Gold and the US election: does it matter who’s president?

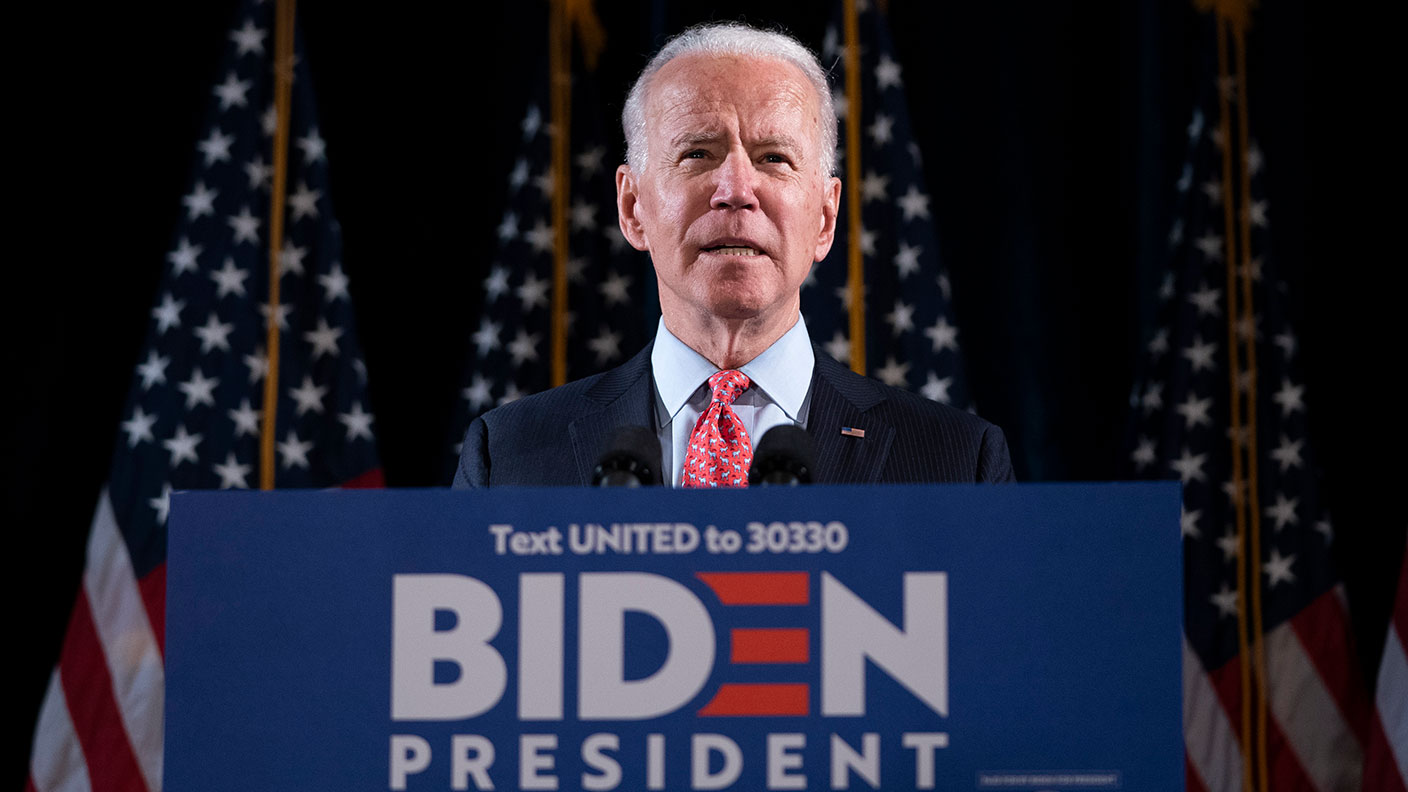

With just two months to go until the American presidential election, Dominic Frisby looks at how the result could affect gold’s bull market, and asks: does it really matter whether Biden or Trump ends up in the White House?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

There are just 62 days to the US presidential election. My, do these things come around fast. It seems like barely last week that Donald Trump was elected for the first time.

