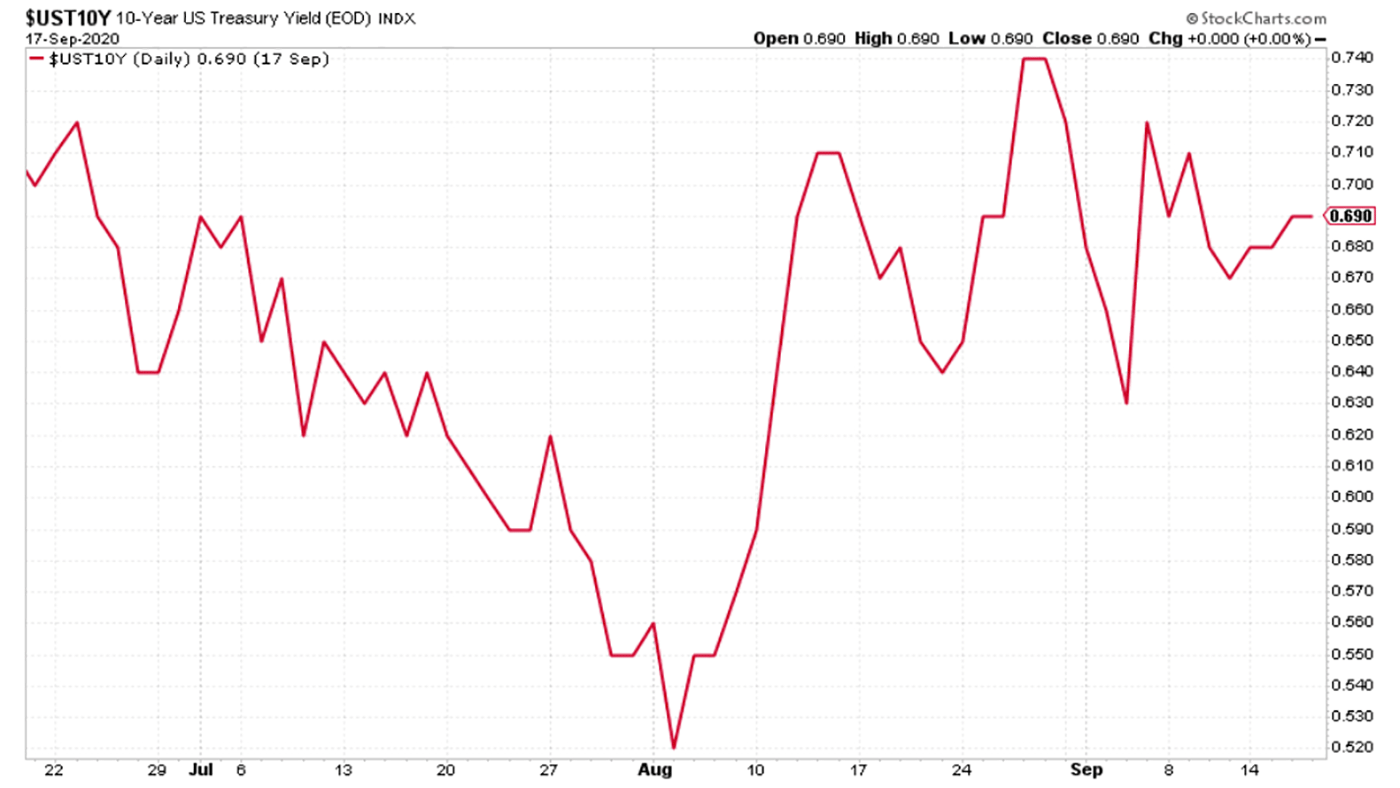

The yield on the ten-year US government bond was little changed on the week.

(Ten-year US Treasury yield: three months)

