The charts that matter: UK house prices and US tech bubbles

UK house prices shoot to new highs while tech stocks come off the boil – John Stepek looks at how the week's events have affected the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

In this week’s issue of MoneyWeek, we look at one of our favourite subjects – investing in Japan – in the wake of prime minister Shinzo Abe’s decision to step down on health grounds. If you’re not already a subscriber, get your copy here.

And don’t miss our excellent online guest article from veteran Japan analyst Peter Tasker, where he writes about Shinzo Abe’s legacy and Warren Buffett’s surprise bargain-hunting spree in Japan.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In our most recent guest podcast, Merryn spoke to respected analyst George Magnus about why he thinks inflation is the clearest road ahead in terms of getting out of our current debt problems. Apologies in advance for the sound quality on Merryn’s side of the conversation – it’s still well worth listening to.

Merryn and I had a chance to catch up this week, too. We discussed V-shaped recoveries and how money burns a hole in your pocket; the Federal Reserve’s shift of stance on inflation and employment; and whether this is the top for the tech bubble or whether there’s even more madness to come.

And we have a new “Too Embarrassed To Ask” video. This week, we explain what a “tracker fund” is. Take five minutes to let me know what you think, at editor@moneyweek.com – or tell us what you’d like us to cover next.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: The Fed has made big changes to its mission: here’s why that matters

- Tuesday: What the simple beauty of technical analysis tells us about the tech stock bubble

- Merryn’s blog: Ordinary investors are missing out as private equity takes over

- Wednesday: Gold and the US election: does it matter who’s president?

- Thursday: How on earth can UK house prices be at record highs right now?

- Guest article: Buffett buys Japan: the ultimate endorsement of Abe’s legacy

- Friday: Is the US tech bubble bursting, or is this just a blip?

Now for the charts of the week.

The charts that matter

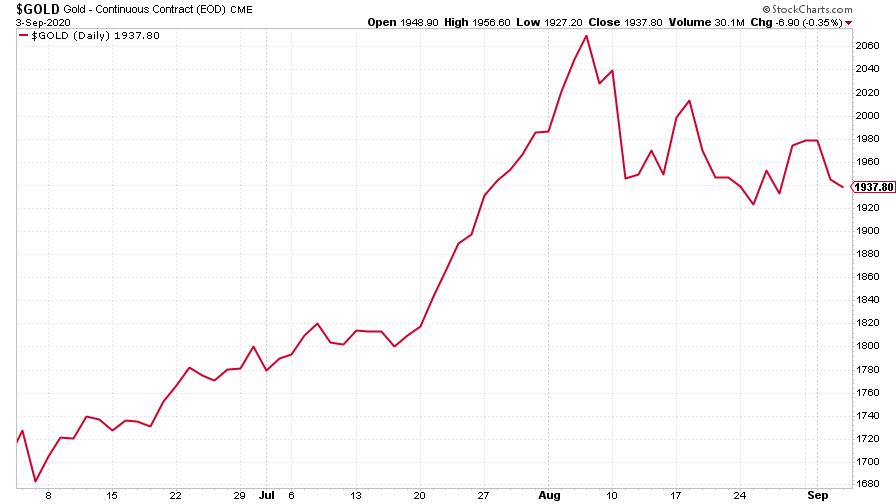

Gold is busily digesting its recent big run up. It’s been hovering around “support” close to the 2011 record high that it recently burst through. As Dominic pointed out earlier this week, a period of consolidation was needed but there’s very likely more to come.

