What is a stock split?

You may have come across "stock split" - but what is a stock split and how does it impact your investments?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Share price growth can be a sign of success for a company, but too much can mean the stock becomes too pricey for new investors – it is at this point that a company may initiate a stock split.

This is when a company decides to increase the number of shares it has in issue by giving its current investors extra shares for each existing share that they already own.

Extra shares sound great on paper, but here is what it really means. We explain what a stock or share split is.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Why do companies use stock splits?

When a company launches a stock split, they issue more shares to existing investors.

This helps reduce their share price by spreading it across more shares, boosting liquidity and making the stock more affordable for new investors.

Major companies such as Amazon, Apple and Google-owner Alphabet have used stock splits in the past to bring their share price down.

How a stock split works

Shares are typically split by ratios of 2-for-1 or 3-for-1, meaning each stockholder will have two or three shares following the split.

Some companies have gone even higher. Alphabet completed a 20-for-1 split in July 2022.

As a result, the company’s share price will fall to reflect the larger number of shares in issue.

For example, if a company with 100 million shares at a share price of £5 per share, carries out a 2:1 (or two-for-one) split, the total number of shares increases to 200 million and the share price falls to £2.50.

This doesn’t reduce the market value of a company as the price is also split across all the shares.

So in the example above, the market capitalisation would stay at £500m and an investor who previously owned 100 shares worth £500 will now have 200 shares worth the same. All financial ratios such as earnings per share and dividends per share will be halved.

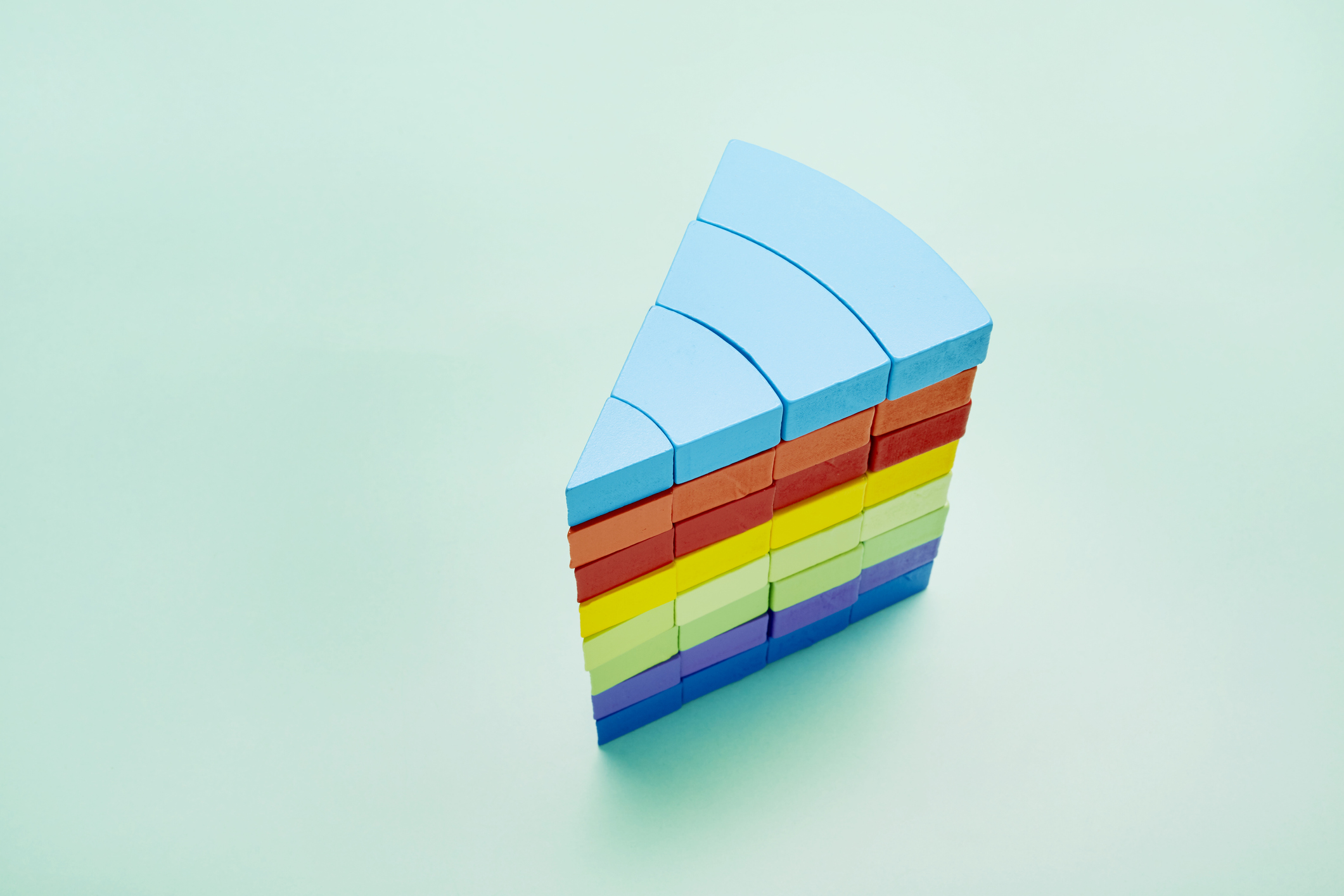

It is like cutting a pizza into 20 slices instead of 10, you still have the same amount but more pieces to share.

Shareholders aren’t really getting anything extra. Each investor still holds the same percentage of the company as they did before the split. It’s just that it’s divided into more individual shares.

Investors also retain the same voting rights but the main concern of a stock split is the type of investors it attracts.

Companies not faring so well may initiate a reverse stock split.

This is where the number of issued shares is reduced by a certain number, which in turn boosts the share price.

A reverse stock split is often seen as a desperate attempt by a company to artificially boost its value but it may help a firm remain listed or to attract the attention of other investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Marc Shoffman is an award-winning freelance journalist specialising in business, personal finance and property. His work has appeared in print and online publications ranging from FT Business to The Times, Mail on Sunday and the i newspaper. He also co-presents the In For A Penny financial planning podcast.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.