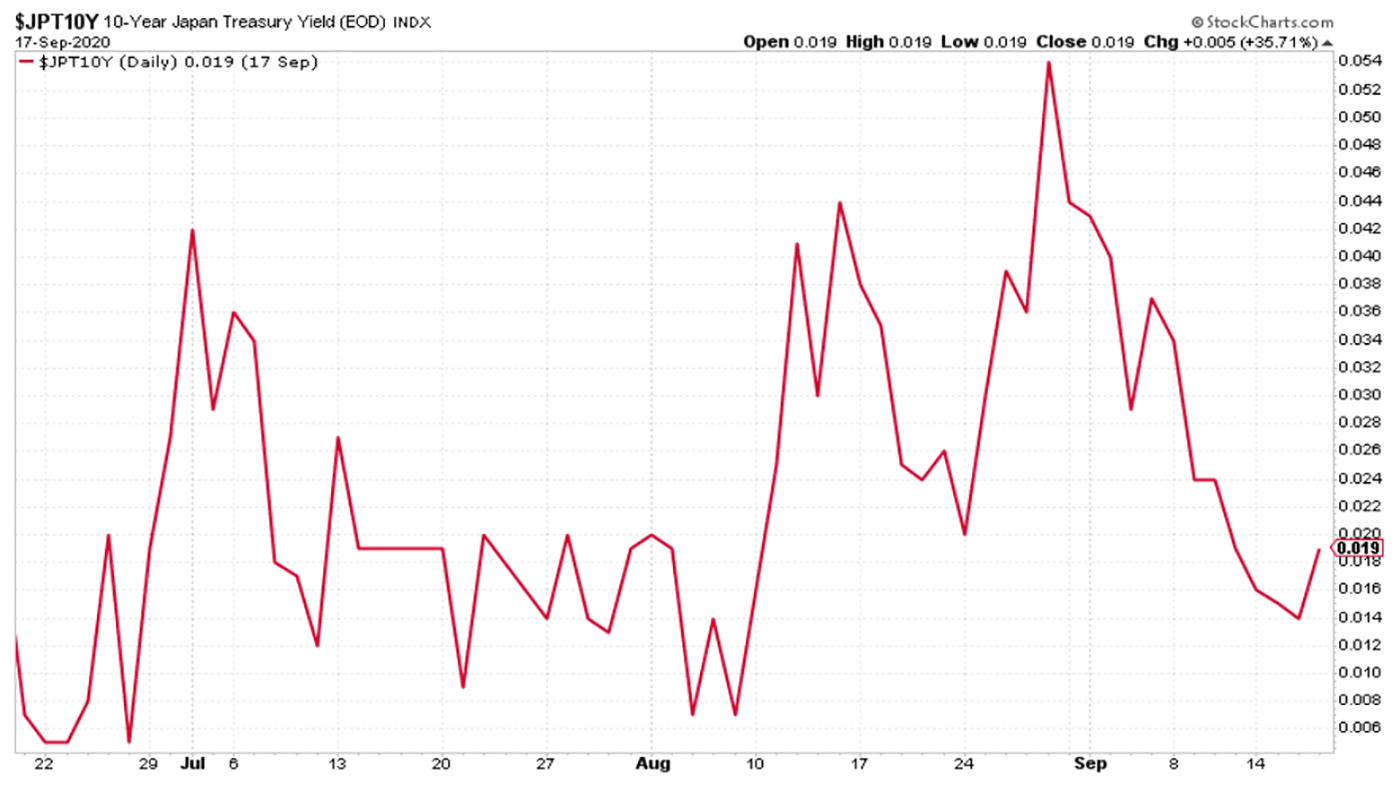

The yield on the Japanese ten-year was pretty much exactly where it always is – nailed within a very tight range of 0%.

(Ten-year Japanese government bond yield: three months)