So now seems like a good time to explore the question – what happens to gold if Trump wins? And what happens if his Democrat opponent, Joe Biden, secures it?

Neither Trump nor Biden will pursue a strong dollar policy

The underlying conditions are favourable to gold, of course. Low rates and money printing; international tension over trade, especially with China; civil unrest; inflation potentially looming; and, not least, the potential re-emergence of corona as winter sets in.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There are more tailwinds than headwinds for gold, I’d say – whoever resides in the White House next year. So my first instinct says more of the same. Having had a great run up this year to a high of $2,089/oz, gold is now meandering about in the $1,900s. Gold has a tendency to do this. In fact, most assets do after a run up. They go through a period of consolidation, digesting the higher prices.

In the bull market of the 2000s, gold would go into periods of consolidation that would last 12 to 18 months after big run ups. Perhaps we are in one such period now and we have another year or more to wait before gold sets off again. It would certainly be typical.

On the other side of the coin, what happens to the US dollar under Donald Trump or Joe Biden? That is perhaps the most important question of all. I can’t see either of them pursuing strong dollar policies, so my inclination is that it gets weaker. The US dollar index currently stands at 92, having been as high as 103 (once under Trump, once under Barack Obama). It’s in a downtrend and I reckon we could see it in the 80s, or even the 70s, before we see it above 100 again.

That said, currencies are strange beasts and they do not always behave as their president wishes. If a crisis rears its head, as in March, the dollar will rally.

As for who might take the White House, currently the odds favour Trump, though only just. From March to May, Trump led. He then plunged in the polls and Biden ruled from June until September. Now things have swung marginally back in Trump’s favour. Interestingly, the polls say Biden, but the odds say Trump. The assumption is that many will vote Trump without actually being prepared to admit it.

The old-school stability that Biden oozed seems to have evaporated with a couple of rambling interviews, and rumours are now circulating about early-onset dementia. If there is even the slightest truth to this, then whether it be Biden or Trump with his lack of convention, we can expect a president who will not have the solidity of Obama or Bush.

Gold won’t mind that.

A brief history of gold under US presidents

In the months after Trump was elected in 2016, gold fell sharply, going from over $1,300/oz into the low $1,100s. But then, in his first year, gold rallied by $200. It started 2017 at $1,150 and ended the year at $1,350.

Looking back at gold under previous presidents – and I’m not sure how valuable an exercise this is, as circumstances are so different – gold had a great first year in Obama’s first term, reaching all-time highs. It then endured four of its worst ever years in his second.

Under Bush, gold had eight years of bull market, going from sub-$300/oz to over $900/oz. Of note, however, is that when Bush was elected for his second term, gold pulled back by 10%.

When Bill Clinton was first elected, gold pulled back. But during his first year in power, 1993, gold rallied. His second term was a bad one for gold – it slid to all-time lows at $250/oz.

Gold fell under George Bush senior in his one term. It actually rallied quite strongly during Ronald Reagan’s second term (though it declined after he was elected). And in Reagan’s first term it was about the worst investment you could have made, going from more than $600/oz to below $300/oz.

In short, looking back at first terms and second terms, Democrat or Republican, no real pattern emerges. The only minor point of note is that sell-offs do seem to follow most elections in the November to January timeframe, before the incumbent takes office.

My finger is not on this particular pulse, but I have a feeling that Trump will win this election. Biden feels to me like the guy who should have got the gig back in 2016 when the Democrats gave it to Hillary. But, hey, hindsight.

Certainly, it is going to be close. The postal voting, the swing states – these are the crucial margins. But I can’t see a barnstorming bull market for gold being caused by whoever wins; it will be other circumstances that drive it.

So, in conclusion, I’m going to say that gold sells off whoever wins – though not too dramatically. It will be more a sell-off of the “consolidation-in-a-bull market” variety rather than the beginning of a bear.

Bottom line and longer term: whoever is president, it won’t make much difference.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is available at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.