(Gold: three months)

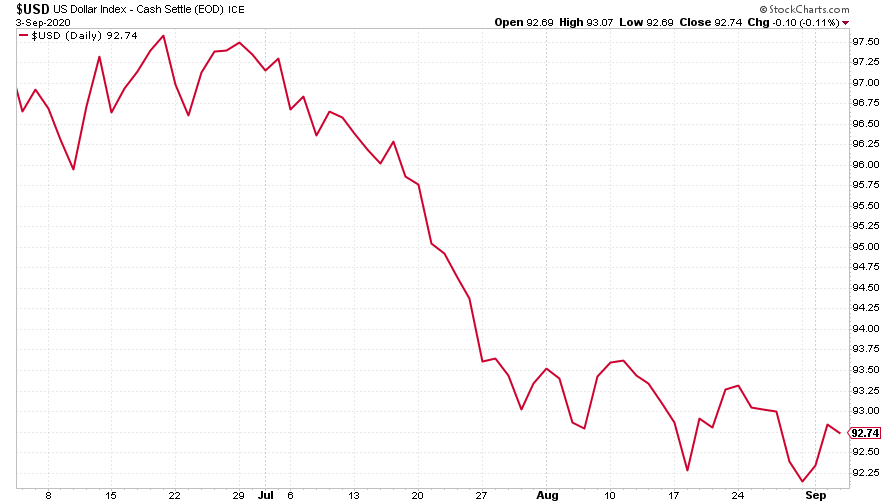

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) perked up this week after sliding lower. That in turn was arguably the catalyst the over-excited US market needed to trigger some profit taking. It was helped by a slightly better than expected jobs report too. Worth noting though that the dollar is still ending the week lower than where it was this time last week.

(DXY: three months)

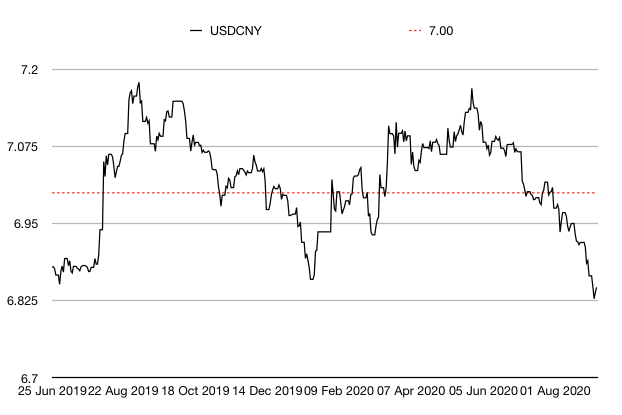

The overall weakness in the dollar continues to be reflected in the Chinese yuan (or renminbi) exchange rate (when the black line below falls, it means the yuan is getting stronger). The good news is that a weaker dollar versus the renminbi is usually a sign that trade tensions are on the backburner.

However, it’s interesting in terms of what it might bode for the longer run. China would like the yuan to be viewed as a serious contender for reserve currency status against the dollar. This apparently relaxed attitude about the impact of a stronger yuan on Chinese exports may indicate that Beijing places more importance on a strong and stable currency, rather than competing in the exchange markets.

(Chinese yuan to the US dollar: since 25 Jun 2019)

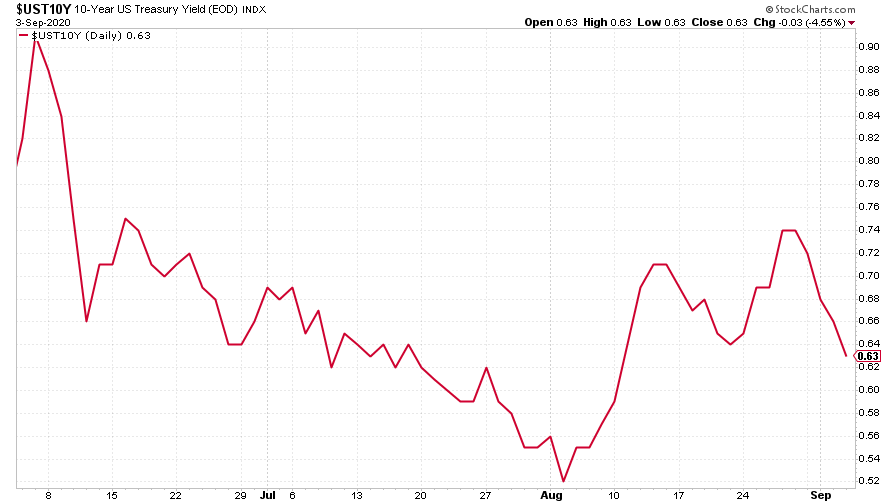

The yield on the ten-year US government bond slipped back as equity markets took a tumble. This is one reason why people still hold bonds in portfolios, despite their extreme valuations (in a historical context) – they often still act as a hedge when investors get nervous.