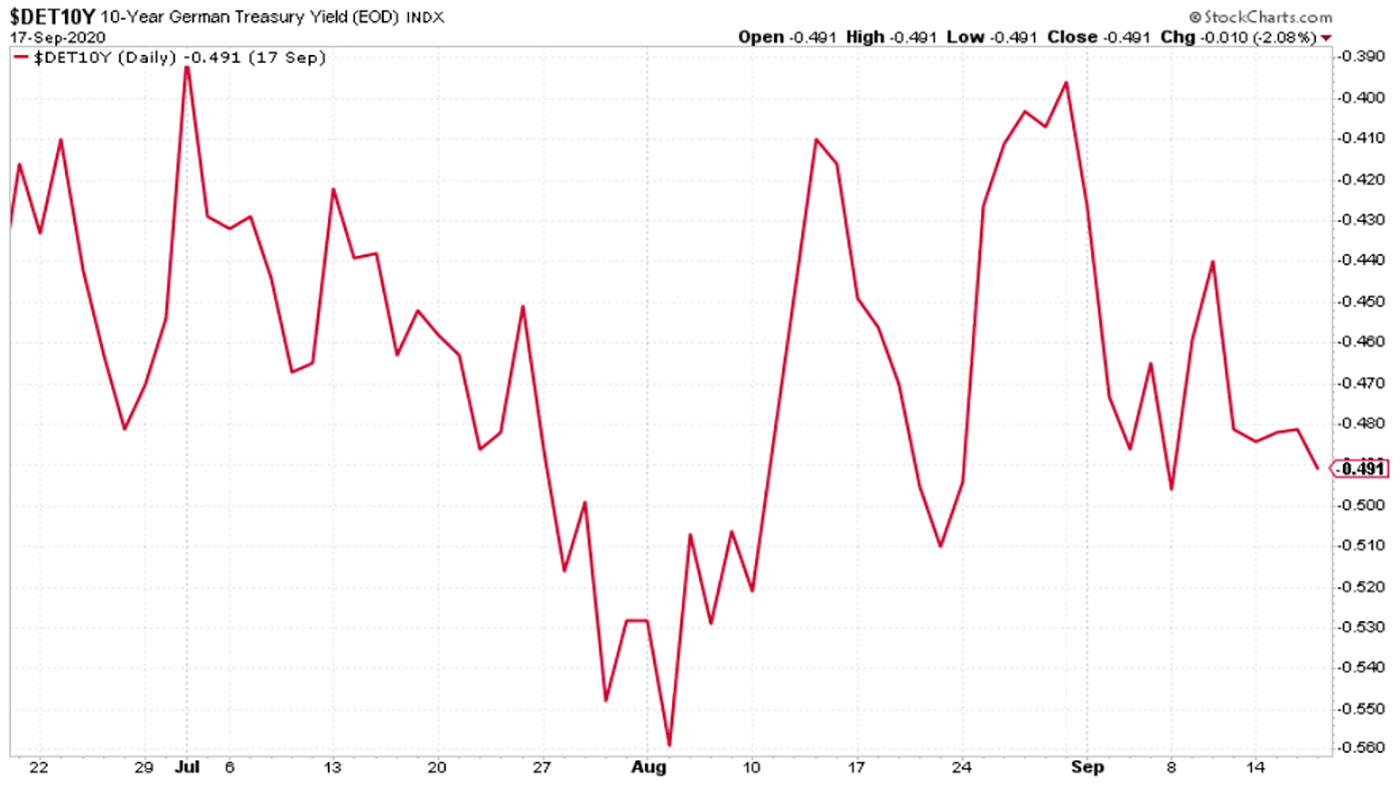

The yield on the ten-year German Bund didn’t move much either this week.

(Ten-year Bund yield: three months)

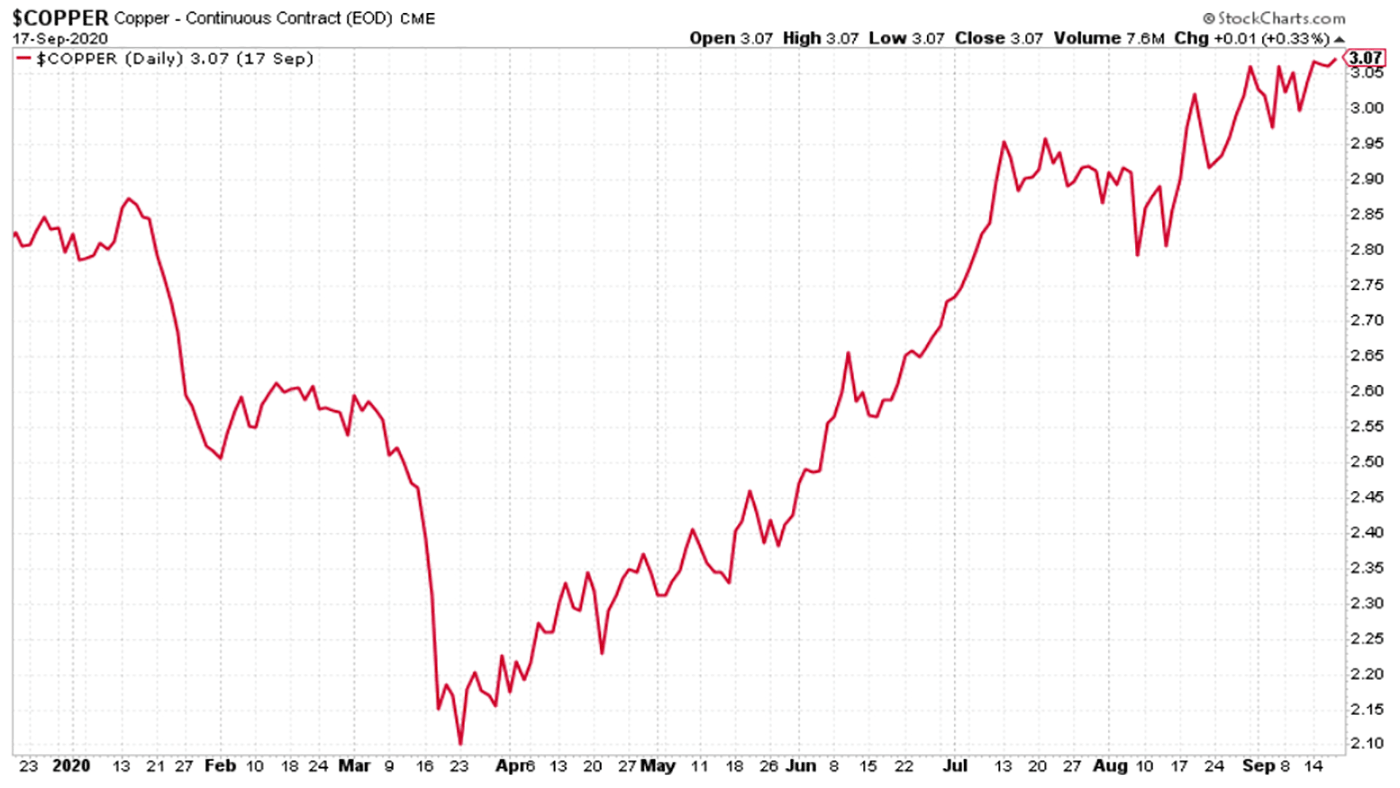

Copper ended the week a little higher and back on an upward trend. The orange metal is both in demand in China and also should be a key beneficiary of electrification and the end of the oil era, which is flavour of the month right now (though I suspect the call on oil is premature).

(Copper: nine months)

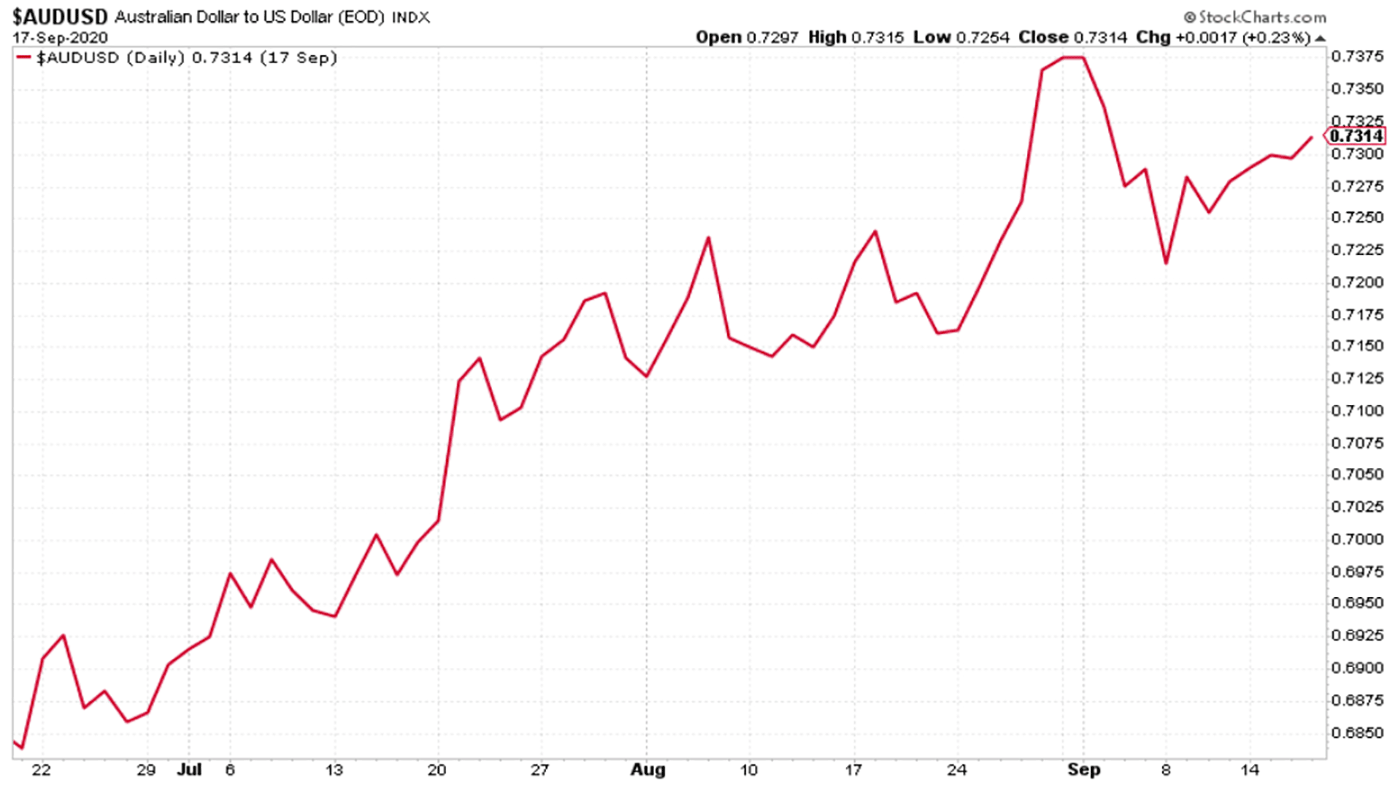

The Aussie dollar strengthened against the US dollar this week, helped by solid Aussie jobs data.