(Ten-year US Treasury yield: three months)

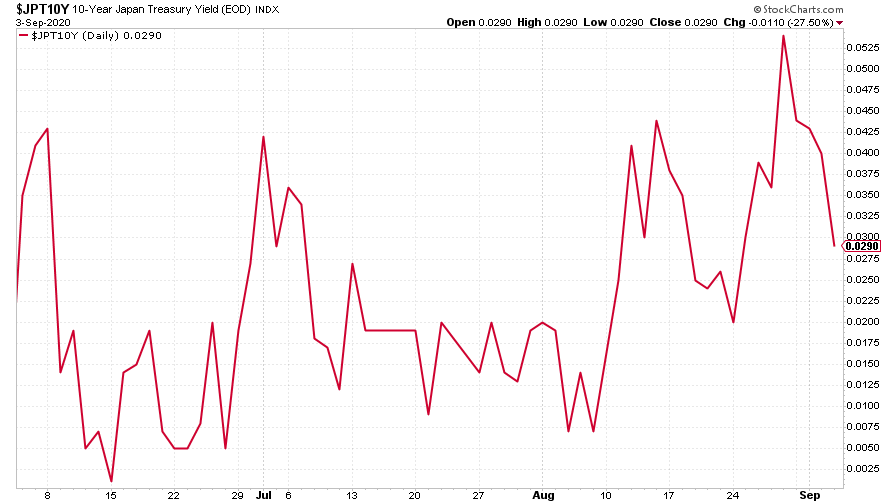

The yield on the Japanese ten-year slipped a bit too.

(Ten-year Japanese government bond yield: three months)

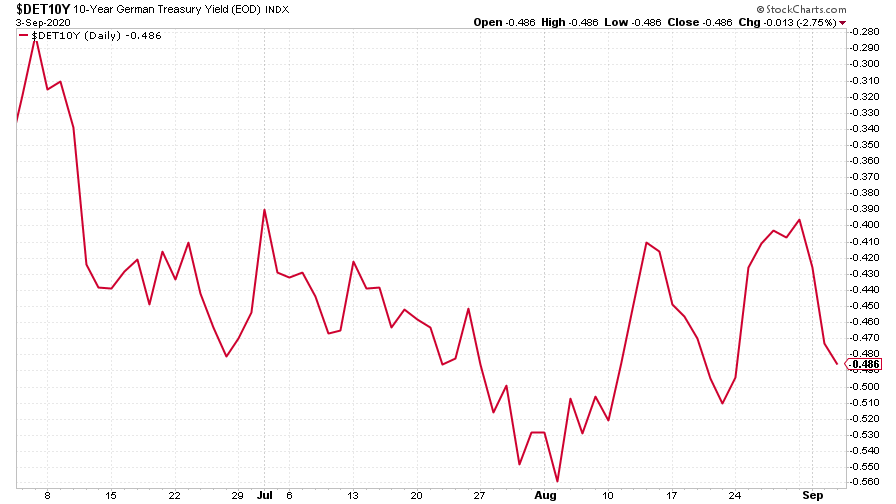

The yield on the ten-year German Bund followed the Treasury market’s lead too.