(Aussie dollar vs US dollar exchange rate: three months)

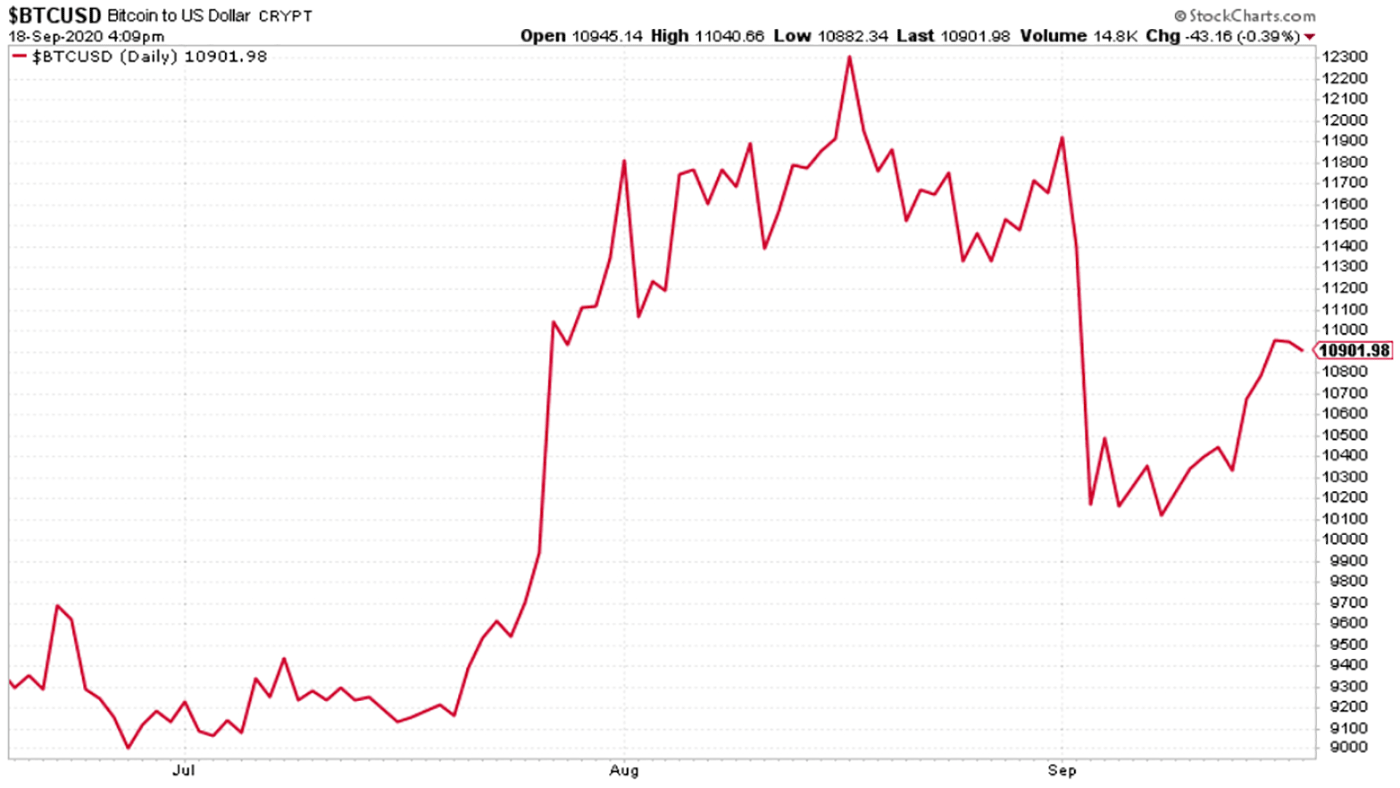

Cryptocurrency bitcoin had a strong bounce this week, getting back above the 11,000 mark. Dominic wrote about the cryptocurrency’s relatively calm 40% trading range earlier this week.