(Ten-year Bund yield: three months)

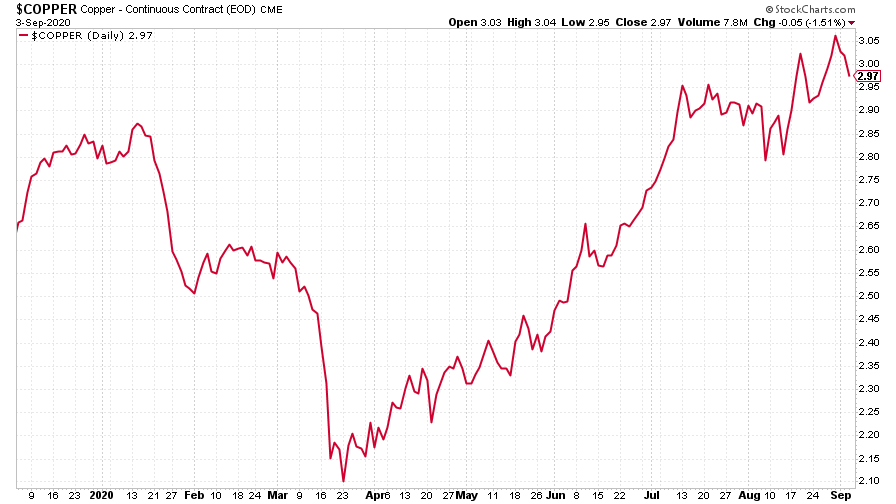

Copper was a little lower but given the sheer strength of its run since the Covid-19 low, that’s not surprising.

(Copper: nine months)

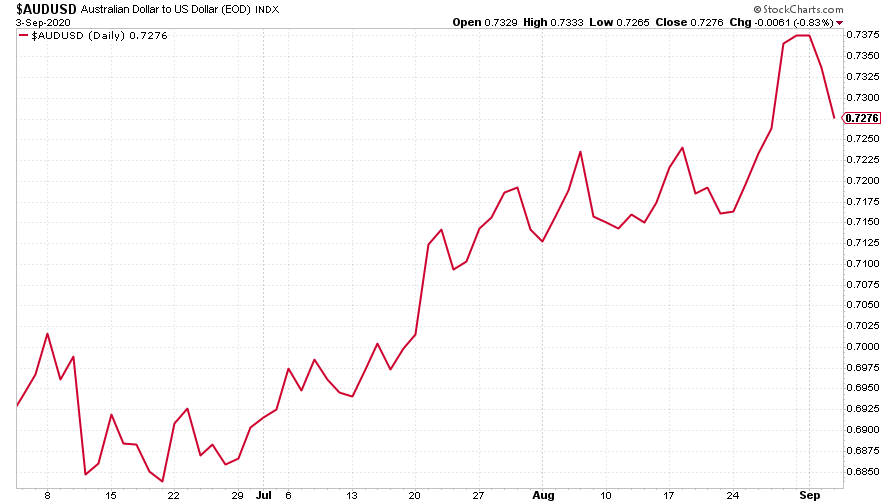

The Aussie dollar surged in the early part of the week then fell back as the US dollar regained some poise in the middle of the week. But note that the Aussie still ends the week little changed on where it was this time last week.

(Aussie dollar vs US dollar exchange rate: three months)