(Bitcoin: three months)

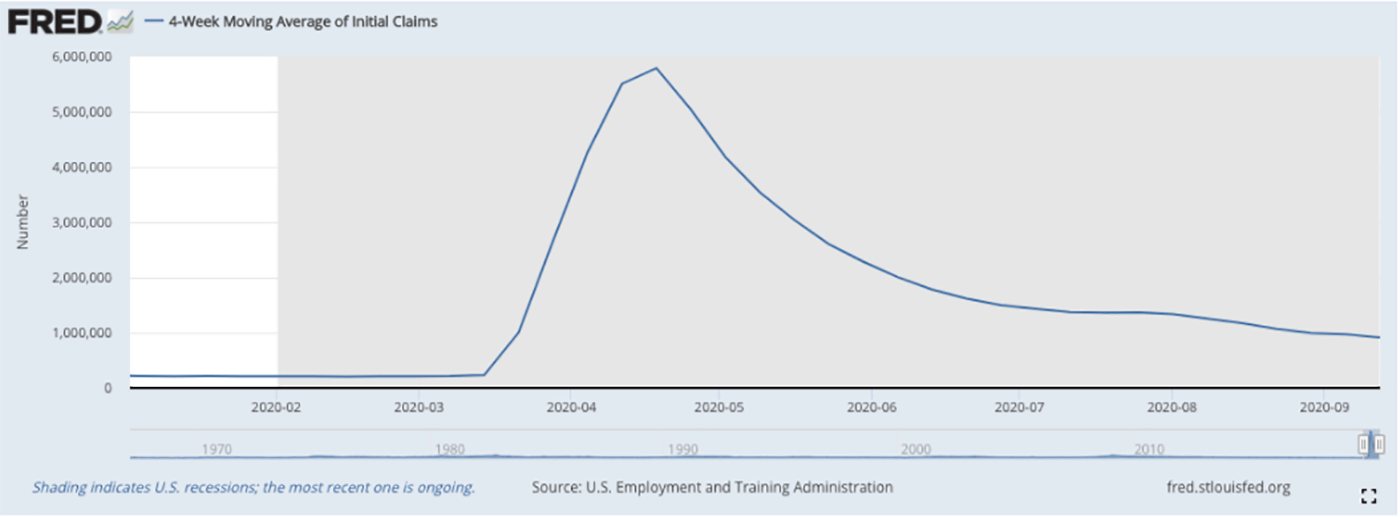

US weekly jobless claims were a little lower than last week. There were 860,000 new claims last week, better than expected, and down from 893,000 last week (though that was revised a little higher). The four-week moving average fell to 912,000 from 973,000 (revised a little lower) previously.

(US jobless claims, four-week moving average: since Jan 2020)