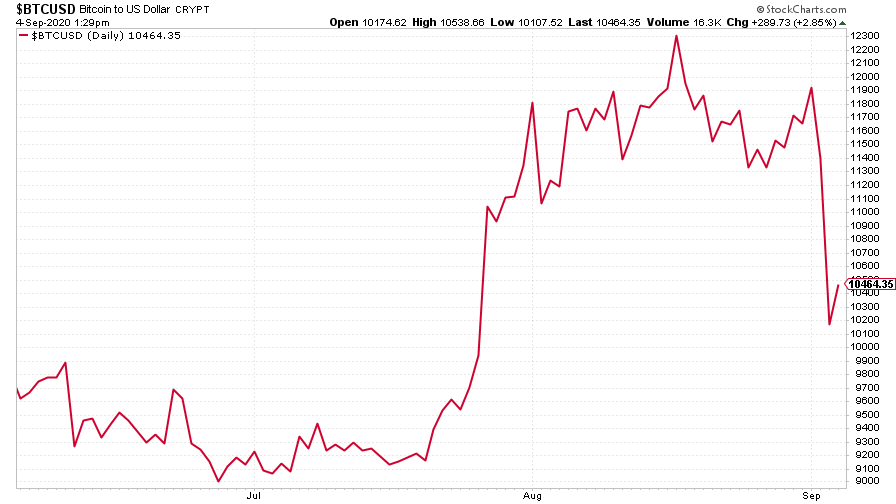

Cryptocurrency bitcoin finally followed the lead of the precious metals, and fell sharply lower as the dollar strengthened. I’m still not sure of what drives bitcoin but concerns about inflation and a flight from fiat currencies generally has to be at least part of it and I think this latest slide is probably linked to that.

(Bitcoin: three months)

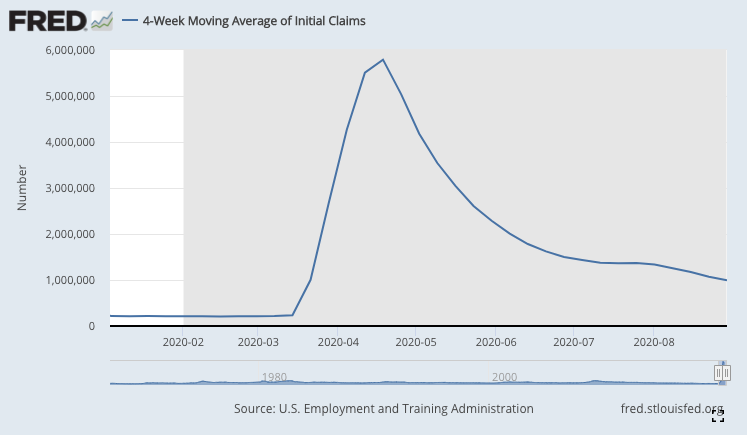

US weekly jobless claims fell again. There were 881,000 new claims last week, better than economists had expected. The four-week moving average fell back to below one million, coming in at 991,750 from 1.07 million previously.

We also got the latest monthly nonfarm payrolls figure. Analysts expected to see an extra 1.375 million jobs last month, with the unemployment rate falling below 10% for the first time since March.

In the end the report was a bit better than expected. The number of jobs added was in line with expectations. However, the bigger surprise was that the unemployment rate slipped to 8.4% as opposed to the 9.8% expected.

The Federal Reserve has already made it very clear that getting unemployment down is its number one priority and it’s certainly not going to raise interest rates or tighten monetary policy if that looks like it represents any sort of threat to a recovery.

That said, markets seemed a little rattled about just how much stronger the unemployment rate was than expected. Any excuse for the US dollar to remain strong is not necessarily welcomed by stock markets at this stage in the game, given that much of their gains are based on the idea that rates will be low for good.

(US jobless claims, four-week moving average: since Jan 2020)

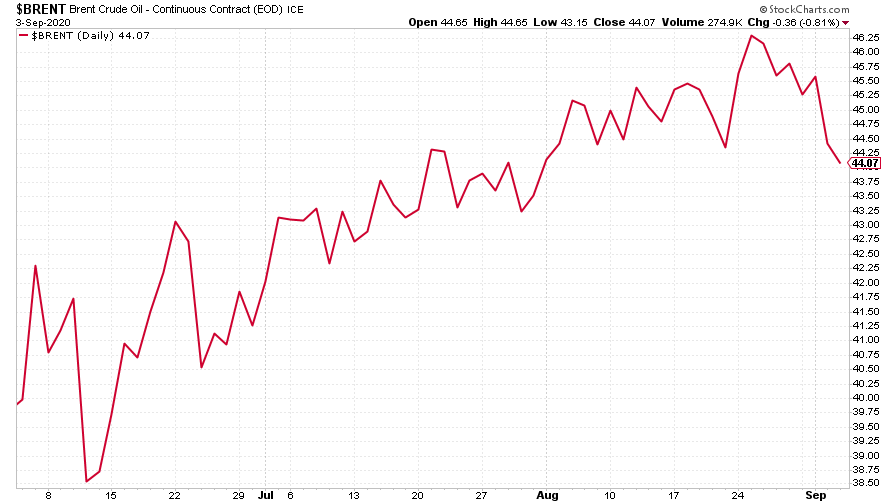

The oil price (as measured by Brent crude) took a hit this week as the dollar strengthened.