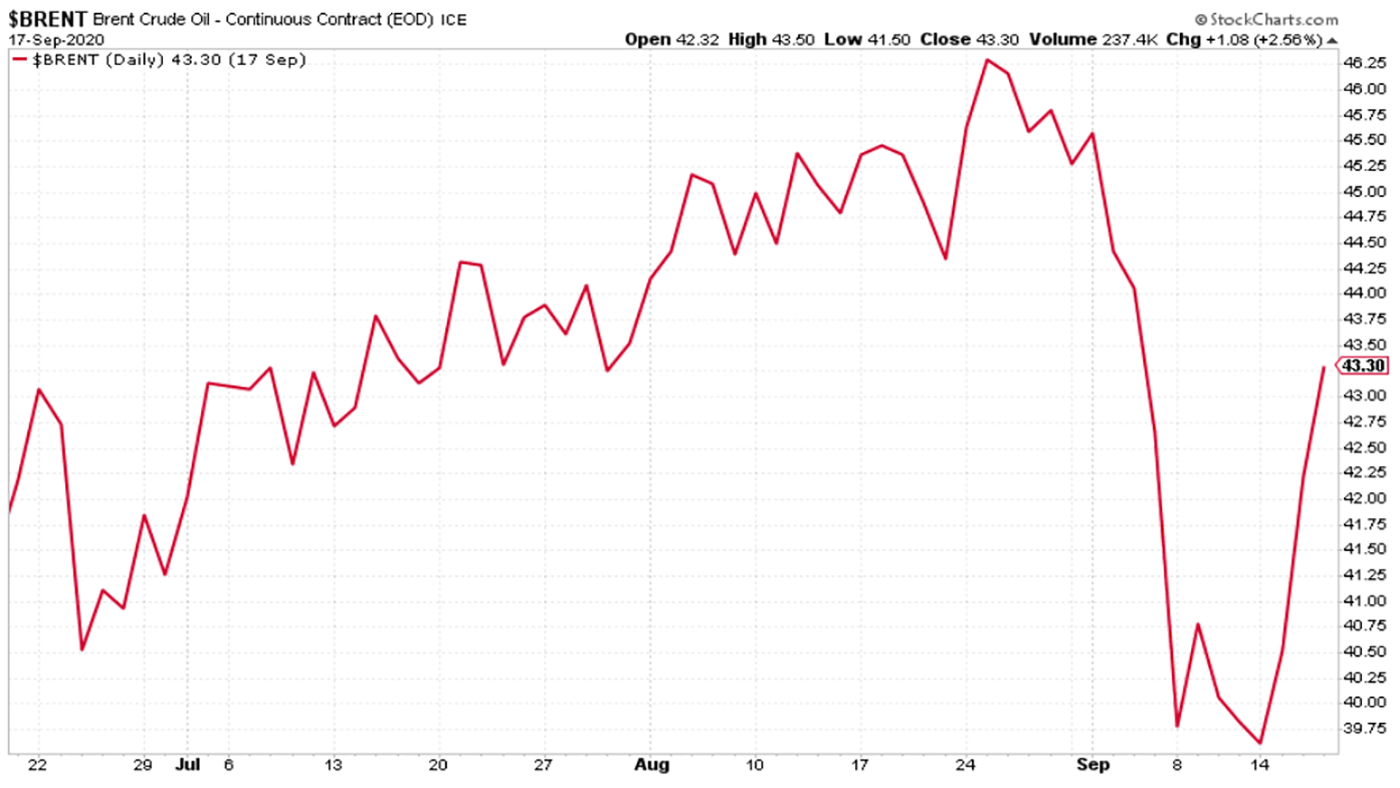

Despite concerns about further lockdowns, the oil price (as measured by Brent crude) rebounded strongly this week (conveniently, just as everyone’s talking about the end of the oil era), as Saudi Arabia delivered a telling off to those members of oil cartel Opec who haven’t been pulling their weight on production cuts.

(Brent crude oil: three months)

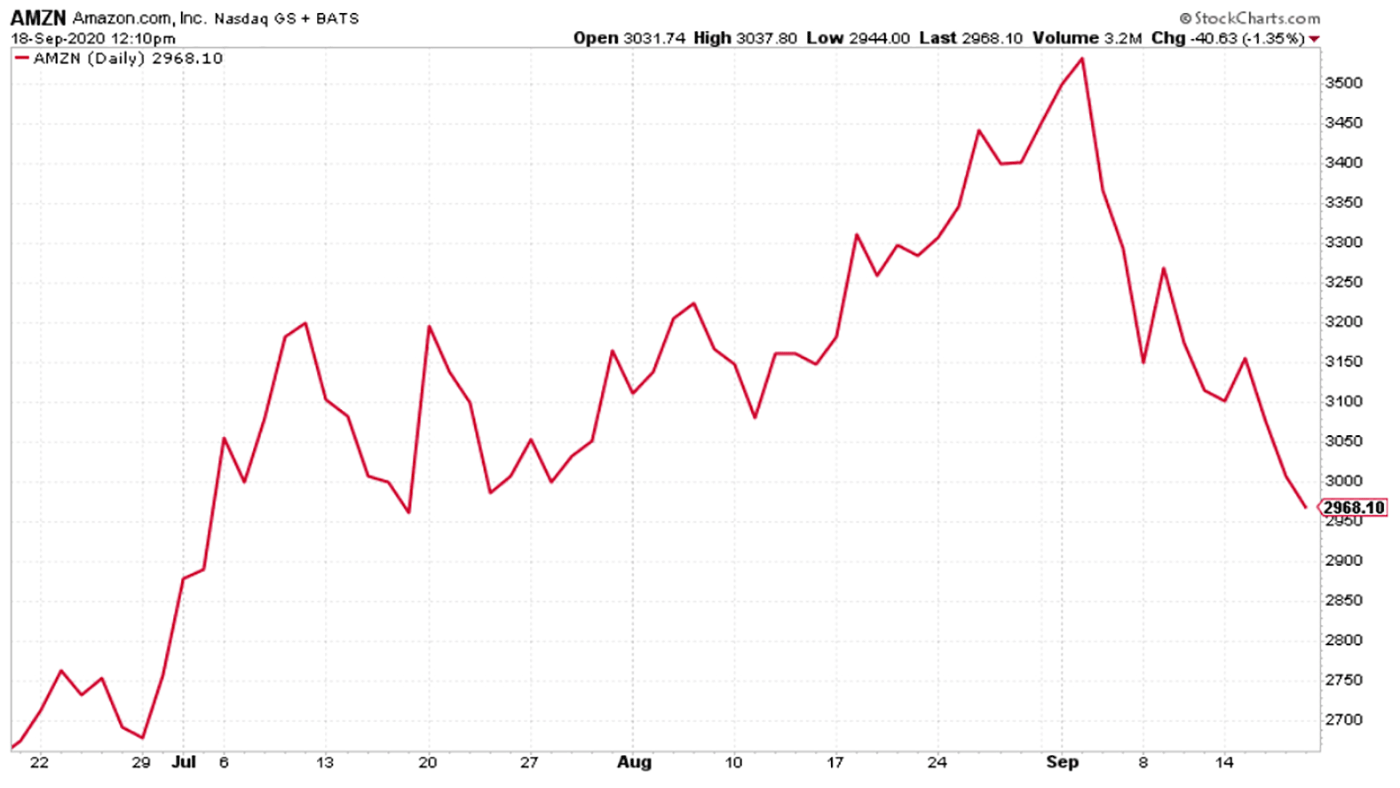

Amazon continued to drift lower this week. The Nasdaq index (of which it’s a member) remains on shaky ground, with traders clearly wary of whether it’s time to just “buy the dip” as usual, or if there’s a bigger correction to come.

(Amazon: three months)

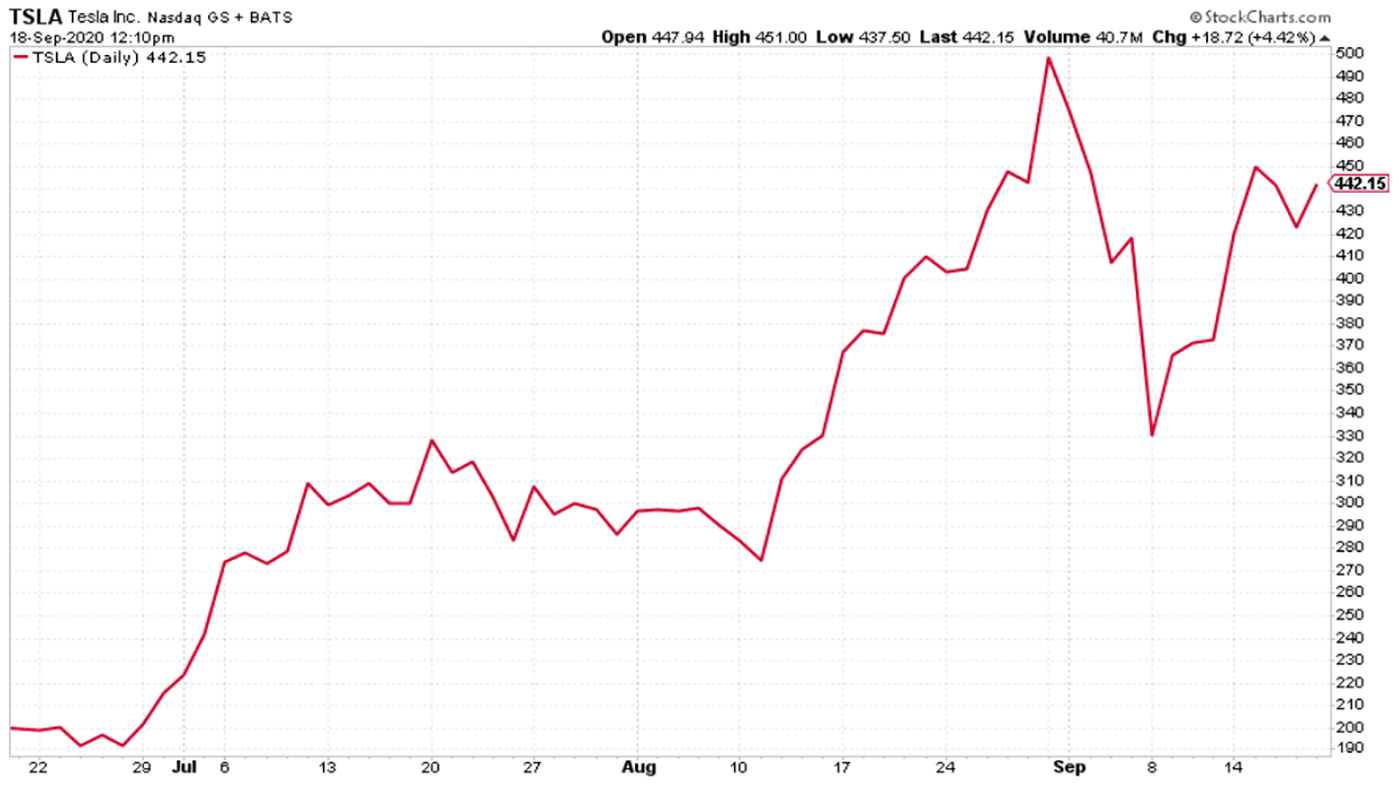

Tesla finally put in a big rebound this week. Investors might be getting excited ahead of Tuesday’s “battery day”, which founder Elon Musk promises “will be very insane”. (And yes, he could also be describing Tesla’s valuation there.)

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?