(Brent crude oil: three months)

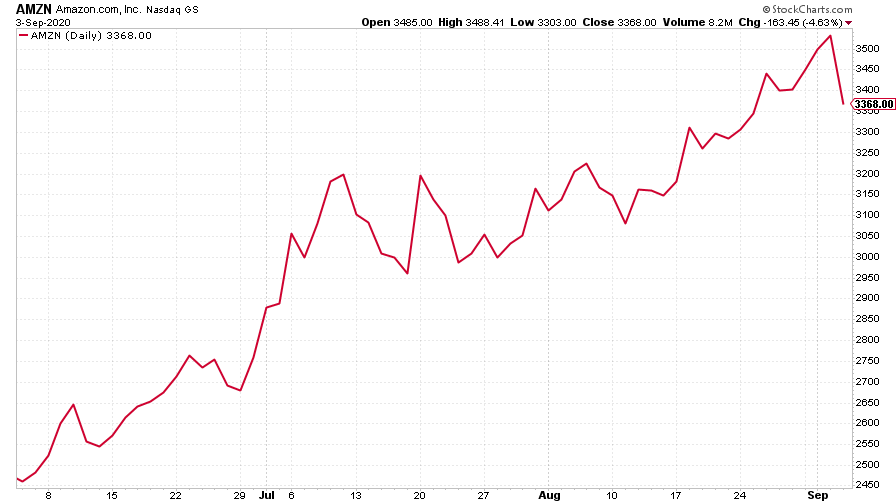

Amazon was lower this week, along with most of its peers, as the Nasdaq hit a bump in the road following its recent surge higher.

(Amazon: three months)

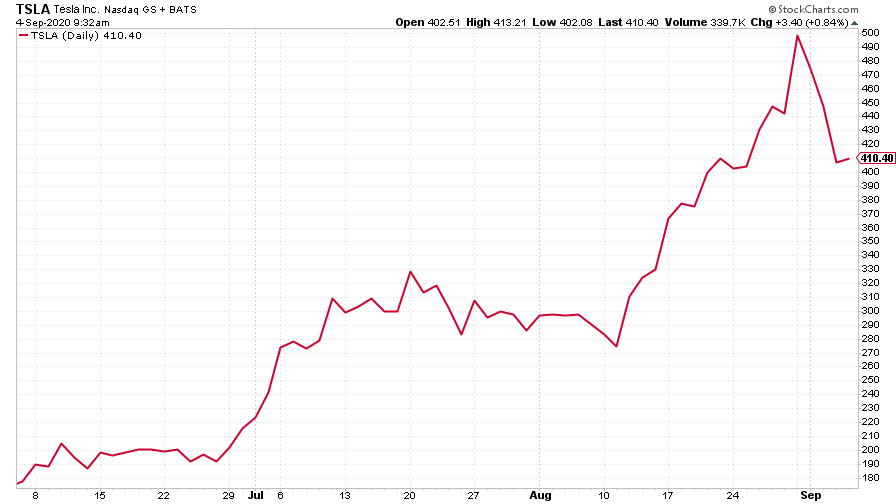

Meanwhile, electric car group Tesla, which has seen a staggering run in recent weeks, saw a rather more brutal correction. Indeed, if you go from the most recent high, Tesla is pretty much in a bear market – although given that this stock makes bitcoin look tame, I’m not sure those sorts of definitions are useful.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?